Coinbase o Robinhood, ¿cómo deberían elegir los novatos en criptomonedas?

Original title: Is Coinbase or Robinhood Stock the Better Bet?

Original author: Jack Inabinet, Bankless

Traducción original: Lucy, BlockBeats

Editors Note: This article discusses two companies that have a significant influence in the cryptocurrency field – Coinbase and Robinhood. Coinbase has won the favor of a large number of US retail and institutional investors with its crypto-native background and deep roots in the industry over the years.

In contrast, although Robinhood is not as popular as Coinbase in terms of cryptocurrency trading volume, it is still extremely popular among retail traders in the United States and has strong compliance capabilities. Robinhood has actively entered the crypto market, developed a non-custodial wallet, and plans to acquire Bitstamp, a long-established European crypto exchange, to further expand its influence in the crypto field.

This article deeply analyzes the unique advantages and potential risks of the two companies in the cryptocurrency market, providing valuable reference information for investors. BlockBeasts compiled the original text as follows:

Coinbase stock has long been the obvious choice for investors to gain exposure to cryptocurrencies through a public company, but now there’s another company challenging that status.

Last Thursday, Robinhood announced that it would spend $200 million to acquire Bitstamp, the oldest cryptocurrency exchange still in operation and which holds valid licenses to operate in more than 50 countries.

So, should you increase your holdings in COIN stock or HOOD stock?

Today, we’ll explore the differences between Coinbase and Robinhood to see why investors are confident in both stocks.

Reasons to support COIN

Coinbase is often considered the most reputable cryptocurrency exchange, a distinction that has enabled it to build deep connections among retail and institutional cryptocurrency enthusiasts in the United States in its 12 years of existence.

Centralized cryptocurrency exchanges typically provide limited insight into their financials; however, as a company listed on the U.S. stock market, Coinbase is required to undergo rigorous audits and file reports with the SEC, reducing the possibility that customer funds could be misappropriated.

While the primary function of most exchanges is trading, Coinbase is more than just a simple mercado; it was one of the first CEXs to establish an on-chain presence and played a major role in infrastructure development, launching its own wallet and Ethereum L2 Base!

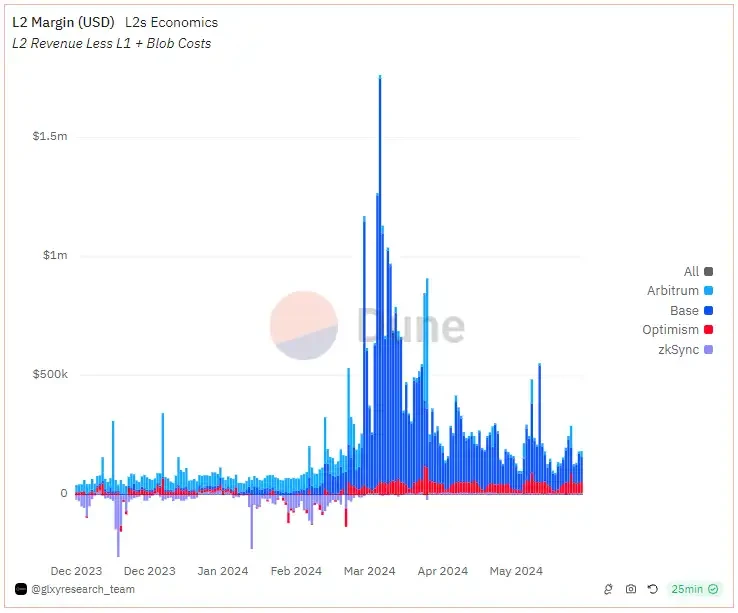

Since Ethereum implemented EIP-4844 in the Dencun upgrade in March, the cost of publishing data on L2 has been reduced by several orders of magnitude, and Bases on-chain operating profit margin has reached almost 100%, which means that almost all transaction fees paid on Base go directly into Coinbases revenue.

While Base’s revenue has dropped significantly since its peak in late March, the network remains the second-largest L2 by TVL and generates more profit than any other major L2, regularly netting over $100,000 per day, according to L2 BEAT.

Source: Dune

In addition to its on-chain infrastructure, Coinbase also provides a full suite of custody tools for its users, offering advanced staking services and an ETH liquid staking token, as well as institutional-grade custody solutions.

Coinbase Custody is widely considered the premier digital asset custody provider and serves eight of the 11 spot BTC ETFs in the U.S., including Grayscale’s GBTC and BlackRock’s IBIT (the two largest products by assets under management). This arrangement enables Coinbase to earn custody fees from the assets they manage, in addition to trading fees from creation and redemption, which will provide a strong revenue driver for the company if spot cryptocurrency ETFs continue to gain traction among traditional market participants.

Crypto payments have yet to achieve mainstream adoption, but the Coinbase team has developed the infrastructure through its Commerce platform, enabling merchants to accept hundreds of crypto assets as payment for goods and services directly into their self-custodial crypto wallets.

If the public becomes more willing to hold crypto assets and they recognize the benefits of self-custody technology, this will help Coinbase generate more revenue through the platform.

Coinbase also caters to international users who are not bound by U.S. financial regulation and can trade futures on a variety of crypto assets through the exchange; these services could easily expand to the U.S. platform — which currently only offers BTC and ETH futures — if the crypto industry gains positive regulatory clarity.

Additionally, COIN stock holders will receive a share of the success of the Coinbase Ventures portfolio, which contains many lucrative private market opportunities that are inaccessible to retail and outside investors.

Reasons to support HOOD

While Coinbase holds the edge in terms of cryptocurrency trading volume processed, Robinhood remains the undisputed champion among retail traders in the United States.

Although the total amount of assets under custody on Robinhoods platform is less than Coinbase, even when stock, options, cash, and cryptocurrency balances are added together, Robinhood had 70% more monthly active users than Coinbase in the first quarter of 2024, highlighting the exchanges popularity among retail traders.

Without a doubt, Robinhood’s biggest advantage is its compliance; as a broker, Robinhood is regulated by the SEC, and if the SEC creates a new classification of digital asset securities and trading is limited to registered brokers, then Robinhood will be expected to become the dominant cryptocurrency exchange.

While Coinbase is clearly the more crypto-native company and has attracted a lot of talent with strong connections within the industry, there’s nothing stopping Robinhood from creating its own crypto app other than regulatory uncertainty.

Robinhood has developed its own proprietary non-custodial wallet solution and recently launched an integration that enables users to purchase cryptocurrencies directly on the Uniswap mobile app using funds from their Robinhood Connect accounts.

With its proposed acquisition of Bitstamp (although it may still be rejected by regulators), Robinhood acknowledged the growth potential of its crypto business despite the ongoing legal battle with the SEC and confirmed that it will participate in blockchain technology to the best of its ability.

Bitstamp’s 4 million active users are primarily based in Europe, a very attractive demographic for its U.S.-centric buyers, and the acquisition also includes Bitstamp’s core staking and lending products, allowing Robinhood to better compete with cryptocurrency CEX services and showing that it can catch up to crypto-native competitors by purchasing crypto technology developed by other companies.

Key Points

It’s not hard for crypto investors who are already bullish on COIN to be equally bullish on HOOD, considering the company seems to be aggressively entering the crypto market and has already won over retail investors in the U.S. If the industry boom picks up again, these investors are likely to enter the cryptocurrency space because of the convenient purchase and custody solutions provided by Robinhood.

On the other hand, Coinbase has a proven crypto business performance and has enjoyed significant institutional adoption, as reflected in the preference for its services among spot crypto ETF issuers.

The two listed exchanges each have their own unique advantages and disadvantages. Although Robinhood is currently at a disadvantage in this competition, Coinbases dominance is not unbreakable, especially in the future stricter crypto financial regulatory environment.

This article is sourced from the internet: Coinbase or Robinhood, how should crypto newbies choose?

Related: Understanding the MASS Adoption Vision of ALIENX, the AI Node Application Chain

Preface With the expansion of blockchain technology and application scenarios, some new narratives and paradigms are emerging, and application chains are one of the hottest ones recently. Application chains (Appchain) are blockchains dedicated to specific applications. They refer to blockchains designed specifically for operating a specific application. As each protocol built on the blockchain wants to expand, they will seek to transform into a sovereign chain, giving them full control over their protocols without relying on the original L1. At present, Ethereums roadmap is gradually moving towards application chains and Rollups. Leading application chain ecosystems Celestia and Cosmos, as well as new generations of IMX and Arbitrum Nova, have made innovative expansions for different application scenarios, which has led to increasingly fierce competition in the application chain track. Competition is…