CVX se convierte en la principal opción de compra de las grandes ballenas en el punto más bajo. ¿Podrá el volante de inercia Curve despegar nuevamente?

Last week, DeFi ushered in the biggest turning point of this cycle. CRV continued to fall to a low of $0.219, and the lending positions of founder Michael Egorov were gradually liquidated. According to Arkham statistics, in less than half a day, all of Michaels loan positions in 5 protocols were liquidated, with a value of $140 million.

Lectura relacionada: El fundador fue finalmente liquidado, ¿el volante Curves está completamente en quiebra?

Although the price of CRV has rebounded, the most eye-catching one is CVX. On June 17, according to Binance market data, CVX briefly rose to $4.66 before falling back, up more than 90% in 24 hours.

Is CVX the first choice for whales to buy at the bottom?

Michael Egorov dicho in an interview with CoinDesk that the liquidation was caused by a vulnerability in UwU Lend. However, unlike in the past, when CRV fell, Michael did not cover his position in time, but allowed the chain liquidation to occur. Because Michaels position was too large, the market could not handle it, resulting in 10 million bad debts.

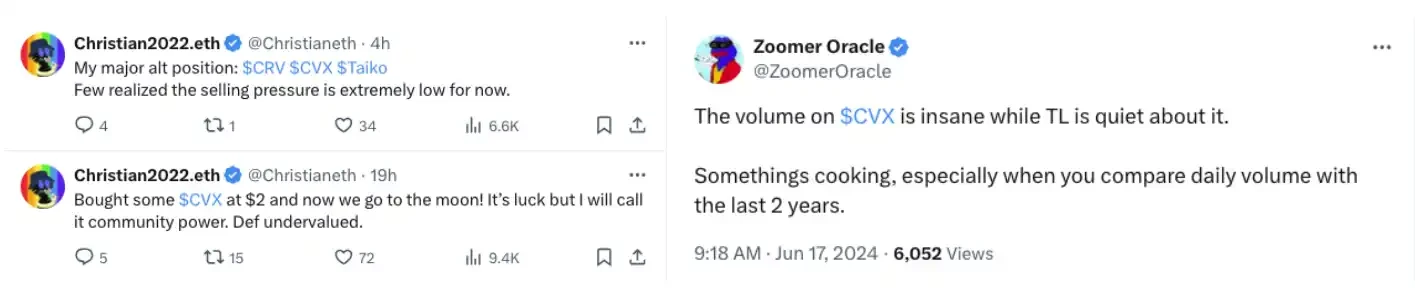

In order to eliminate the adverse impact of accumulated bad debts on the market as soon as possible, on the evening of June 13, Christian, co-founder of the crypto fund NDV and NFT giant, posted on social media that he had received 30 million CRV from Michael.

In addition to helping Michael repay the loan, Christian also dicho that Curve was under pressure because Michael obtained liquidity in advance that ordinary project parties could not get. Now that the liquidation is completed, it means that Michael has finally used up the liquidity in his hands. Christian believes that there will be no secondary market selling pressure at least before 2028.

This also means that now is a good time to buy CRV at a low point, and the market performance is indeed the case. According to data from the Binance platform, when CRV hit the bottom of $0.219, the trading volume of the CRV/USDT spot trading pair reached 463 million (trading volume of $111.5 million) in just one hour, setting a record high for the trading pair. At the same time, CRV also topped the Smart Money 24-hour inflow list for two consecutive days.

As the largest stablecoin exchange protocol on Ethereum, most DeFi relies on Curve, and the Curve protocol remains valid and immutable. So, we have reason to speculate that Michael鈥檚 liquidation may mark the beginning of DeFi鈥檚 return.

On June 17, Curve Finance officially announced that the funds flowing into veCRV last week were 6 times the inflation of that week. These inflows include direct lock-ups, as well as lock-ups through Convex Finance, Stake DAO, and Yearn. This is the highest weekly inflow of CRV lock-ups in recent years.

As one of the three major protocols that started the Curve War, Convex Finances TVL reached US$1.316 billion at the time of writing, accounting for more than half of Curve ($2.285 billion). This also means that Convexs chips are more concentrated, and the big whales naturally set their sights on Convex Finance.

In addition to Christian mentioned above, Kennel Capital member Zoomer Oracle also clearly stated that he bought CVX at 2.05. Zoomer Oracle believes that CRV/CVX is undervalued, and Convex is the beta of Curve, with a simple 5x potential.

In addition to CVX, what other targets are there in the Curve ecosystem?

Michael鈥檚 loan is gone, the market no longer has PTSD, bad debts have been cleared, and DeFi may have seen good things.

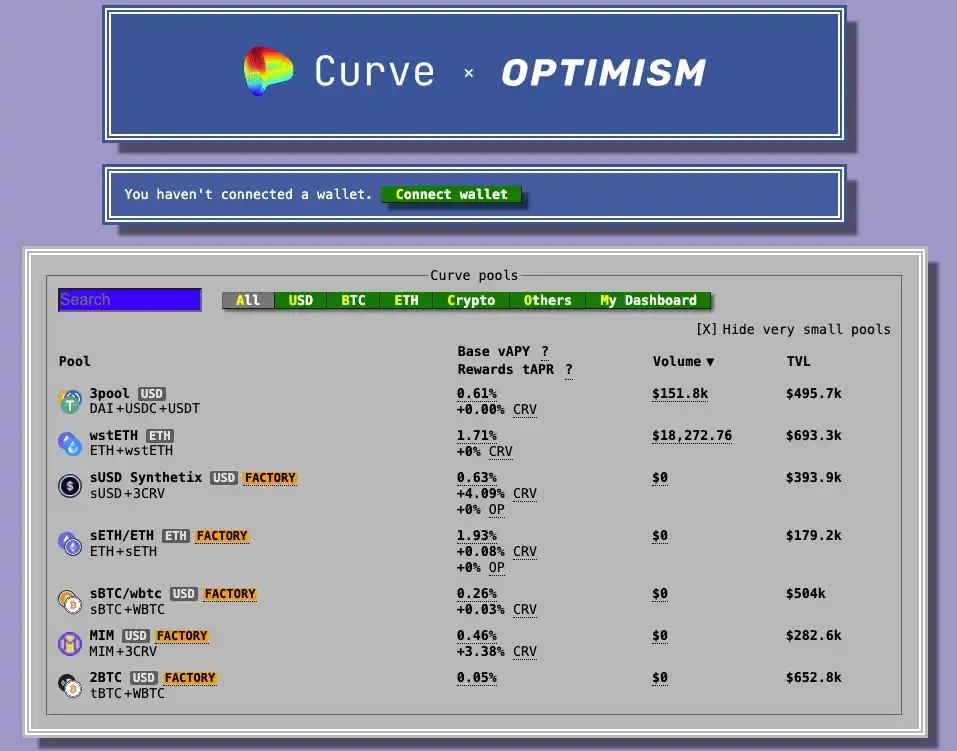

In addition to the various DeFi protocols in Curve War, such as Stake DAO, Yearn Finance, Olympus, and Frax, the gameplay of each protocol can be seen in Curve War Upgrades CVX War, the exciting power struggle continues . Another application scenario of the Curve protocol is to support stablecoin projects through the Curve 3 pool (DAI/USDC/USDT fund pool).

According to Curve data, the current transaction volume and TVL data of the three pools are less than one million, which means that some more mainstream stablecoins are less likely to adopt Curve transactions, but the liquidity of the Curve protocol itself can still support small stablecoin projects.

At present, the modular market is gradually emerging, and modularization will lead to an increase in chains. In order for each chain to continue to develop application scenarios, stablecoins may become a necessity. Then, Curve 3 pool can provide certain liquidity for these stablecoins, especially algorithmic stablecoins. Of course, since Curve 3 pool uses CRV as a distribution reward, this requires CRV itself to have sufficient value.

After the liquidation, Michael said that this incident may help strengthen Curves security measures and loan mechanisms, and may create better services for users in the coming months. Whether this can really make Curve flywheel take off again, it will take time to judge.

This article is sourced from the internet: CVX becomes the top choice for big whales to buy at the bottom. Can the Curve flywheel take off again?

Related: Understanding the AO Token Economics of the Decentralized Supercomputer

Original translation: PANews Editorial Department On June 14, the AO Foundation officially launched the token economics of the decentralized supercomputer AO. 8 Key Facts and Dates about AO Token AO is a 100% fair issuance token that follows the Bitcoin economic model. AO tokens will be used to secure messaging within its network. The minting mechanism runs retroactively starting at 13:00 EST on February 27, 2024 (block 1372724). 100% of the AO tokens minted during this period have been awarded to Arweave token holders based on their respective balances held every 5 minutes. If you hold AR on an exchange or custodian, you should ask the exchange how to receive the tokens. In the future, one-third (33.3%) of AO tokens will be minted every 5 minutes to AR token holders…