Columna de volatilidad de SignalPlus (20240709): ¿Se ha tocado fondo?

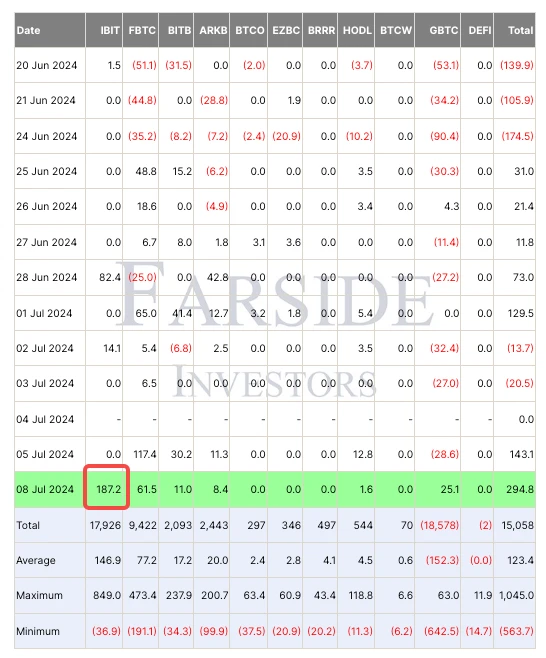

The German governments plan to sell Bitcoin is still ongoing. The governments main wallet address currently holds about 26,000 BTC, worth $1.5 billion, and the address used for selling holds 4,800 BTC, worth $276 million, which once caused the price of the currency to drop to the $55,000 support level again last night. But the market soon showed resilience, and the price rebounded and climbed, recovering all the lost ground during the day. From the data, yesterday, the ETF leader IBIT saw an inflow of up to $187.2 M again after many days, providing confidence and encouragement for the bulls. BTC looked at the $58,500 resistance level that seemed to be close at hand, trying to break through to gain momentum for further increases.

Fuente: TradingView; Farside Investors

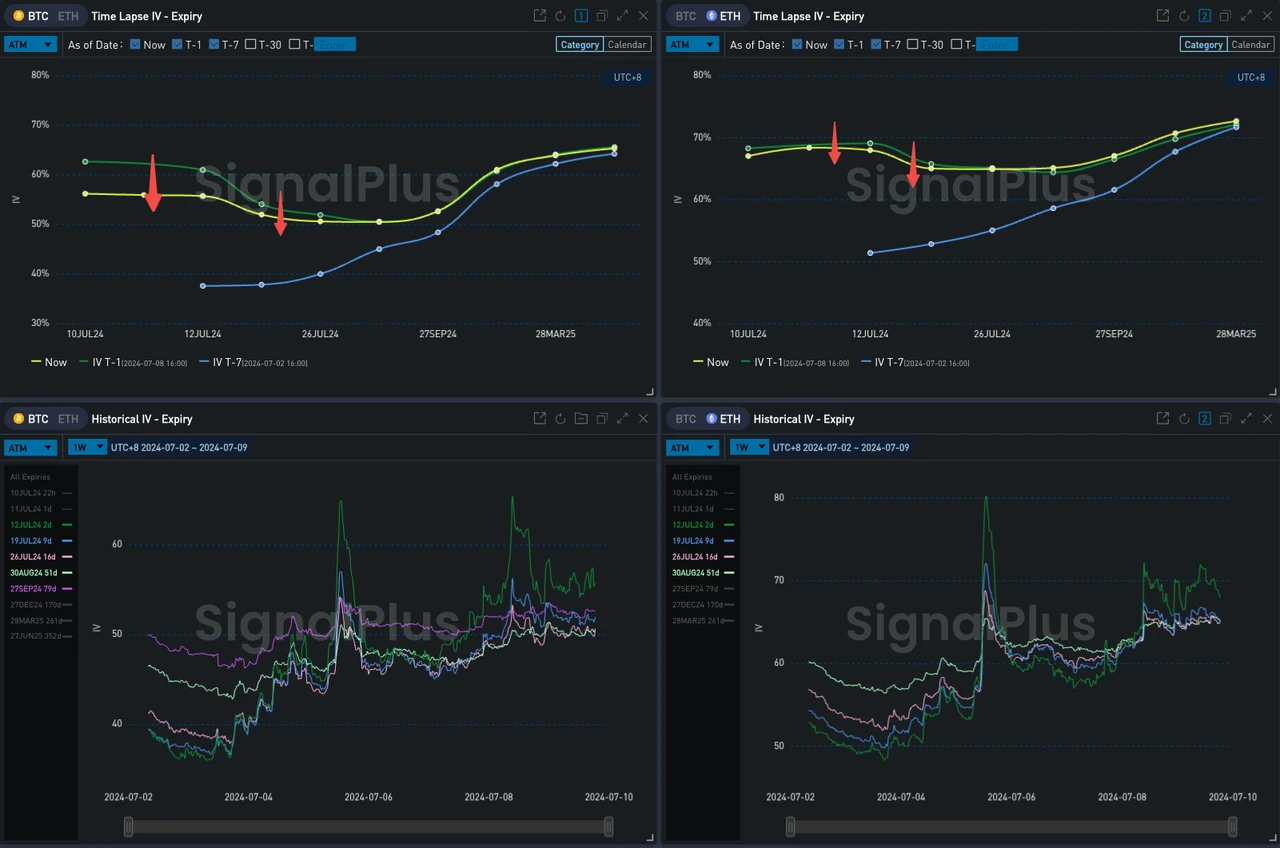

The rebound in the price of the currency stimulated betting in the options market. From the perspective of the overall implied volatility level, although the IV has dropped compared to the last 16 points, it should be noted that the price fluctuated violently before and after the last settlement point. At that time, the IV was at the intraday high. Even if the current IV has dropped a little, it is still at a recent high. In addition, 12 JUL occupied a local high point under the uncertainty brought about by the two heavy macro data of CPI/PPI.

Source: Deribit (as of 9 JU L2 4 16: 00 UTC+ 8)

Fuente: SignalPlus

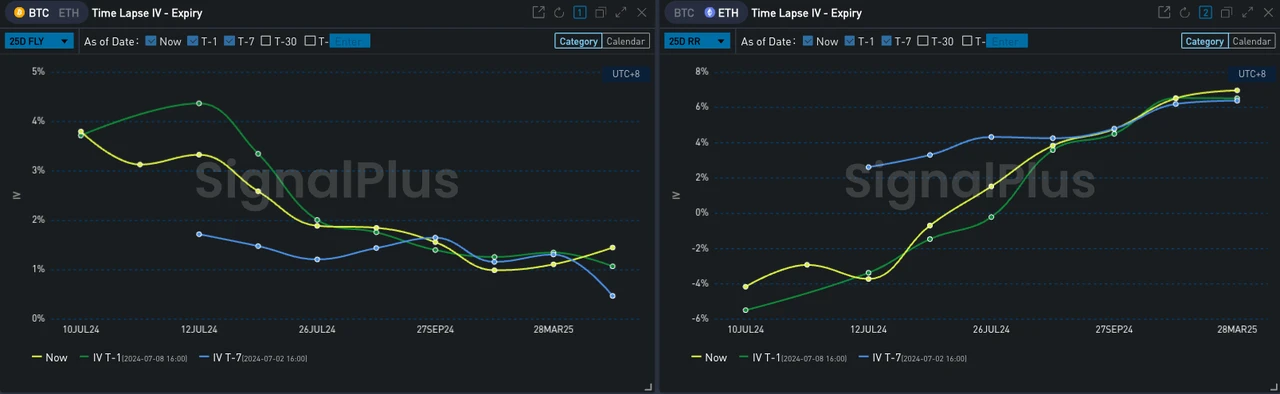

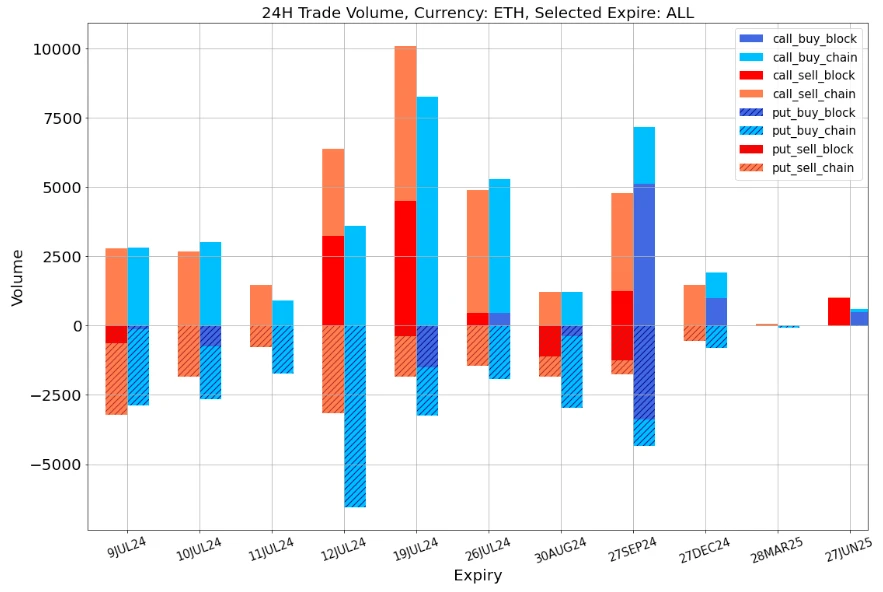

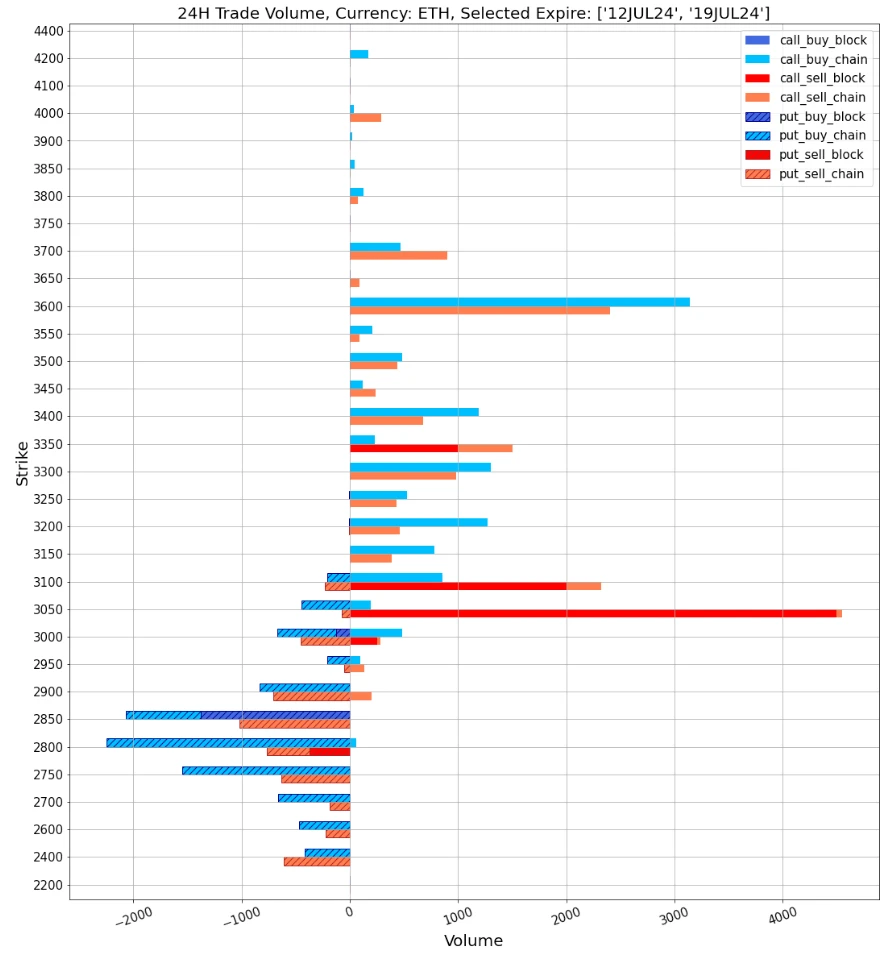

From the perspective of trading, ETH and BTC present completely different trends. The price rebound attracted traders to build a large number of long put options and short call options on ETHs two-period options. Perhaps they were worried that the tragedy of Grayscales sell-off would happen again in the short term after the ETF was released. Therefore, the front-end Vol Skew was low, which was completely opposite to the term trend of BTC. BTC block trading was active, and the proportional bullish spread strategy represented by 27 DEC 24 85000 vs 95000 became the focus of the market. It can also be seen from the risk scenario simulation in the figure below that the strategy expressed a limited bullish view to the market with unlimited tail risk.

Source: SignalPlus, BTC/ETH Vol Skew trend comparison

Data Source: Deribit, ETH overall transaction distribution; ETH 12 JU L2 4 19 JU L2 4 transaction distribution

Fuente de datos: Deribit, distribución general de transacciones BTC

Source: SignalPlus, Simulation 27 DEC 85000 vs 95000 Ratio Call Spread Risk Scenario

Fuente: Deribit Block Trade

Fuente: Deribit Block Trade

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240709): Has the bottom been reached?

Compiled by Karen, Foresight News The much-anticipated ZKsync airdrop distribution plan has been finalized. The ZKsync Association will conduct a one-time airdrop of 3.6 billion ZK tokens to early users and adopters of ZKsync next week, with 695,232 eligible wallets. The snapshot time is March 24th, and community members can check the airdrop eligibility on the claim.zknation.io website and claim the airdrop starting next week until January 3, 2025. The airdrop represents 17.5% of the total supply of ZK tokens. Users will be able to claim their tokens starting next week until January 3, 2025. Contributors will be able to claim starting June 24. Who is eligible for the ZKsync airdrop? Two categories of ZKsync users are eligible for a total of 17.5% of the airdrops: 1. Users (89%): ZKsync…