Columna de volatilidad de SignalPlus (14/06/2024): Los ETF vuelven a experimentar grandes salidas

En la reunión del FOMC de esta semana, la declaración oficial de la Fed y el gráfico de puntos tuvieron un impacto agresivo en el mercado. Los pronósticos mostraron que solo habría un recorte de tasas en 2024, y se predijo que la inflación PCE básica alcanzaría 2,8% para fin de año (más alta que la previsión anterior de 2,6%). Sin embargo, Powell luego llevó la discusión a una postura moderada en la entrevista, señalando que la mayoría de los funcionarios no tomaron en cuenta los datos del IPC inferiores a lo esperado que se acababan de publicar antes de la reunión. Los operadores también estaban más inclinados a centrarse en los aspectos positivos aportados por los datos del IPC en lugar de la declaración del FOMC. El bono del Tesoro a 10 años cayó a la marca de 4,20% durante varios días, y el mercado de valores de EE. UU. alcanzó un nuevo máximo.

Fuente: Invertir

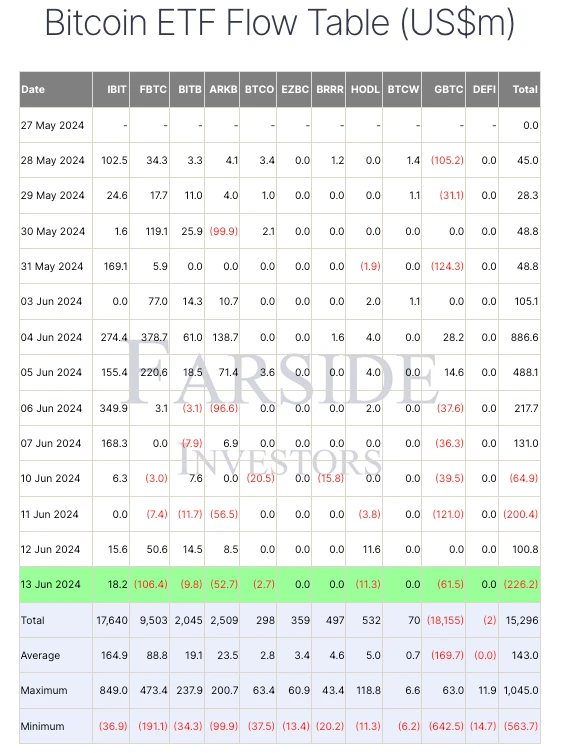

En términos de monedas digitales, BTC se desvinculó brevemente del entorno macroeconómico y de la deuda estadounidense. Los ETF volvieron a registrar importantes salidas de capital: FBTC y GBTC perdieron 10.640.000 TPH y 10.610.500 TPH respectivamente, y ARKB, bajo Ark, también perdió 10.530.000 TPH. En lo que va de esta semana, las salidas netas han alcanzado los 10.564.000 TPH.

Además, el conocido comerciante Peter Brandt también expresó sus puntos de vista sobre la tendencia reciente. Cree que si no hay un repunte en el corto plazo, la presión a la baja sobre el precio de la moneda continuará. Además, a partir de un análisis técnico, si el precio de BTC cae por debajo del nivel de soporte de $65,000, es probable que continúe cayendo hasta la marca de $60,000, y el siguiente paso hacia abajo es el mínimo de $48,000. Es cierto que BTC no ha logrado desafiar un nuevo máximo durante tres meses consecutivos, y el sentimiento bajista en el mercado no ha disminuido en el corto plazo, pero Brandt aún señaló el potencial de una tendencia alcista en el futuro, enfatizando la tendencia del precio de Hump con Slump y luego Pump y Dump que a menudo ocurre antes de un mercado alcista.

Fuente: Inversores de Farside

Fuente: TradingView

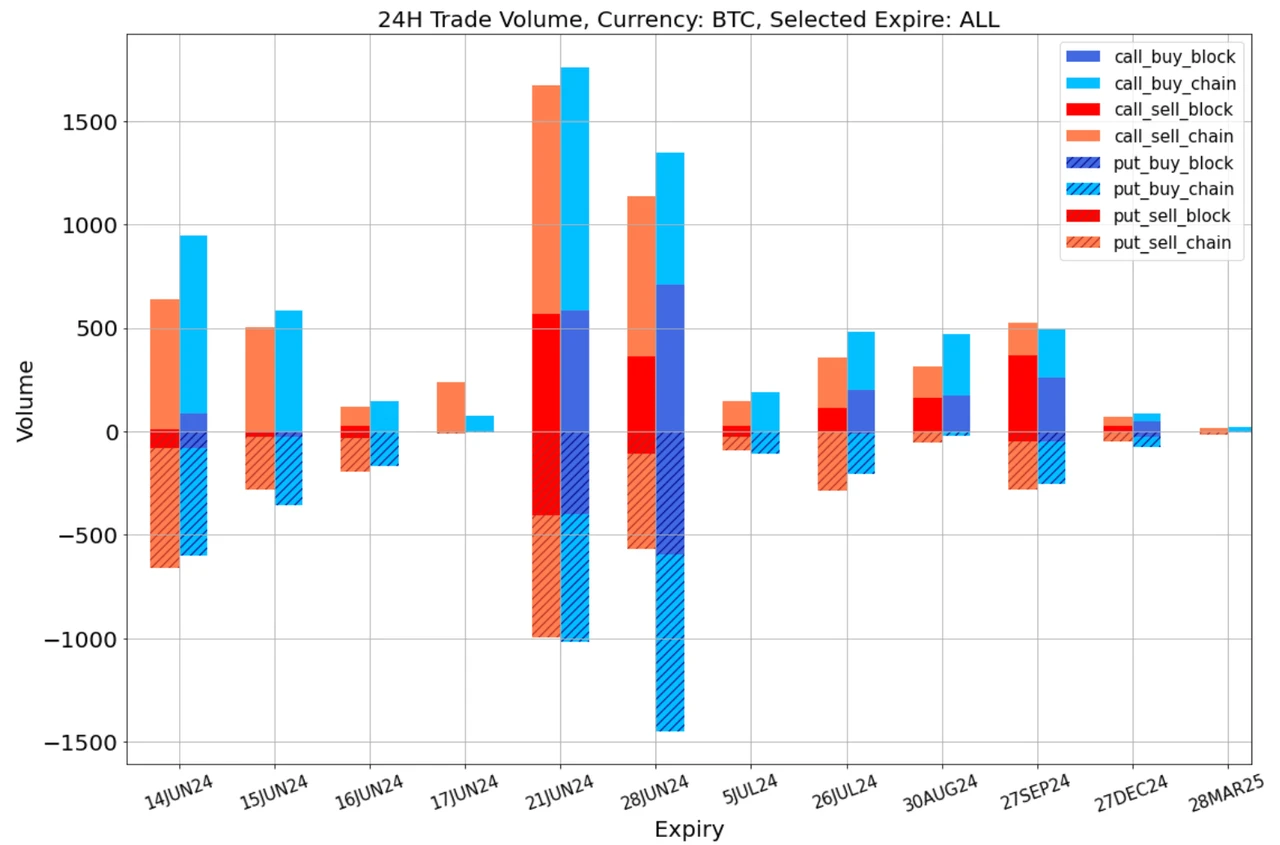

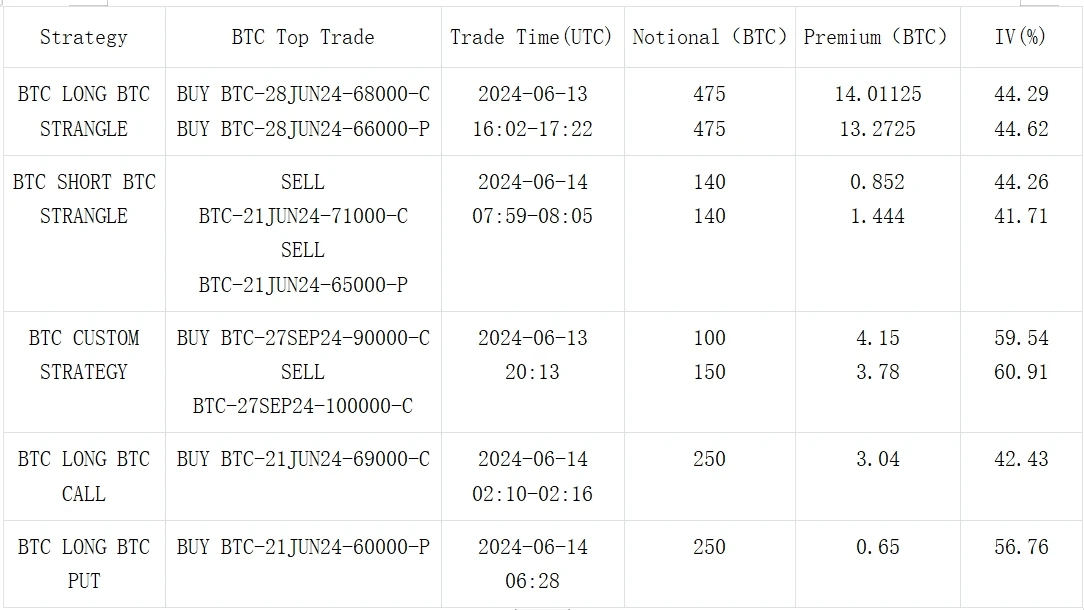

En términos de opciones, la volatilidad implícita aumentó abruptamente hasta el máximo intradiario al mediodía, y las estrategias de volatilidad alcista representadas por 28 JUN 24 66000-68000 Long Strangle aparecieron en BTC, y una cantidad considerable de posiciones Call/Put Outright se compraron el 21 JUN 24. Sin embargo, la situación cambió repentinamente una hora antes de la liquidación, y IV rápidamente renunció a todas las ganancias del día, acompañada por la estrategia Short Vol de BTC el 21 JUN 24 y el Flow de una gran cantidad de opciones de compra en ETH durante este período, y el precio general finalmente cerró a la baja en aproximadamente 1%.

Fuente: Deribit (a fecha del 14 de junio de 2016:00 UTC+8)

Fuente: SignalPlus

Fuente de datos: Deribit, distribución general de transacciones ETH

Fuente de datos: Deribit, distribución general de transacciones BTC

Fuente: Deribit Block Trade

Fuente: Deribit Block Trade

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

Este artículo proviene de Internet: Columna de volatilidad de SignalPlus (20240614): Los ETF vuelven a experimentar grandes salidas

Relacionado: Galaxy Partners: MEV jugará un papel importante en el mercado espacial en bloque

Artículo original de Will Nuelle, socio general de Galaxy Ventures Traducción original: Luffy, Foresight News presenta Anteriormente señalamos en el artículo Blockspace Business Model que las ventas de blockspace son uno de los cuatro segmentos del mercado de criptomonedas que pueden producir un ajuste sólido y repetible entre el producto y el mercado. Con el tiempo, esperamos que blockspace se convierta en el segundo segmento de mayor beneficio bruto después de los exchanges, e incluso en el mercado de mayor beneficio bruto a medida que el volumen de operaciones pase de CEX a DEX. Este es un modelo de negocio B2B2C, donde blockchain atrae a los desarrolladores de aplicaciones, y los desarrolladores de aplicaciones atraen a los consumidores (tanto individuos como empresas) para que utilicen blockspace a través de sus aplicaciones. También creemos que blockspace es un negocio basado en efectos de red, en marcado contraste con su modelo de negocio similar, la computación en la nube centralizada, que tiene economías de escala pero no…