SignalPlus Macro Analysis Special Edition: Half Way Through

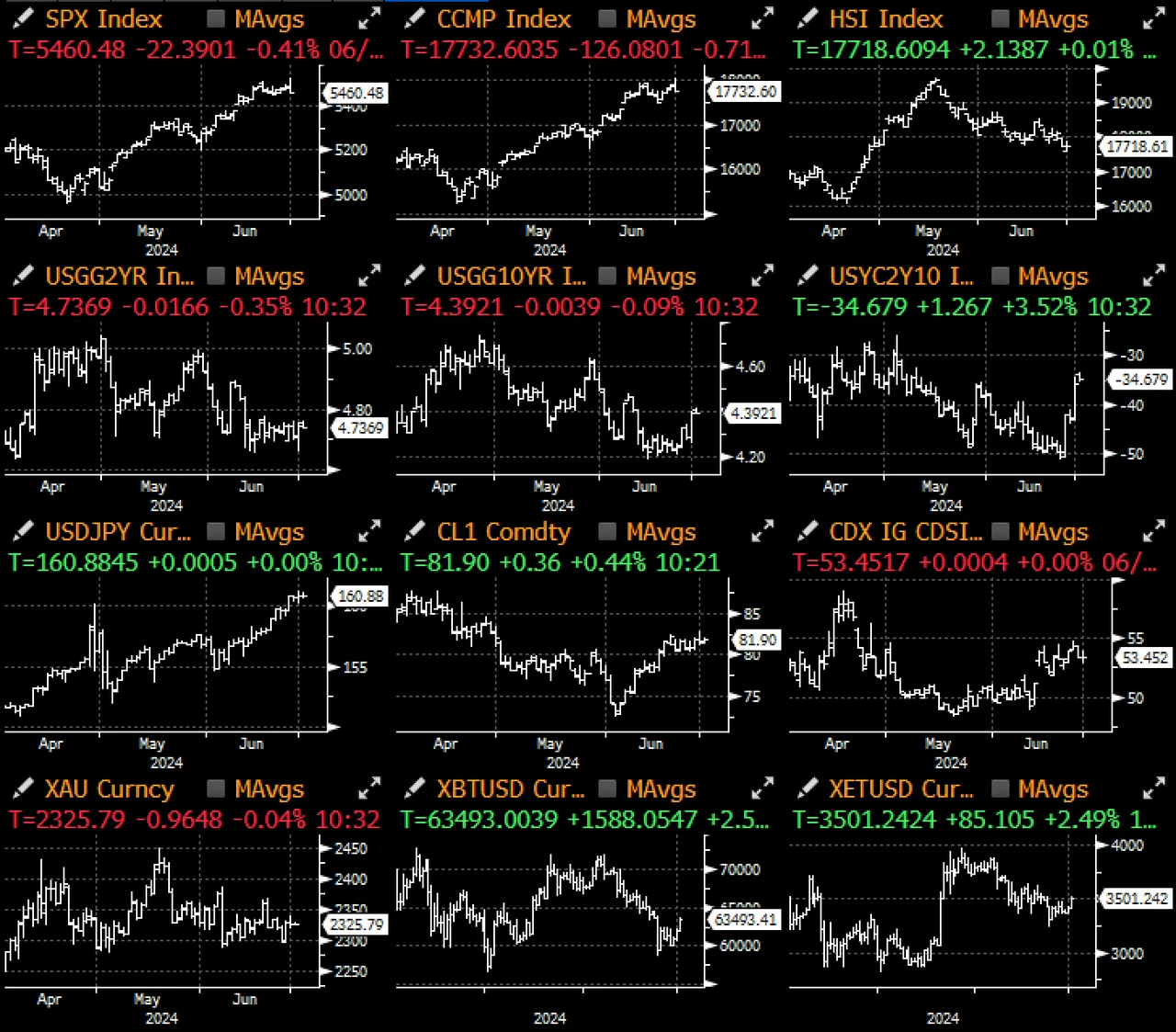

An unusually quiet first half of the year has come to an end, and a quick review of the first half of the year shows that the SPX, Nasdaq, Nikkei and gold prices have outperformed, while on the other hand, the Japanese yen, Japanese government bonds, the euro and most recently French government bonds (OATs) have lagged due to the continued zero interest rate policy of the Bank of Japan and Macrons political adventure of early elections.

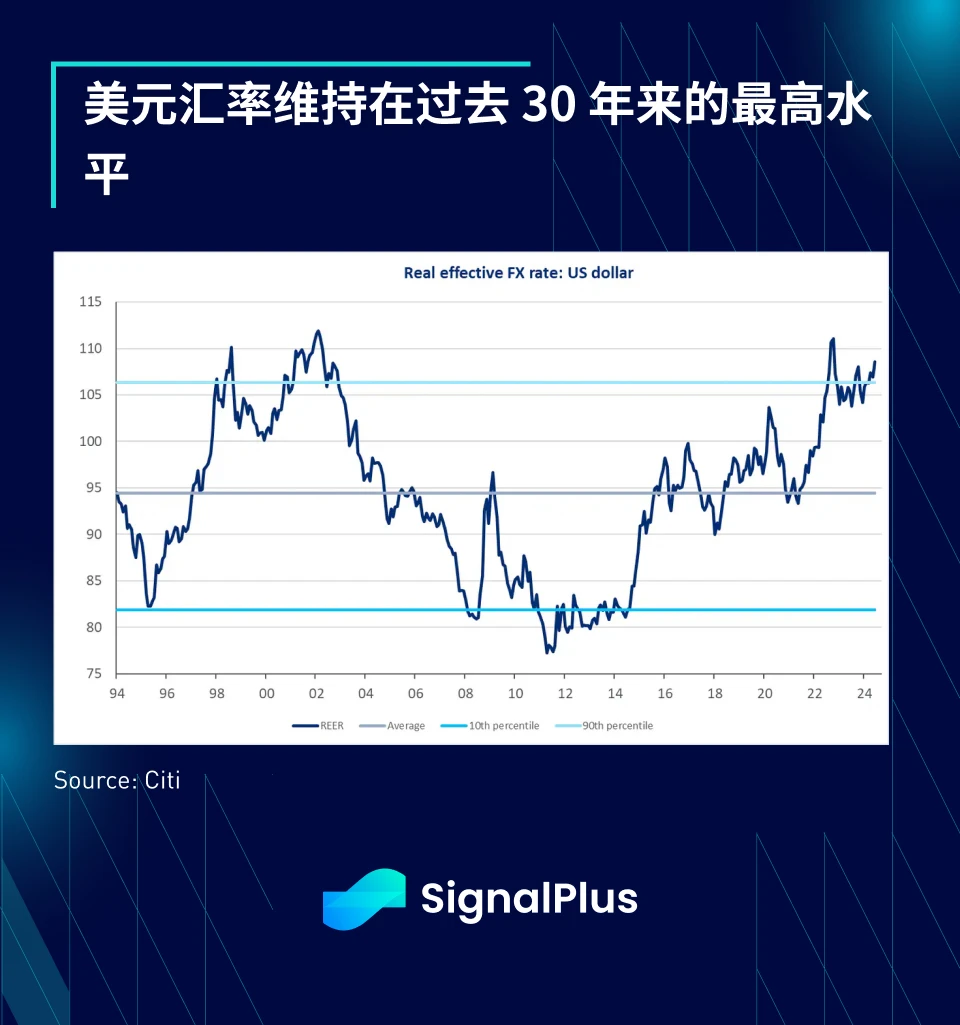

Not to be outdone, the US dollar has also remained near its highest level in the past 30 years as AI continues to drive capital inflows, strong economic conditions and high benchmark interest rates. This year, the outstanding performance of the US capital market continues to exceed the expectations of most skeptics.

As capital continues to flow out of China, India has maintained its lead among emerging markets, with Indian markets up 30% (in US dollar terms) over the past 1.5 years, while Chinese stocks have fallen about 15%, a performance gap of 45%.

In the second half of the year, the US election will be the focus, and the market performance may still exceed expectations, although it may be different from the style of the first half of the year. We have long believed that the main axis of this election is about unsustainable US fiscal policy, which is reflected in the bond market, bringing higher yields and a steeper yield curve. However, in general, US customers believe that tariff policy is more important and that a stronger US dollar is a better choice. Although we basically agree with this view, we are not sure how much upside there is. After all, the US dollar index is only a few percentage points lower than its peak in the past 30 years.

Some clear themes that will emerge in the second half of the year:

-

U.S. economic momentum slows, although overall growth remains healthy

-

US recessions are rarer than unicorns

-

Inflation pressures are easing toward the Fed’s target, but not fast enough to justify a quick rate cut in the near term

-

Although there has been some rotation/correction in the US market, AI continues to drive overall sentiment

-

With the Fed passive and the economy on autopilot, the focus will turn to politics, with the US election, fiscal spending, new tariff policies and Treasury supply dominating the investment narrative

Judging from economic data, the US economy has slowed down from its highs in the past two years, the economic surprise index has fallen to a multi-year low, and high-frequency consumer data showed a sharp drop in savings during the epidemic and a worrying increase in consumer debt.

However, even at a lower level overall, economic activity is still relatively active compared to previous cycles, with non-farm payrolls expected to be around 190,000 this week, unemployment expected to be 4%, and average hourly earnings still having a chance to show a positive growth of 0.4%. At the current rate, the average job growth in 3 months is still 249,000, while the average before the epidemic in 2010-2019 was only 181,000.

On the inflation front, price pressures appear to be finally easing after several disappointments. PCE rose 0.08% in May, below market expectations, and “super core” PCE rose just 0.1%, helping to clarify the Fed’s plans for a possible rate cut in September.

On the political front, President Biden’s performance in the first presidential debate was below expectations, raising concerns about his age and health, while former President Trump’s performance was relatively stable (by his standards), and his post-debate reaction was swift and significant, with the difference in odds between Trump and Biden widening from +10 points before the debate to +22 points. Outside of the head-to-head matchup, Biden’s odds (35%) are now 7 points lower than the Democratic odds (42%), while Trump and the Republican odds are now well over 50%.

A landslide victory for Trump could have far-reaching implications for U.S.-China tariff policy, fiscal spending and extensions of tax breaks, monetary policy and the independence of the Federal Reserve, and potentially even the framework for cryptocurrencies.

Meanwhile, the first round of voting in the French election was won as expected by Le Pens National Rally, with the far-right party winning 34% of the vote, putting it on track for a majority.

This holiday-shortened week, with only 3.5 trading days, will see a slew of data releases on Wednesday, including ADP, jobless claims, the ISM services index and the FOMC, and Friday is expected to be very busy with the release of nonfarm payrolls immediately following Thursday’s holiday.

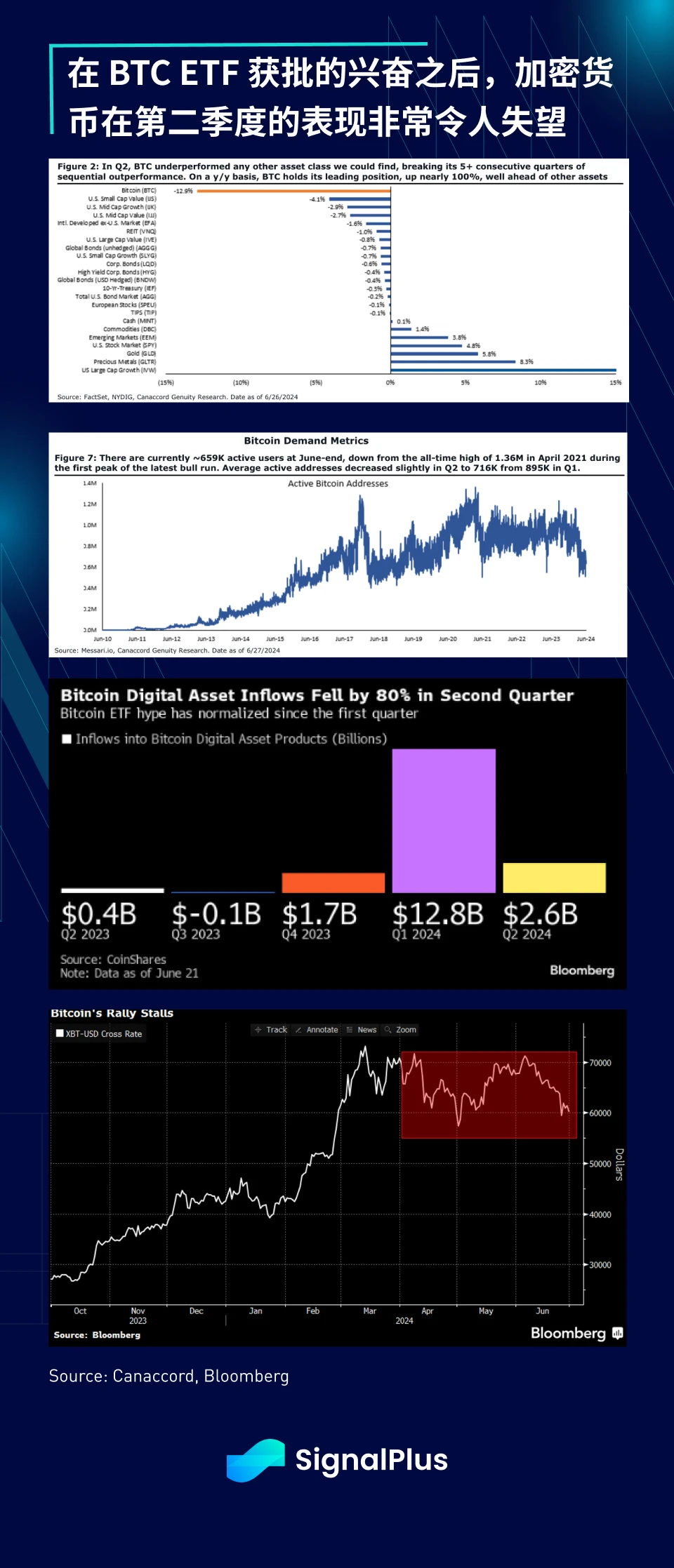

In terms of cryptocurrencies, a very disappointing quarter ended last Friday, with BTC falling 13% in the second quarter. Slowing capital inflows, a lack of substantial mainstream technological innovation, falling demand indicators, and supply-side concerns have all exacerbated the woes of cryptocurrencies, with BTC failing to break out of the 60-70k range.

Ethereum has also been disappointing, with expectations of ETF approval failing to generate excitement about the mainnet, and concerns about L2 offloads and reduced fees/increased supply (L1 fees fell to an all-time low last week), as the community continues to question the Ethereum Foundation over long-term structural issues.

Will the ETFs expected approval in the third quarter and the lawsuit victory against the SEC (regarding staking) change ETHs fortunes? Will Trumps victory solve the problem of mainstream application in the industry? Only time will tell…

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Half Way Through

Relacionado: Outlier Ventures: El auge de las redes sociales descentralizadas

Artículo original de: Lorenzo Sicilia, director de ingeniería en Outlier Ventures Traducción original: xiaozou, Golden Finance Outlier Ventures ha notado un crecimiento saludable en algunas redes sociales descentralizadas, y Farcaster y Lens Protocol han comenzado a ganar la atención real de los usuarios. Cuando se trata de productos para el mercado masivo, las criptomonedas se están volviendo cada vez más prácticas y eficientes. Hasta ahora, la falta de administración de claves privadas y la experiencia móvil han obstaculizado la adopción de criptomonedas por parte de las personas. En este artículo, analizaremos en profundidad varios de los principales contendientes de redes sociales descentralizadas de criptomonedas, sus respectivas características, arquitectura y las oportunidades que los fundadores de Web3 están interesados en construir nuevos protocolos de gráficos sociales sin permisos. 1. Redes sociales Después de más de una década de usar Instagram, Facebook, Twitter y otras plataformas, todos saben cómo funcionan las redes sociales. El…