Una revisión de 25 proyectos de financiación a gran escala que aún no han emitido tokens

Autor original: The Smart Ape , Cripto KOL

Traducción original: Félix, PANews

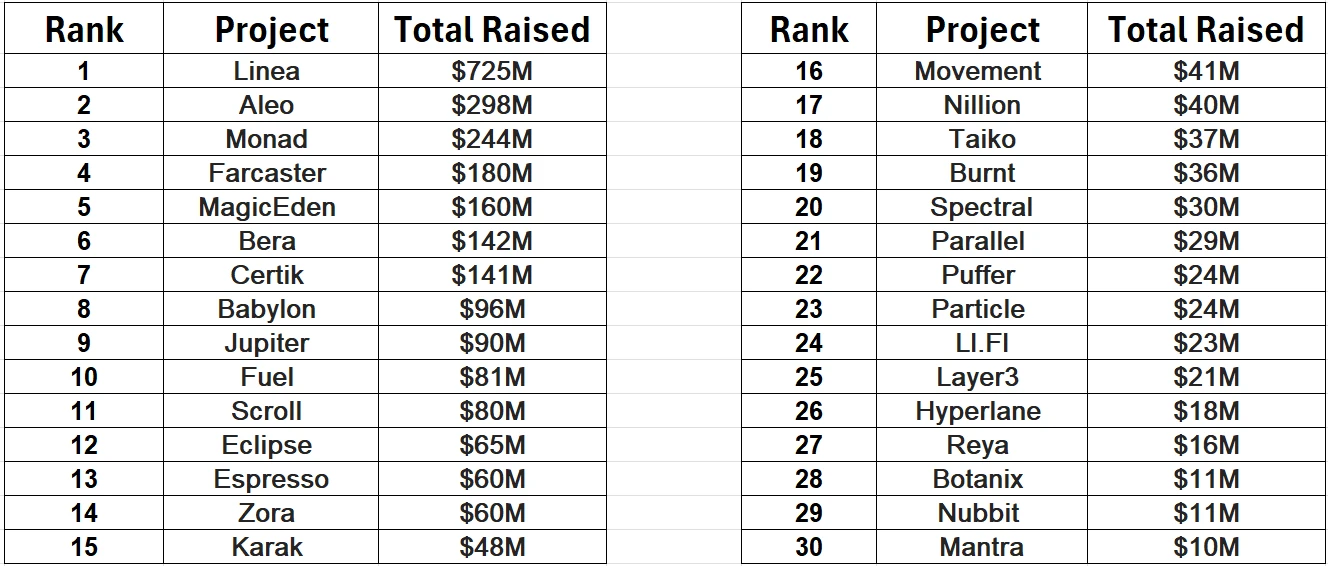

Crypto KOL The Smart Ape took stock of the projects that have completed financing but have not yet issued tokens, as shown in the figure below (5 of them have already issued tokens).

1. Linea: $725 million

Linea is an L2 blockchain project focused on creating a user-friendly platform for decentralized applications (dApps). It aims to provide developers with tools to build scalable and efficient dApps, thereby enhancing the overall user experience in the crypto space.

Lectura relacionada: In the ever-increasingly involutionary Layer 2 race, can ConsenSys lead Linea to break through?

2. Aleo: $298 million

Aleo is a privacy-focused blockchain that enables developers to build decentralized applications using zero-knowledge proofs. Aleo allows for secure and private transactions, ensuring that users’ data remains confidential while maintaining transparency and trust in the network.

Lectura relacionada: Aleo, la cadena pública de privacidad liderada por a16z, ha confirmado el airdrop y su estrategia interactiva se detalla a continuación

3. Monad: $244 million

Monad is a blockchain infrastructure project that aims to improve the performance and scalability of centralized applications. Monad focuses on providing developers with a powerful and efficient platform to build and deploy dapps, focusing on speed and reliability.

Lectura relacionada: A step-by-step guide to ambush the airdrop Big Hair: Monad and Polymer Labs

4. Farcaster: $180 million

Farcaster is a decentralized social networking protocol that allows users to own and control their social identities. Farcaster aims to provide a platform where users can communicate and share content without relying on centralized entities, ensuring greater privacy and freedom.

Lectura relacionada: Farcaster received $150 million in financing despite low user numbers. Is this a trap set by VC for LP?

5. Magic Eden: $160 million

MagicEden is an NFT mercado on the Solana blockchain. MagicEden provides a platform for artists, creators, and collectors to buy, sell, and trade NFTs, creating a vibrant ecosystem for digital art and collectibles.

Lectura relacionada: Grabbing Bitcoin Ecosystem Traffic, Magic Eden Lands on the Market Leader

6. Berachain: $142 million

Berachain is a cutting-edge decentralized finance (DeFi) platform that integrates advanced blockchain technology to provide a wide range of financial services, including lending and yield farming. Berachain aims to create a highly scalable and efficient ecosystem where users can maximize their asset returns.

Lectura relacionada: Interview with Smokey The Bera, co-founder of Berachain: How the innovative PoL public chain solves the liquidity problem and may be launched in a few months

7. CertiK: $141 million

Certik is a blockchain security company specializing in the auditing of smart contracts and blockchain protocols. Certik provides security solutions to ensure the security and integrity of blockchain projects, helping to prevent vulnerabilities and exploits.

Note: CertiK launched the token CTK in 2020, and upgraded it to Shentu Chain Token (CTK) in 2021. Currently, the introduction of CTK has been deleted from the CertiK official website.

8. Babylon: $96 million

Babylon is a decentralized finance (DeFi) platform that focuses on providing yield mining and liquidity mining opportunities. Babylon aims to provide users with higher returns on crypto assets by optimizing the yield strategies of various DeFi protocols.

Lectura relacionada: Babylon in detail: How to unlock the security value of Bitcoin?

9. Fuel: $81 million

Fuel is a high-performance blockchain network designed to provide scalable and low-cost transactions. Fuel focuses on optimizing throughput and reducing fees, making it suitable for applications that require fast and economical transactions.

Lectura relacionada: With the mainnet launch imminent, how will Fuel stir up the L2 battle?

10. Scroll: $80 million

Scroll is a Layer 2 scaling solution for the Ethereum blockchain that aims to increase transaction speeds and reduce costs. Scroll leverages rollup technology to bundle multiple transactions into a single batch, thereby enhancing the scalability of the Ethereum network.

Lectura relacionada: TVL exceeds 800 million US dollars, a record high. How to use high-quality accounts to interact with Scroll?

11. Espresso Systems: $60 million

Espresso is a privacy-centric blockchain that leverages advanced cryptography to ensure the confidentiality of transactions. Espresso aims to provide users with a secure and private environment to conduct transactions and interact with decentralized applications.

Lectura relacionada: From concept to reality: How does Espresso achieve L2 expansion through shared sorting?

12. Zora: $60 million

Zora is an NFT marketplace that allows creators to mint, sell, and trade their digital assets. Zora is focused on giving artists and creators greater control, allowing them to effectively monetize their work.

Lectura relacionada: After zkSync, here are 10 potential airdrops this year

13. Karak: $48 million

Karak provides a unique re-staking protocol that enables users to maximize their staking rewards through innovative mechanisms. Karak aims to simplify and optimize the staking process and provide a safe and efficient solution for users to participate in DeFi activities.

Lectura relacionada: Karak, the new staking star, emerges, will launch a vampire attack on Eigenlayer? (with interactive tutorial)

14. Movement: $41 million

Movement Labs is building a modular blockchain network based on Move, designed to enhance security, performance, and user experience. Movement’s flagship product, M2, is a Layer 2 rollup for Ethereum that leverages the Move virtual machine (originally from Facebook) to improve efficiency and throughput, achieving speeds of over 145,000 TPS.

Lectura relacionada: A new interpretation of Movement’s public chain: How does “introducing Move into EVM” reshape Ethereum and Move?

15. Nillion: $40 million

Nillion is a decentralized, privacy-preserving network designed for secure data storage and computation. Nillion enables users to share and process data without revealing the actual data, leveraging cryptography to maintain privacy and security across the network.

Lectura relacionada: A quick look at the first 13 graduated projects of Web3 accelerator Beacon

16. XION: $36 million

Burnt launches XION, the first Layer 1 blockchain designed for consumer adoption through chain abstraction. XION simplifies the Web3 experience by removing technical barriers, providing powerful protocol-level abstractions for accounts, signatures and gas, and seamless mobile support.

Lectura relacionada: Is XION aiming to rewrite the technical narrative of blockchain networks?

17. Parallel Network: $29 million

Parallel is a platform that supports interoperable decentralized applications, facilitating seamless communication and data transfer between different blockchain networks.

Lectura relacionada: Blast Ecosystem Lending Protocol Pac Finance is caught in a “liquidation” storm, and its sister project ParaSpace once staged an internal fight

18. Puffer Finance: $24 million

Puffer is a DeFi protocol that provides financial services such as lending and yield mining, focusing on high returns and secure investments.

Lectura relacionada: Dialogue with Puffer: How can LRT attract top capital such as Binance Labs and Franklin to invest in it under the internal circulation of LRT?

19. Particle Network: $24 million

Particle Network is a blockchain project focused on providing decentralized infrastructure for data sharing and computing. Particle aims to enable secure and efficient data transactions, using blockchain technology to ensure privacy and integrity.

Lectura relacionada: Messari: How does the modular L1 Particle Network tell a good abstract narrative of the “universal” chain?

20. LI.FI: $23 million

LIFI is a multi-chain liquidity aggregation protocol that supports swaps by aggregating bridges and DEX aggregators from more than 20 networks.

Lectura relacionada: Analyzing the current status of the aggregator track: What are the advantages of Li.Fi?

21. Layer 3: $21 million

Layer 3 is a platform designed to make exploring and learning about cryptocurrency fun and rewarding. Through interactive quests, users can collect CUBES for completing tasks, collate their on-chain achievements, and unlock rewards.

Lectura relacionada: Layer 3 Foundation will announce L3 token economics details next week

22. Hyperlane: $18 million

Hyperlane is an interoperability protocol that enables permissionless connectivity between blockchains. Hyperlane allows developers to easily launch modular blockchains with built-in interoperability, facilitating seamless communication and data transfer between different blockchain ecosystems.

Lectura relacionada: Introducing two airdrop projects worth paying attention to: Hyperlane and Pontem

23. Reya Labs: $16 million

Reya is a blockchain network focused on providing decentralized and scalable solutions. Reya aims to empower developers and users by providing a powerful infrastructure for building and deploying decentralized applications (dApps), enhancing the accessibility and usability of blockchain technology.

Lectura relacionada: How does Reya Network, which is supported by Coinbase, Wintermute and other institutions, build a modular L2 optimized for transaction scenarios?

24. Botanix Labs: $11 million

Botanix Labs is focused on creating sustainable blockchain solutions that promote environmental protection. By leveraging blockchain technology, Botanix aims to support green initiatives and ensure transparency and trust in environmental projects.

Lectura relacionada: Dialogue with Botanix Labs founder: Analyzing the first fully decentralized EVM equivalent L2 on Bitcoin

25. Nubit: $11 million

Nubit is able to expand Bitcoin’s data capacity without compromise, powering applications such as Ordinals, Layer 2, Price Oracles, and Indexers, thereby expanding the scope and efficiency of the Bitcoin ecosystem.

This article is sourced from the internet: A review of 25 large-scale financing projects that have not yet issued tokens

Original author: @LiamWang 88 Web3 independent researcher I first heard about and participated in blockchain in late 2017 and early 2018. At that time, I was working in a large Internet company. Thanks to the inherent advantages of Internet companies in trying new technologies first in their business and the relatively strong programmer atmosphere, I had the opportunity to get in touch with blockchain relatively early. At that time, I often hung out with a group of programmer friends, and the topics they talked about most were: Bitcoin, mining, ICO, air coins, etc. I don’t come from a technical background, so what they said was completely confusing to me. But because I come from a content background, my intuition tells me that blockchain is a very different technology. So, I…