Original|Odaily Planet Daily ( @OdailyChina )

Autor: Wenser ( @wenser 2010 )

The fallout from the WBTC controversy continues to spread.

On August 19, the well-known market maker Wintermute recharged 1,631.863 WBTC to Binance within 13 hours, with a value of US$97.03 million. Since the 17th, the cumulative transfer volume has grown to 5,860.67, with a total value of US$348 million; MakerDAO passed the Reduce WBTC Collateral Size proposal on August 15, and subsequent implementation includes: the core treasury will reduce WBTC-A DC-IAM (maximum collateral amount) from 500 million to 0; WBTC-B DC-IAM (maximum collateral amount) from 250 million to 0; WBTC-C DC-IAM (maximum collateral amount) from 500 million to 0; disable WBTC lending in SparkLend; reduce WBTC LTV from 74% to 0%.

In the face of implicit risks, the operations of these institutions are understandable. However, many people also ask: After WBTC, what other custodial BTC options are available for DeFi liquidity?

Odaily Planet Daily will briefly introduce other alternatives available in the market in this article.

FBTC

In April this year, FBTC, a new Bitcoin asset and brand powered by Ethereum L2 network Mantle, Mantle LSP and digital asset financial services platform Antalpha Prime , Anunciado plans to launch its full-chain Bitcoin asset.

It is understood that FBTC maintains a 1:1 peg with Bitcoin, aiming to adopt a yield-enhancing strategy in the Bitcoin ecosystem to enhance the utility and liquidity of Bitcoin. In the initial launch phase in May, FBTC is expected to be deployed on chains such as Ethereum, Solana, Aptos, Sui, Merlin Chain, BNB Smart Chain and Polygon POS. Later, FBTC may be integrated with wallets such as Binance Wallet, Bybit Wallet, Bitget Wallet, OKX Wallet, Particle Network, TokenPocket and UniSat.

FBTC launches promotional materials

De acuerdo a the FBTC official website , FBTC will launch Genesis Bonfire and revenue strategy-related plans in the third quarter of 2024, and start ecosystem construction and multi-chain expansion in the fourth quarter. It is worth mentioning that FBTC supports seamless interoperability to support various applications on L1 and L2 networks.

swBTC

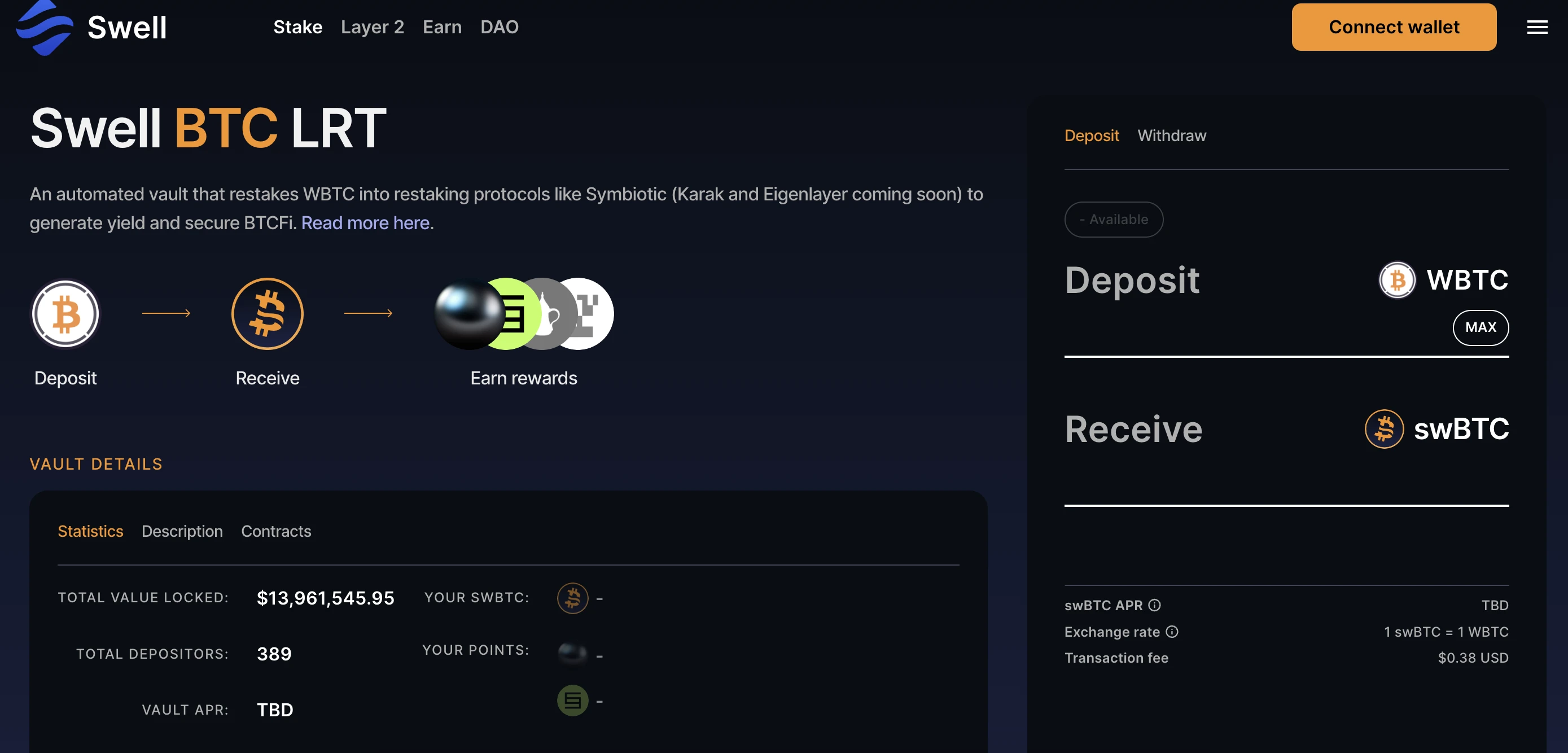

On August 14, the Ethereum staking project Swell ( @swellnetworkio ) Anunciado the launch of the liquidity re-staking token swBTC. Users can deposit WBTC to obtain swBTC to generate income. It is expected that the re-staking income will be distributed from mid-September.

The platform later Anunciado that since the launch of swBTC this week, the platform has deposited more than $13 million in WBTC (currently about $13.6 million), and Curve Finance has $3 million in liquidity. In addition, lending integration is coming soon.

According to Swell’s official statement , the security of swBTC mainly includes:

-

Based on the battle-tested @yearnfi v3

-

Risk monitoring provided by @gauntlet_xyz

-

Vault strategy provided by @aerafinance

-

Security audit by @NethermindEth and @chain_security

De acuerdo a el sitio web oficial , as of the time of writing, the locked amount of swBTC has reached 13.9615 million US dollars, which is close to 14 million US dollars in less than a week after its launch, equivalent to 234 BTC.

yBTC

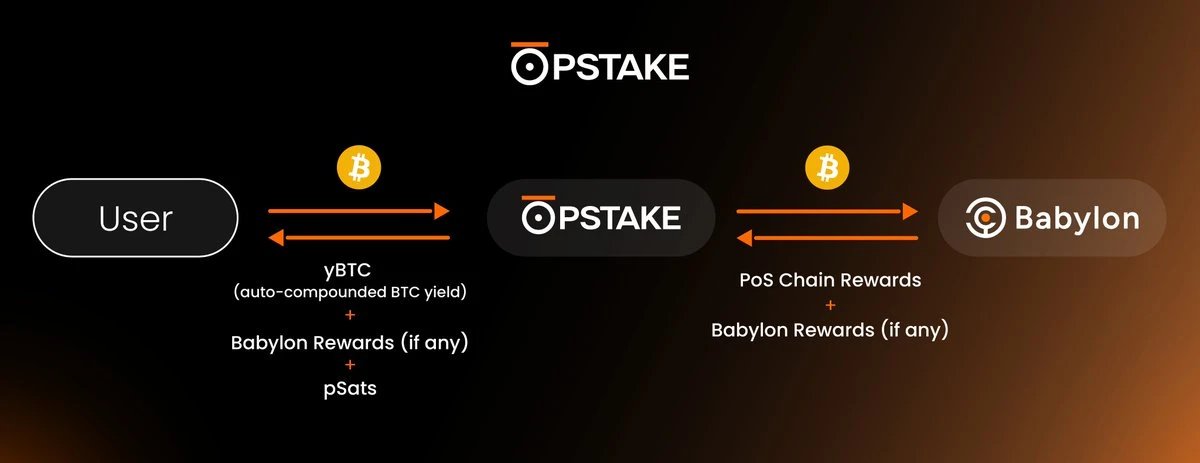

In July, @pStakeFinance officially declaró que pSTAKE aims to use the expertise accumulated since entering the liquidity staking field in early 2021 to solve Babylons staking income problem, that is, to achieve automatically compounded Bitcoin income with the help of yBTC. pSTAKE will issue yBTC (yield BTC) on Ethereum, the leading ecosystem in DeFi and liquidity, in future versions. Subsequently, yBTC will also be integrated into the EVM ecosystem and BTC L2 network to provide additional accessibility and benefits, so as to achieve providing reliable Bitcoin income to everyone.

In the near future, Babylon’s mainnet staking activity will be launched. Users will be able to deposit BTC into @pStakeFinance to mint yBTC. Subsequent native BTC deposits will flow into Babylon, and the corresponding income will be automatically compounded to the yBTC holders as a BTC derivative.

pSTAKE’s explanation of yBTC’s operation mode

Previously, according to official information , after pSTAKE launched the semi-public v1 (BTC deposit only) testnet, 46,710 users deposited 54.69 testnet BTC and completed 73,546 on-chain transactions. For more updates on yBTC, please refer to the official testnet website for relevant information.

cbBTC

On August 14, the official Coinbase account posted that cbBTC would be launched soon, but no further details were disclosed. Community users speculated that the exchange was planning to launch its own wrapped Bitcoin token.

Earlier in the day, Jesse Pollak, head of the Base protocol, also al corriente : “I want to say it loudly: I love Bitcoin and I am very grateful for its pioneering role in the field of cryptocurrency. We will build a large-scale Bitcoin economy on Base.”

Bitget Research Institute said in response to this news, Coinbase may bring Bitcoin into the DeFi ecosystem through centralized + compliant custody, and the market generally looks forward to the arrival of BTCfi.

tBTC

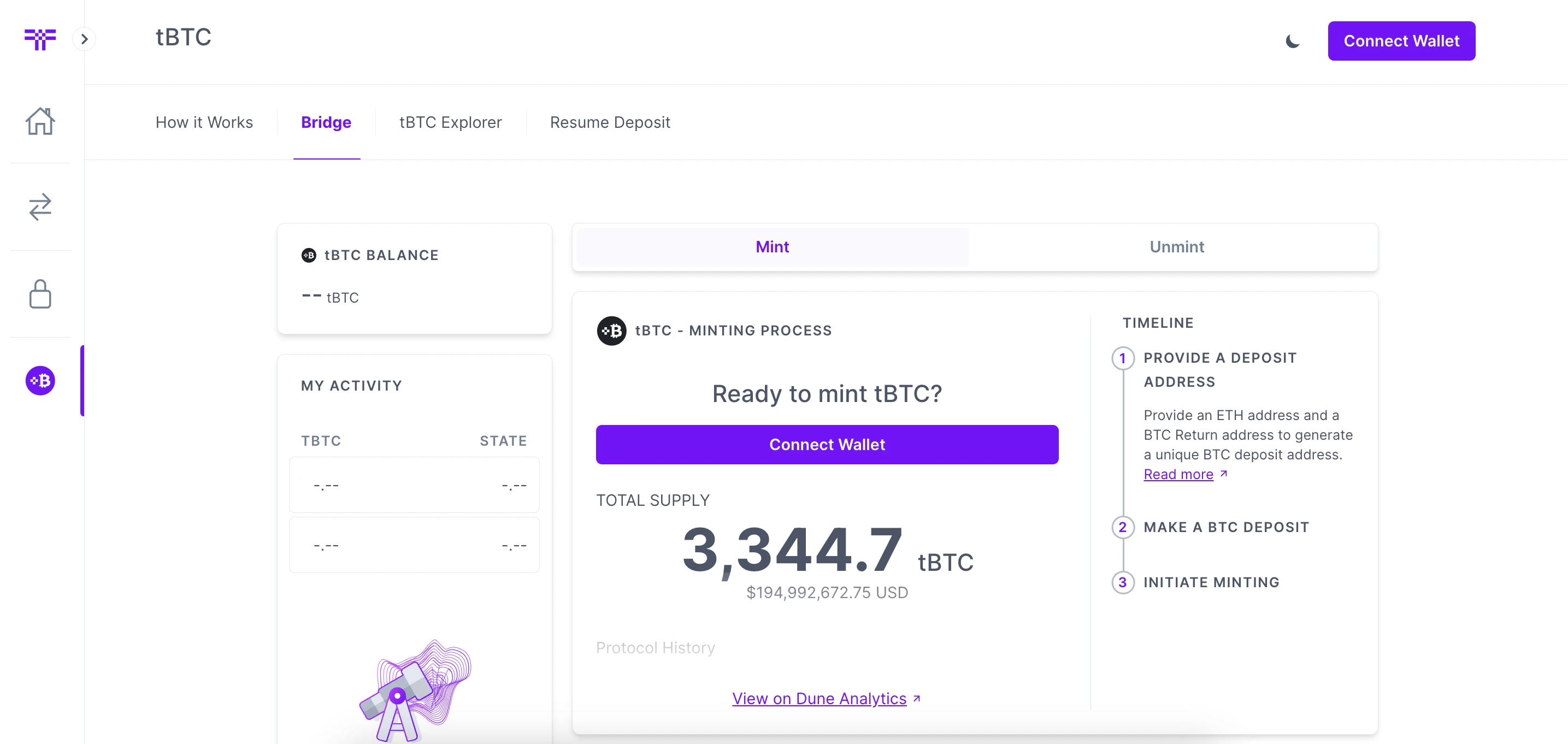

@tBTC_project allows users to create tBTC using BTC through a network of signers, who are randomly selected and a different set of signers are selected for each minted tBTC. Signers must provide ETH as collateral to ensure that they cannot take the locked BTC. In fact, signers must over-collateralize their deposit by providing ETH worth 1.5 BTC. Signers are willing to lock up their ETH, so they will be rewarded by the fees paid when redeemed.

De acuerdo a el sitio web oficial , the current total amount of tBTC is 3344.7, equivalent to approximately US$195 million.

De acuerdo a Datos de dunas , the number of tBTC holders is 1,269, accounting for about 2.1% of the BTC share on Ethereum. The top contracts holding tBTC include Mezo, Wormhole, Curve, etc.

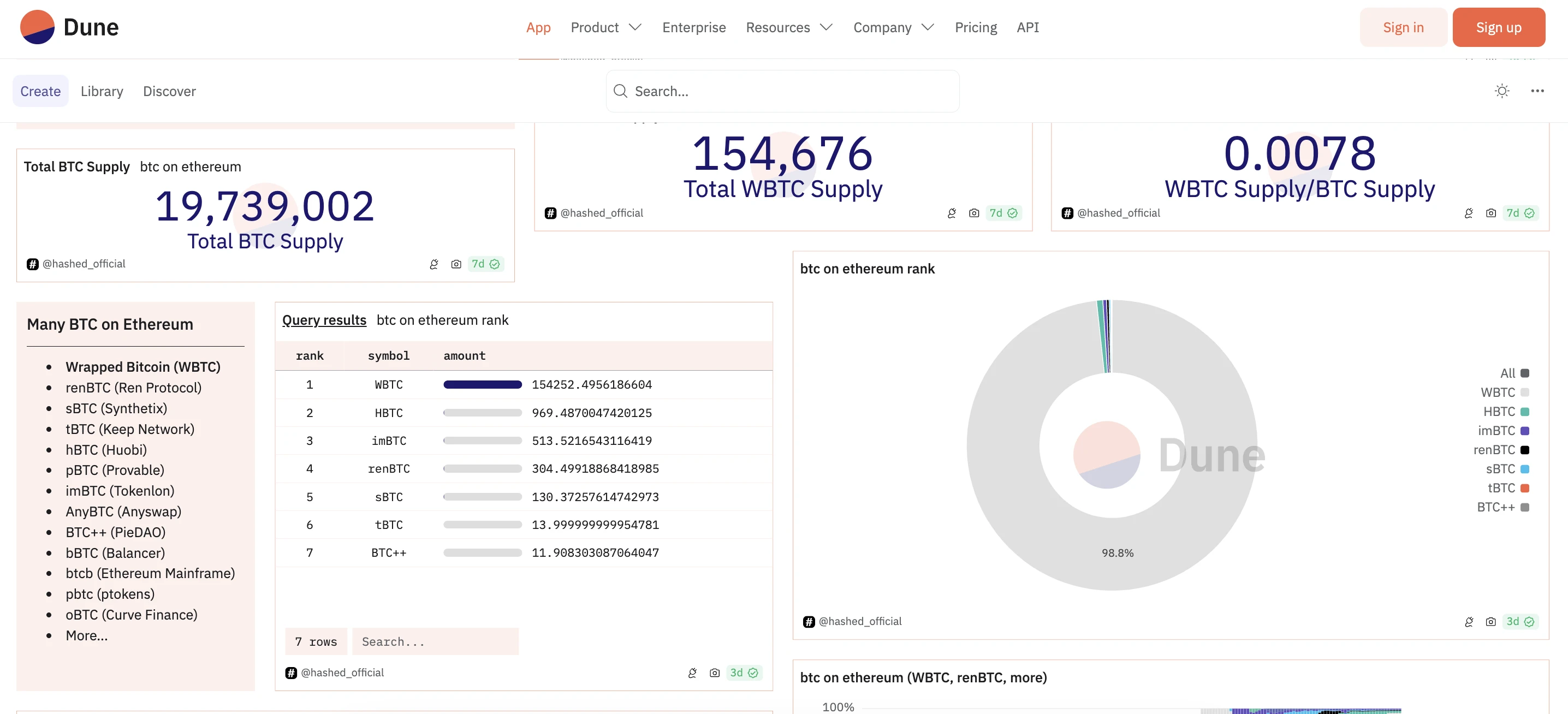

otro

It is worth noting that according to Datos de dunas , the current custodial BTC on the Ethereum chain also includes renBTC, HBTC, imBTC, sBTC and other solutions, but both the number and the scale of funds are dwarfed by WBTC, among which:

renBTC was coldly received by the market after the FTX crash in November 2022: MakerDAO canceled the use of renBTC as collateral and reduced the risk exposure of assets considered risky by DAO. The asset was developed by RenProtocol, a project supported by AlamedaResearch, and is a wrapped Bitcoin asset like WBTC. Previously, hackers also exchanged 10,000 ETH for 685 renBTC and bridged it to the Bitcoin network. The last message on the official account was in January this year.

HBTC was previously questioned by Theblock for information transparency issues. The latest news on its official X platform account es a response to the doubts in 2022, but el sitio web oficial does not seem to have been updated for a long time. Perhaps after Huobi changed its owner, the project was gradually abandoned.

sBTC is one of the synthetic assets created by the Synthetix protocol. Generally speaking, synthetic assets track the value of different assets, such as the SP500 index, TESLA stock, oil prices, or Bitcoin. In Synthetix, all synthetic assets are secured by collateral in the form of SNX tokens, and the protocol is overcollateralized, mainly to absorb drastic price changes of synthetic assets. According to Datos de dunas , the current ETHBTC trading volume of Synthetix V2 on August 14 was around US$280,000.

Además, in March this year , the Bifrost Foundation announced a partnership with Stacks. The Stacks network is expected to be upgraded this year to enable sBTC, a non-custodial asset pegged 1:1 to Bitcoin. sBTC will be used as collateral for the BTCFi service and support the use of BtcUSD in the Stacks ecosystem (BtcUSD is the over-collateralized stablecoin for Bifrosts proposed native Bitcoin staking service BTCFi).

Dune data information interface

Summary: Different xBTC, different functions

If the role of WBTC is to introduce BTC liquidity into the Ethereum ecosystem, then other types of xBTC are more like assets that meet different needs in different scenarios (such as interest-bearing, mortgage, etc.).

Now that the legality and transparency of WBTC are being questioned, various types of decentralized or centralized custodial BTC assets may usher in a new wave of “overflow liquidity”, which may come from WBTC or native BTC assets.

Artículos de referencia:

Has Bitcoin finally taken over Ethereum? Learn about wBTC, tBTC, renBTC and sBTC in one article

This article is sourced from the internet: After WBTC, the landscape of BTC custody

Related: INTO: The “Traffic Magnet” of the Web3 World

In the world of Web3, there is a voice that is becoming louder and louder – traffic is king. Yes, whether in the traditional Internet or Web3, traffic is the key factor that determines success or failure. As a leader in the Web3 social field, INTO is reshuffling the industry with its unique traffic aggregation strategy. 1. Traffic aggregation is the key to Web3 commercialization In the world of Web3, the importance of traffic is being magnified unprecedentedly. Behind this, there are profound industry logic and technical roots. First, from the perspective of business model, Web3 is reshaping the underlying logic of the Internet economy. Unlike the Web2 era, the commercial value of the Web3 era no longer comes mainly from advertising and e-commerce, but from the Token economy and…