El Salvador recibe más de 10T1.6 mil millones en inversión, ¿se reabrirá la Ciudad Bitcoin luego de dos años de retraso?

Original author: Ting, BlockTempo

After El Salvador officially listed Bitcoin as legal tender in September 2021, President Nayib Bukele actively promoted a number of Bitcoin-related policies, including developing wallets, launching an investment citizenship program in December last year, where an investment of $1 million in Bitcoin or USDT can obtain a residence visa and citizenship, and seeking to issue a $1 billion Bitcoin Volcano Bond.

Received $1.62 billion investment from Turkish company

In this context, the Salvadoran government said on the 11th that Turkish company Yilport Holding will invest $1.62 billion in two seaports in El Salvador, which is also the largest private investment in the countrys history. President Bugelei also said in a video shared on Monday:

“It will be a mixed-ownership company between Yilport Holding and El Salvador that will operate the two seaports for the next 50 years.”

One of the participating ports is Acajutla, which handles most of the country’s exports of coffee, sugar, and balsamic vinegar and salt from Peru. Another is La Union, the site of the planned Bitcoin City, an inactive and neglected port.

Will Bitcoin City Recover?

It is worth mentioning that Stacy Herbert, head of the Bitcoin Office in El Salvador, retweeted Jose Valdezs tweet, which stated that Yilport Holdings investment of US$1.62 billion will create thousands of direct and indirect jobs and more investment in local infrastructure.

At the same time, Stacy Herbert also hinted that Yilport Holding’s investment is of great significance to Bitcoin City:

“This agreement is of great significance for the eastern region of El Salvador, near the future Bitcoin City, and will have many positive effects.”

Max Keiser, a member of the Bitcoin Office in El Salvador, tweeted directly that Yilport Holding will invest in Bitcoin City and revealed that Qatar Investment is also in talks:

“El Salvador invests $1.6 billion in Bitcoin City infrastructure, the largest private investment in El Salvador’s history: $1.6 billion

Yilport Holding to invest in Pacific Port Alliance and Bitcoin City, President Bugelei’s visit to Turkey was a huge success!

According to previous reports from the Dynamic Zone, Bitcoin City was first proposed in November 2021. The city will rely on geothermal power for electricity, residents will be exempt from various taxes, and a huge Bitcoin symbol is planned to be built in the city center. However, after more than two years, Bitcoin City seems to have made no substantial progress. However, with Yilport Holding investing in ports around Bitcoin City, peoples expectations for the recovery of Bitcoin City have increased.

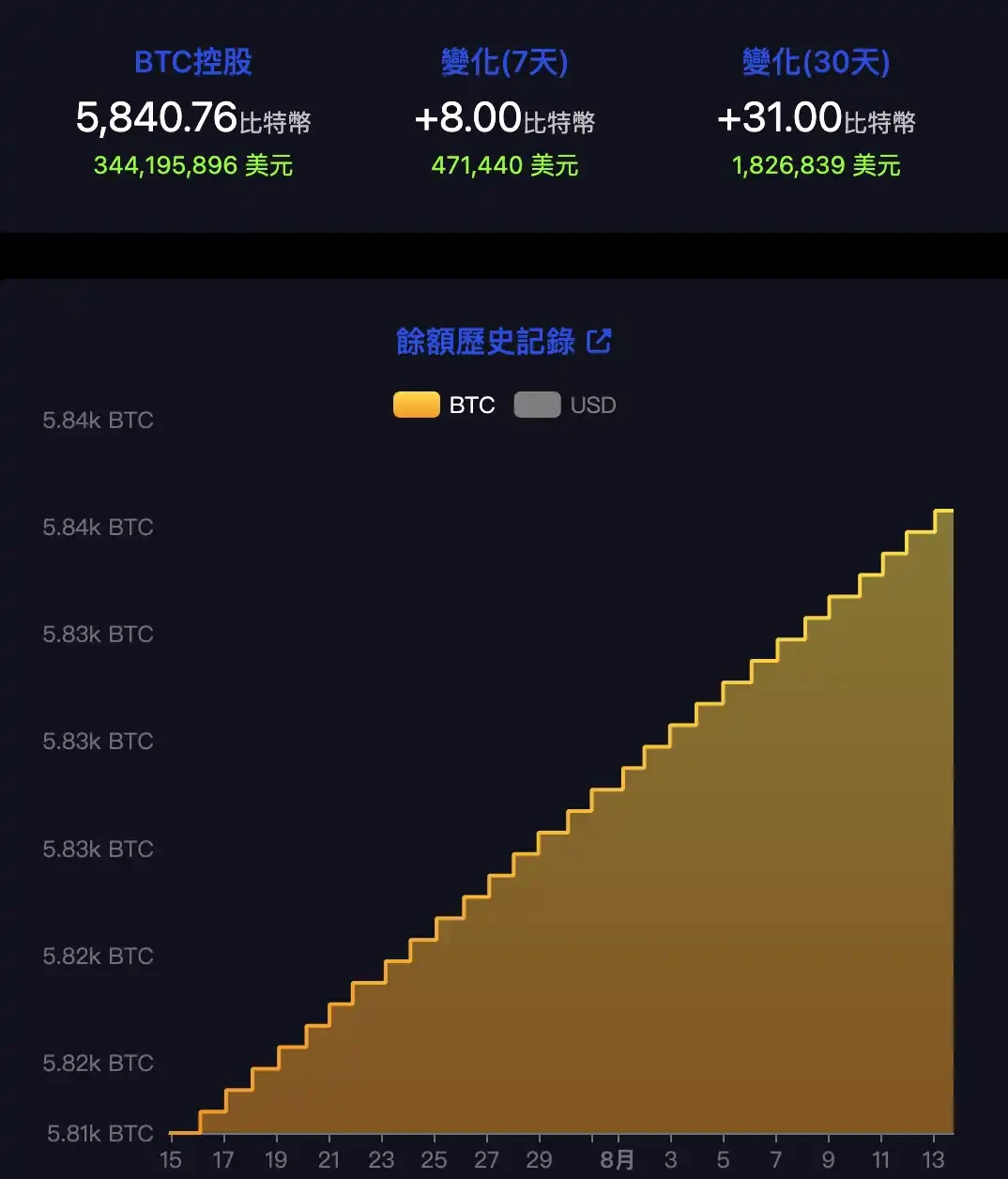

Daily fixed investment has accumulated BTC worth 344 million US dollars

On the other hand, Buglei announced at the end of 2022 that El Salvador would continue to buy one Bitcoin every day until it became unaffordable to buy Bitcoin with fiat currency.

In order to facilitate observation of whether El Salvador has fulfilled its promise, the National Bitcoin Office of El Salvador announced on May 13, 2024 that it would cooperate with mempool to launch a website dedicated to tracking the Bitcoin reserves of the El Salvador government. According to the records of the website, the El Salvador government has indeed implemented a policy of investing 1 Bitcoin every day. El Salvador currently holds 5,840.76 BTC, worth about US$344 million.

source:mempool

This article is sourced from the internet: El Salvador receives over $1.6 billion in investment, will the Bitcoin City be reopened after a two-year delay?

Autor original: CRYPTO, DISTILLED Traducción original: TechFlow Las criptomonedas, como la mayoría de los activos de riesgo, se enfrentan actualmente a graves vientos en contra a nivel macroeconómico, lo que genera una mayor volatilidad y miedo en el mercado. A pesar de estos desafíos, la sólida propuesta de valor de Bitcoin y blockchain sigue respaldando una perspectiva alcista a largo plazo. Espere algunos desafíos en el corto y mediano plazo. Concéntrese en la seguridad, mantenga la mente abierta y sea cauteloso al aprovechar las oportunidades. Aquí hay tres señales bajistas y tres señales alcistas para su referencia. Señal bajista #1: ruptura del oro En 2019, cuando el oro volvió a estallar, Bitcoin alcanzó sus máximos. Este patrón se repite en marzo de 2024. ¿Se enfriará el mercado durante 6 a 9 meses antes de 2025? Fuente: Intocryptoverse (i) ¿Por qué una ruptura del oro es bajista? Como refugio seguro, el oro tiende a…