Conozca a Andrew Kang: un portavoz de Crypto Capital con activos de 0 a 9 cifras

Original | Odaily Planeta Diario ( @OdailyChina )

Autor: Wenser ( @wenser 2010 )

Editors note: Recently, Mechanism Capital co-founder Andrew Kang made relevant remarks about bearish ETH. Previously, Azuma, a senior writer of Odaily Planet Daily, also compiled his remarks. For details, please see the article Ethereum Big Short Manifesto: ETH/BTC will fall for another year . Perhaps many people have limited knowledge of him, but he has been deeply involved in the crypto industry for many years. He has invested in high-quality projects with a market value of billions such as Thorchain, Pancakeswap, and Frax Finance, and has also made a lot of gains in trading. Odaily Planet Daily will introduce Andrew Kang in this article in combination with the sharing of X platform user @Atlas for readers reference.

Recent Views: ETH has limited upside potential, BTC may hit a new high in 2025

In the current bull-bear market, everyone has different opinions on this. The perspectives of Andrew Kang (hereinafter referred to as Kang), who has multiple identities as a capital partner, crypto KOL and legendary trader, may be more valuable for reference.

On June 24, Kang wrote on X : I began to realize that this is the first cycle and complete bull market that many cryptocurrency investors have experienced. In this bull market, BTCs multi-day decline has been very limited, limited to 20%, and many people seem to have increased leverage in the last pullback in April. However, the market in the last cycle often carried out leveraged liquidations, resulting in 30% to 60% retracements, evaporating hundreds of billions of dollars in total. Different cycles have different paradigms, but when people are too comfortable and believe that something is impossible, it is usually when disaster strikes. Although I am bearish, this is not to tell you to short the market or sell everything. Be sure to pay attention to investment risks and dont bet all your bets on one transaction. If you face market fluctuations that are larger than expected, the option of having more capital reserves is priceless.

Then, perhaps out of consideration for preventing slap in the face, or perhaps because he felt that the risk warning was not clear, he added: The current market environment reminds me of May 2021, not June 2021, let alone December 2020. At that time, we were accustomed to only rising and competing for bottom fishing. We experienced a major adjustment from $64,000 to $45,000, but everyone expected the market to rebound. But the end result was that the bottom went all the way down. We held hope; for example, more retail investors are coming, $40,000 is a strong support, super cycle, and so on. The current environment is the same, all 9-10 months after the start of the bull market. Except this time it is the Ethereum ETF -legendary trader GCR has expressed bullishness . I believe GCRs time frame is correct in the multi-year time frame, and we will see BTC hit a new high in 2025 (but not all altcoins can do this). This does not mean that the market will not experience extreme corrections within a few months. After all, the market can tame every unruly person and make him humble as before.

On June 23, Kang published an article analyzing the potential impact of Ethereum spot ETFs on the market. He believes that Bitcoin spot ETFs provide a channel for many new buyers to allocate Bitcoin in their portfolios, but the impact of Ethereum ETFs is far less clear. Unless Ethereum creates a convincing way to improve economic conditions, its price will not see significant upside due to the approval of spot ETFs.

On June 20, Kang’s view was as clear as ever: “Although the market momentum has turned from up to down due to the lack of large ETF fund inflows, I firmly believe that Bitcoin is still strong and will not fall below $50,000; for Ethereum, I predict that its price may remain stable until the ETF is listed, but the upper limit of this year is expected to be around $4,000.”

It can be seen that compared with Ethereum, Kang is more optimistic about the future of Bitcoin, and this is based on his rich experience in the crypto market in the past.

Multiple roles: the dual life of crypto KOL and crypto investor

As of now, Kangs personal account has over 260,000 followers on the X platform. Previously, he was the co-founder of the cryptocurrency mining operator MinerUpdate and once dicho : Most mining operations do not currently use derivatives. This is a huge upside opportunity for derivatives exchanges such as Deribit, BitMEX, and Binance. As competition in the mining industry intensifies and profit margins decline, mining operators will need to start getting involved in the derivatives market in order to survive and thrive. The resulting trading activities can generate several times the revenue of miners activities.

In June 2020, the @Mechanism Capital official account was officially established, and Kang also transformed from a trader and crypto KOL to an official crypto investor. Investing in the best influencers is usually a major feature of the cryptocurrency industry. As we mentioned in the article Disassembling the investment list of top KOLs and looking for new Alpha , when the influence of KOLs reaches a certain level, along with the growth of personal wealth assets, there will be an increase in investment opportunities. It is a natural thing to become an angel investor in the crypto industry. The difference is that some people maintain their personal investment status, while others choose to set up an institution to operate the corresponding investment fund. Kang chose the latter. Previamente, Mechanism Capital successfully invested in the well-known blockchain project NEON.

In February this year, Kang shared his investment philosophy on the social media platform: The way to achieve a thousand-fold increase is to discover teams with excellent product potential early on.

He mentioned, In 2018, I had a portfolio worth $50,000, and by mid-2021, I had grown this portfolio to the same size as many well-known cryptocurrency funds in the field without absorbing any external funds. The only way this is possible is to discover S-level teams with excellent product potential early, accumulate majority ownership of the projects through the public market, and fully support them until they increase in value by more than 100 times, and some even increase in value by 1,000 times. Support methods include token incentives/issuance design, marketing/community development strategies, DeFi integration/partnerships, exchange connections, product design, introducing other signal/value-added funds/investors/users/developers, becoming high-energy users of the protocol, and so on. For many of these projects, I have followed them all the way from the start-up stage with a market value of less than $50 million to more than $2 billion, and some even exceeded $5 billion, including Thorchain, Pancakeswap, Frax Finance, etc.

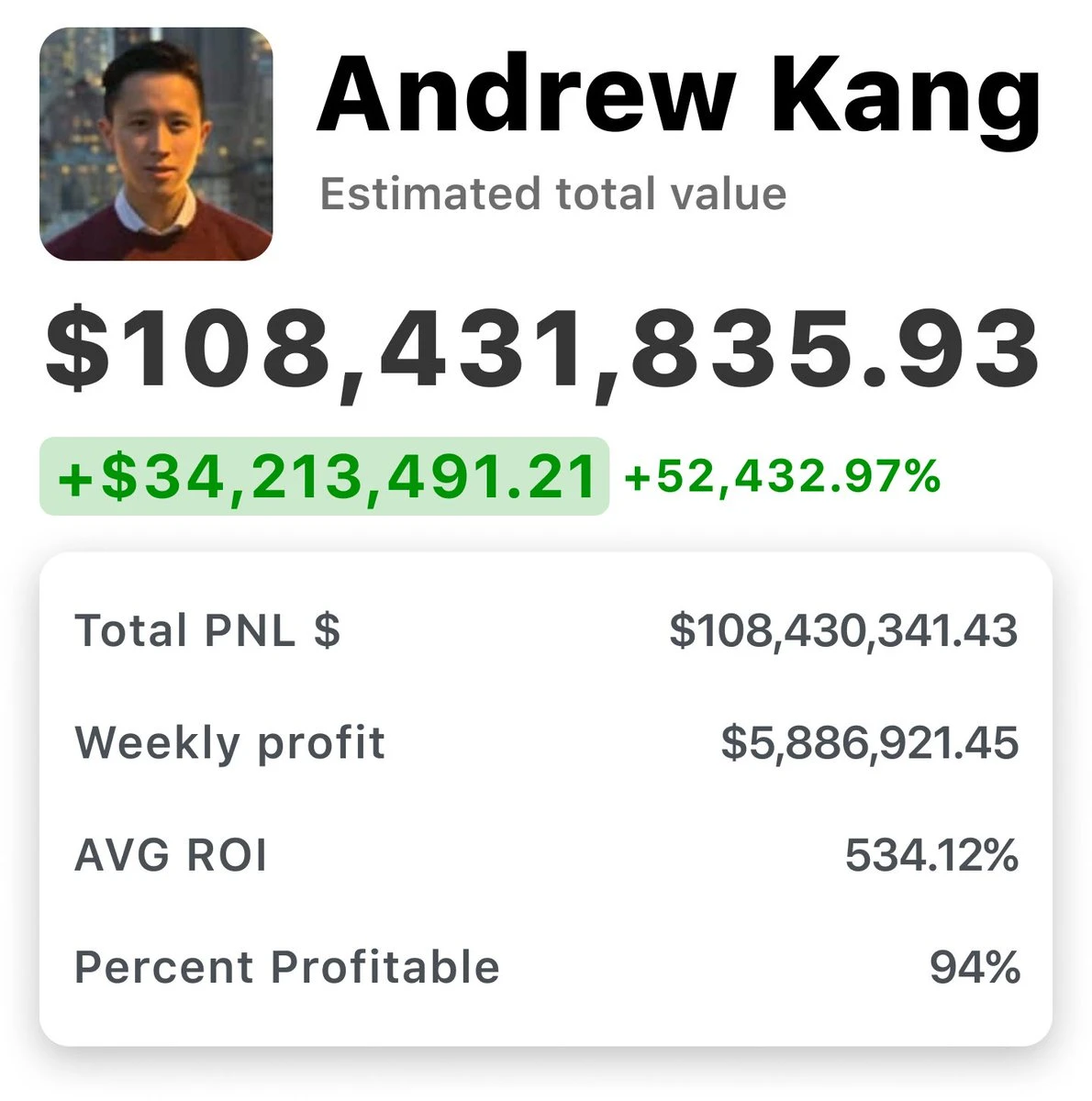

A glance at Kangs balance sheet

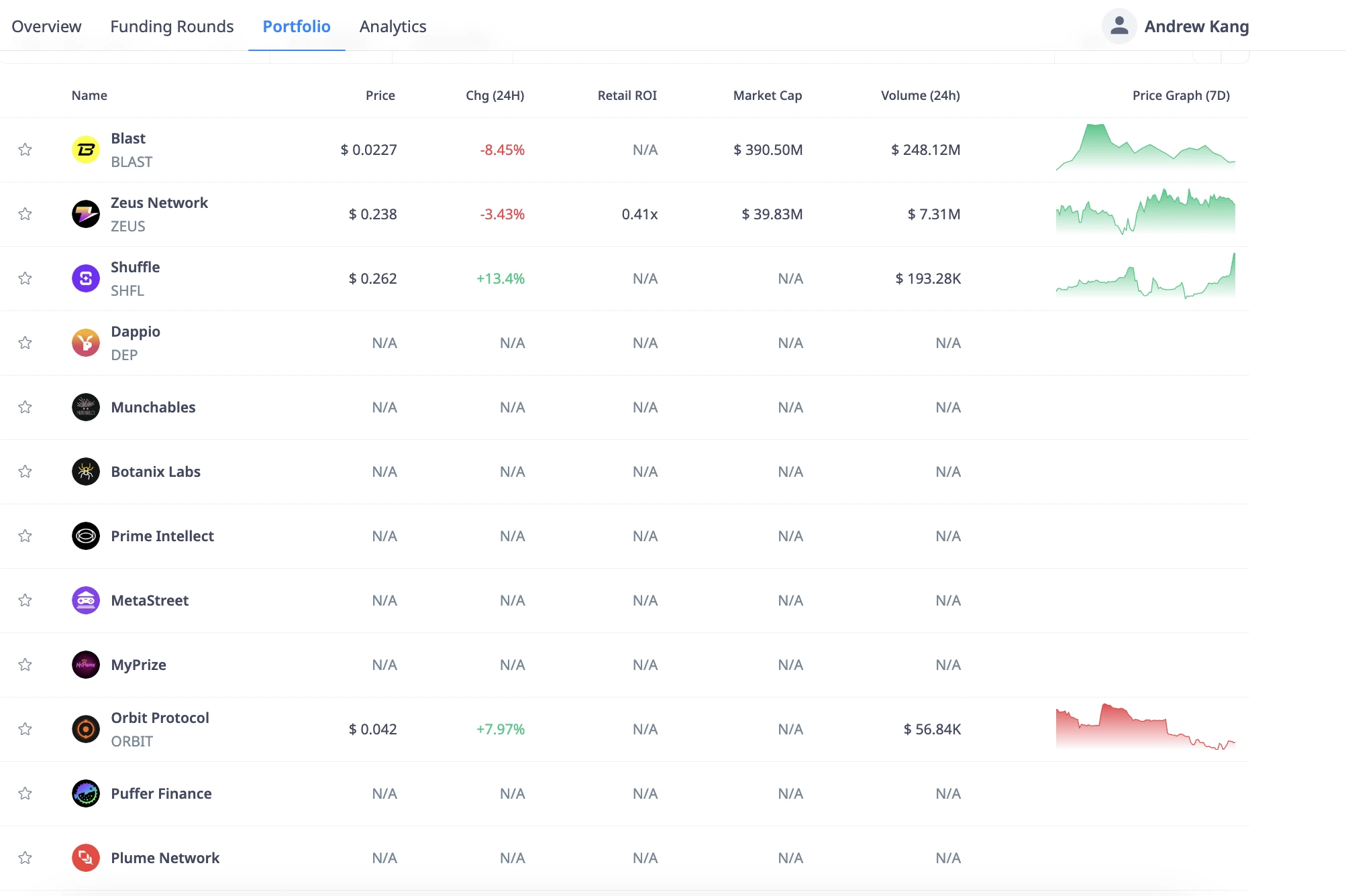

Según datos de @CryptoRank_io , Kangs latest and well-known investments are @Blast_L2 y @puffer_finance . In addition, he has also invested in NFT mortgage lending platform MetaStreet, Solana ecological cross-chain communication network Zeus Network (and is the lead investor), crypto gaming and gambling platform Shuffle, Blast ecological lending project Orbit Protocol, RWA Layer 2 network Plume Network and many other projects.

In addition, Kang has also paid close attention to another hot track besides cryptocurrency. In February this year, he made the largest investment in history in the AI humanoid robot company Figure (note: different from the blockchain financial services company Figure Technologies), with an investment amount of US$19 million. He believes that Brett Adcock (founder of Figure) and his team will take the lead in the human labor market, the worlds largest capital market with a scale of US$42 trillion, and deploy millions of robots in the next few years, and at least 100 million robots by the end of this decade.

Crypto Rank Investment Portfolio Interface

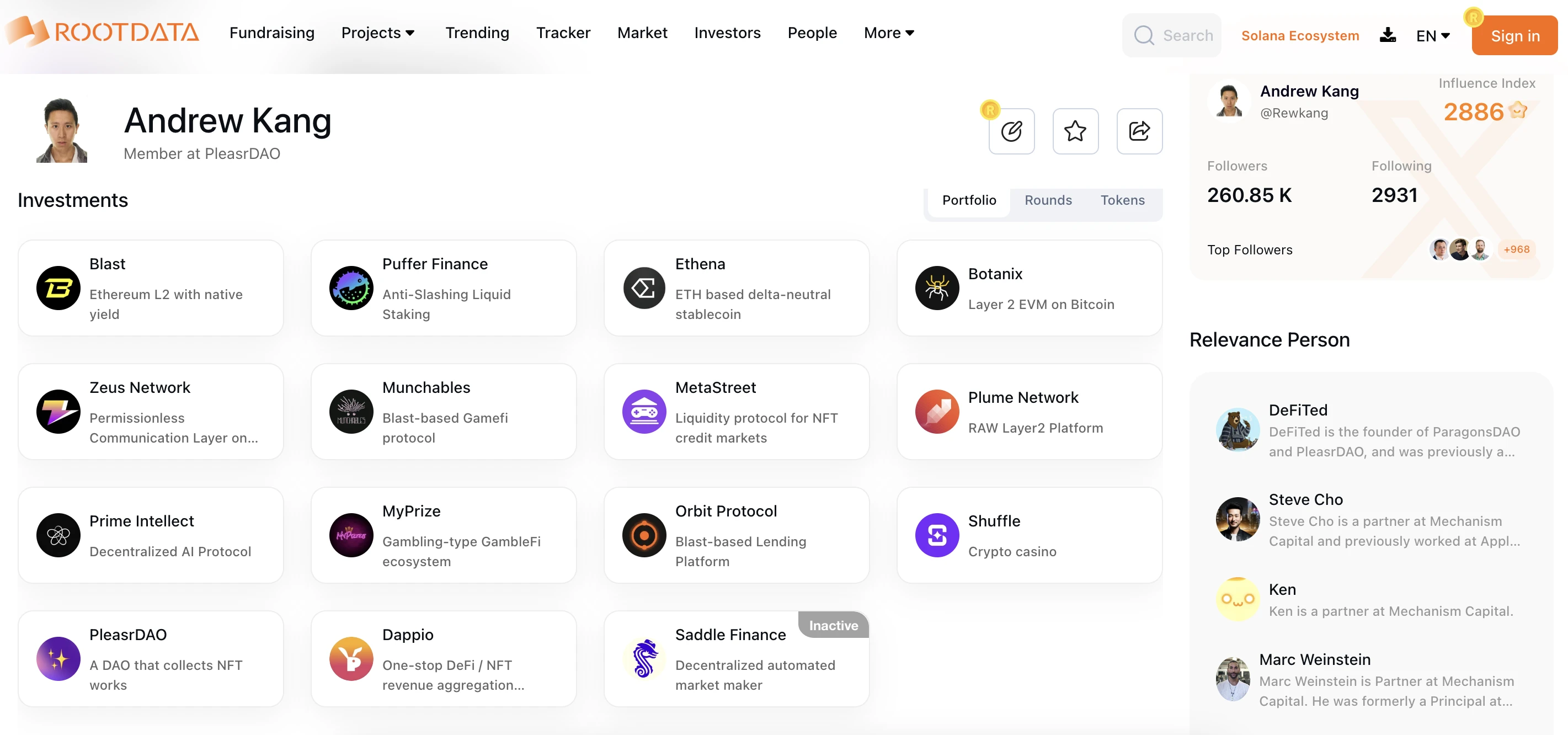

Además, según data from the Rootdata website , Kang has invested in a total of 12 projects in the past year, and there are 15 recorded projects, including the NFT crowdfunding DAO organization PleasrDAO in which he is deeply involved.

It is worth mentioning that according to the information on the Rootdata website, its relevant network of contacts includes several partners of Mechanism Capital, including Steven Cho, Ken, Marc Weinstein, and PleasrDAO founder DeFiTed.

This inevitably brings up Kang’s other multiple identities: a senior NFT collector and an active participant in Meme coins.

Cultural enthusiast: Azuki was once a favorite, and Meme coins are a new asset class

As early as 2021, Mechanism Capital invested in the NFT project Kanon . The first sub-project launched by the project at that time was K21, a closed art machine gun pool that will provide liquidity exposure to the works of 21 influential contemporary, digital and crypto artists, and integrate DeFi to combine the motivation of artists creation and the income of investors, which will reshape the funding, charity, curation and custody models.

In September 2022, Kang purchased Azuki #4978 for 105 ETH (worth approximately $143,000 at the time) through the NFT trading market X2Y2.

In October 2022, Kang purchased Azuki#5558 through the NFT trading market X2Y2 for 200 ETH.

In June 2023, according to the data of Nansen, a crypto data monitoring platform, Kang held 299 Azuki and 580 Elementals, both of which ranked first in the total holdings of the relevant series. In addition, he also held 436 BEANZ at that time.

In March 2024, Kang purchased the original Pepe NFT originally owned by 3AC (Three Arrows Capital) through Sothebys auction house. This NFT was the first Pepe NFT authorized by the first Pepe creator Matt Furie. It was first sold for 420 ETH on April 17, 2021, and was subsequently acquired by Starry Night Capital, a subsidiary of 3AC, for 1,000 ETH on October 5, 2021.

Not only that, Kang also has a high opinion of Meme Coin and has bought it many times. He has also changed his X platform account avatar to a Meme character picture of IQ 50.

In February this year, Kang made a high-profile statement : his crypto fund Mechanism Capital has bet on Trump concept tokens and related NFTs. Subsequently, Nansen monitoring data showed that on January 19, the Mechanism Capital wallet purchased 500,000 TRUMPs at a cost price of approximately US$0.506, and then purchased another 23,900 TRUMPs on the same day. Among them, 136,200 TRUMPs were allocated to the Mechanism Capital wallet, 135,800 TRUMPs were sent to the Mechanism Capital team-related wallets, and 58,400 TRUMPs were sent to partner Marc Weinstein.

In March, Kang once again made a clear call , saying that Meme coins have become the focus of global speculative liquidity. Compared with traditional equity, Meme coins are now easily accessible to global users. This is why Dogecoins increase is higher than GameStops stock price increase. The total market value of Meme coins reached 100 billion US dollars in the last cycle. The market value peaks in each cycle usually increase by multiple times. In addition to retail investors, HWN traders and hedge funds are gradually entering the market. There is still a long way to go in the future. He then dicho that new funds will continue to buy Meme coins in order to achieve excess returns in the market, and boldly predicted : Meme coin 2.0 or culture coins will appear, targeting specific audiences/ideologies/populations. Every celebrity/influencer will have their favorite cooperative tokens, and they are mainly tokens that are not on CEX, which means that new US dollars will appear on the chain to buy a large number of SOL tokens, just like the ETH and NFT season that year.

Subsequently, the market developed as expected. Popular Solana meme coins such as BOME, NAP, and SLERF emerged one after another, and cooperated with old projects such as PEPE, PEOPLE, WIF, BONK, and FLOKI to set off a meme coin craze. The subsequent celebrity meme coin projects such as JENNER and MOTHER launched by pump.fun also became examples.

At that time, different from other market views, he spoke highly of Meme coin : Meme coin is not a zero-sum game, but a new asset class.

Conclusion: Investors who dare to make judgments are good traders

Looking back at Kang’s past investment history and tweets on social media platforms, we can see a multi-role figure with great personal charm and the courage to make judgments when the market environment is complex: he can not only respond to the market in a timely manner, but also provide corresponding analysis basis. At the same time, he also personally advocates for investment projects and promising narrative tracks. It can be said that his success from scratch to today’s huge wealth is by no means accidental.

It’s no wonder that in February of this year, Chris Burniske, former head of crypto at ARK Invest and current partner at Placeholder VC, expressed an open attitude towards Kang’s view that the price of Bitcoin will hit a record high in March. And then, the market trend did so.

Of course, Kangs investment experience has not been smooth sailing along the way. For example, he built a position in CELR in 2021 and put forward the view that Layer 2 is not a winner-takes-all field, which now seems to be highly forward-looking. Although the token is now forgotten by the public, his views have many things worth learning from.

Kang uses his own personal experience to tell us that we must dare to express our opinions and make our own judgments. Only in this way can we find our own mechanism principles in the turbulent crypto market and grow into a capital giant.

This article is sourced from the internet: Meet Andrew Kang: A Crypto Capital Spokesperson with Assets from 0 to 9 Figures

Original author: @Web3 Mario Introduction: On May 21, 2024, Vitalik liked a project called orb.land in Warpcast. After in-depth research, he was quite interested in the design ideas behind it. So I spent some time reading the book Radical Markets and had some insights that I would like to share with you. Of course, I found a more detailed article about the project itself, which is convenient for everyone to read and understand. In general, the book proposes a politically left-leaning ownership system – a shared ownership mechanism, combined with the Harberger tax model, which aims to solve the social injustice caused by the excessive monopoly of resources. This is inspiring for solving the problems facing the current Web3 industry, such as the recently popular high-valuation VC coins. What is…