El sentimiento toca fondo, se elimina el apalancamiento, 5 razones para ser optimistas en el mercado de futuros

Original title: Where are we in the current crypto cycle and where do we go from here?

Original author: Tom Dunleavy

Translated by Joyce, BlockBeats Editors note: The impact of the German and American governments selling of coins and the Mentougou case on the market is coming to an end, and community sentiment has bottomed out. Where should the crypto market go next? There are many factors to consider in this process. The author of this article, Tom Dunleavy, remains optimistic about the future market and believes that the current crypto market is at a historical turning point. Bitcoin has great potential and market fluctuations are only temporary adjustments.

Different from the general simple bullish voice, Tom Dunleavy gave specific reasons for his bullishness from the aspects of technical indicators, macro liquidity and market structure, and made his own analysis of the potential new crisis in the crypto market. Readers who hold a bullish or bearish attitude can get some inspiration from the review of this article.

In this post, I will discuss:

Current market status: We are standing at a historical turning point, Bitcoin has huge potential, and market fluctuations are temporary adjustments.

Outlook for the next 18 months: Increased global liquidity and influx of institutional funds will continue to drive the market, and the outlook is promising.

Investment advice: It is crucial to choose promising areas and early-stage projects, and invest with focus and caution.

In short, you are not optimistic enough.

After massive deleveraging, the market is about to start

First, lets review the current market conditions. In the fourth quarter of 2023, the expectation that the United States would approve a Bitcoin ETF triggered a wave of enthusiasm, marking the beginning of this cycle. In the first half of 2024, the market attracted about $15 billion in new capital inflows. In particular, the launch of the Ethereum ETF on May 23 caused the price to soar by more than 30% at one point. Although there has been a pullback in recent weeks, this is just a normal fluctuation within the cycle and there is no need to worry too much.

At the same time, we also experienced a massive deleveraging event. At the end of the second quarter, nearly $1 billion in assets were liquidated over a weekend. Although this may seem scary, it actually helped the market get rid of the burden of excessive leverage, making it healthier and more stable.

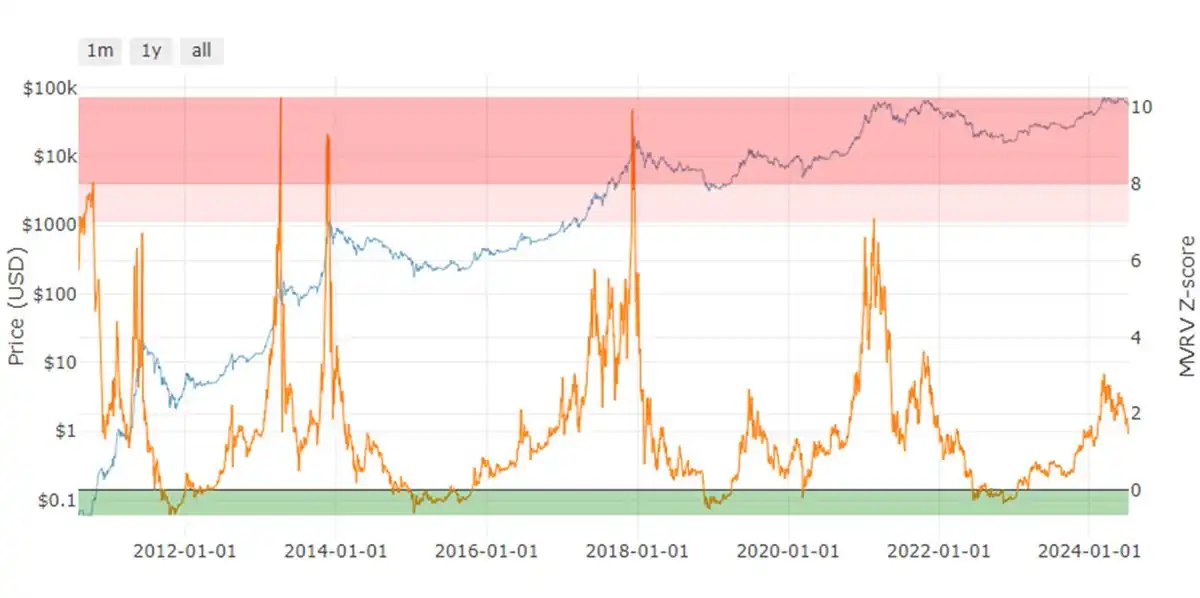

Key Metric: MVRV

Lets look at a very important market indicator – MVRV, which is the ratio of market value to realized value. This ratio is an important reference for judging whether the market is overvalued or undervalued, and it is also the most reliable indicator for indicating BTC short selling or oversold conditions. Currently, BTCs MVRV ratio is 1.5, indicating that the market is relatively undervalued.

As a lot of leverage in the market is removed, the current low MVRV value suggests that the market has the potential to rise further. Historical data shows that when the ratio exceeds 4, it is often a signal to sell; when it is below 1, it is a good time to buy. Therefore, from this perspective, Bitcoin still has a lot of room to rise in the future.

The positive stimulus of global liquidity

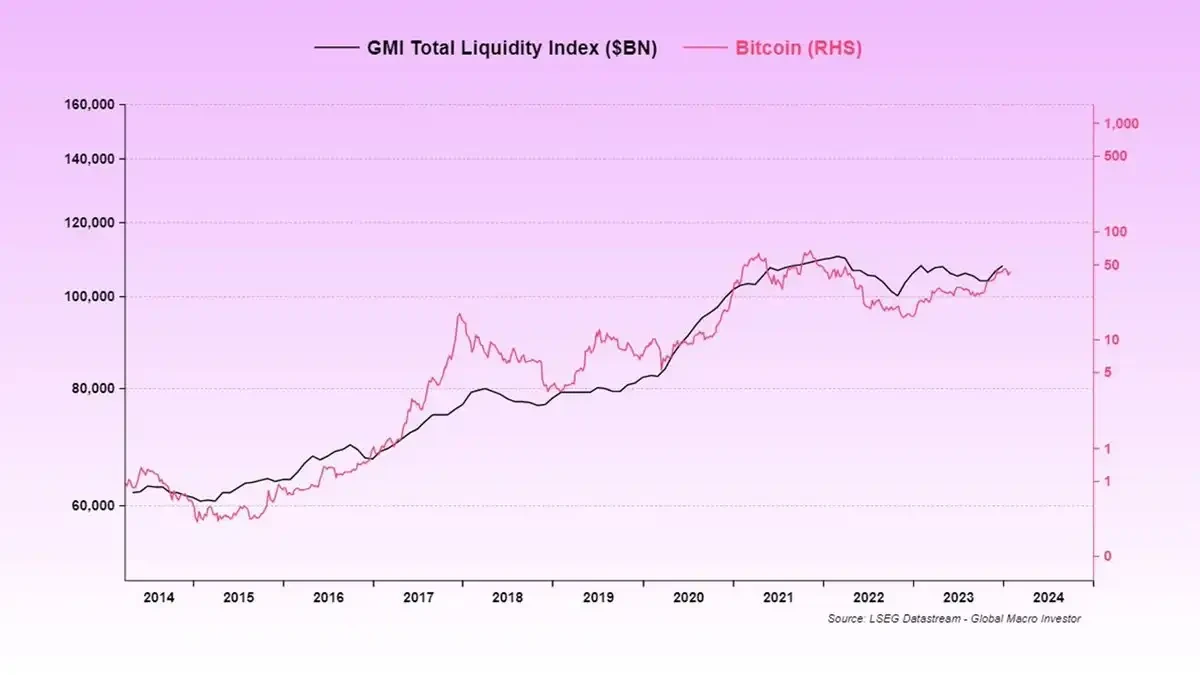

Global liquidity is an important driver of market cycles. As we all know, the stimulus policies of central banks and governments around the world have a profound impact on the market, especially in the United States. As the worlds largest economy, policy changes in the United States are crucial to the market. Currently, the market expects that the Federal Reserve may cut interest rates twice this year, and Citigroup even predicts that it may cut interest rates eight times in the next 12 months. This will greatly increase market liquidity, which is undoubtedly good news for the cryptocurrency market.

Crossbordercap, an institution focused on liquidity, has called for an increase in liquidity growth to 20% in the second half of 2024. In addition, the Swedish and European Central Banks have also stated that they will begin to relax monetary policy. Such policy changes will inject more funds into the market and drive up the prices of risky assets.

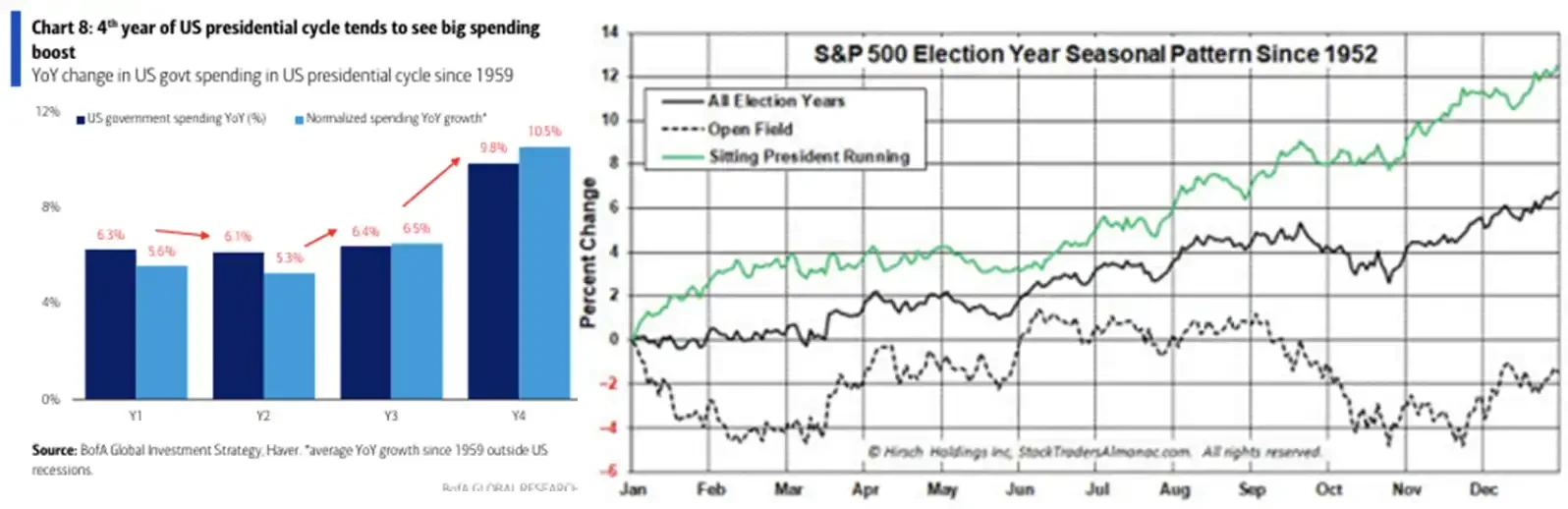

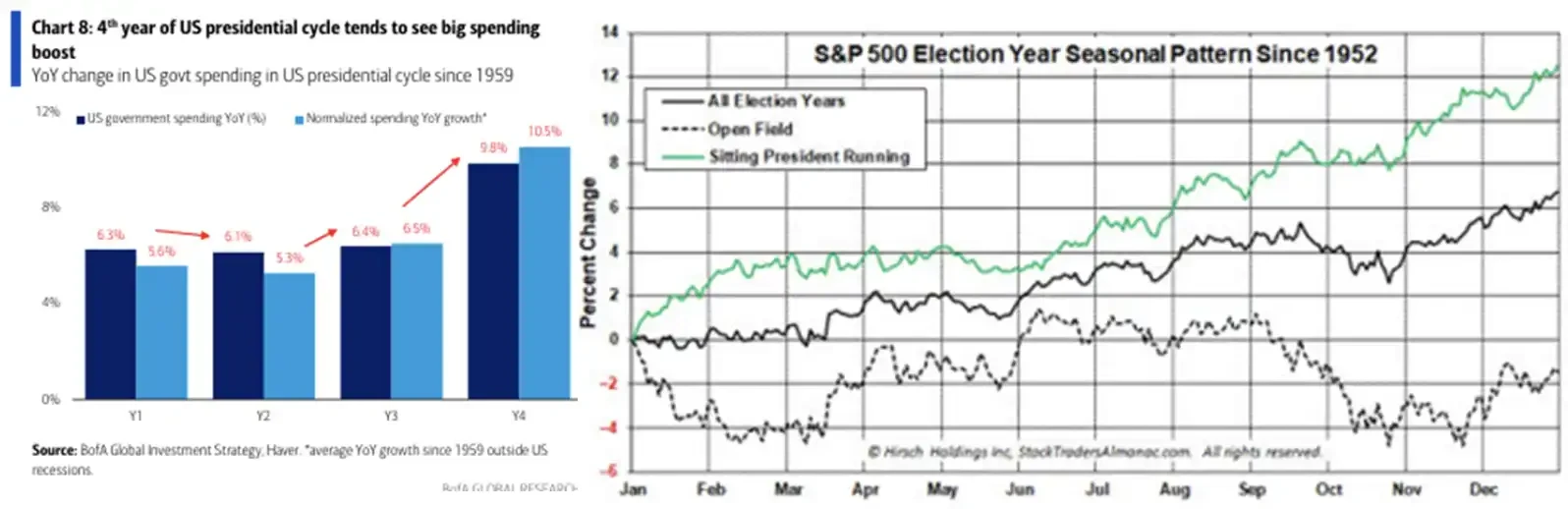

The impact of the election cycle

The impact of the election cycle on the market cannot be ignored either. In election years, government spending tends to increase, which is also a positive signal for the market. In particular, the incumbent government usually increases direct and indirect spending during the campaign, which usually leads to a strong market performance at the beginning of the year, a slight calm in the summer, and a rebound in the second half of the year. The 2024 election cycle is no exception, and the market is expected to perform well in the second half of the year.

New purchasing power from FTX

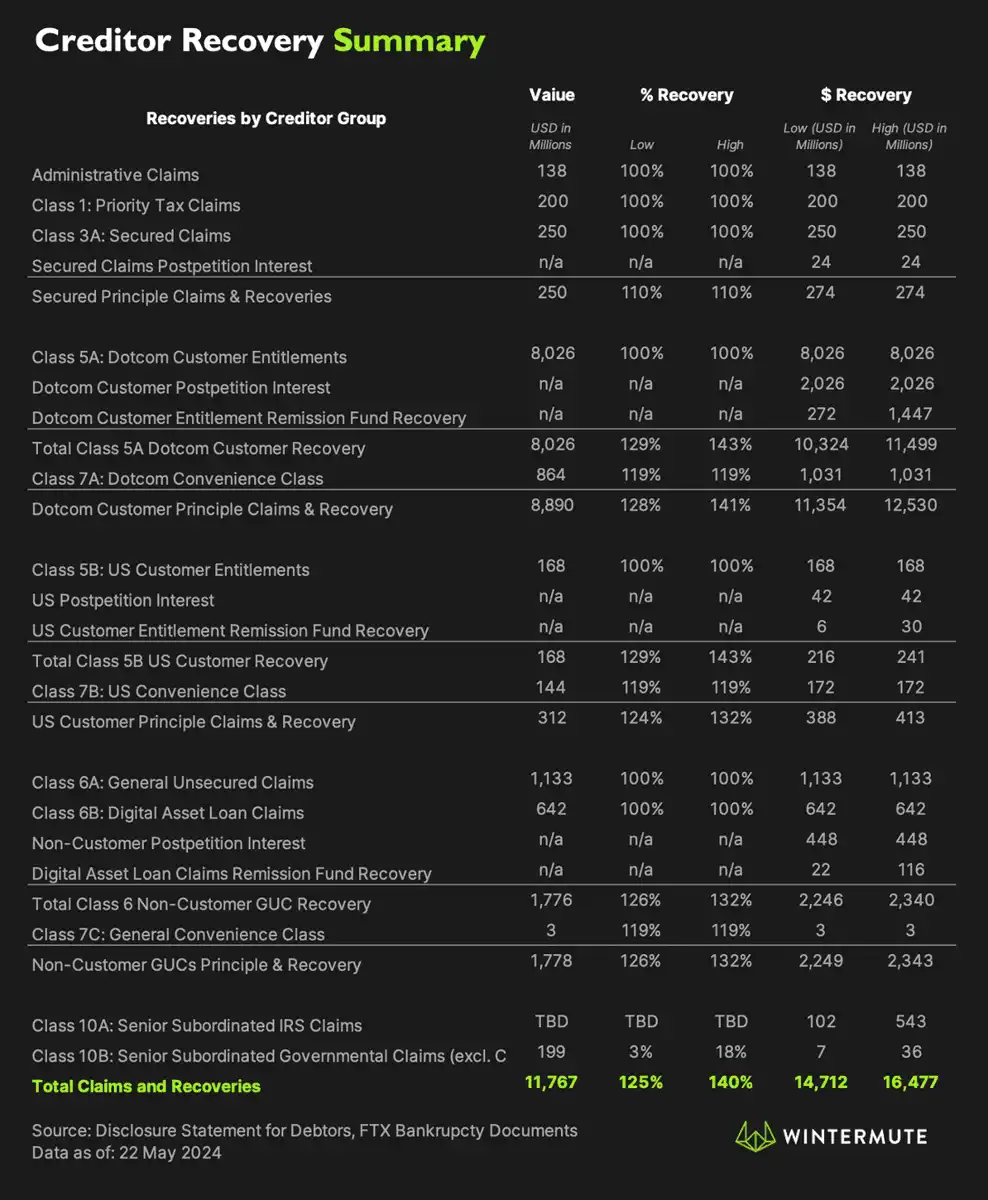

We have an additional bullish catalyst in the form of $12 billion to $14 billion in FTX claims expected to flow into the market in October and November 2024. This will inject a large amount of new capital into the cryptocurrency market, further pushing up market prices. This is undoubtedly very good news for investors.

Halving Tradition

Having said that, we cannot ignore the lessons of the past. Historically, the cryptocurrency market tends to follow a four-year cycle centered on the Bitcoin halving. In the first year after the halving, the market rises rapidly; in the second year, the increase begins to slow; in the third year, the price remains roughly the same; in the fourth year, the price falls sharply. Prices usually peak around 500 days after the halving. If this cycle follows the same pattern, the market may peak around October 2025.

If we follow this tradition, we are still in the early stages of the cycle and the market is expected to be relatively quiet in July and August before the rapid rise in the next 12 months.

How to manage this bull market without sticking to the old ways?

While we believe the market will follow the previous cycle and rise, there are indeed some nuances in this cycle.

Market variables that cannot be ignored

The impact of institutional entry

In this cycle, we have seen some new factors. First, the influence of institutional products is growing. Since the approval of the Bitcoin ETF, the market has attracted more than $15 billion in inflows. Moreover, only about 25% of US financial advisors can currently recommend these products to their clients, which means there is still a lot of room for growth in the future.

Gold ETFs have seen net inflows for five consecutive years since they were approved, so we can expect Bitcoin ETFs to continue to attract inflows. This will help reduce market volatility and extend the duration of the cycle.

More tokens and a larger backlog of issuances

Secondly, the number of tokens available for purchase has increased significantly. In 2021, there were about 400,000 tokens on the market, and now this number has exceeded 3 million, with 100,000 new tokens added every day. In addition, there are a large number of tokens unlocked from previous issuances, with $350 million worth of tokens unlocked in July alone. Such an increase in supply will undoubtedly have an impact on the market.

There are also a large number of private projects ready to go public. These projects are expected to conduct token generation events in the fall. More than 1,000 projects funded in 2023 and early 2024 have not yet issued tokens, and the total supply is expected to be in the billions. The issuance of these new tokens may have a significant impact on the market.

Macroeconomic conditions

Macroeconomic conditions in the United States also have an important impact on the market. Currently, the unemployment rate in the United States remains low, inflation continues to decline, unemployment benefit applications are flat, and wage growth is stagnant. These factors provide the Federal Reserve with a reason to cut interest rates. We expect to see interest rate cuts in 2024 and 2025, which will reduce the cost of capital for companies, reduce debt interest rates for consumers, and provide more funds for risky assets.

VC Reserve Funds

In 2021 and 2022, multiple $1 billion+ crypto-focused funds were successfully raised. These funds typically have a 3-4 year timeline for capital deployment. Due to the impact of FTX, many funds were cautious in investing in late 2022 and early 2023. However, the recent market rally caught many VCs by surprise, causing a large amount of reserve funds to sit on the sidelines in this cycle. Many reserve funds are being actively deployed in Q1 and Q2 of 2024.

A clearer regulatory environment

Finally, changes in the regulatory environment also have an important impact on the market. Although the upcoming regulations may be controversial, clear rules can reduce market uncertainty. The EUs MiCA has been launched, and the United States also has multiple bills on market structure, banking services, and stablecoins. If the Republicans win the presidency and the Senate, these bills will be quickly introduced in the first quarter of 2024.

How do you view this cycle?

Longer and less volatile

Overall, we think this cycle is likely to be longer and less volatile than previous ones. Large assets will lead the rally, and the large reserves of venture capital firms will support a range of new projects, but we still need new net buyers to support more assets. Although we have many buyers through ETFs, these buyers are unlikely to be on-chain users who support the valuation of other tokens.

Large-cap assets lead the gains, and the “altcoin season” is over

We expect large assets to lead the way in this cycle, while long-tail assets will be more volatile. Many top assets are likely to be included in institutional-grade products. Compared with past cycles, many small or emerging protocols will go to zero as competition for capital intensifies. This cycle will see a huge divergence in investment and performance of long-tail protocols.

Choice and focus are crucial

Asset selection is more important than ever in this cycle. The old “cast a wide net to catch all” approach no longer works. Due to the increase in supply, attention is almost as important as fundamentals (even more important in some verticals). Investors should focus on verticals and protocols at the seed and Series A stages.

This article is sourced from the internet: Sentiment hits bottom, leverage cleared, 5 reasons to be bullish on future market

Original source: Ash from Signum Capital Compiled by: Odaily Planet Daily Wenser Editors Note: On May 18, Fantom community members initiated a series of governance proposals on the Sonic network , the main contents of which include: Sonic will be a brand new L1 chain, and will be bridged to chains such as Ethereum through native L2 cross-chain. According to the results of the first governance vote, FTM holders will be able to migrate to Sonics native token S at a 1:1 ratio when Sonic is created. Using the new bridge architecture, Sonic will provide users and DApp developers with performance that is superior to the existing Opera network. Fantom Operations Ltd promises to continue to provide validator support for Opera, and Sonic Operations Ltd provides support for Sonic. The…