Clasificación de ingresos de la cadena pública: Ethereum gana $2.2 mil millones al año, Optimism está profundamente en números rojos

Original title: Which Blockchains Actually Make Money?

Original author: David C, Bankless

Original translation: Baishui, Golden Finance

Two weeks ago, I wrote about protocols with strong fundamentals (such as excess revenue or token supply) that showed promise in the latest wave of price increases.

We now take a closer look at L1 and L2 using the same fundamentals-driven approach.

Whether it’s an influx of institutional investment or general disillusionment with high-FDV token issuance, the recent surge presents a potential opportunity to take a closer look at blockchain’s overall fundamentals, not just its revenues but its earnings as well.

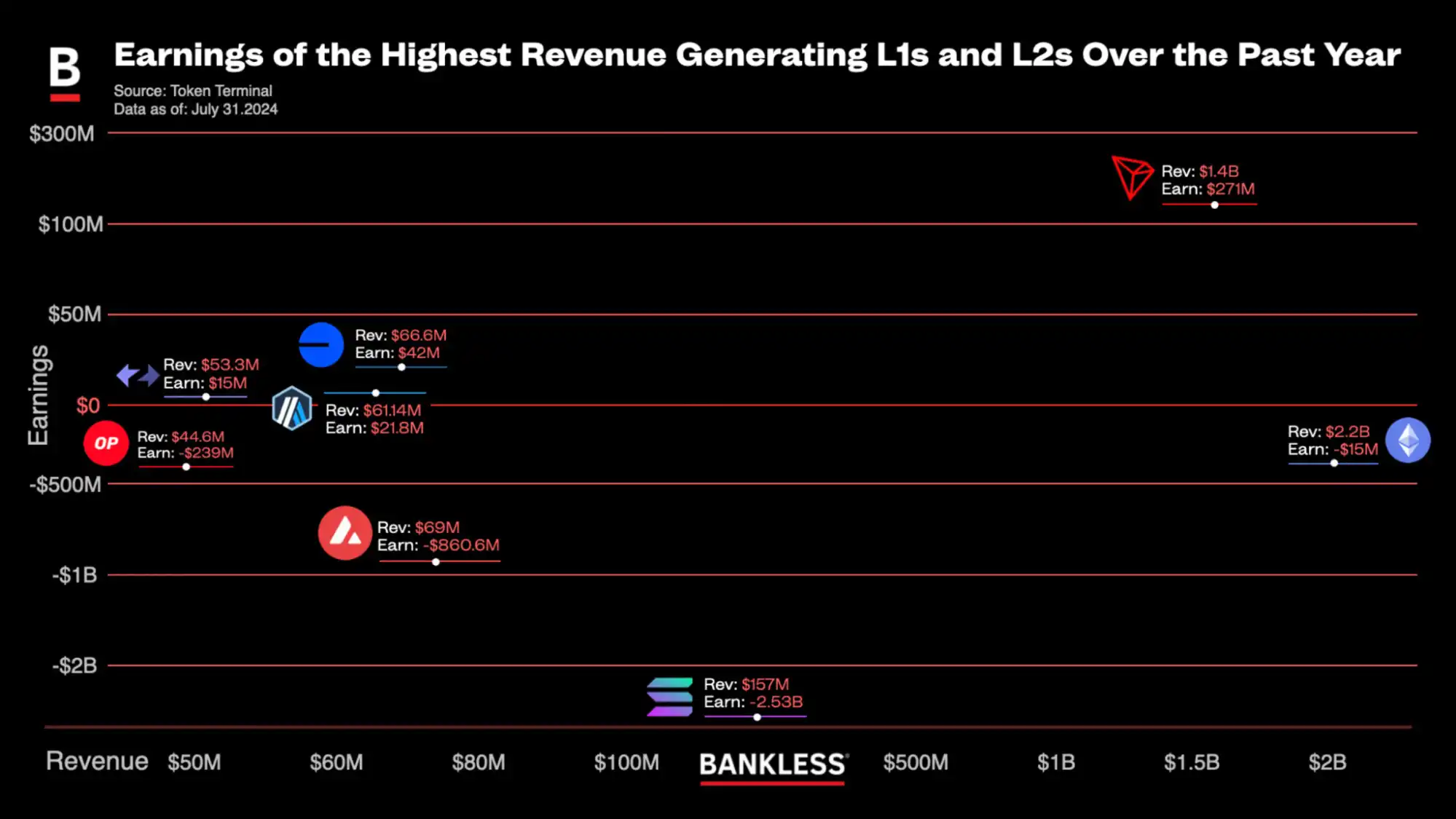

Today, we’ll explore just that, analyzing the top 4 L1 and L2 by revenue, and then diving into how much of that revenue, if any, these blockchains actually keep.

Note: Just like TradFi, there are many complex ways to filter returns for various projects. In today’s post, we’ll keep it simple and define returns as total revenue minus token issuance (the number of native tokens distributed to users) and operating expenses (the costs of developing, maintaining, and upgrading the protocol).

Which L1 blockchains can be profitable?

Without further ado, let’s look at the numbers.

Etereum

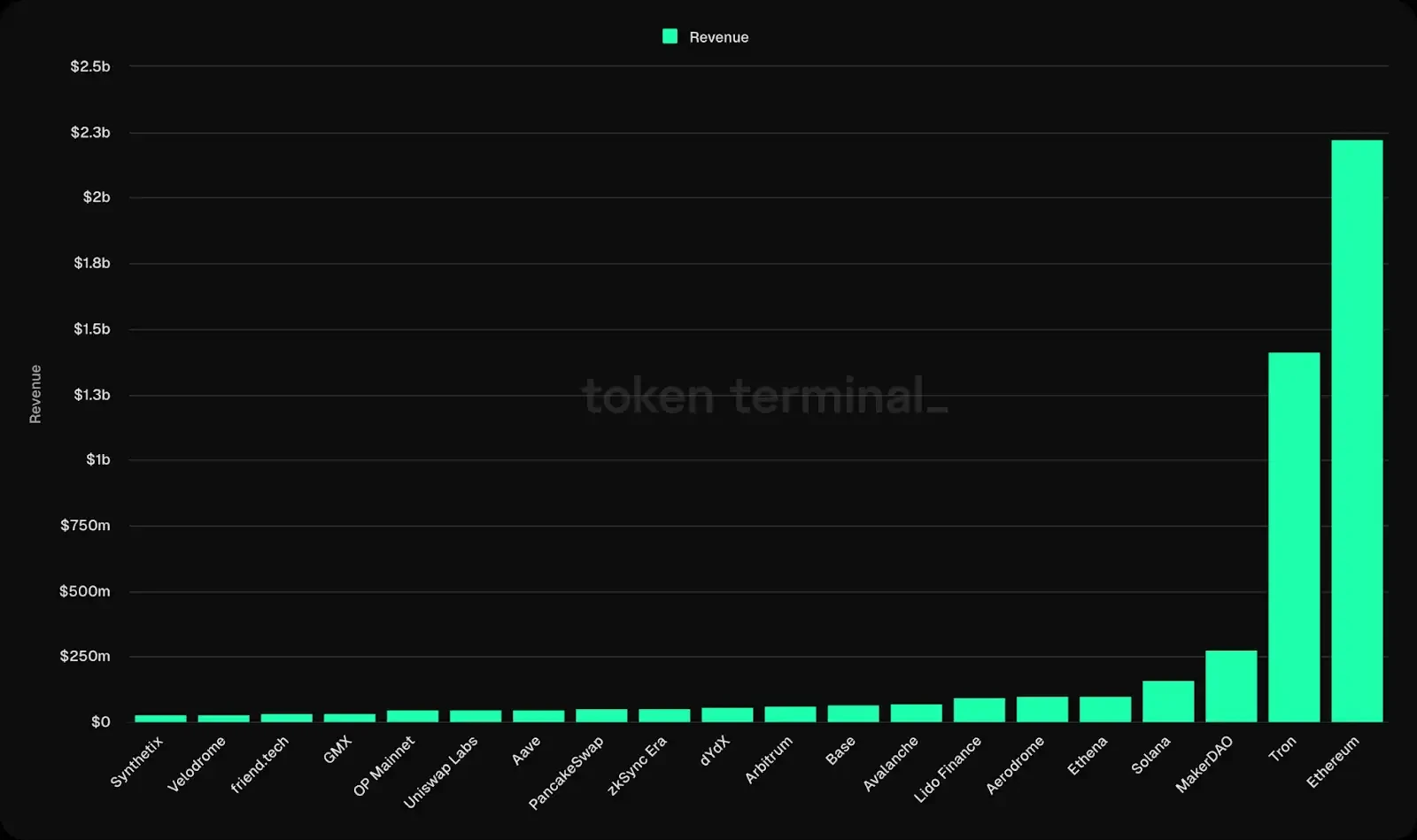

In terms of revenue generated, Ethereum is far ahead of all other blockchains (both L1 and L2), with $2.22 billion in revenue over the past year.

Yet, despite the impressive revenue, Ethereum recorded a net loss of $15 million. The reason? This loss was primarily due to the issuance of new tokens outpacing its revenue, with earnings turning negative year-to-date after a strong second half of 2023. This can largely be attributed to the shift of transaction activity to L2, which reduces direct payments to the world computer. As a result, despite Ethereums high transaction volume and network activity, this migration led to a decline in its earnings.

Trón

Low-profile giant Tron ranked second in terms of total revenue, with $1.4 billion in revenue over the past year.

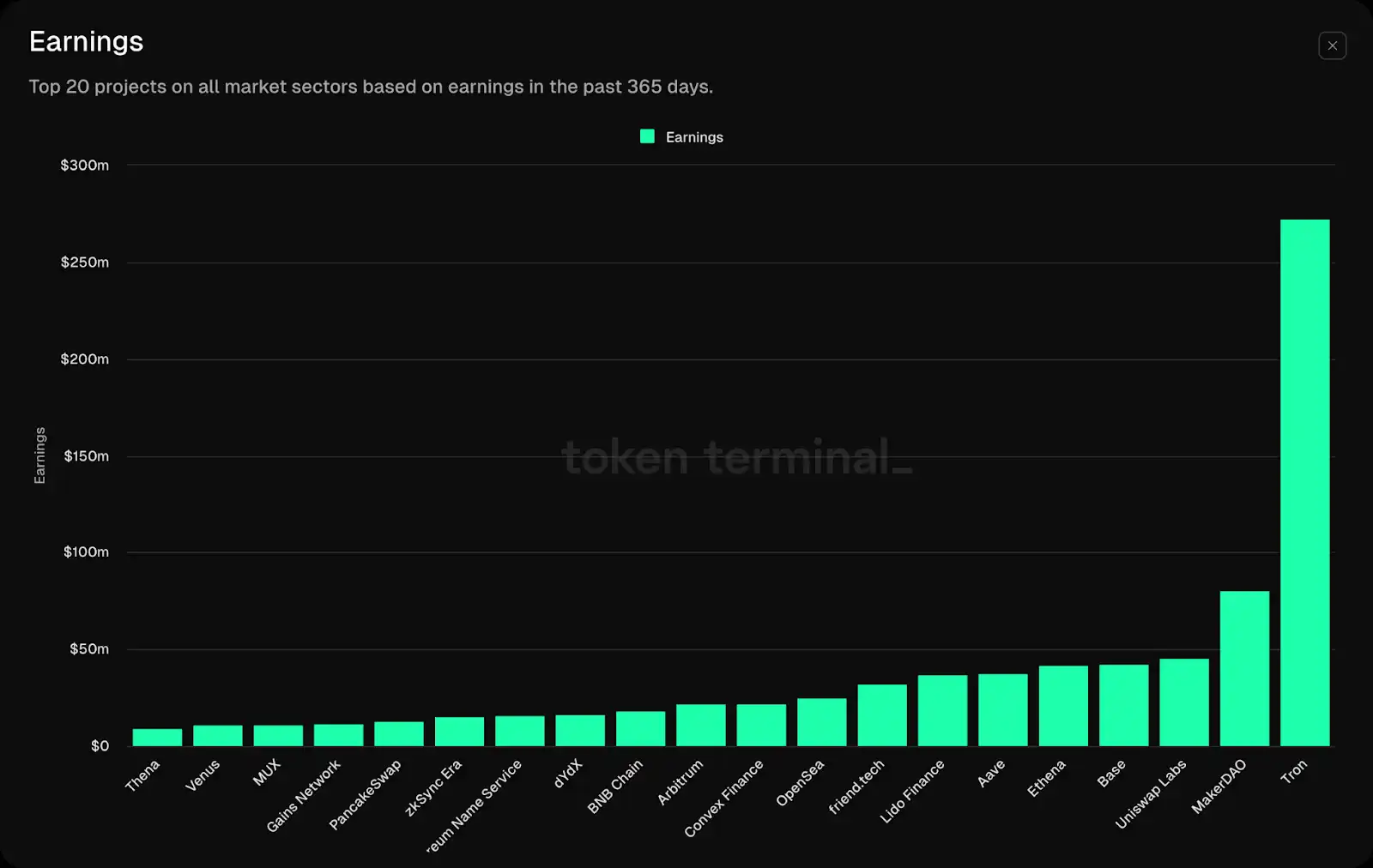

This success can be directly attributed to the network’s extensive stablecoin activity, with Tron ranking second only to Ethereum among networks with the most stablecoins, thanks to heavy usage in developing economies such as Argentina, Turkey, and various African countries, where high inflation remains an ongoing problem. While some may call it a one-trick pony, this “one-trick pony” has generated $271 million in revenue over the past year, making it the most profitable blockchain to date.

Solana

As one might expect, Solana also ranks among the highest-grossing protocols, with $157 million in revenue over the past year.

Popularity as a memecoin hub, capital growth from airdrops, technical upgrades to address spam issues, and support for leading trends like AI have all contributed to its prominence and strong revenues this cycle. However, this growth has not translated into earnings. Taking into account the issuance of tokens to stakers and operating costs, Solana has posted a net loss of $2.53 billion over the past four full quarters, completely wiping out its revenues and going into the red.

avalancha

L1 Avalanche, which has its own memecoin fund, ranked fourth with $69 million in revenue over the past year.

Avalanche, known for its subnet scaling solutions and focus on gaming, is about to launch a major upgrade called ACP-77, which will improve the experience of deploying and managing subnets, making them more affordable, thereby potentially increasing revenue. With this in mind, the blockchain still has a long way to go, as it faced a net loss of $860.6 million over the past year due to token issuance and operating costs.

Which L2 blockchains can be profitable?

Base

Despite being less than a year old, Coinbase’s L2 Base, launched alongside OP Stack, has quickly generated $66.6 million in revenue since its inception.

Remarkably, Base managed to retain 63% of its revenue, netting $42 million during the same period. This success can be attributed to two key factors.

First, Base’s implementation of blobs via EIP-4844 significantly reduced costs, cutting those costs from $9.34 million in Q1 2024 to $699,000 in Q2 2024.

Secondly, Base has no native token, which makes it more competitive and avoids the distribution-related fees incurred by other L2s.

Arbitrum

Arbitrum is the largest L2 by TVL, with $17.2 billion locked and generating $61.14 million in revenue over the past year.

Arbitrum is the center of DeFi, with leading DeFi protocols such as GMX and Pendle calling it home, and its SDK being the main infrastructure for L3s such as Sanko, Degen chain, and Xai. While Arbitrum’s revenue levels are still not at Base, it has achieved $21.8 million in revenue over the past year, with an outstanding second quarter, with its expenses falling to just $613,000, compared to $20 million in the first quarter.

zkSync Era

zkSync Era is one of the leading ZK-based L2s, bringing in $53.3 million in revenue over the past year.

Following the June 2023 airdrop, the network’s TVL surged as ZK added around $850 million to the chain, though that number has gradually fallen as users sell the airdropped tokens. The chain remains profitable, though, netting $15.3 million over the past year — and $17.5 million over the past four full quarters. This makes zkSync the third most profitable L2.

Red principal OP

Optimism is at the center of the hyperchain, bringing in $44.6 million in revenue over the past year from sorter fees on its mainchain and in networks like Zora and Base.

Optimisms network activity hit an all-time high in the second quarter of 2024. Despite the market downturn, average daily active addresses surged to 121.6K, up 37% month-on-month, and daily transactions rose to 601K, up 28% month-on-month. As for other L2s, EIP-4844 made a significant contribution to this growth, resulting in lower fees and thus increased network activity, which increased Optimisms net profitability by more than 150%.

Despite the growth, Optimism remains deeply in the red, facing a net loss of $239 million over the past year due to retroactive airdrops, incentive programs, and operating costs.

Narrative and Fundamentals

When you look at these numbers, remember that, just like with TradFi, profitability is only part of the story. No one is betting trillions of dollars on Nvidia’s current financials; it’s the narrative that’s driving its growth.

Narrative-driven investing is often the default choice for cryptocurrency buyers who risk their money in the hope of outsized returns, but it’s still important to remember that there are still networks that have built massive businesses around today’s activity.

Diving deeper into the revenues and earnings of the top L1 and L2 networks gives us a clearer picture of the underlying health of these networks and their place in the competitive landscape.

This article is sourced from the internet: Public chain revenue ranking: Ethereum earns $2.2 billion a year, Optimism is deeply in the red

Related: BTC Volatility: Week in Review July 22–29, 2024

Key Metrics: (July 22, 4pm -> July 29, 4pm Hong Kong time): BTC/USD +3.4% ($67,240 -> $69,500), ETH/USD -3.2% ($3,480 -> $3,370) BTC/USD December (end of year) ATM volatility -11% (68.5 -> 61.1), December 25 day RR volatility -45% (7.3 -> 3.3) BTC price continued to climb after a local breakthrough last week (triggered by liquidation in traditional financial markets) — initial support is at 68-68.25k, with stronger support at 66.75-67k. The top major resistance is around 70k-70.25k; if it can be fully broken through, it will challenge the historical high again. A break below 66.75k could trigger a choppy consolidation period in the 63.5 – 67k range. Market events: The ETH ETF launched on July 23 still failed to drive up the spot price, ETH long positions were liquidated,…