Columna de volatilidad de SignalPlus (20240806): Lunes negro

Last week, the weak economic data represented by the US non-farm and manufacturing index triggered market concerns about economic slowdown, and global assets suffered from the selling pressure brought by Black Monday. The exchange rate of the US dollar against the Japanese yen once fell below 142, giving up almost all the gains in the past year. The stock indexes of Japan, South Korea, and Turkey triggered the circuit breaker mechanism. The three major US stock indexes all closed down by about 3%, and the market value of the Big Seven evaporated by 1.3 trillion US dollars at the opening. The futures market fully priced in the Federal Reserves 50 basis point rate cut in September. The yield on the two-year US Treasury bond once ended the inversion with the 10-year bond during the session, and is now at 3.957%.

Fuente: TradingView

The markets selling sentiment has also spread from traditional markets to digital currencies. As a risk asset highly correlated with SP 500, BTC plunged below $50,000 yesterday, triggering panic in the market. Short-term IV rushed to the three-digit range, liquidity ran, and Vol Skew also fell along with the price. The surge in demand on Wing caused Flys valuation to rise rapidly.

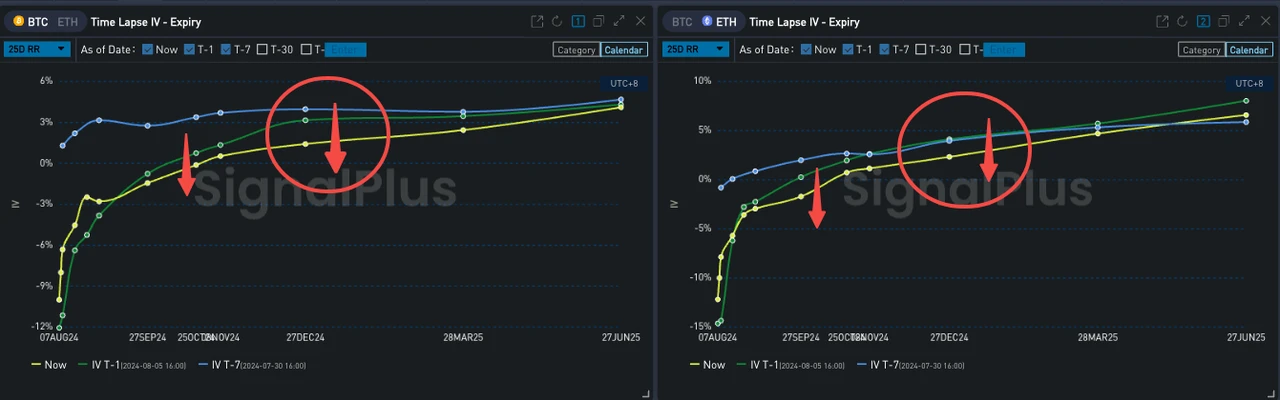

However, as the price gradually rebounded back to $55,000, the liquidity of the options market gradually returned, IV escaped from the local high point, the high Vol Premium at the tail was also repriced, and Fly fell overall. For Vol Skew, although the negative slope of the front end rebounded slightly, the more noteworthy change is the further sharp drop in the far-end Vol Skew. In fact, when the price plummeted yesterday, only the front end responded, and the far-end Risky with poor liquidity was not re-priced until today.

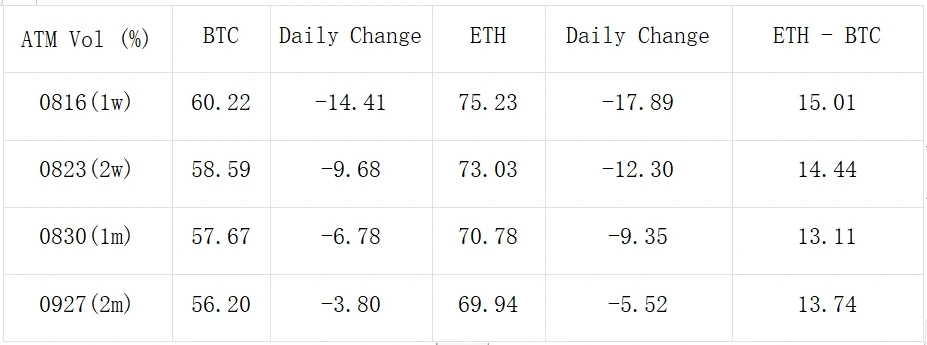

Source: Deribit (As of 6 AUG 16: 00 UTC+ 8)

Source: SignalPlus, ATM Vol.

Source: SignalPlus, 25 dRR, Far End Vol Skew is Repriced

Source: SignalPlus, 25 dFly

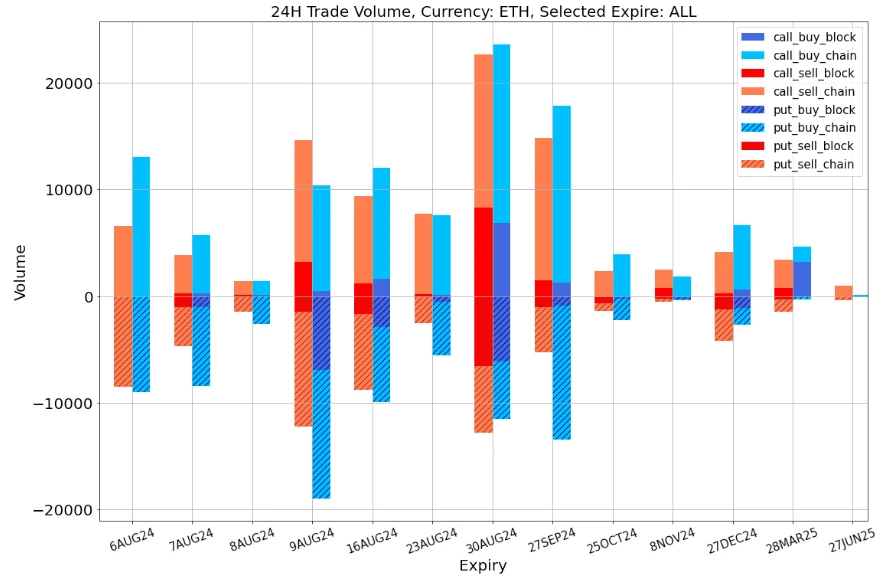

Fuente de datos: Deribit, distribución general de transacciones ETH

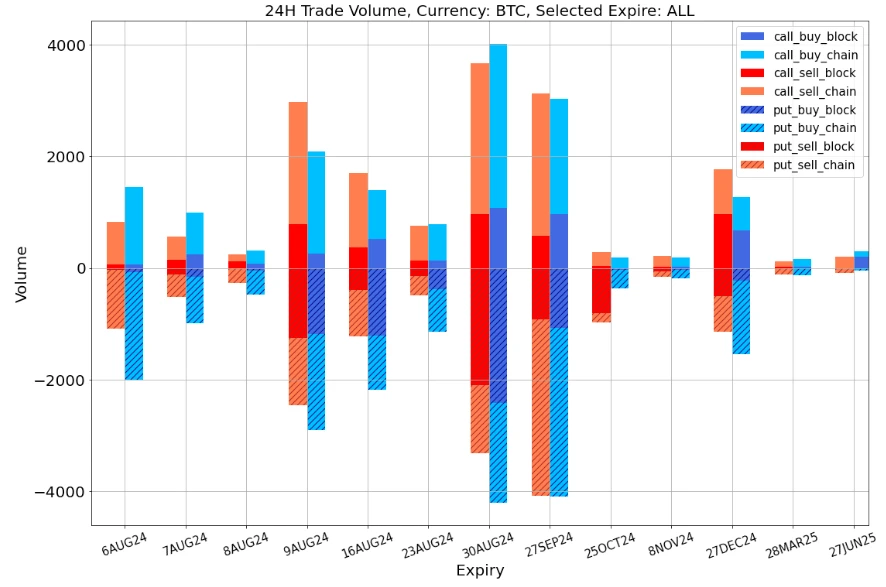

Fuente de datos: Deribit, distribución general de transacciones BTC

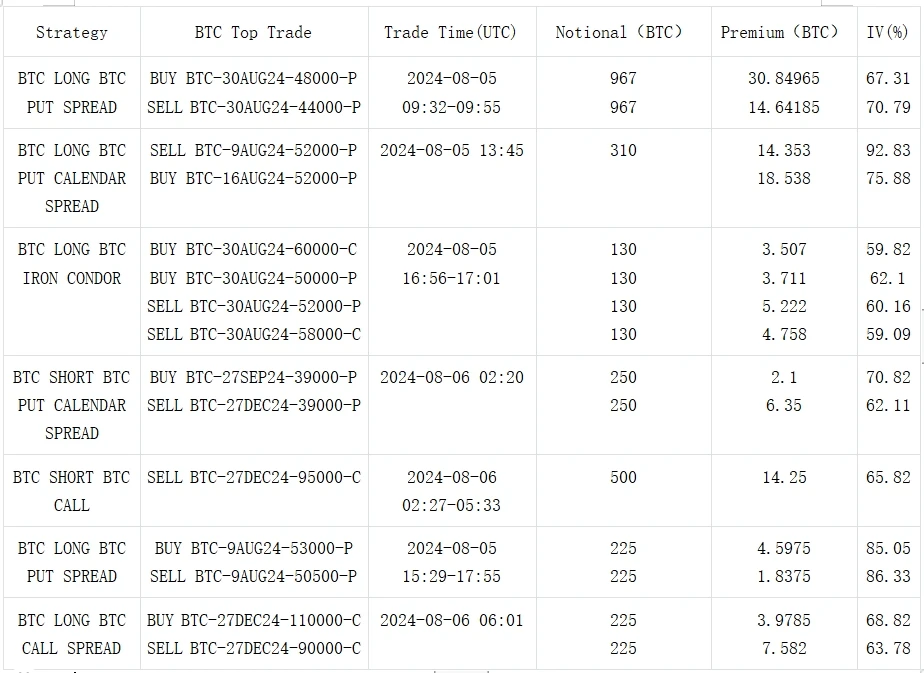

Fuente: Deribit Block Trade

Fuente: Deribit Block Trade

Puede utilizar la función de ventanilla de negociación de SignalPlus en t.signalplus.com para obtener más información sobre criptomonedas en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlusCN o únase a nuestro grupo de WeChat (agregue el asistente de WeChat: SignalPlus 123), grupo de Telegram y comunidad de Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240806): Black Monday

Related: Early-stage potential projects that must be participated in this week: Movement, WORLD3

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) Since the ZKsync and LayerZero airdrops, many people have said that the era of scalping is over. Coupled with the sluggish market in the past two weeks, the communitys enthusiasm for scalping has dropped to a low point. It is true that the era of achieving financial freedom by mindlessly signing up for airdrops is gone forever, but as the definition of high-quality accounts becomes more and more stringent, retail investors have become an entry point to understand high-finance or popular projects by scaling in a short period of time. Odaily Planet Daily has compiled two projects worth participating in this week based on financing status, project popularity and other aspects. Movement: Building the first L2…