Columna de volatilidad de SignalPlus (20240812): basada en datos

Bitcoin just experienced the impact of the macro market last week, and it was around 60,000-61,000 during the weekend. However, in the early morning of Asian time today, BTC fell to below 59,000 without any warning. Looking back at the ups and downs of digital currency prices with macro risk sentiment in recent days, the outflow of ETF funds last Friday was also quite disappointing. Therefore, before the release of inflation data such as CPI this week, traders may adopt more defensive strategies to reduce risk exposure, giving rise to some risk aversion.

Source: TradingView;SignalPlus, Economic Calendar

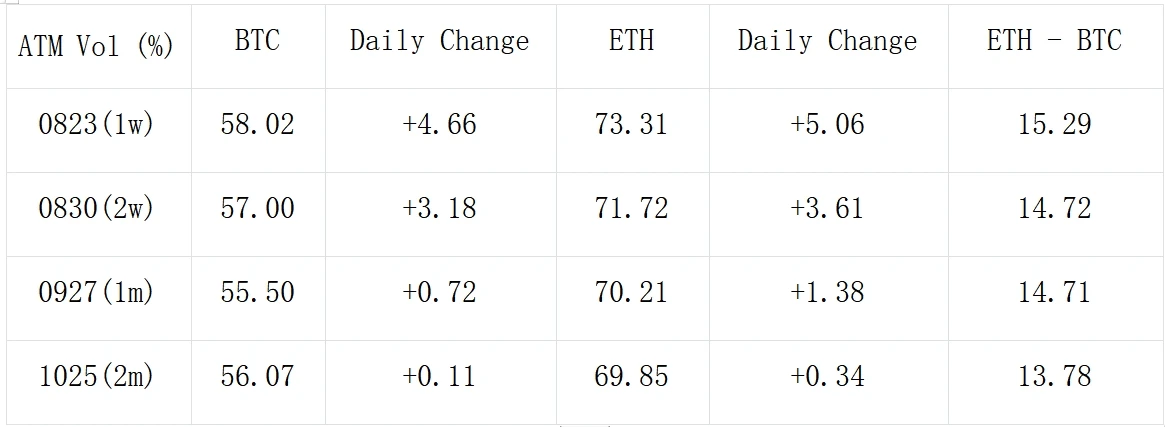

From the perspective of options, the price fluctuations broke the previous short-term tranquility, and the impact of the release of macro data was also amplified, causing the front-end IV to rise sharply and the curve to flatten. Vol Skew also ended the slow rebound of the previous two days, and collapsed again with the short-term price decline, returning to the low point, but from the trading we can see that it was this wave of decline that allowed the trader to seize the opportunity to sell a large number of put options on the Wing that week and gain a higher Vol Preimum.

Source: Deribit (as of 12 AUG 16: 00 UTC+ 8)

Fuente: SignalPlus

Fuente: SignalPlus

Fuente: SignalPlus

Puede utilizar la función de ventanilla de negociación de SignalPlus en t.signalplus.com para obtener más información sobre criptomonedas en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlusCN o únase a nuestro grupo de WeChat (agregue el asistente de WeChat: SignalPlus 123), grupo de Telegram y comunidad de Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240812): Data-driven

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Odaily Planet Daily took stock of the airdrop projects that can be claimed from July 15 to July 21, and added 3 TON ecosystem free project airdrops (as shown below). At the same time, it sorted out and introduced the interactive projects/tasks and important airdrop information added last week. For detailed information, see the text. Sanctum Project and air investment qualification introduction Sanctum is the LST liquidity aggregation protocol on the Solana ecosystem. The project announced the opening of airdrop applications on July 18, with over 100,000 addresses eligible for airdrops. The Sanctum airdrop adopts a dynamic amount mechanism. Depending on the time of application, the amount of tokens that users can obtain will also vary. Immediate…