Autor original: Zhou Zhou, Foresight News

Ethereum spot ETF is undervalued.

At first, people did not expect that the Bitcoin spot ETF could create such a huge miracle. Now, the Ethereum spot ETF is also being underestimated. Traditional institutions have shown strong demand for the Ethereum ETF in the first seven trading days.

On July 23, 2024, the US Ethereum spot ETF was officially traded, and it was only half a year after the US Bitcoin spot ETF was officially traded. In the past six months (as of July 2024), the net inflow of assets to the Bitcoin spot ETF reached 17 billion US dollars. This is equivalent to an average of more than 100 million US dollars of net funds flowing into Bitcoin every trading day after the emergence of the Bitcoin ETF. The market reacted quickly, and after the Bitcoin ETF was passed, Bitcoin rose by 50% in two months.

The influence of Bitcoin spot ETF on the price of Bitcoin in this cycle is unparalleled. Binance co-founder He Yi once said in an interview with Foresight News : From 2021 to 2024, this so-called bull market is not driven by innovation, but by independent events such as ETFs. This is not an exaggeration. According to Caixin Weekly, the average daily trading volume of Bitcoin spot ETF is about 4 billion to 5 billion US dollars, accounting for 15% to 20% of the total trading volume of global cryptocurrency exchanges. ETFs have brought massive liquidity to the Bitcoin market.

The US Bitcoin ETF has also created miracles in the US ETF market. Only half a year after its launch, among the nearly 2,000 ETFs launched in the past five years, two Bitcoin spot ETFs (IBIT and FBTC) have squeezed into the top 10 in terms of capital inflows. BlackRock IBIT became the fastest ETF in the United States to reach $20 billion in just 137 days (the previous record holder was the JEPI actively managed fund issued by JPMorgan Chase, which took 985 days to reach $20 billion). As of July 31, 2024, BlackRocks IBIT had a net inflow of $20.023 billion, and Fidelitys FBTC had a net inflow of $9.952 billion.

As the single variable that may currently have the greatest impact on the Bitcoin and cryptocurrency markets, the performance of the Bitcoin spot ETF provides a rare and valuable template and reference for subsequent other cryptocurrency ETFs such as Ethereum. People can intuitively see and compare the net inflows, trading volumes and other data of Bitcoin and Ethereum spot ETFs every day.

So, will Ethereum replicate the success of the Bitcoin spot ETF? When will the Ethereum spot ETF’s trading volume and net inflow reach a certain scale to be considered to outperform the Bitcoin spot ETF? Will the Ethereum ETF’s impact on Ethereum’s liquidity and price be as great as the Bitcoin ETF’s impact on Bitcoin’s price and liquidity?

Undervalued Ethereum Spot ETF

Traditional institutions showed strong demand for Ethereum ETFs in the first seven trading days. According to the market capitalization share (30%), the net inflow of funds in Ethereum spot ETFs even exceeded that of Bitcoin spot ETFs.

As of August 1, Ethereum’s market value was 30% of Bitcoin’s. Based on this ratio, the first-day and first-week data of the Ethereum ETF exceeded that of the “Bitcoin Spot ETF”.

On the first day of trading, the eight Ethereum ETFs other than Grayscale had a net inflow of $591 million, while the nine Bitcoin ETFs other than Grayscale had a net inflow of $750 million on the first day, with the Ethereum ETF accounting for 78% of that. Considering that Ethereums market value is 30% of Bitcoins, Ethereums first day performance is quite amazing, surpassing the performance of Bitcoin spot ETFs.

Data of Ethereum spot ETF in the first 7 trading days (Data source: Coinglass)

If we extend the time to a week, we will still find that the performance of Ethereum spot ETF is no less than that of Bitcoin spot ETF.

In the first seven trading days, the eight Ethereum ETFs except Grayscale had a net inflow of $1.494 billion. In contrast, the net inflow of the nine Bitcoin ETFs except Grayscale in the first few trading days was $4.536 billion, and the former accounted for 32% of the latter. Considering that the market value of Ethereum is 30% of Bitcoin, the data of the Ethereum ETF in the first seven days is not inferior to or even slightly better than that of the Bitcoin ETF.

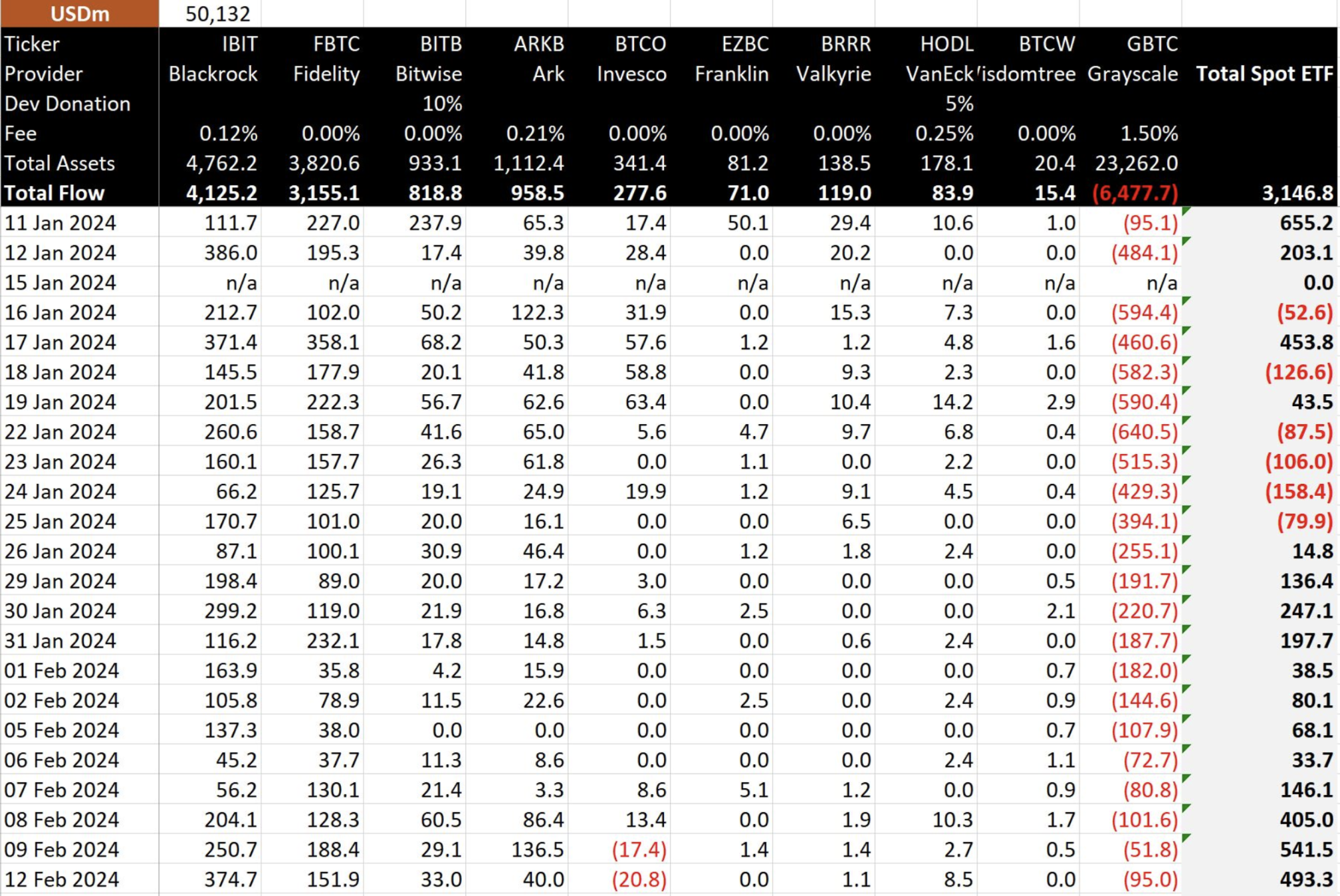

Data of the first 11 trading days of Bitcoin spot ETF (data source: BitMEX Research)

From the above two figures, we can see that in the first 11 trading days, only Grayscale was selling Bitcoin spot ETFs (10) and Ethereum spot ETFs (9), while the others were buying. Moreover, Grayscales selling volume was much higher than the total buying volume of the other eight companies.

This is because Grayscales layout was early, the chips of Bitcoin and Ethereum it obtained were very low, and the handling fees after the ETF was listed were very high, so both Bitcoin and Ethereum faced massive selling pressure from Grayscale in the past few weeks. Therefore, the prices of Bitcoin and Ethereum will not rise directly from this.

According to Coinglasss data, as of July 30, 2024, the total asset management scale of US Ethereum ETFs is US$9.009 billion, while the asset management scale of Grayscale ETFE is US$6.896 billion, accounting for 76% of the overall US Ethereum spot ETF market. Grayscales Ethereum selling pressure will continue for some time.

Grayscale ETFE has an asset management scale of US$6.896 billion, accounting for 76% of the market (Image source: The Block)

In the first seven trading days, 9 Ethereum spot ETFs had a total outflow of $484 million. Among them, Grayscale ETHE had an outflow of $1.977 billion. While the other eight ETFs were buying, Grayscale alone caused a net outflow of Ethereum spot ETFs.

So, how long will the Grayscale Ethereum Spot ETF continue to bring selling pressure to the market? When will the Ethereum ETFs funds begin to accelerate, bringing a steady stream of net inflows and liquidity to the Ethereum market? Or even begin to directly affect the price of Ethereum?

Will Ethereum ETF surpass Bitcoin ETF in the future?

How to judge the performance of Ethereum Spot ETF?

US ETF analysts believe that BlackRocks ETF data performance will be an important reference. (Indicator 1)

Whether it is the Bitcoin spot ETF or the Ethereum spot ETF, BlackRock is the largest ETF buyer, and it is expected to absorb all of Grayscales selling over time.

As the worlds largest asset management company with $10 trillion in assets, BlackRock alone bought more Bitcoin ETFs than the other nine Bitcoin ETFs combined. In the six months from January 11, 2024 to July 31, 2024, BlackRock attracted a net inflow of $20.023 billion in Bitcoin, while the net inflows of the other eight Bitcoin spot ETFs except Grayscale totaled $16.6 billion, and Grayscales sales were $19 billion. BlackRock completely ate the Bitcoin sold by Grayscale.

According to Bitcoin ETF data, on the 12th working day after the issuance of Bitcoin ETF (January 29), BlackRocks Bitcoin spot ETF exceeded Grayscale Bitcoin Trust (GBTC) in trading volume for the first time. Some professional ETF analysts in the United States believe that this is a significant weakening of the strength of Grayscales selling pressure on Bitcoin, which is one of the signals that Bitcoin has bottomed out.

Data of the first 23 trading days of Bitcoin spot ETF (data source: BitMEX Research)

In fact, since that day (the 12th working day after its issuance), the Bitcoin ETF has begun to receive sustained net inflows of funds.

As shown in the above figure, after the 12th trading day, Grayscales selling pressure on the Bitcoin ETF could not maintain the previous level, while BlackRock and Fidelitys buying pressure could still maintain the previous level. The price of Bitcoin has been rising since January 26, reaching its peak on March 14. In these two months, the Bitcoin ETF has net injected nearly tens of billions of dollars of assets into the Bitcoin market.

The second indicator worth paying attention to is whether the net inflow of assets after the Ethereum ETF is issued can reach 30% of the Bitcoin ETF. (Indicator 2)

Eugene, head of institutional business at Bybit, told Foresight News: For traditional financial institutions, it will take a little longer to understand ETH than BTC. We expect the net inflow of assets into the Ethereum ETF to be approximately 25%-30% of that of the Bitcoin ETF, based on the market capitalization ratio of Ethereum and Bitcoin.

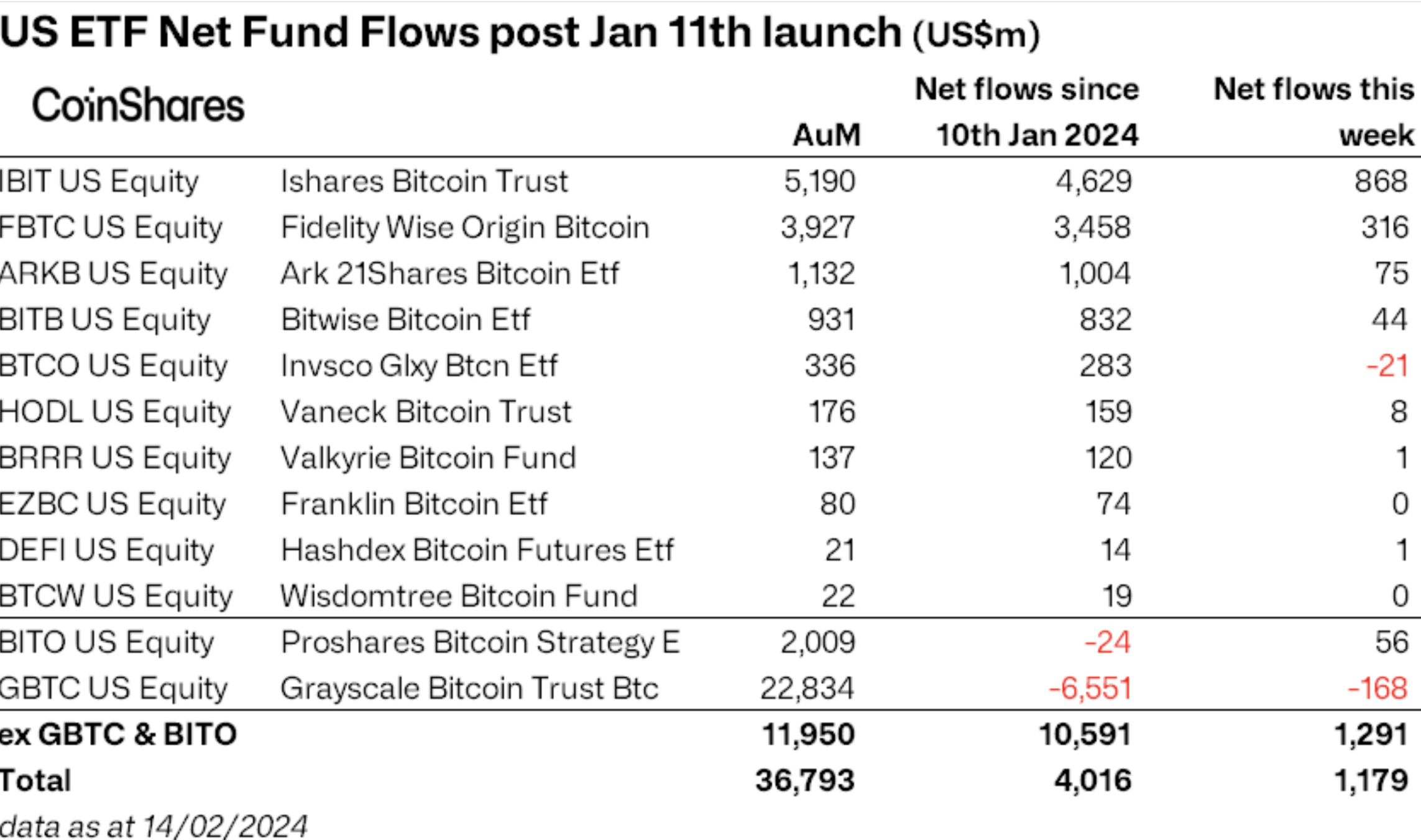

Image credit: James Butterfill, head of research at CoinShares

Net inflow of assets represents the actual net inflow of funds into the Ethereum market by Ethereum ETT, that is, the incremental amount.

As shown in the above figure, in the first month after the official launch of the Bitcoin spot ETF (February 14), the total net inflow reached US$4 billion, which brought substantial incremental funds to the Bitcoin market.

Further quantify indicator 2:

1) In the first month, around August 23, 2024, can the Ethereum ETF’s net inflow of assets reach $1 billion?

2) Two months later, around September 23, did the net inflow reach $2.7 billion and the total AUM reach $16.5 billion (as of July 31, the total AUM of the Ethereum ETF was $9.119 billion)?

3) Six months later, on January 23, 2025, will the net inflow of funds reach US$4.6 billion (after 6 months, the net inflow of Bitcoin spot ETFs will reach US$15.2 billion)?

When all Ethereum spot ETFs generate net asset inflows for the first time, it will be another key signal. (Indicator 3)

As shown in the figure below, as of July 31, the Ethereum ETF had a net outflow of $484 million. This means that Grayscales selling pressure is greater than the buying of the other eight Ethereum spot ETFs.

Fuente de datos: Coinglass

However, Grayscale ETFE currently has an asset management scale of $6.896 billion. At the current average daily selling rate of $282 million, Grayscale ETFEs asset management scale will be halved after 12 trading days. This is obviously unsustainable and unreasonable. According to the data of Grayscale Bitcoin ETFs selling, although Grayscale has been selling Bitcoin almost every day for six months, even after six months, it has only sold more than half of the Bitcoin it holds.

Judging from Grayscales Ethereum ETF holdings and selling speed, it is difficult for Grayscale to sell Ethereum at the same pace as in the previous seven weeks, while institutions such as BlackRock are expected to continue to maintain their previous purchasing power. If this is true, the net inflow of Ethereum ETFs will reach a turning point within a few weeks.

ETF, the biggest variable affecting Ethereum prices in the short term?

Bitcoin ETF is the biggest variable affecting Bitcoin price in this cycle. After the emergence of Ethereum ETF, will it become the biggest variable affecting Ethereum price in the current cycle?

As Bybits head of institutional business Eugene told Foresight News, it depends on whether traditional institutions can understand what Ethereum is as quickly as they understand Bitcoin and pay for it.

Many people believe that the main attraction of Bitcoin is its scarcity, but many people also believe that the attraction of Ethereum lies in its practicality. You can think of Ethereum as a global platform for applications that can run without decentralized intermediaries. Bloomberg ETF analyst Eric Balchunas introduced Ethereum in this way.

Ethereum is a global application platform that can run without a central agency. It is the first truly decentralized platform in history. Some practitioners also introduced it this way. In any case, in the next six months, Ethereum will be observed by traditional institutions, who will use funds to prove whether they will pay for Ethereums technology, builders, business narratives and future prospects.

The good news is that, based on the 30% market value, in the first seven trading days of data known so far, apart from the Grayscale factor, traditional institutions have shown strong demand for Ethereum ETFs. Ethereum ETFs account for 32% of the net inflow of Bitcoin ETF funds. This data alone indicates that the performance of Ethereum ETF spot has slightly exceeded that of Bitcoin spot ETFs so far.

Index 1: https://farside.co.uk/?p=1518

Indicator 2: https://x.com/jbutterfill

Indicator 3: https://www.coinglass.com/zh/eth-etf

Grayscale holdings: https://www.theblock.co/data/crypto-markets/ethereum-etf

This article is sourced from the internet: The Undervalued Ethereum Spot ETF

Related: Continue Capital: Where is the way out for blockchain business model?

Original author: Pima, co-founder of ContinueCapital The value path of blockchain investment What are you buying in the public chain market or the blockchain industry? Or what is the way out for the blockchain business model? The performance of the copycat market that is lower than expected has caused many people to have industry concerns. In a complex environment and at different stages of industry development, it is inevitable that investment difficulties will increase, but the fundamental problem lies in finding a business model for the long-term sustainable development of the project. Ten years have passed, and I’ve found that many people, even those who have been in the industry for a long time, still don’t quite understand why public chains have always dominated the TOP 100 list, and why…