Registro completo de las operaciones de inversión del departamento editorial de Odaily (28 de junio)

Esta nueva columna es una muestra de experiencias reales de inversión por parte de miembros del departamento editorial de Odaily. No acepta ningún tipo de publicidad comercial ni No constituye asesoramiento de inversión (porque nuestros colegas son muy buenos perdiendo dinero) Su objetivo es ampliar las perspectivas de los lectores y enriquecer sus fuentes de información. Te invitamos a unirte a la comunidad de Odaily (WeChat @Odaily 2018, Grupo de intercambio de Telegram , Cuenta oficial de X ) para comunicarse y quejarse.

Recomendador: Nan Zhi (X: @Asesino_Malvo )

Introducción :Jugador en cadena, analista de datos, juega todo excepto NFT

compartir :

-

Political memes are starting to iterate. USACTO is the best-performing token today. Political figure tokens are falling, but Trump tokens are clearly in the lead. We recommend users to pay attention to the social software Truth Social launched by Trump, as well as the article The US election is approaching, this may be the most complete collection of election concept MEMEs .

-

On Wednesday, we reminded you to pay attention to Solana Blinks innovative application. Although the creative idea has not yet been implemented, the related Meme token has begun to develop, reaching a market value of 2 million US dollars. Solana officials expect to continue to mention the word Blinks for at least several weeks or even months, so it is worth ambush.

Recomendado por: Wenser (X: @wenser 2010 )

Introducción : A demo account player, a person who has difficulty gaining followers on X platform, a crypto guy who sometimes talks a lot and sometimes doesn鈥檛.

compartir :

-

The wealth-creating effect of moonshot has not been fully explored yet. It is recommended to pay attention to the main promotion of the dexscreener platform (such as the first one mentioned) and meme tokens starting with moon;

-

WEN announced yesterday that it had bought HavetheCat, the largest cat-themed account on the X platform, which has more than 4 million followers. The official account is very cautious about publishing content related to cryptocurrency, and revealed that it hopes to build a brand that gathers cat lovers around the world, etc., so I personally think it has some potential and can be paid attention to in the long term;

-

SOL-JUP-W, this is what I think is the three-piece set of the ecological foundation. Combined with the recent positive news about SOL, ETF is actually irrelevant to the Solana ecosystem. What is important is whether the capital siphoning effect of the ecosystem still exists, so you can buy it at the right time below 180; JUP wants to monopolize the ecosystem, so bet on it; W, forget it, let鈥檚 not talk about it, I have given up on it.

-

After observing the oracle track, it seems that there are new players entering the market. The decentralized cross-chain oracle AnchorZero announced the completion of an $8 million seed round of financing. After LINK, API3 and PYTH can also be paid attention to and bought at low points.

Recommender: Hao Fangzhou (X: @Forget it, my account is blocked again, please pay more attention to our website)

Introducción : A supermarket-shopping investment experiencer, who has hundreds of long-term holdings and is good at taking profits

compartir :

-

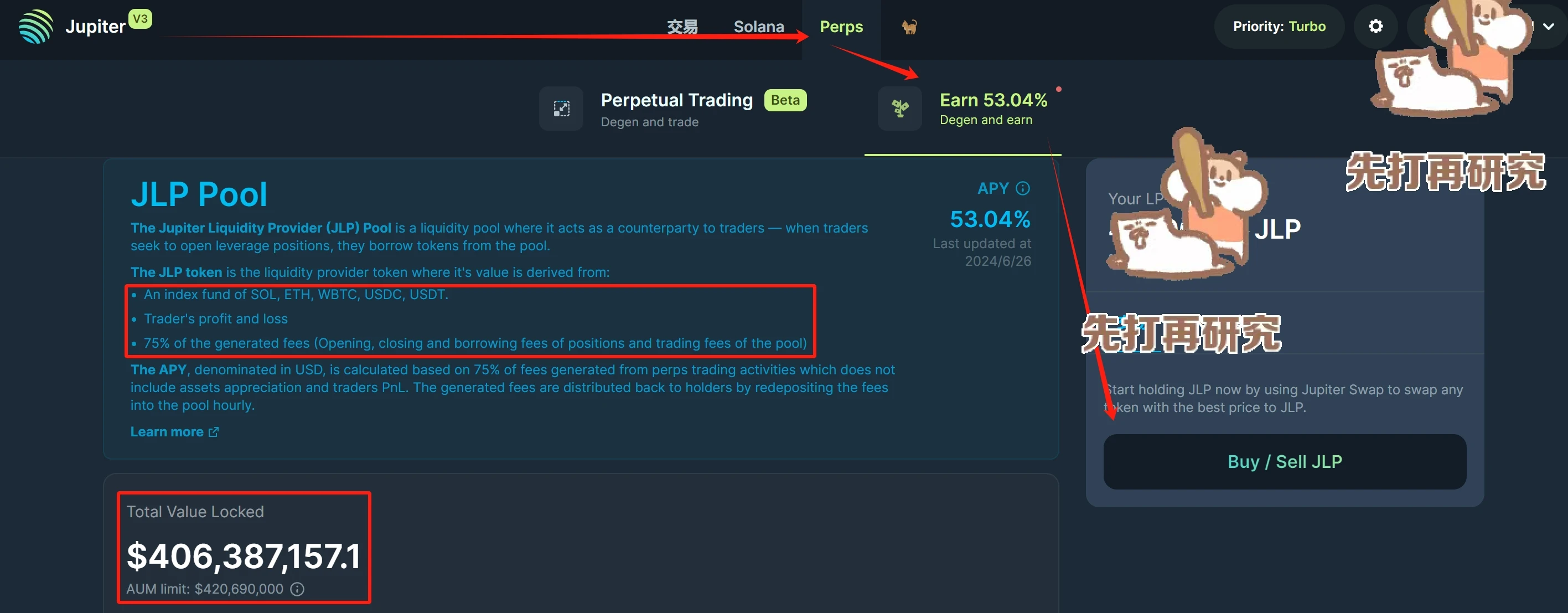

Continue to buy SOL/ETH. SOLs previous trend is not too far away, you can recall it; fundamentally, ambush ZK Compression and Blinks. Considering the feeling of ETH (it is great to be able to pass the ETF), I followed Mr. Azuma (X: @azuma_eth ) and allocated some JLP. Pay attention to the red box information below, buy as soon as possible.

-

Daily implementation of the copycat recycling plan: when I have time, I will empty my wallet to see which zero-value coins I have forgotten, and gather them back to the mainstream (first big cake, and then platform coins in the future when the time comes, just like stocks); daily financial management: Blast, Scroll (Pencils is good), Sui and the stablecoins on the exchange move higher, this week follow the article of a colleague – The era of boutique account interaction is coming, what is the optimal solution to the Scroll problem? .

-

After watching the Tokyo Governor Election, I did some research on the political and economic situation in Japan and the capital flows between Japan and the United States. The future is in tatters. Short the Japanese yen in the foreign exchange account, and buy some spot Japanese yen to hedge (xiao) – if it dares to rebound, just treat it as a bargain hunting and go for a trip to spend it. Attached CNY/JPY daily line:

-

Uninstall the Blast app.

Registros anteriores

Lectura recomendada

When BTC and ETH diverge, 12 industry insiders make the following judgments on the future market:

Cuando el mercado esté lento, consulte esta guía para aumentar el valor de las monedas estables

This article is sourced from the internet: Full record of Odaily editorial department investment operations (June 28)

Relacionado: Una descripción general del desarrollo de las apuestas de liquidez en Solana

Autor original: Tom Wan, analista de datos en cadena Traducción original: 1912212.eth, Foresight News El compromiso de liquidez en el ecosistema Ethereum ha desencadenado una ola de compromisos, e incluso ahora el acuerdo de nuevo compromiso está en pleno apogeo. Pero un fenómeno interesante es que esta tendencia no parece extenderse a otras cadenas. La razón de esto es que, además del enorme valor de mercado de Ethereum que sigue ocupando una ventaja significativa, ¿qué otros factores profundamente arraigados están en juego? Cuando trasladamos nuestra implementación a Solana y el acuerdo de promesa de liquidez en Ethereum, ¿cuál es la tendencia de desarrollo actual de LST en Solana? Este artículo le revelará el panorama completo. 1. Aunque la tasa de compromiso es superior a 60%, sólo 6% ($3.4 mil millones) de los SOL prometidos provienen de promesas de liquidez...