CGV Research: Más que minijuegos, un análisis en profundidad de las “ambiciones” de TON en el ámbito de los pagos

Original author: Satou

In the field of blockchain, The Open Network (TON) has gradually emerged in the payment track with its unique advantages and deep user base. In 2024, the TON ecosystem has shown strong growth momentum in many aspects. According to the latest data, as of July 21, 2024, more than 730 M USDT has been issued on the TON network, becoming an important driving force for the development of the TON payment ecosystem. In addition, TON game platforms such as Notcoin, Hamster Kombat and Catizen have also achieved remarkable achievements, attracting 35 million, 230 million and 25 million users respectively.

As the TON ecosystem continues to mature and expand, its application prospects in multiple fields such as DeFi, GameFi, and SocialFi are becoming increasingly clear. The CGV research team deeply analyzes TONs ambition in the payment track and explores how it can use its own advantages to overcome challenges and achieve long-term development in the fields of crypto asset management and DeFi.

TON’s unique advantage: Backed by Telegram’s large user base

According to Statista data, as of April 2024, Telegram has 900 million monthly active users, ranking eighth on the global social network list. In comparison, according to Token Terminal, the public chain with the most monthly active addresses is Solana, with 14 million monthly active addresses, which is less than 2% of Telegram users.

From the perspective of regional distribution of users, except for Russia and Ukraine, where Telegram software originated, and the United States with a diverse population structure, Telegram users are mainly distributed in developing countries such as Southeast Asia, Africa, and Latin America.

According to the user portrait, Telegram has a huge number of users, but the average income per user is low, which makes Telegram more suitable for carrying traffic-related businesses rather than serving high-net-worth individuals.

Compared with other social network projects, Telegram launched its own encrypted public chain at a very early stage, and the public chain is strongly bound to the social network.

-

In 2017, Telegram founders Pavel Durov and Nikolai Durov began developing a blockchain project called Telegram Open Network (TON) and planned to launch its native cryptocurrency Gram.

-

In 2018, it raised about $1.7 billion through ICOs, but it also attracted the attention of the U.S. Securities and Exchange Commission (SEC).

-

In 2020, due to regulatory issues, Telegram announced its withdrawal from the TON project. The development work was returned to the community and taken over by the TON Foundation. The project was renamed The Open Network and the token name was changed to Toncoin. The ICO funds were also refunded.

After several twists and turns, in 2023, Telegram officially announced that the TON blockchain would be the first choice for its Web3 infrastructure and planned to integrate it into the Telegram App interface. In contrast, the Libra (Diem) cryptocurrency network launched by Facebook announced that it would no longer be launched after two and a half years of setbacks and regulatory pressure.

In addition, Telegrams privacy protection and non-regulatory features make it more friendly to cryptocurrencies. To a certain extent, it also carries gray industries that cannot pass regulatory review. These gray industries are precisely the widespread application scenarios of cryptocurrencies in the early days. Therefore, Telegram carries a large number of crypto users.

In general, with the help of Telegram, the TON ecosystem has the first-mover advantage in developing cryptocurrency from the very beginning.

How to monetize traffic: Overview of the current status of TON mini-games

Compared with the popular halal full-chain game on Ethereum, the recent hot games on TON may be full-chain games (Fully Offchain Game), some casual (maybe even slightly younger) small games that attract users through economic incentives. Halal full-chain games use the grand narrative of the autonomous world to attract users through potential cultural identity, but they often fail to gain a large number of users. The small games on TON are more pure. Turn on your phone, click the screen a few times, and then you can get 1 point, which can be exchanged for tokens with real value in the future.

Recently, the popularity of the TON gaming project seems to have made us see the unlimited potential of the industry.

-

Notcoin is extremely easy to play. You can earn coins by clicking on the screen of your mobile phone. The coins can eventually be exchanged for Notcoin tokens. It has attracted more than 35 million game users and was first launched on Binance and OKX. After listing, the price of the coin has been rising, with the highest market value approaching 3 B.

-

Hamster Kombat also uses the Tap to Earn model. In addition, it also provides ways for players to obtain rewards, such as purchasing/synthesizing cards, daily check-ins, social media tasks, and recommendations. It has gained more than 230 million registered users in less than four months.

-

Catizen is a casual cat-raising game that directly builds cash flow through game monetization combined with airdrops, as well as over $10 million in revenue, over 25 million players, and has converted 1.4 million on-chain users.

Notcoin has opened up the imagination space of the track, and Hamster Kombat has taken a lead in the road of traffic. Catizen is more refined and sustainable, and also represents the future development direction: it cannot be just a little bit, but a cash flywheel needs to be established from day one.

On the one hand, simple game design allows more users to participate in the game, thereby achieving better user data. On the other hand, due to the simplicity of game design, the cost of brushing is low, and the data may be highly inflated.

In the future, the small game project owners of the TON ecosystem will inevitably shift from competing in simple user traffic to competing in the conversion rate of user traffic. This not only requires better game design, but also requires a sophisticated monetization system to obtain continuous cash flow and maintain the ability to develop sustainably.

Glimpse into the development focus from official channels

According to the TON official website, Mini Apps, GameFi, and DeFi are the key product types that the official wants to onboard.

The TON Foundation’s Grants program also explicitly mentions support for these categories and provides product examples for each category. The key statements are excerpted below.

-

Telegram Mini Apps: Social Web3 Use Cases

-

SocialFi: Creator Economy

-

E-commerce: The mercado for electronic or physical goods

-

Utility: Daily tools with embedded Web3 elements

-

Community Brand management: Tools for managing Telegram communities

-

Onboarding platforms: Use simple scenarios to bring new users to @wallet or sub-hosted TON wallets

-

DeFi

-

Lending protocols

-

Derivatives DEXs

-

DEXs with weighted pools (like Balancer.fi)

-

Yield aggregators

-

Liquidity layers

-

Retomando

-

GameFi

-

We are always happy to support web3 games with easy onboarding, viral social mechanics, referral programs, elements of competition (squads, leaderboards, group challenges) and exciting gameplay.

According to the above content, the Social Web3 use case supported by TGs built-in Mini App will be the focus of development; for DeFi, the TON ecosystem hopes to enrich the application types of the DeFi ecosystem; for GameFi, the TON ecosystem can provide assistance to games in social gameplay such as user onboarding, viral social communication, invitation system, and competition system.

Predicting the short-term future, the red and black of TON ecology

Why it’s not DeFi “yet”

A key indicator of whether the DeFi track will explode is TVL. Judging from the current public chain data, Ethereum is far ahead, with a DeFi TVL of 60 B, which exceeds the sum of DeFi TVL of all other public chains. First, the value of Ethereums native asset ETH is high, which makes DeFi TVL rise; second, the completeness of the DeFi ecosystem, almost all DeFi innovations occur on Ethereum; Ethereum has also introduced a large amount of wBTC through Wrapped Token, which also supplements DeFis liquidity; finally, the staking restaking mechanism introduced by Ethereum has enabled a large amount of LST/LRT to be issued, creating a large amount of TVL.

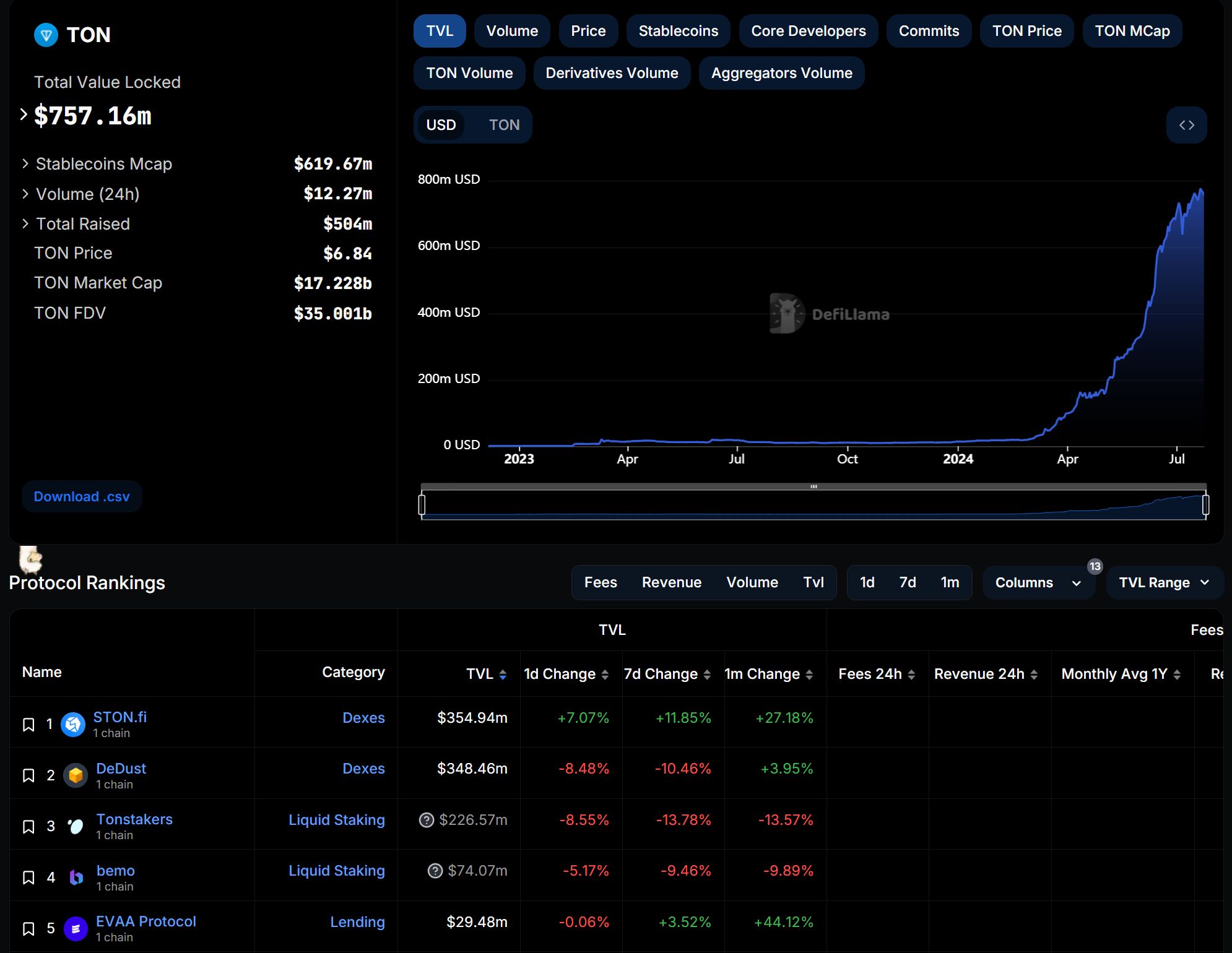

For TON, the largest asset on the chain is Toncoin, with a market value of about 17.5 B, and the second largest asset should be USDT authorized by Tether, which exceeded 730 M on July 21, ranking fifth among all blockchains. According to DefiLlama data, the current TVL of the TON ecosystem is 757 M, showing obvious shortcomings.

In the view of the CGV Research team, the outbreak of DeFi in the TON ecosystem still lacks the following conditions:

-

Onboarding of assets such as BTC and ETH: The most traded assets in CEX are usually large-cap blue-chip assets such as BTC and ETH. Therefore, it is necessary to rely on highly secure, low-slippage, and low-cost BTC and ETH asset cross-chain bridges to introduce a large amount of BTC and ETH into the TON ecosystem, and the current cross-chain bridge infrastructure on TON is still under construction.

-

More diverse liquidity staking products: TON switched from PoW to PoS, and the initial supply was allocated to miners and teams. This means that after switching to PoS, it can only choose to increase inflation at a rate of 0.6% per year to reward PoS miners. Compared with other PoS public chains, TONs staking rate of less than 10% is not high, so it is necessary to launch more liquidity staking products to improve the staking level and chain security on the one hand, and to increase TVL on the other.

-

More secure wallet infrastructure: Telegrams built-in @wallet wallet is a custodial wallet. Coupled with Telegrams unregulated nature, large users often do not trust TONs security. TON needs to launch a more secure wallet infrastructure, including the MPC wallet, and undergo a full audit to allow high-net-worth users to trust TONs security.

All these conditions are irrelevant to Telegrams biggest advantage – user traffic, which is equivalent to giving up its biggest moat, and may result in half the result with twice the effort.

Why payment

Native USDT is being issued on the TON network at a very high growth rate. As mentioned before, as of July 21, 730M USDT has been issued. Currently, the chain with the most USDT issuance is Tron, and TRC 20-USDT has issued more than 60B. From Trons data, we can get a glimpse of the huge potential of the stablecoin payment track.

The TRON network has over 235 million users, over 7.8 billion transactions, $450 million in fees (network fees) a year, and an average of 2-3 million user accounts transferring over $10 billion per day. Most USDT holders on TRON are “retailers” or small holders. There are 52.6 million holders with balances below $1,000, and this number is growing even during the 2022 bear market. In comparison, the $1K-$10K group has 359,000 holders.

From the perspective of on-chain activities, Tron’s on-chain transactions are basically USDT transfers, DeFi adoption is low, NFT is almost non-existent, and other popular public chains such as LST/LRT and Memecoin are not present at all, but it still supports 7.8 billion transactions. It can be said that Tron is a public chain born for stablecoin payments.

The reason why Tron can gain such a large-scale adoption of stablecoin payments lies in:

-

The transaction fee of Tron network is lower than that of Ethereum, the speed is faster, and the TPS is higher

-

Early adoption triggers the Matthew effect, a two-way flywheel between users and merchants

-

Long-term stable service wins user trust

Compared with Tron, the payment service on TON has the following advantages:

-

Higher TPS: After sharding is enabled, it can support up to one million TPS, and the handling fee is cheaper than TON

-

Closer to users: TON wallet is directly built into Telegram, which is more convenient to use and has more scenarios, similar to WeChat Pay.

-

On-chain activities are more diversified: TON chain has more application scenarios to deposit funds, not just simple movement of funds.

The TON Foundation is also actively promoting the application of USDT on TON:

-

5 million TONs will be used to reward USDT Farming Pool. Deposit USDT to get Toncoin with a maximum APY of 50%.

-

On July 1, Tether partnered with Web3 shopping and infrastructure company Uquid to allow Filipino citizens to pay social security funds with USDT on TON.

-

Using the built-in wallet on Telegram, USDT transfers are free, instant, and can be transferred directly to friends without an address

-

Subscriptions, VPNs, gaming platforms, eSIMs, and other products on Telegram can be paid directly with USDT on TON

At the same time, payment will also serve as a key primitive to empower Telegram Mini App and serve various types of Social Web3 Use Cases. For example, the creator economy (SocialFi) requires payment to complete subscription and reward functions; e-commerce requires payment to complete the purchase of goods. More importantly, Telegram Mini App is expected to become the Web3 version of AppStore, and AppStore requires payment functions to complete the management of paid applications. In the future, Telegram may follow Apples example and collect fees from paid services of applications logged in to its AppStore to further diversify its profit model.

Currently, TON has been connected to multiple third-party payment service platforms, allowing merchants to accept payments in various ways.

Of course, compared to WeChat Pay, the payment business of TON ecosystem still has risks. The most critical one is that Telegrams privacy protection and unregulated characteristics may cause a large number of physical businesses to be unable to access TON payment due to compliance factors. However, the TON Foundation is also actively looking for countermeasures. One of the manifestations is that TONs USDT Farming Pool requires KYC before receiving rewards, from which we can guess TONs attitude towards compliance.

In summary, the CGV Research team believes that TONs rise in the payment track is not accidental, but the result of the strong user base, technological advantages and ecological strategy behind it. Although it still faces many challenges, such as regulatory issues and user trust, TON has shown strong growth potential with its innovative payment solutions and an ecosystem closely integrated with Telegram.

In the future, with the implementation of more high-quality applications and the conversion of user traffic, TON is expected to occupy a place in the global payment market and become an important force in the blockchain payment field.

Descargo de responsabilidad

The information and materials introduced in this article are all from public channels, and the company does not make any guarantee on their accuracy and completeness. The description or prediction of future situations are forward-looking statements, and any suggestions and opinions are for reference only and do not constitute investment advice or suggestion to anyone. The strategies that the company may adopt may be the same, opposite or have nothing to do with the strategies that readers speculate based on this article.

This article is sourced from the internet: CGV Research: More than just mini-games, an in-depth analysis of TON’s “ambitions” in the payment track

Related: A brief analysis of pump.fun data: Degen’s “non-return-to-zero” internal reference

Original author: Moonke Dev (X: @moonkedev) 1/5 As a degen on @pumpdotfun, how likely are you to lose money? We analyzed 75,991 tokens created on @pumpdotfun from June 10th to June 16th. Lets dive in. 2/5 How many pumpfun tokens will be successfully listed on Raydium? Of the 75,991 tokens created between June 10 and June 16, only 1.42% were listed on Raydium. 85.85% of the new tokens were created by unique wallets, while 14.15% were created by duplicate wallets. 3/5How long does it take for a token to be listed on Raydium? Among all the tokens deployed from pumpfun to Radydium: 50th percentile token: 15 minutes to list on Raydium 75th percentile token: 59 minutes to list Raydium 90th percentile token: 4.9 hours to list Raydium If your tokens…