Edición especial de SignalPlus Macro Research: Los días caninos del verano

Last week was a painful one for macro trading, with many popular trades (e.g., tech stocks, USD/JPY, etc.) seeing significant liquidation, while realized volatility in the SPX jumped to its highest level in a year.

While there was no single catalyst, President Biden’s withdrawal from the race coincided with the unwinding of various “Trump trades,” particularly in the stock market. Additionally, the “Great Rotation” remains in full swing, with stock market investors continuing to rotate out of growth stocks and into small-cap stocks as earnings season approaches, and options traders are the most bullish on small-cap stocks in nearly 20 years (based on a risk parity measure).

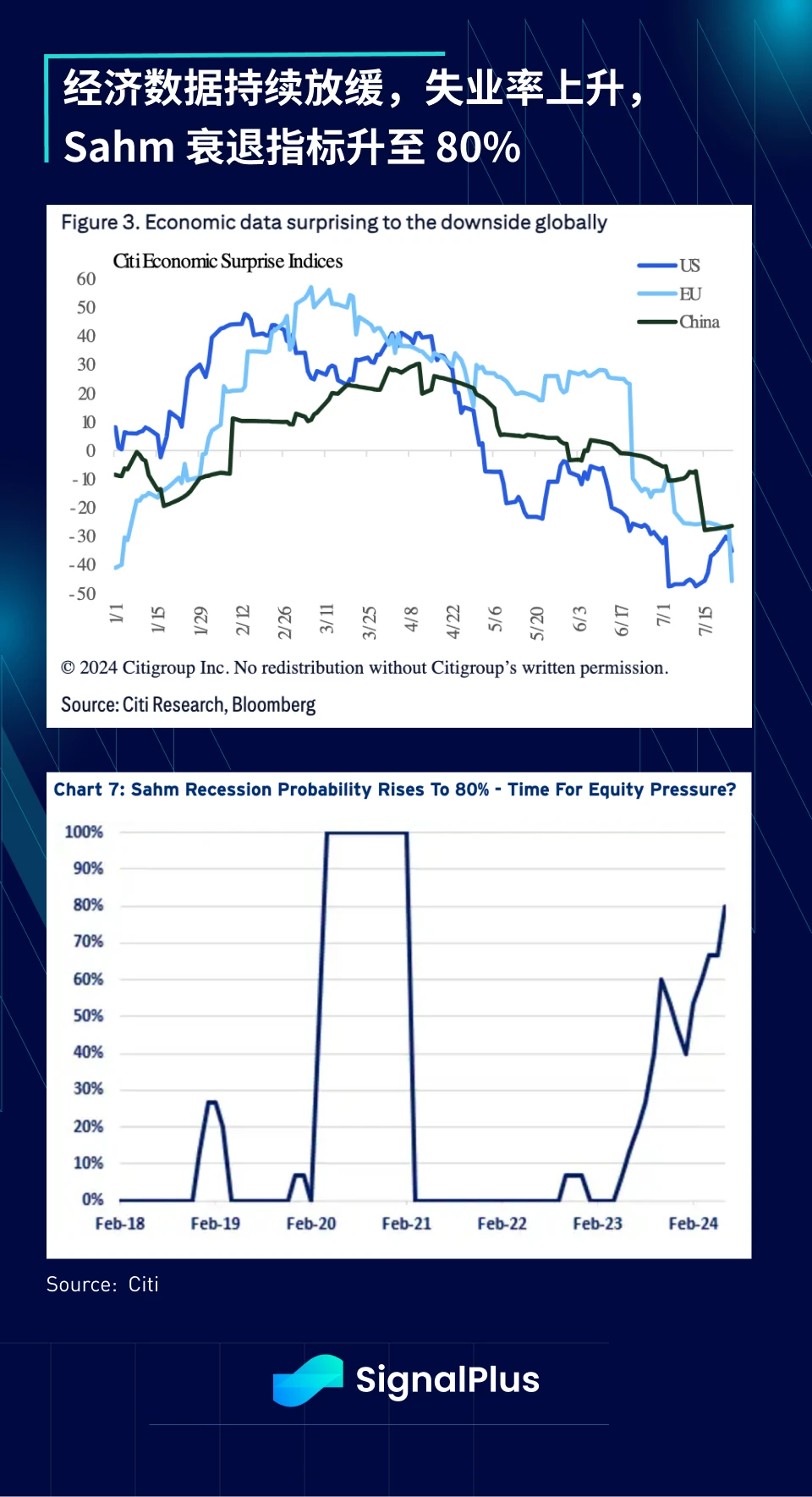

Economic momentum has also begun to deteriorate further. The Global Economic Surprise Index is at its lowest level of the year. After the release of non-agricultural employment data last month, the Sahm Recession Indexs recession probability has risen to 80%. This indicator measures the gap between the 3-month average unemployment rate and the low point of the past year. The current reading is 0.43%, which is very close to the threshold of 0.5, which is a signal that the economy is about to begin a recession.

At the same time, the easing of inflationary pressures has opened the door for the Fed to cut interest rates. Last Friday, the PCE price index fell to 2.5% year-on-year, moving towards the Feds long-term target of 2%. Average hourly wage growth also fell from a high of 6% in 2022 to 3.9% last month, which is consistent with the trend of labor slack and a slowing job market.

Recent developments have prompted some macro observers to call for the Fed to cut rates earlier than the market expects. Mohamed El-Erian, former CEO and CIO of Pimco, expressed the view that a soft landing may fail if unhelpful noisy data is allowed to delay rate cuts beyond September. Bill Dudley, former president of the Federal Reserve Bank of New York, also said that the Fed needs to cut rates as soon as possible because waiting until September to cut rates will unnecessarily increase the risk of recession.

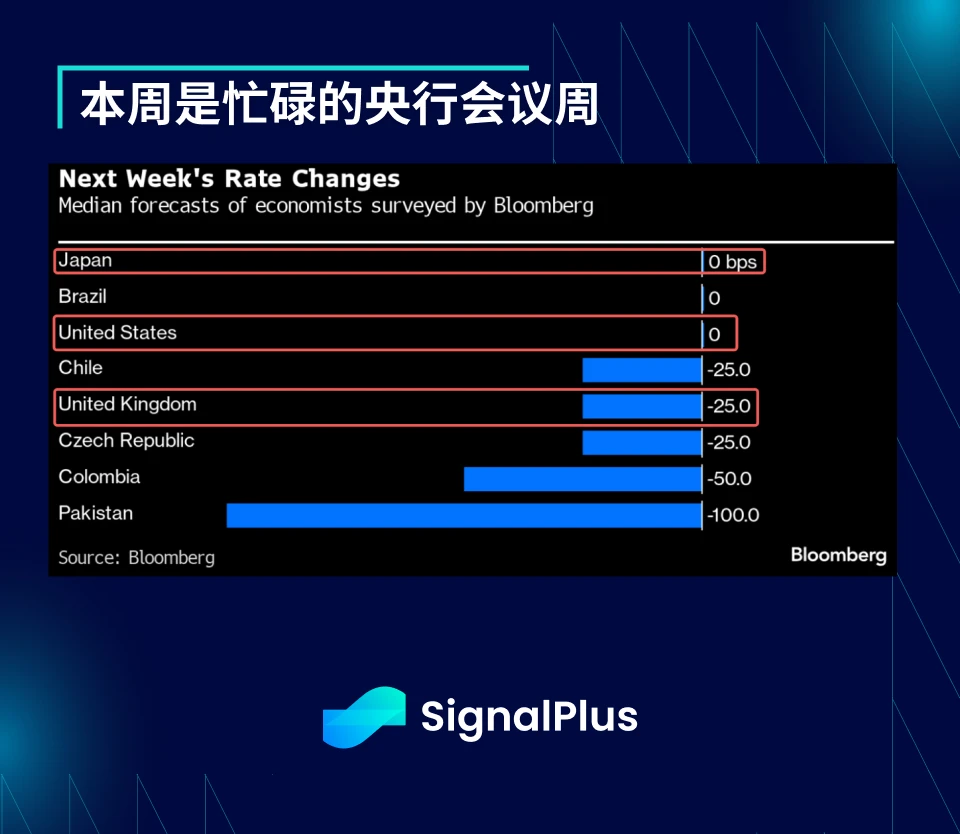

That being said, the market considers the more likely scenario that the Fed will remain on hold this week (chance of a rate cut

In addition to the Fed, there are two major central bank meetings this week: the Bank of Japan and the Bank of England. The market generally expects the Bank of Japan to keep interest rates unchanged, but further reduce the scale of bond purchases to allow long-term yields to rise further. On the other hand, the market expects the Bank of England to cut interest rates by 25 basis points, but 8 of the 32 economists surveyed by Bloomberg expect to keep interest rates unchanged. Both central bank meetings are likely to have surprises, and interest rate volatility is expected to increase this week.

In addition to the central bank meeting, this week is also US employment data week (ADP, JOLTS, NFP), and Amazon, Apple, Meta and Microsoft will release earnings reports between Tuesday and Thursday. All of this will happen at a critical time when the Nasdaq is at important technical support levels, and thin liquidity during the summer vacation may further increase volatility.

In addition to the central bank meeting, this week is also US employment data week (ADP, JOLTS, NFP), and Amazon, Apple, Meta and Microsoft will release earnings reports between Tuesday and Thursday. All of this will happen at a critical time when the Nasdaq is at important technical support levels, and thin liquidity during the summer vacation may further increase volatility.

On the cryptocurrency front, Trump’s much-anticipated Nashville conference attendance turned out to be a bit lackluster. As expected, his attendance was more of a campaign and fundraiser, and it would be unrealistic to expect any concrete details to be announced (such as purchasing BTC as a strategic reserve). That being said, the former president still made some “feel-good” comments, such as “I am developing plans to ensure that the United States becomes the global cryptocurrency capital and the Bitcoin superpower of the world” and named the Winklevoss brothers, describing them as “male models with brains”, which is still relatively positive for the long-term narrative of cryptocurrency.

In addition, Bloomberg reported that cryptocurrency donations for the 2024 election are already greater than the total of all previous cycles (including the FTX/SBF era). Since announcing the acceptance of donations in May, Trumps campaign team has received more than $4 million in cryptocurrency donations. Republican Senator Cynthia Lummis said she plans to draft a bill requiring the government to reserve 1 million BTC within 5 years and hold it for 20 years (although the bill is almost impossible to pass Congress).

BTC is back to the familiar $67,000 price range, where it has been almost exclusively since March. In addition, we saw the market aggressively short BTC implied volatility after Trump’s speech, and we may have to take more cues from the Fed and other central banks’ shifts to have a chance to try again in the fourth quarter to push BTC above $70,000.

I wish you all the best in trading during this long and hot summer!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Research Special Edition: Dog Days of Summer

Relacionado: ¿Cómo el dinero inteligente obtuvo ganancias de 100 veces después del tiroteo de Trump?

Autor original: Lucy, Joyce El 14 de julio, Trump recibió un disparo en la oreja mientras daba un discurso en un mitin de campaña. Levantó el puño derecho mientras estaba protegido por seguridad. Después de eso, los conceptos de memes de Trump se dispararon, con TRUMP subiendo casi 70% en 1 hora y MAGA subiendo 33% en 1 hora. Además, varias monedas meme relacionadas aparecieron en Solana, incluidas FIGHT y EAR, que aumentaron más de 100 veces después de estar en línea. Anoche, Trump publicó un nuevo correo electrónico social a las 11:51 hora de Beijing, con el texto No tengas miedo (FEAR NOT), soy Trump, haré que Estados Unidos vuelva a ser grande. Después de eso, en Solana apareció un token meme llamado FEAR NOT, que aumentó 33 veces en dos horas. Después de un evento noticioso explosivo, una serie de memes relacionados…