Bitget Research Institute: La Reserva Federal ha reducido sus expectativas sobre el número de recortes de tasas de interés este año

En las últimas 24 horas, han aparecido en el mercado muchas nuevas monedas y temas populares, que pueden ser la próxima oportunidad para ganar dinero. incluido:

-

Sectors with strong wealth-creating effects are: New public chain sector and AI sector;

-

The most popular tokens and topics searched by users are: IO.NET, Hifi Finance, Daddy, Aethir;

-

Potential airdrop opportunities include: Symbiotic, Mezo;

Data statistics time: June 13, 2024 4: 00 (UTC + 0)

1. Entorno de mercado

Yesterday, the US released the latest CPI data of 3.3%, lower than the expected 3.4%, and the market rebounded. Then at 2 am Beijing time, the Fed FOMC meeting released the latest dot plot, which showed that most Fed officials lowered their expectations for interest rate cuts to one, or 25 basis points, this year. Then the market erased all the gains after the CPI was released.

As for Bitcoin ETF, yesterdays data showed that ETF had a cumulative net purchase of 100 million US dollars, reversing two consecutive days of net outflow. From the trading level, we can see that although the Federal Reserve has lowered the expected number of interest rate cuts this year, the market generally believes that there may be two interest rate cuts this year. After the release of this data, the market may enter a period of calm, and investors can wait for the market to release further clear signals before making trading decisions.

2. Sector generador de riqueza

1) Sector changes: New public chain sector (TON)

Main reason: Recently, the number of active users on the TON public chain has surpassed Ethereum. Due to the seamless connection between Telegrams huge user base and the TON ecosystem, the TON public chain has recently seen a frequent wealth-creating effect, and the demand for TON tokens has continued to rise.

Rising situation: TON rose 8.5% in the past 24 hours;

Factores que afectan las perspectivas del mercado:

-

Data from all aspects are impressive: TON network activity has gradually increased since February. As of now, the number of daily active addresses of TON has exceeded that of Ethereum, and the TVL of the TON ecosystem has exceeded US$460 million, setting a record high.

-

Ecological construction continues to gain momentum: Recently, TON ecological projects have received widespread attention from users on the chain. With the wealth-creating effect of NOT, users are paying more attention to game projects on the TON chain, such as Hamster Kombat, Catizen, etc.

2) Sector changes: AI sector (IO, ATH)

The main reason: IO, ATH, etc., as recently launched AI track infrastructure projects, have received widespread attention from the market. Such projects as platforms can generate relatively stable cash flow. At the same time, the AI track, as the core narrative of the global technology community, will also continue to raise the valuation of AI projects in the crypto industry.

Rising situation: IO rose 45.8% in the past 24 hours, and ATH rose 50.6% in the past 24 hours;

Factores que afectan las perspectivas del mercado:

-

AI narrative: Projects such as IO and ATH are AI computing power supply platforms and belong to infrastructure projects. If such projects can form cooperation with the mainstream technology industry, such as reaching cooperation projects with companies such as Apple, Microsoft, and Nvidia, then the valuation of project tokens will naturally rise;

-

Core data of ecological development: The cash flow of platform projects is relatively clear. If the platform demand can continue to develop healthily and generate stable cash flow, the valuation of platform tokens will enter a healthy development.

3. Búsquedas activas de usuarios

1) Aplicaciones populares

IO.NET

The project is a decentralized computing network that supports the development, execution, and expansion of ML applications on the Solana blockchain, combining 1 million GPUs to form the worlds largest GPU cluster and DePIN.io.net to aggregate underutilized resources. The project was launched on the secondary market in a relatively sluggish market and is relatively undervalued. The current price has entered the upward space, with a 24-hour increase of more than 50%, and the trading volume is in the top 10 in the market. The token has been listed on Bitget, and you can continue to pay attention.

2) Gorjeo

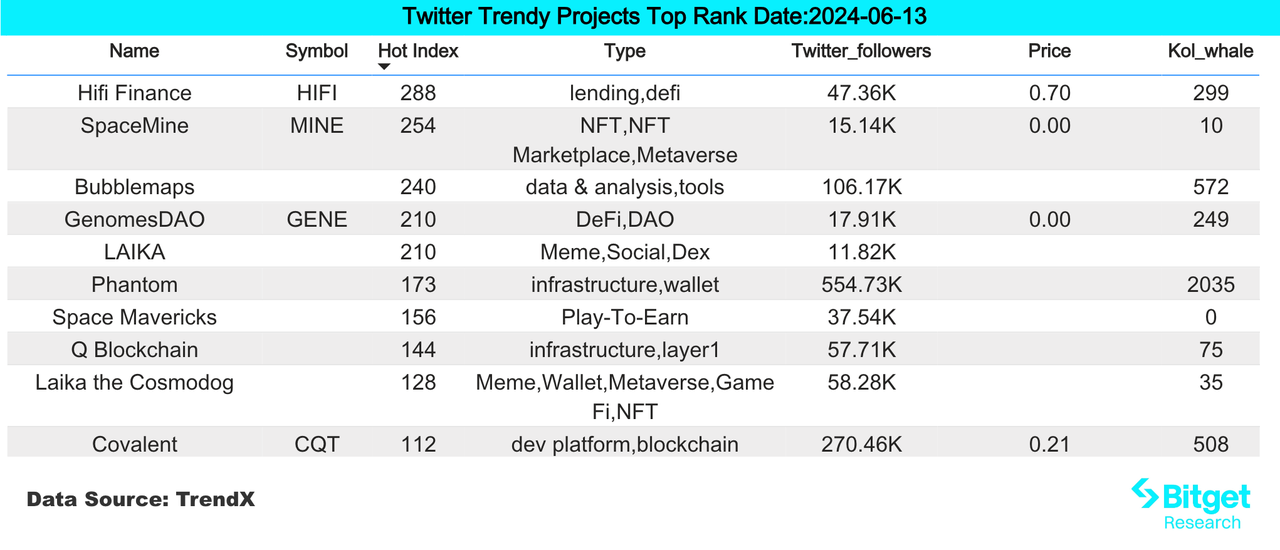

Hifi Finance (HIFI): RWA track project, recently produced more promotional and educational videos to help the community better understand RWA and Hifi Finance, the project maintains a good level of operation. The recent trend of the project token is general, following the market trend in the process of downward adjustment. The secondary market has a history of violent ups and downs, and it is the target of major funds.

3) Región de búsqueda de Google

Desde una perspectiva global:

Daddy: The core hype comes from the struggle between Andrew Tate and Ansem, both of whom issued Daddy tokens in the community. Andrew Tate is a famous American Internet celebrity and a former professional boxer; Ansem is an early evangelist of WIF, has a very high influence in the Crypto industry, and is also an amateur boxer. At present, Tates meme coin has completely defeated Ansems, and the market attention is relatively high.

Aethir: The project is engaged in decentralized, real-time content rendering technology; the project has a decentralized cloud service infrastructure that serves games and AI products, and the project is in the second place in this track. The project token and the token of the track leader io.net were launched at the same time, and the trend of both tokens is very good, and the market trading heat and attention are gradually increasing.

De las búsquedas más candentes en cada región:

(1) In the hot searches in Asia, “Crypto Crash” and “Why Crypto is Down” were the most prominent. The crypto market released FOMC and CPI data at the same time yesterday. The risk aversion sentiment was quite serious in advance, and the market was under pressure before the data came out.

(2) In Europe and the United States, people pay attention to projects with fundamentals, mainly focusing on AI, DeFi, and ZK. Hot search projects include io.net, ZK, AEVO, UNI, etc. In addition, the region is more concerned about the macro situation, and CPI and FOMC appear on the lists of several European countries.

(3) The CIS region focuses on a wide range of areas, including projects such as IO, Blast Crypto, ADA, and Crypto Whales.

Potencial Airdrop Oportunidades

Symbiotic

Symbiotic is a general purpose restaking project that enables decentralized networks to bootstrap powerful, fully sovereign ecosystems. It provides a method for decentralized applications, called Active Validation Services or AVS, to collectively ensure the security of each other.

Symbiotic recently completed its seed round of financing, with Paradigm and Cyber Fund participating in the investment, with a financing amount of US$5.8 million.

How to participate: Go to the project’s official website, link your wallet, and deposit ETH and ETH LSD assets.

mezo

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stage of operation.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

Enlace original: https://www.bitget.com/zh-CN/research/articles/12560603811201

【Descargo de responsabilidad】El mercado es riesgoso, así que tenga cuidado al invertir. Este artículo no constituye un consejo de inversión y los usuarios deben considerar si las opiniones, puntos de vista o conclusiones de este artículo son adecuados para sus circunstancias específicas. La inversión basada en esta información es bajo su propio riesgo.

This article is sourced from the internet: Bitget Research Institute: The Federal Reserve has reduced its expectations for the number of interest rate cuts this year, and the IO price has hit a new high against the trend

Original author: @Web3 Mario Introduction: EigenLayer AVS has been online for a while. In addition to its official long-guided EigenDA and Layer 2 and other related use cases, the author found a very interesting phenomenon, that is, EigenLayer AVS seems to be very attractive to projects in the privacy computing track. Among the 9 AVS that have been online, three belong to this track, including two ZK coprocessor projects Brevis and Lagrange, and a trusted execution environment project Automata. Therefore, I decided to conduct a detailed investigation to explore the significance of EigenLayer AVS to related products and future development trends. The appeal of “cheap security” is the key to the success or failure of the EigenLayer AVS ecosystem With TVL having officially exceeded 15 billion US dollars, EigenLayer has…