Análisis completo del mercado de criptomonedas actual: BTC está nuevamente en el rango de 5 dígitos, ¿sigue existiendo el mercado alcista?

Autor original: Gargoyle

Compilado por: TechFlow

Why did El $BTC sell-off occur? This is the result of a combination of factors, including the Mt. Gox incident, ETFs, halving, Germany, etc.

I have prepared a comprehensive analysis of the current situation.

In the past week, Bitcoin has fallen from $71,000 to $57,000, a drop of about 20%, which is something we have not seen in a long time.

Today, we’ll take a look at why this is happening and what the outlook for BTC holds.

Mentougou

The cryptocurrency exchange collapsed in 2014 following a hacker attack.

At the end of last month, there were reports that Mentougou was about to start repaying its creditors.

Representatives of the exchange plan to distribute 142,000 BTC (0.68% of the total Bitcoin supply) to customers.

Many people are concerned that creditors may choose to sell the Bitcoin they received, which would certainly have an impact on the market considering the amount of BTC they hold.

Furthermore, the mere fear of this possibility has caused many to start selling their assets.

But that’s not all.

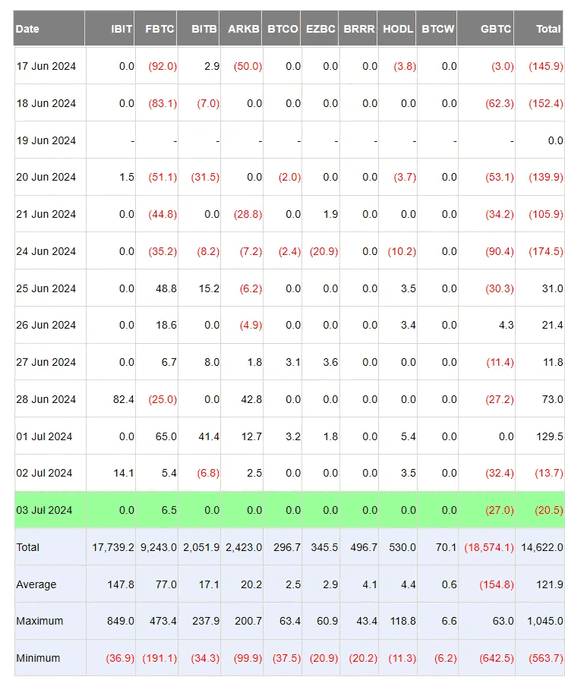

BTC ETF

A spot Bitcoin ETF makes the cryptocurrency’s price even more dependent on the sentiment of large investors.

Currently, the BTC ETF holds 5% of the total Bitcoin supply.

ETFs saw outflows again earlier this month, and these changes have also put pressure on cryptocurrency prices.

Challenges facing miners

On April 20, 2024, Bitcoin will undergo a halving event, reducing miners’ rewards from 6.25 BTC per block to 3.125 BTC.

In order for miners to continue mining, a rise in the price of Bitcoin is necessary, and many people are looking forward to it.

However, the price has not risen as expected and many miners are now forced to sell their BTC.

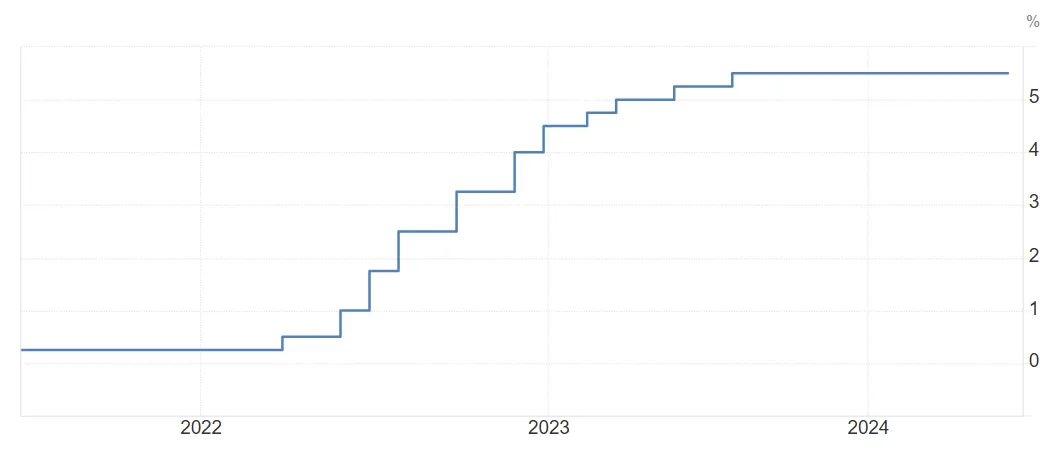

US interest rates

The lower interest rates become, the more attractive risky investments like cryptocurrencies become.

The minutes of the FRS meeting showed that policymakers were reluctant to cut interest rates unless there was more data showing that inflation was moving towards the target rate of 2%.

Germany

The German government holds a large amount of Bitcoin and has begun to sell off its assets.

According to Arkham data, the German government recently transferred 400 BTC to Bitstamp, Coinbase, and Kraken exchanges.

A total of 2,700 BTC has been transferred from government wallets to exchanges in the past two weeks.

All of these factors have combined to lead to the market conditions we are currently seeing. However, there is always another side to the story, and there are also factors that support the rise of Bitcoin right now, let’s discuss them in detail.

Major investors are not selling BTC

Despite the drop in Bitcoin prices, companies did not sell their assets. Instead, many companies started buying BTC during the price drop.

Despite the need to free up capital, the largest miner, Marathon Digital Holdings, has not disposed of its assets.

It is worth noting that miner capitulation could signal an impending trend reversal.

Statistics show that Bitcoin usually starts to rise about four months after the halving event.

If history repeats itself, bulls could oust bears by late summer.

-

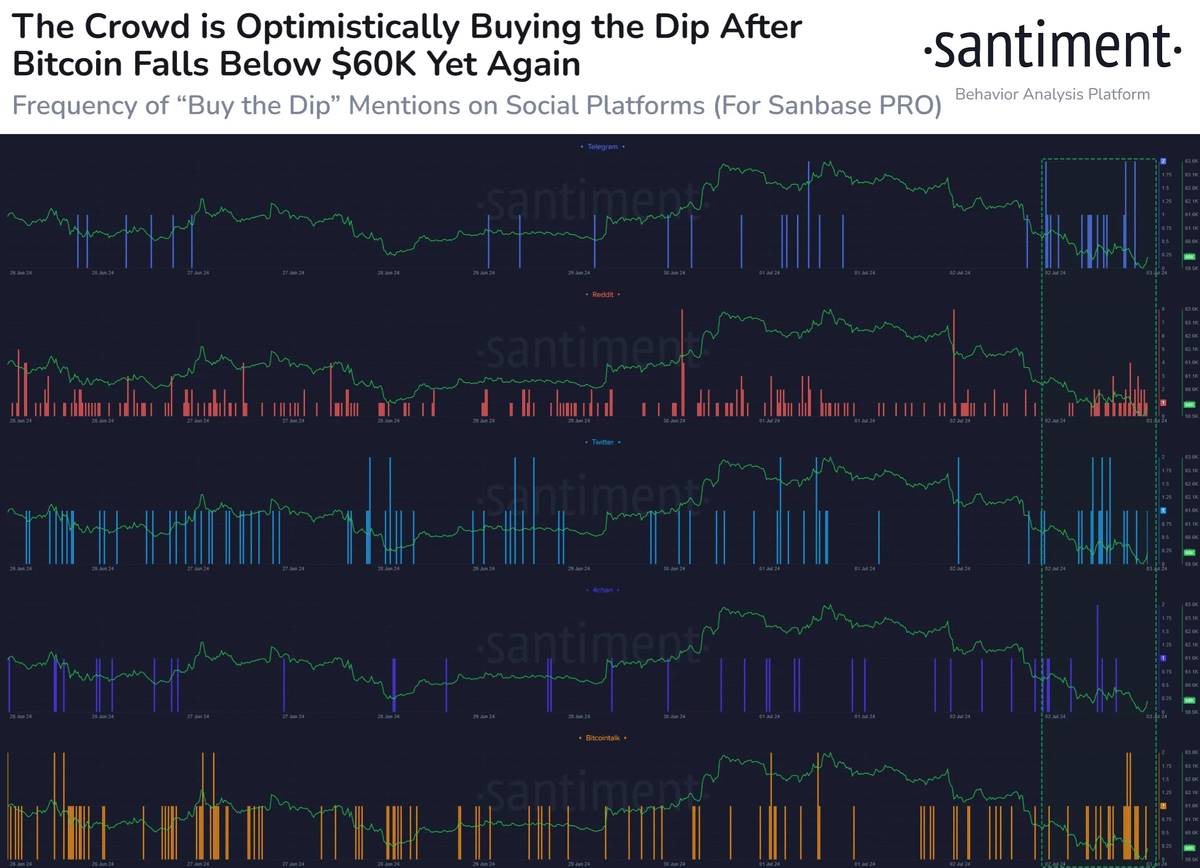

Comunidad

According to data from Santiment, there are growing calls on social media to “buy the dip.”

When Bitcoin was priced below $60,000, people considered it particularly attractive.

The graph below shows statistics on calls to buy Bitcoin on various social networks.

Expectations of a Fed rate cut

While most market participants are convinced the Fed will not cut rates at its next meeting in late July, delegates hinted that investors could see a rate cut later this year.

Elecciones en EE.UU.

The crypto community in the United States is growing rapidly, and the topic has not been ignored by the presidential candidates.

After the recent debate, everyone believes that Donald Trump, who has publicly pledged to support the development of the crypto market, will become president.

If he wins, the head of the SEC could be a positive for cryptocurrencies.

en conclusión

I have analyzed the positives and negatives of the current market. I do not want to impose any opinions on you, just do your own analysis and develop your own strategy.

Personally, I think Bitcoin is a very good long-term investment (at least 4 years). I am not worried about the future of cryptocurrencies and I believe the market is in good shape.

This article is sourced from the internet: Comprehensive analysis of the current crypto market: BTC is back in the 5-digit range, is the bull market still there?

Relacionado: Bitwise: mercado de $20 billones, oportunidades a largo plazo para IA+Criptomonedas

Escrito por: Juan León, analista de criptomonedas de Bitwise Compilado por: Luffy, Foresight News Hace poco asistí a Consensus en Austin, una de las conferencias de criptomonedas más grandes del mundo. En el evento, que contó con más de 15 000 asistentes, innumerables expertos de la industria discutieron una amplia gama de temas, desde tokenización y regulación hasta política monetaria y ETF de Bitcoin. Pero si tuviera que señalar la mayor conclusión de la conferencia, sería esta: la intersección de la inteligencia artificial (IA) y las criptomonedas es más prometedora de lo que la gente piensa. Para 2030, estas dos industrias podrían contribuir con $20 billones al PIB mundial. No sucederá de la noche a la mañana, pero ya estamos viendo los inicios de su enorme potencial. Minería de Bitcoin e inteligencia artificial: una asociación emergente Sin duda habrás oído hablar del reciente auge de la IA, que ha impulsado a Nvidia (la…