Columna de volatilidad de SignalPlus (20240626): el pánico se calma

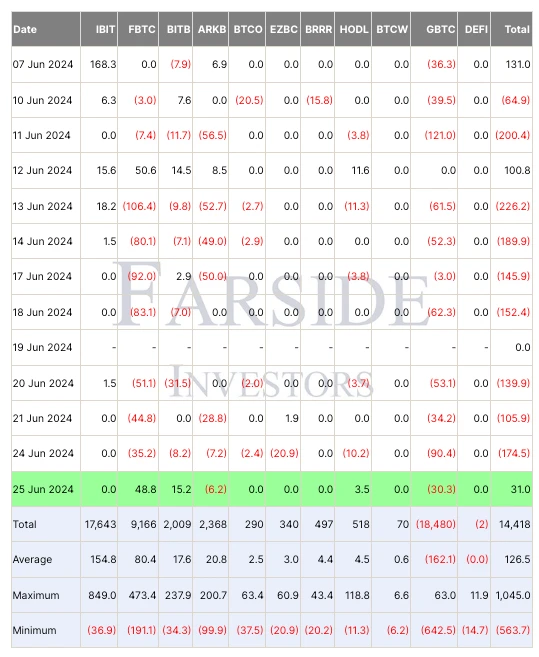

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

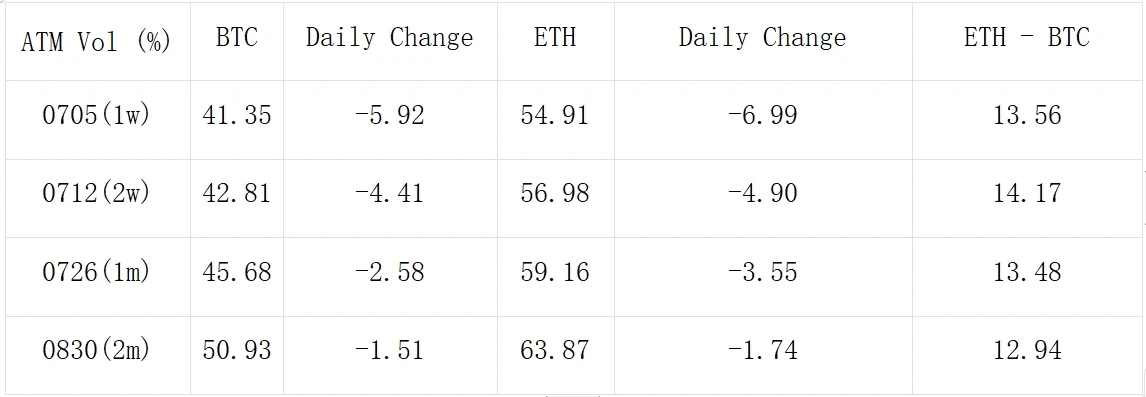

Source: Farside Investors; SignalPlus, ATM Vol.

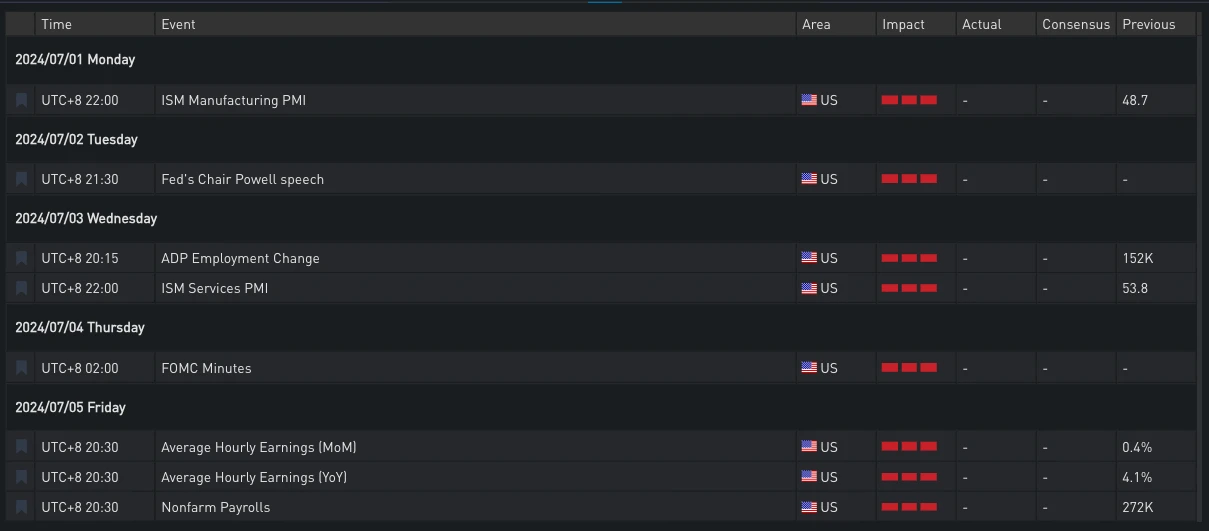

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

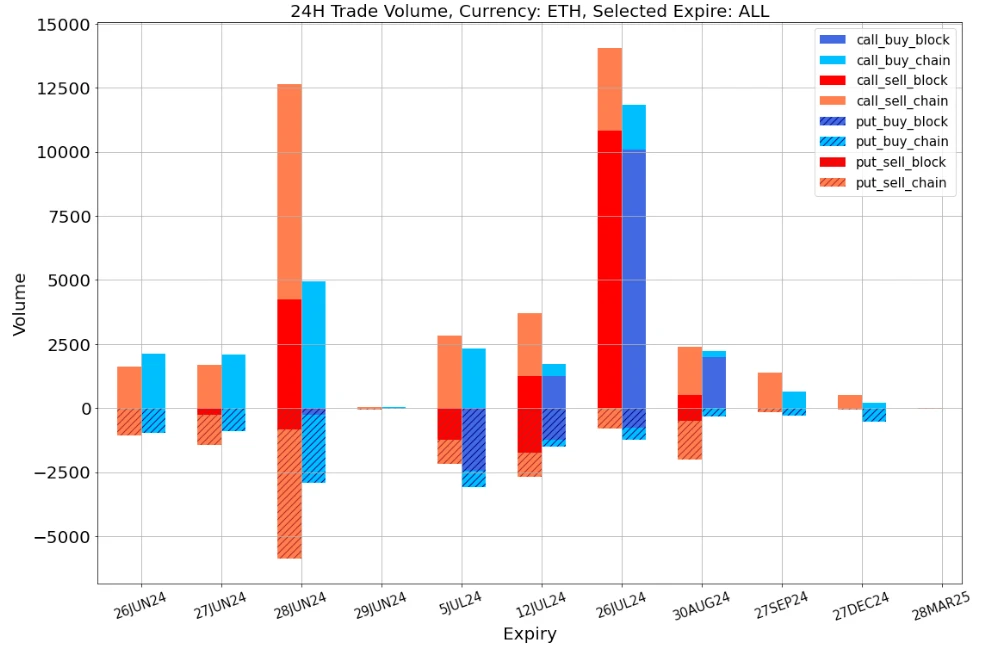

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

Fuente de datos: Deribit, distribución general de transacciones BTC

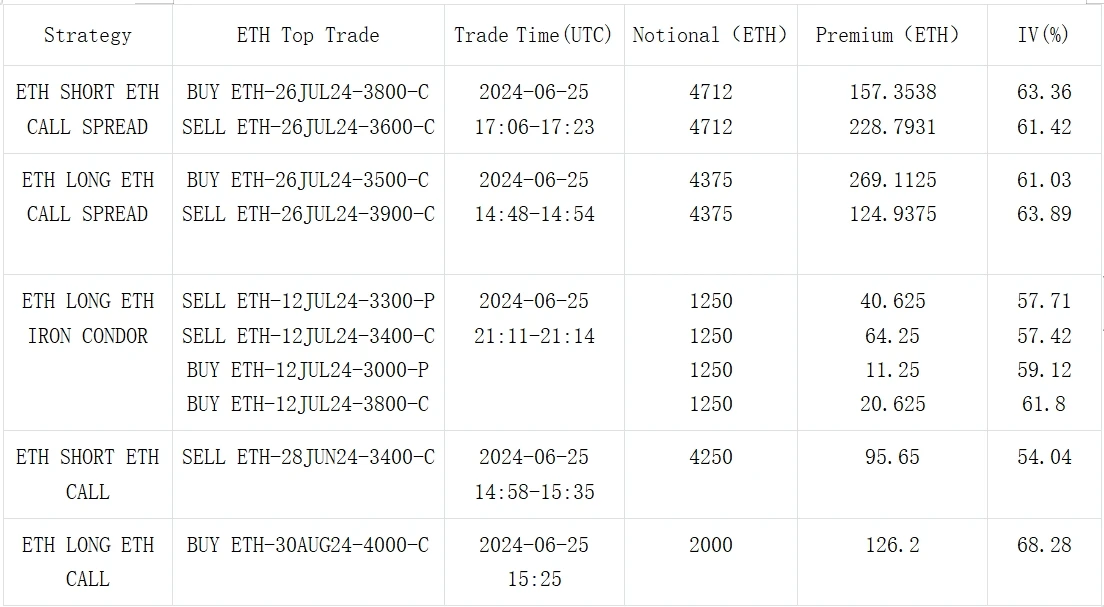

Fuente de datos: Deribit, distribución general de transacciones ETH

Fuente: Deribit Block Trade

Fuente: Deribit Block Trade

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

Relacionado: Un vistazo rápido a 10 tokens prometedores en poder de a16z, BlackRock y Coinbase

Autor original: Atlas, Crypto KOL Traducción original: Felix, PANews Los inversores de riesgo invierten millones de dólares en varias altcoins todos los días, lo que hace subir los precios de estas altcoins. Rastrear las billeteras de las principales instituciones de capital de riesgo y las ballenas y seguir sus tenencias puede generar ganancias excesivas. Crypto KOL Atlas escaneó más de 100 carteras de fondos y ballenas rentables, analizó sus carteras y revisó todos los proyectos, y seleccionó los fondos con mejor rendimiento en Web3, incluidos a16z, BlackRock y Coinbase. Aquí están los 10 tokens más prometedores que posee. Nota de PANews: Este artículo está destinado a proporcionar información de mercado y no constituye un asesoramiento de inversión, DYOR. Compound Labs (COMP) Un protocolo DeFi para préstamos que permite a los usuarios ganar intereses sobre las criptomonedas depositadas en uno de sus grupos. Valor de mercado: $386…