Descubriendo el lado oscuro de las finanzas: un ex socio de Polychains fue expuesto a recibir beneficios en secreto

Original title: Top Crypto VC Says Ex-General Partner Made Undisclosed Side Deal With Portfolio Company

Original article by Sam Kessler, CoinDesk

Original translation: DeThings

Editors note: Niraj Pant, a former general partner at a top crypto venture capital firm, has reached a secret agreement with portfolio company Eclipse Labs, but the timeline is unclear, which has caused some controversy. This incident has raised concerns about potential conflicts of interest and ethical standards in the venture capital industry, highlighting the complex relationship between investors and startups.

Polychain said its former general partner Niraj Pant entered into a secret agreement with portfolio company Eclipse Labs that violated the fund’s policies.

A CoinDesk investigation revealed that former Eclipse Labs CEO Neel Somani promised Pant $13.3 million worth of Eclipse tokens.

According to Eclipse sources, Somani promised the tokens as an incentive for Pant to receive Polychain funds.

Polychain said Pant did not disclose the deal to the fund, which later invested in Pant’s artificial intelligence startup Ritual.

Pant confirmed that Eclipse Labs allocated him “advisory” tokens, but said he did not enter into an agreement with the company until after Polychain’s investment.

The situation offers a glimpse into the typically shady dealings of the crypto industry’s funding scene, where venture capital firms invest in projects and investments in exchange for tokens rather than traditional equity.

Crypto venture capital giant Polychain has accused former employee Niraj Pant of entering into a backroom deal with portfolio company Eclipse Labs that violated the fund’s policies.

According to three people familiar with the matter and internal Eclipse documents reviewed by CoinDesk, former Eclipse Labs CEO Neel Somani quietly allocated 5% of the upcoming Eclipse crypto token to Pant in September 2022 — just days after Pant directed Polychain to lead the company’s $6 million pre-seed funding round.

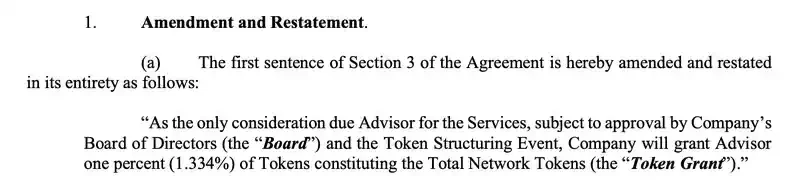

The allocation was ultimately reduced to 1.33%, worth $13.3 million, at the token’s most recent fully diluted valuation in a private investment round. (According to a source close to Eclipse Labs, the company’s most recent funding round valued the token at $1 billion on a fully diluted basis (FDV).

Founded by Olaf Carlson-Wee (first employee) of cryptocurrency exchange Coinbase, Polychain is one of the largest and most well-known cryptocurrency venture capital firms, with more than $11 billion in assets under management. Pant served as a general partner at the firm from 2017 to 2023, responsible for directing the firm’s venture investments into promising crypto startups.

Pant has since become a prominent figure in the crypto industry and currently serves as co-founder of blockchain AI startup Ritual, another Polychain portfolio investment.

Eclipse Labs built a blockchain that mixes technology from the popular Solana and Ethereum networks. After leading Eclipse’s pre-seed round in August 2022, Polychain participated in a $50 million Series A round in March 2024.

Pant spearheaded the pre-seed deal, and a CoinDesk investigation revealed that around the same time, he allocated as many Eclipse crypto tokens as Polychain itself. The deal was not disclosed to most of Eclipse’s executives, advisors or large investors, according to CoinDesk’s sources.

Pant insisted the arrangement was entirely kosher because it wasn’t finalized until September 2022, a month after Polychain had invested in Eclipse. He shared legal documents with CoinDesk showing that his “advisory” allocation of Eclipse tokens was revised to 1.33% in 2024, but declined to comment on the size of his initial stake, or why it was changed.

Polychain told CoinDesk it didn’t know Pant had a financial stake in Eclipse until after he left the firm in 2023. The fund said he should have disclosed the transaction under its policies, which are designed to protect the firm and its investors from conflicts of interest.

“Polychain was not aware of the financial relationship between Eclipse and Niraj Pant until after he left the company,” a Polychain spokesperson said in an email to CoinDesk. “Polychain has robust policies and procedures for employees who serve in advisory roles. After Mr. Pant left Polychain, the company became aware that he had violated its policies and investigated the matter.”

Polychain’s statement to CoinDesk provides a rare insight into the sausage-making process of the cozy world of crypto venture capital firms and the projects they fund. VC firms rarely discuss personnel matters or deal structures publicly, and Polychain did not publicly disclose Pant’s policy violations until CoinDesk reported on them.

Blurred timeline

The revelation is likely to deepen the controversial narrative surrounding Somani, who resigned as Eclipse CEO in May amid allegations of sexual misconduct. Somani has denied the allegations and declined to comment for this story.

Two sources close to Eclipse who wish to remain anonymous claimed that Somani promised Pant his 5% consulting stake in Eclipse tokens before the pre-seed deal was done.

Pant’s stake is higher than any other Eclipse investor except Polychain, which also holds 5% of Eclipse tokens, according to documents reviewed by CoinDesk. Pant’s stake exceeds the shares allocated to other advisors, investors and all Eclipse employees except the former CEO.

Somani told his inner circle that the generous token grants were designed to incentivize Pant to get both Polychain’s cash and the veteran venture capitalist’s coveted endorsement, according to two people familiar with the matter.

According to Polychain officials, the arrangement was not disclosed to the venture capital firm or its limited partners at the time.

Tokens, not equity

The deal also offers a glimpse into the cryptocurrency industry’s unique fundraising practices, with digital tokens often granted alongside or in lieu of any equity. Blockchain applications, digital assets and decentralized ledgers are often promoted as more transparent alternatives to traditional finance, but the ownership structures of many leading projects and cryptocurrencies remain opaque.

Eclipse Labs built a layer 2 blockchain that provides users with a faster and cheaper way to transact on the Ethereum network. The network’s main appeal is that it borrows elements from the popular Solana blockchain to power key elements of its technical design — a detail that has helped it win buzz in two of the largest blockchain communities.

Token distribution was crucial in Eclipse’s funding round because few investors received equity in the project. Most were simply promised a share of Eclipse’s tokens — a cryptocurrency that didn’t exist yet and that Eclipse hadn’t even announced publicly.

This setup is not atypical. Cryptocurrency investors often provide cash in exchange for tokens rather than traditional equity, and companies rarely disclose these arrangements to the public lest they provide ammunition to financial regulators in their fight to classify cryptocurrencies as investment securities.

“Eclipse Labs does not disclose investor ownership percentages to the public,” an Eclipse Labs spokesperson told CoinDesk.

Eclipse employees, investors and advisors have received nearly 50% of the future Eclipse token supply, according to an internal token allocation table reviewed by CoinDesk.

Pant insists his own consulting agreement with Eclipse is above board, and he shared with CoinDesk legal documents showing he will receive a 1.33% stake in Eclipse tokens.

Excerpt from the revised consulting agreement provided by Niraj Pant

That amount — revised from an earlier total that Pant had not disclosed — is less than the 5 percent Pant had initially pledged, according to documents and people familiar with the matter, but still more than all other Eclipse advisers and nearly all of its investors and employees.

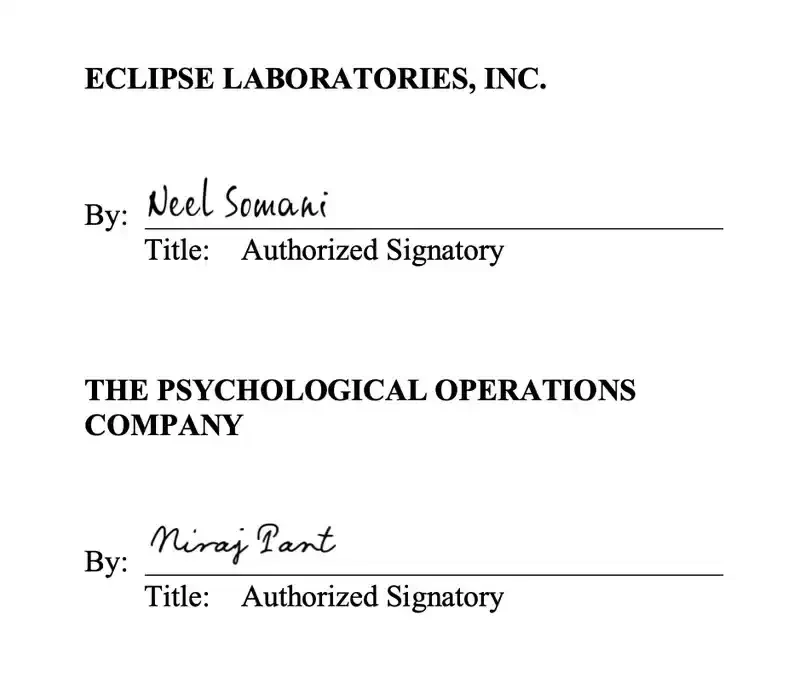

The consulting agreement Pant shared is dated April 29, 2024 — after he left Polychain — and is signed by two parties: Neel Somani, on behalf of Eclipse Labs; and Niraj Pant, on behalf of “The Psychological Operations Co.”

Extract from the revised consulting agreement provided by Niraj Pant and signed by Pant and Neel Somani

Under the agreement, Psychological Operations Co. will receive grants in Eclipse tokens in exchange for “regular, synchronized teleconference meetings” required by Eclipse. The agreement itself makes no mention of Polychain or its pre-seed investment in Eclipse.

The version of the agreement Pant provided to CoinDesk noted that it was an “amendment” to an earlier advisory agreement dated Sept. 8, 2022 — just weeks after Eclipse’s pre-seed round closed, while he was still a general partner at Polychain.

Pant declined to share the original agreement.

Polychain’s Policy

Regardless of whether Pant’s advisory role was completed before the pre-seed deal, if his initial advisory role at Eclipse began while he was still working at Polychain — as his own filings attest — then he may still have been required to disclose it under the company’s ethics policy, which it described in a lengthy disclosure to the U.S. Securities and Exchange Commission (SEC).

Olaf Carlson-Wee, CEO of Polychain (Danny Nelson/CoinDesk)

In its official policy document filed with the SEC, Polychain wrote: “To monitor for any conflicts of interest, Polychain employees are required to pre-clear certain anticipated transactions in their personal accounts that could give the appearance of impropriety and are required to disclose holdings of all personal accounts initially and annually, as well as all transactions quarterly.

This situation is particularly notable because Pant is not only a former Polychain employee, but also the co-founder of one of Polychain’s hottest portfolio companies, Ritual.

After leaving Polychain and founding Ritual last year, Pant quickly became a staple of the blockchain industry’s speaking staff and is seen as a thought leader at the intersection of crypto and AI. Ritual, which aims to decentralize the execution of AI models, is one of a class of blockchain-meets-AI projects that have themselves grown into venture capital darlings. Last November, it raised $25 million from Polychain and others.

Polychain declined to comment on whether its relationship with Ritual changed as a result of Pant’s alleged policy violation, or whether it knew about the violation before investing in Ritual.

Despite the alleged policy violations, Polychain’s investment in Eclipse may still pay off. According to a source close to the fund, the value of its stake in Eclipse has increased tenfold since the firm first invested in 2022.

This article is sourced from the internet: Uncovering the dark side of financing: Polychains former partner was exposed to secretly receiving benefits

Related: SignalPlus Macro Research Special Edition: Now Hiring

The non-farm payrolls data was slightly weaker than expected, continuing the recent trend of weakening momentum in the US economy. The unemployment rate rose from a cycle low of 3.43% to 4.05%. Of the approximately 200,000 new jobs added in the past month, approximately 150,000 were from the government and healthcare sectors, and the employment data for the past two months was also revised down by 111,000. Wage growth slowed to 3.9% and 3.5% year-on-year and month-on-month, respectively, providing more positive signals to the Federal Reserve that inflation is slowly falling back to its long-term target. In addition, given the recent performance of cryptocurrencies, will we see a small surge in job seekers and lead to lower wage pressures in the coming months? With only a few meetings left before…