Ten questions and ten answers: What is the impact of the German government’s stock market crash, the “culprit of the cra

Original | Odaily Planeta Diario ( @OdailyChina )

Autor: Azuma ( @azuma.eth )

16038.7 bitcoins, with a total value of over US$900 million, is the amount of BTC that the German government transferred to exchanges and market makers (part of which has been withdrawn) in one day yesterday.

Since it started selling BTC on June 19, the German government has continued to “dump the market” for about 20 days. Yesterday was the peak of selling in terms of days, with the single-day selling amount exceeding the total amount of the previous nearly 20 days, causing the market’s rebound trend to be forcibly interrupted.

As one of the two most obvious negative factors in the current market (the other is Mt.Gox starting to repay in coin standard ), many readers do not know enough about the ins and outs of the German governments dumping, which makes it impossible to accurately assess the potential impact of this event on the market. To eliminate these doubts, Odaily Planet Daily will combine market information and on-chain data to clarify this information in the form of questions and answers.

-

Q1: Where did the German government’s Bitcoin come from?

A1 : In January 2024, the police in Saxony, eastern Germany, announced the seizure of nearly 50,000 BTC, which was worth about $2.2 billion at the time. The Saxony police commented at the time: This is the largest seizure of Bitcoin by law enforcement authorities in the Federal Republic of Germany to date.

These bitcoins came from a pirated film and television website Movie2k.to that was active around 2013. After Movie2k.to was shut down, German law enforcement authorities, with the assistance of the FBI, confirmed that the operators behind the website were a Pole and a German. There is not much information about the details of the subsequent investigation, but there are reports that one of the suspects voluntarily handed over these BTC to German law enforcement authorities.

After the seizure, the German Federal Criminal Police Office transferred the bitcoins to an address it controlled.

-

Q2: How much Bitcoin does the German government actually hold?

A2 : Currently, the only German government holdings that can be tracked through public information and on-chain analysis are the funds seized from Movie2k.to , which is approximately 50,000 BTC.

However, considering that the Saxony police described the seizure as the largest operation rather than the first operation at the time, it is not ruled out that the German government has previously obtained some Bitcoins through other operations.

Therefore, we conservatively estimate that the German government held at least 50,000 BTC before the sell-off.

-

Q3: When did the German government start selling? How far has the selling progress progressed?

A3 : On June 19 this year, Arkham monitoring found that 6,500 BTC were transferred from addresses related to the German government, and 2,500 BTC were transferred to exchanges such as Kraken and Bitstamp through new addresses. The price of BTC on that day was about US$64,000.

Since then, addresses related to the German government have been transferring out BTC almost every day, ranging from hundreds to thousands. Yesterday, the German governments selling reached its peak. On-chain analyst Ember Monitoring pointed out that the German government transferred a total of 16,038.7 BTC (about $915 million) to exchanges and market makers yesterday.

However, early this morning, the German government-related addresses have recovered a total of 3,673 bitcoins (worth over $200 million), of which 3,623 bitcoins came from Coinbase, Kraken and Bitstamp, and 50 bitcoins came from addresses starting with bc1qxw .

Steven Zheng, head of research at The Block, analyzed that the German government may have signed sales agreements with some exchanges, and these return transactions were probably because the exchanges were unable to complete the sales within the target price range, so they returned the BTC to the German government address.

As of the time of writing, the German government still holds approximately 27,500 BTC in related addresses, which means that the German government may have sold 23,500 BTC and the selling progress is close to half.

-

Q4: How to monitor subsequent developments?

A4 : Arkham provides a German government address tracking interface , and it is recommended to monitor through this tool. If other on-chain tools are used for detection, it is recommended to track the following addresses directly.

Main holding address: bc1q0unygz3ddt8x0v33s6ztxkrnw0s0tl7zk4yxwd.

Common intermediary address for transfer out: bc1qq0l4jgg9rcm3puhhfwaz4c9t8hdee8hfz6738z.

-

Q5 : Will the sell-off continue?

A5 : Let me tell you the conclusion first. It will most likely continue.

A potential variable here is German MP Joana Cotar. Joana has repeatedly called on the German government to stop selling and suggested that the government convert the remaining bitcoins into strategic reserve funds.

Joana mentioned that she has expressed her concerns to Saxony’s governor, President Michael Kretschmer, Finance Minister Christian Lindner and Chancellor Olaf Scholz, and invited officials to attend a “National Bitcoin Strategy” lecture on October 17 to discuss how Bitcoin can be used to improve the country’s economy.

Obviously, at the current rate of the German government’s selling, the remaining BTC will not last until October 17th…

-

Q6 : How big is the actual impact of the sell-off?

A6 : Coingecko data shows that Bitcoins trading volume in the past 24 hours was approximately US$33.7 billion.

In terms of absolute amounts, the BTC sold by the German government does not account for a large proportion of the total market transactions – based on yesterdays peak data of approximately US$710 million (16039 – 3673 = 12366 BTC), it accounts for approximately 2.15%; assuming that the remaining approximately 27,500 BTC (approximately US$1.54 billion) are all dumped into the market, the proportion is only 4.7%.

-

Q7 : Why is the market reacting so strongly?

A7 : Generally speaking, there are three main reasons.

First, the German government did not use the over-the-counter channels commonly used for large-scale transactions, but directly dumped it into the exchange . The surge in short-term selling pressure can easily break the buyer liquidity in major exchanges, thereby causing a rapid short-term decline in the market.

Second, the German government’s continued selling can easily affect market sentiment , especially in the current already pessimistic market environment.

Third, the German government’s completely transparent operating mode also gave some short sellers the opportunity to take advantage of the situation , exacerbating market volatility.

-

Q8 : How do various institutions and bigwigs comment on this matter?

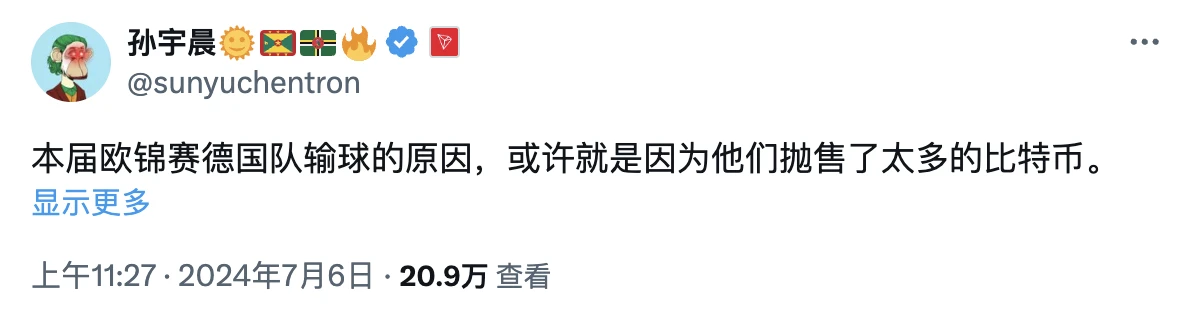

A8 : The most well-known public comment on this matter is undoubtedly Sun Yuchens previous public statement that he was willing to buy all the BTC of the German government off-market. However, there has been no progress on this matter for the time being. Sun Yuchen even sarcastically said after Germany was defeated by Spain in the European Cup: The reason why the German team lost may be because they sold too many Bitcoins.

Back to the topic, many institutions and bigwigs have expressed their views on the German governments selling behavior.

Bitfinex said in its latest report that the market has gradually realized that although the nominal value of BTC transferred by the German government is large, it accounts for a small proportion of the total BTC trading volume, which is a potential market bottoming signal.

James Butterfill, head of research at CoinShares, said that although the sell-off was actually relatively small, it significantly affected market sentiment.

Analyst Alex Krüger calculated the current market liquidity and the extent of the market decline caused by several previous large-scale Bitcoin transfers. He believed that in extreme cases, if the German government and Mt. Gox both chose to sell at one time (the latter assuming a 30% sell-off), it might cause BTC to fall 10.5% in the short term , but the market could eventually absorb the selling pressure.

-

Q9 : What are the BTC holdings of other governments?

A9 : Arkham has also created a dedicated tracking interface for the BTC situation of other governments. Excluding the German government, the total value of BTC holdings of various governments exceeds US$15 billion.

The U.S. government holds the largest share of BTC, valued at around $12 billion , most of which came from the 2013 Silk Road bust and subsequent investigations into darknet markets.

The UK government holds approximately $3.3 billion worth of BTC , and the country’s tax authority, Her Majesty’s Revenue and Customs (HMRC), has previously auctioned off seized cryptocurrencies.

El Salvador holds $314 million in Bitcoin in its treasury . El Salvador’s situation is different from other countries because it represents a strategic investment rather than an asset seizure. The country became the first to adopt Bitcoin as legal tender in 2021 and has since accumulated more BTC through direct purchases and mining operations.

-

Q10 : What are the selling trends of other governments?

A10: In addition to the German government, what we need to pay more attention to at the moment is the potential sales trend of the US government.

Casa co-founder Jameson Lopp counted the U.S. governments BTC sales record at the end of last month – since 2014, the U.S. government has seized and sold at least 195,091 bitcoins, making a profit of more than $366 million.

Recently, the US government-related addresses have also transferred BTC many times – including transferring 4,000 BTC to Coinbase on June 27, 11.84 BTC to the address starting with 3KHnT on June 28, and 10.5 BTC to bc1qvc on July 4. 237 BTC were transferred to the address at the beginning.

Unlike the German government, the US government holds a variety of assets besides BTC, including ETH (about 50,000), BNB (about 40,000), UNI (about 300,000) , and transferred about 3,375 ETH to the address starting with 0x5ac4 on July 1. For users holding the above currencies, they should pay more attention to the address movements of the US government.

This article is sourced from the internet: Ten questions and ten answers: What is the impact of the German government’s stock market crash, the “culprit of the crash”?

Original author: Alex Liu, Foresight News The Aptos public chain was created by some members of Facebooks former blockchain team Diem after independence, raising a total of up to $350 million in funds. After a large airdrop on the test network, the Aptos main network has been online for more than a year and a half, and the ecological projects are becoming increasingly mature, but most of them have not yet issued coins. How can we layout to kill two birds with one stone and maximize the benefits of the interactive Aptos ecosystem? This article takes stock of the main potential projects of the ecosystem and gives a detailed interaction path. Among the top 5 protocols in the Aptos ecosystem by TVL on DefiLlama, only Thala has issued tokens Potential…