Informe de investigación sobre el sentimiento del mercado de criptomonedas (del 2 al 9 de agosto de 2024): ¿Ha llegado la recesión? Las nóminas no agrícolas de EE. UU. en julio cayeron

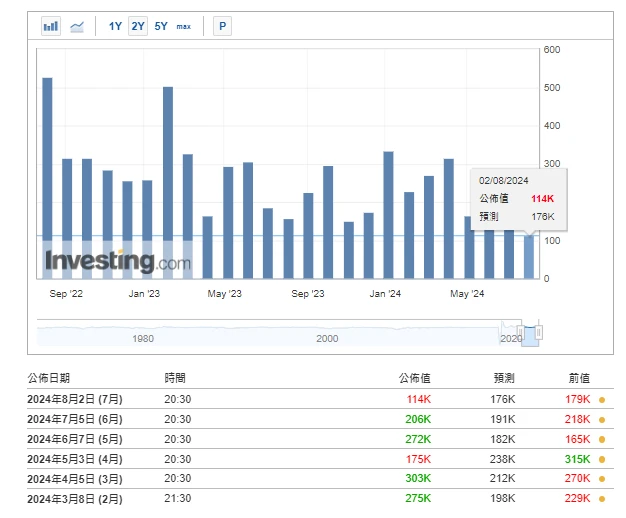

Recession has arrived? US non-farm payrolls in July fell far short of expectations

Fuente de imagen: https://hk.investing.com/economic-calendar/nonfarm-payrolls-227

The US non-farm payrolls report for July surprised the market, with the number of new jobs hitting a three-and-a-half-year low and the unemployment rate rising to a three-year high, triggering the Sams Rule, a recession indicator with 100% accuracy. Panic spread rapidly, and traders began to bet on the possibility of a 50 basis point rate cut in September, and predicted that the rate cut this year would exceed 110 basis points. This week, both US stocks and Bitcoin rebounded after a significant decline.

-

The Sahm Rule is an indicator proposed by economist Claudia Sahm to predict economic recessions. The rule is based on changes in the unemployment rate and has a trigger condition: if the three-month moving average employment rate is 0.5 percentage points lower than the highest employment rate in the past 12 months, then the indicator is triggered, indicating that the economy may be about to or has entered a recession.

There are about 40 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

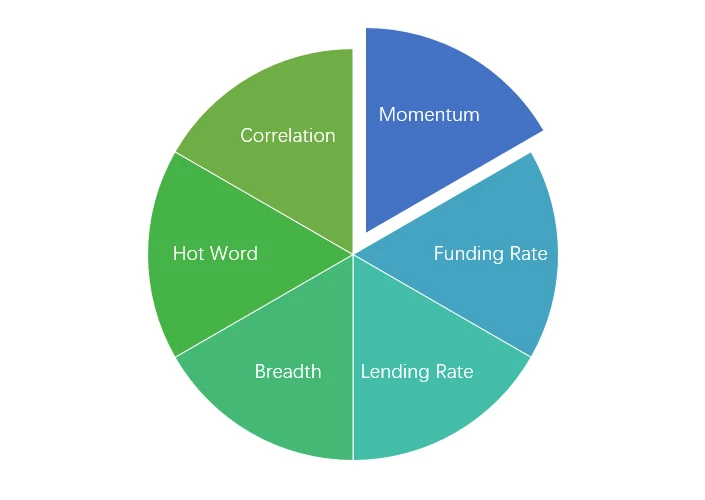

Análisis del entorno técnico y de sentimiento del mercado.

Componentes del análisis de sentimiento

Indicadores técnicos

Price Trends

BTC price fell -5.61% and ETH price fell -16.26% in the past week.

La imagen de arriba es el gráfico de precios de BTC la semana pasada.

La imagen de arriba es el gráfico de precios de ETH la semana pasada.

La tabla muestra la tasa de cambio de precios durante la última semana.

Gráfico de distribución de volumen de precios (soporte y resistencia)

In the past week, BTC and ETH fell to a low level and formed a new dense trading area before rebounding.

La imagen de arriba muestra la distribución de las densas áreas comerciales de BTC durante la semana pasada.

La imagen de arriba muestra la distribución de las densas áreas comerciales de ETH durante la semana pasada.

La tabla muestra el rango de negociación intensivo semanal de BTC y ETH durante la semana pasada.

Volumen e interés abierto

In the past week, both BTC and ETH had the largest trading volume when they fell to 8.5; the open interest of BTC and ETH both fell sharply.

La parte superior de la imagen de arriba muestra la tendencia del precio de BTC, el medio muestra el volumen de operaciones, la parte inferior muestra el interés abierto, el azul claro es el promedio de 1 día y el naranja es el promedio de 7 días. El color de la línea K representa el estado actual, el verde significa que el aumento de precios está respaldado por el volumen de operaciones, el rojo significa cerrar posiciones, el amarillo significa acumular posiciones lentamente y el negro significa estado abarrotado.

La parte superior de la imagen de arriba muestra la tendencia del precio de ETH, el medio es el volumen de operaciones, la parte inferior es el interés abierto, el azul claro es el promedio de 1 día y el naranja es el promedio de 7 días. El color de la línea K representa el estado actual, el verde significa que el aumento de precios está respaldado por el volumen de operaciones, el rojo significa que se cierran posiciones, el amarillo se acumula lentamente y el negro está abarrotado.

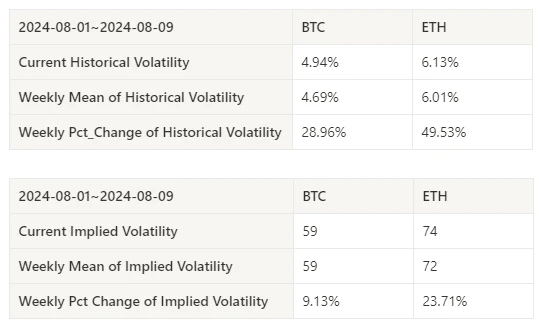

Volatilidad histórica versus volatilidad implícita

This past week, historical volatility for BTC and ETH was highest at 8.5, while implied volatility for both BTC and ETH increased.

La línea amarilla es la volatilidad histórica, la línea azul es la volatilidad implícita y el punto rojo es su promedio de 7 días.

Evento conducido

The non-farm data of the past week was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Indicadores de sentimiento

Sentimiento de impulso

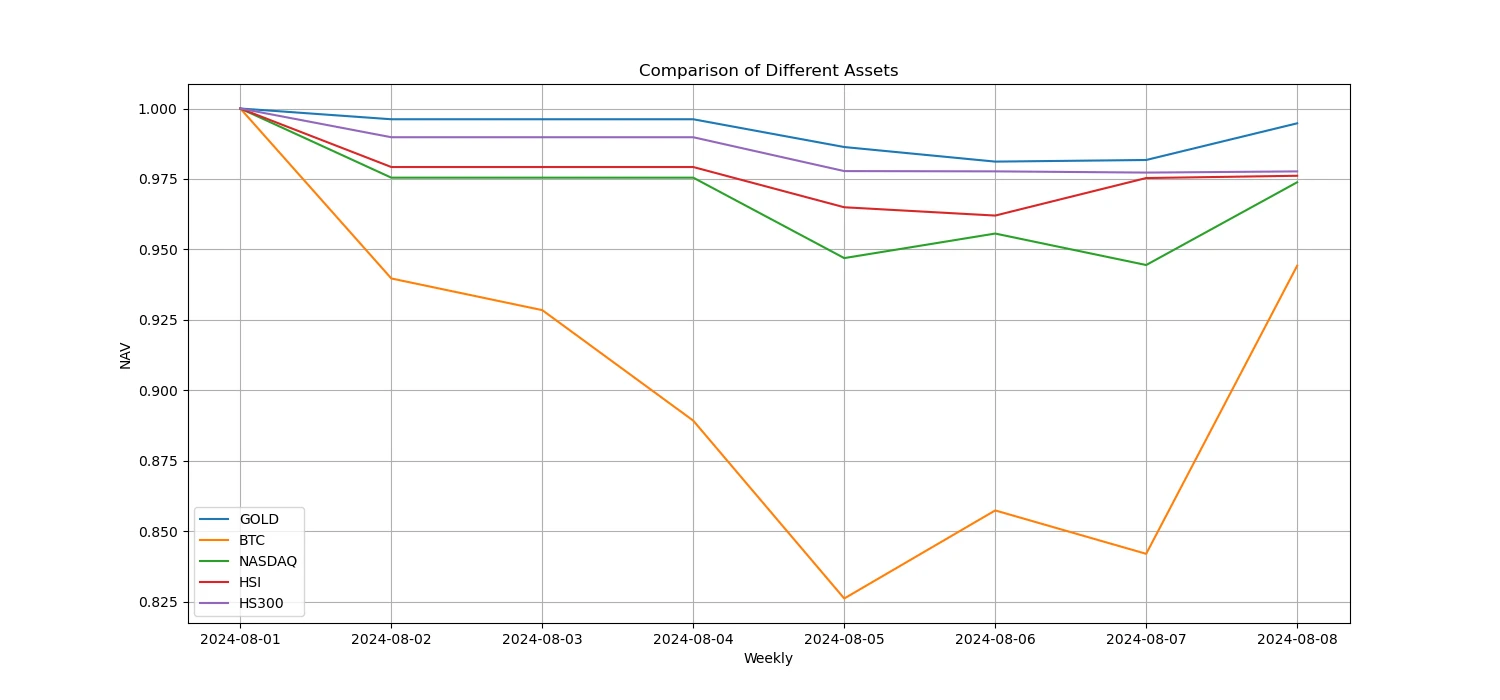

La semana pasada, entre Bitcoin/Oro/Nasdaq/Hang Seng Index/SSE 300, el oro fue el más fuerte, mientras que Bitcoin tuvo el peor desempeño.

La imagen de arriba muestra la tendencia de diferentes activos durante la semana pasada.

Tasa de préstamo_Sentimiento de préstamo

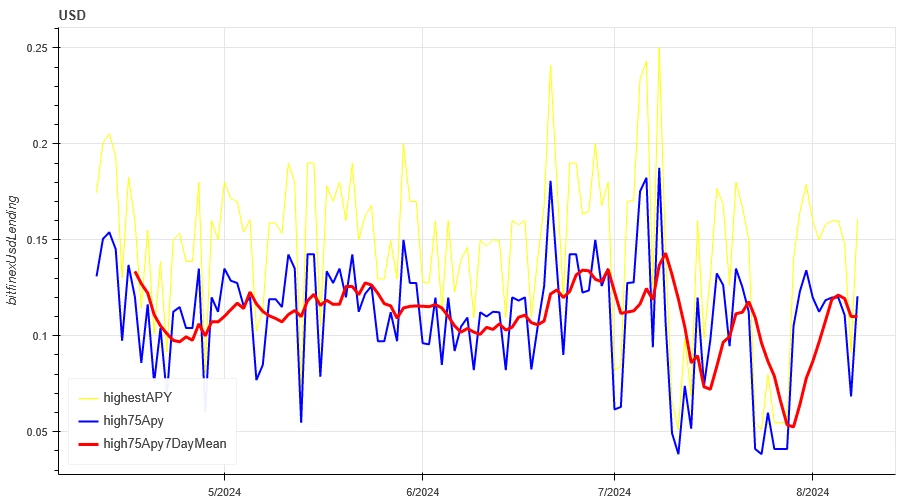

The average annualized return on USD lending over the past week was 11.1%, and short-term interest rates remained at 12.1%.

La línea amarilla es el precio más alto de la tasa de interés en USD, la línea azul es 75% del precio más alto y la línea roja es el promedio de 7 días de 75% del precio más alto.

La tabla muestra los rendimientos promedio de las tasas de interés en USD para diferentes días de tenencia en el pasado.

Tasa de financiación_Sentimiento de apalancamiento del contrato

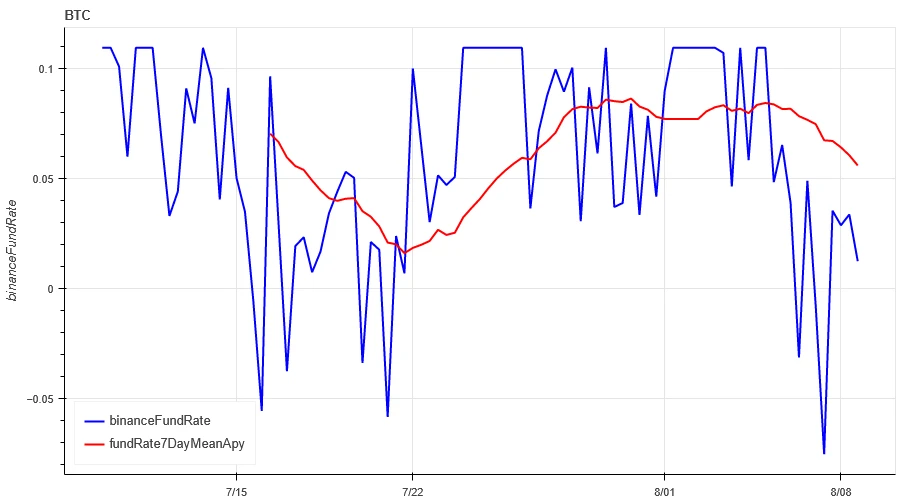

The average annualized return on BTC fees in the past week was 5.8%, and contract leverage sentiment was gradually declining.

La línea azul es la tasa de financiación de BTC en Binance y la línea roja es su promedio de 7 días.

La tabla muestra el rendimiento promedio de las tarifas de BTC para diferentes días de tenencia en el pasado.

Correlación del mercado_Sentimiento de consenso

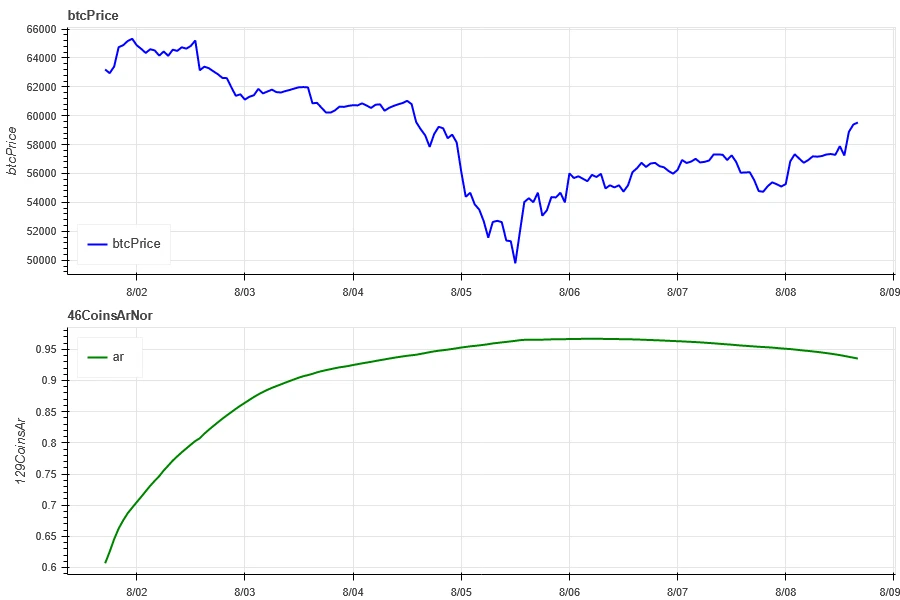

The correlation among the 129 coins selected in the past week was around 0.95, and the consistency between different varieties rose to a high level.

En la imagen de arriba, la línea azul es el precio de Bitcoin, y la línea verde es [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jazmín, kava, klay, ksm, ldo, enlazar, telar, lpt, lqty, lrc, ltc, luna 2, magia, mana, matic, meme, mina, mkr, cerca, neo, océano, uno, ont, op, pendle, qnt, qtum, rndr, rosa, runa, rvn, arena, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, olas, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] correlación general

Amplitud del mercado_Sentimiento general

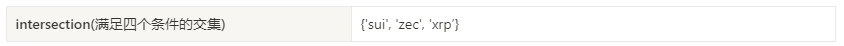

Among the 129 coins selected in the past week, 6.3% of them were priced above the 30-day moving average, 12% were priced above the 30-day moving average relative to BTC, 9% were more than 20% away from the lowest price in the past 30 days, and 10% were less than 10% from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

La imagen de arriba es [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apto, arb, ar, astr, átomo, avax, hachas, bal, banda, murciélago, bch, bigtime, difuminar, pastel, celo, cfx, chz, ckb, comp, crv, cvx, cyber, guión, dux, punto, dydx, egld, enj, ens, eos, etc. fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jazmín, jto, saltar, kava, klay, ksm, ldo, enlazar, telar, lpt, lqty, lrc, ltc, luna 2, magia, mana, manta, máscara, matic, meme, mina, mkr, cerca , neo, nfp, océano, uno, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rosa, runa, rvn, arena, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, veterinario, olas, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] Proporción de 30 días de cada indicador de ancho

Resumir

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell sharply on August 5, when the volatility and trading volume of these two cryptocurrencies reached a peak. The volume of open contracts decreased significantly, while the implied volatility increased simultaneously. Bitcoins funding rate continued to decline, which may reflect the weakening interest of market participants in its leveraged trading. Market breadth indicators show that the prices of most cryptocurrencies fell, and the entire market continued to be under pressure. In addition, the non-agricultural data was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Gorjeo: @ https://x.com/CTA_ChannelCmt

Sitio web: canalcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (August 2–9, 2024): Has recession arrived? U.S. non-farm payrolls in July fell far short of expectations

Related: Must-read guide: Play with the TON ecosystem and seize early dividends

Original author: Biteye core contributor Viee Original editor: Biteye core contributor Crush Have you started to FOMO TON? These past two days, I have been crazy about posting black and white dog MEMEs and showing off my points. I thought the bull market was back. Today, Biteye will teach you how to play in the TON ecosystem and seize potential airdrop opportunities. We have organized this thread into a mind map, please take it if you need it. 01 Wallet Introduction The first step to participate in the TON ecosystem is to use a wallet. Currently, there are 49 wallets that support the TON chain. Here are two of the most popular ones: Wallet and TON Space Wallet Wallet is Telegrams native centralized custodian wallet, similar to WeChat Wallet, which…