El estado actual de zkSync: el efecto airdrop ha fallado, las ganancias se han reducido significativamente y la conservación ecológica

Autor original: Nancy, PANews

Recently, the news about zkSyncs upcoming coin issuance and the prediction of airdrop rules have caused market discussions. After reviewing zkSyncs data this year, PANews found that although zkSyncs market size is still in a leading position, its user participation willingness is decreasing, and its profit capture ability is also greatly reduced. This is closely related to its airdrop PUA for several years, the poor quality of ecological projects, and the neglect of user rights.

There are few high TVL ecological projects and they are of a single type. On-chain profits rely on Gas income but have shrunk significantly

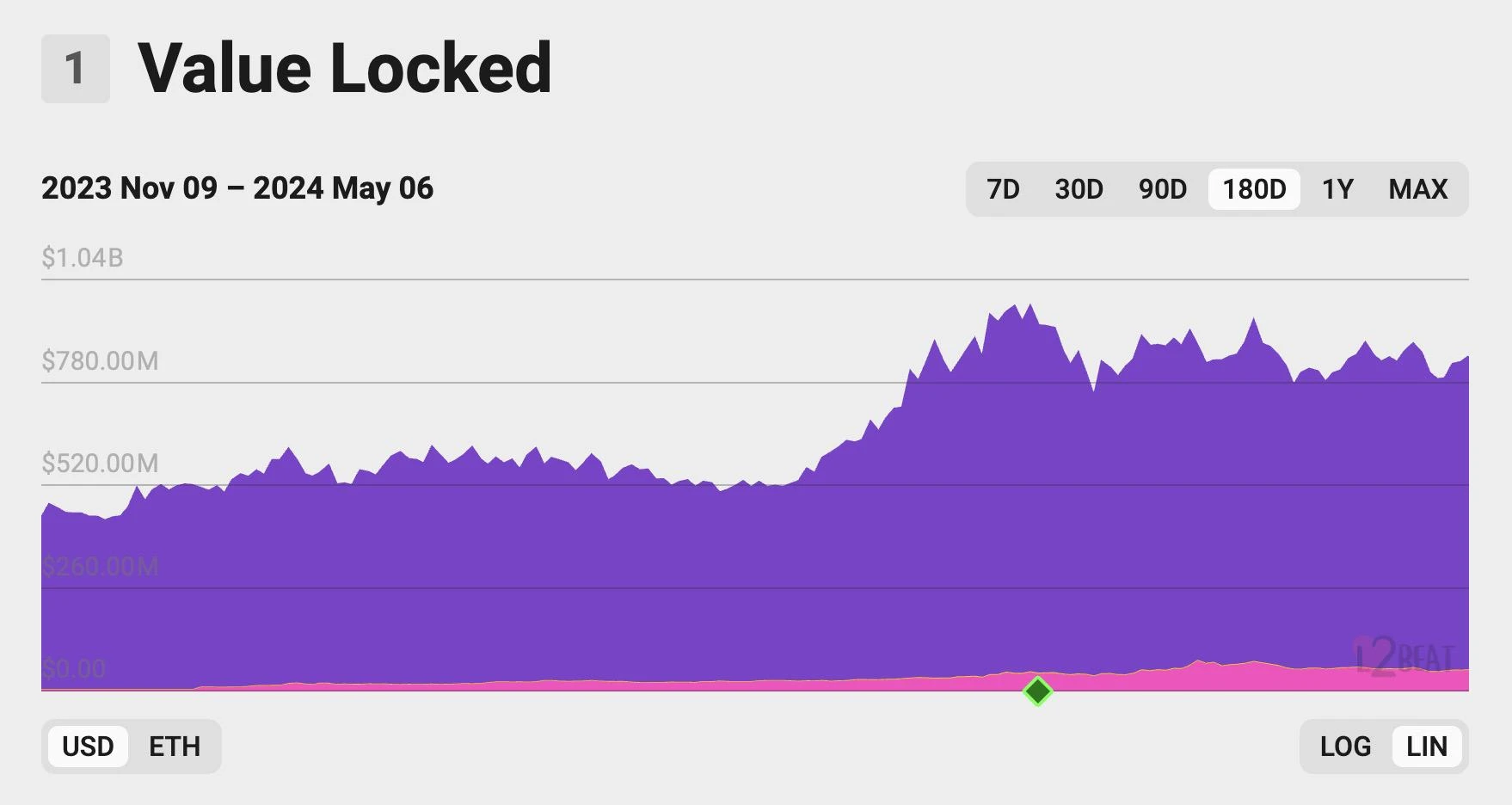

To date, according to L2 BEAT data, as of May 6, the total locked volume of zkSync Era was nearly US$850 million, an increase of about 44.1% from the beginning of the year, ranking eighth among L2 projects.

However, the zkSync ecological projects with high TVL are relatively single and few in number. The zkSync official website shows that as of May 6, although its ecological projects have reached 243, covering DeFi, games, trading markets, NFT, Social, wallets and DEX, etc., the data from DeFiLlama also shows that only 4 zkSync projects have a TVL of over 10 million US dollars, accounting for nearly 66% of the total locked volume. At the same time, among the top 10 TVL projects, most are from DEX and lending tracks. Its ecological dilemma also greatly affects the degree of user participation.

In terms of the number of users and the scale of funds, zkSync Era has achieved good growth this year. Dune data shows that as of May 6, the number of zkSync Era users has reached nearly 3.13 million, an increase of 16.3% from the beginning of this year; the total amount of ETH bridged exceeds 3.22 million, an increase of 38.8% from the beginning of the year. However, the average number of ETH bridged by users is only 1.37, and more than 80% of users have less than 1 ETH bridged, and only 1.3% of the address balance exceeds 10 ETH. From this point of view, although the airdrop expectation of zkSync is still attractive, users are more inclined to low-cost investment.

The participation of a large number of rollup parties has also brought huge benefits to zkSync Era. The latest data from Dune shows that as of May 1, after deducting the cost of publishing data to L1 and the cost of verifying proofs on L1, zkSync Eras profit from Gas in the past four months was about 1,848 ETH, accounting for 10.3% of the total profit of the Rollup chain, but there is still a clear gap with Base, Arbitrum and Scroll, and the monthly profit has shown a trend of a sharp decline.

zkSync Era鈥檚 on-chain profit data source: Dune@niftytable

Among them, since the beginning of this year, zkSync Era has received a total of 7,678 ETH in transaction fees, accounting for only nearly 17.3% of the total. And from the perspective of the monthly transaction fee changes, it shows a continuous downward trend month by month, among which the fees captured in April fell by about 88.9% compared with January; the cost required to send to L1 each month has dropped by nearly 96.2%, and the performance is still better than competitors such as Arbitrum, OP Mainnet, Base, Starknet and Linea; the cost of verification proof on L1 reached 1,541 ETH this year, accounting for 49.7% of the total. In other words, zkSync Eras on-chain profits mainly come from Gas income, but it has shrunk significantly.

L2 monthly transaction fee changes data source: Dune@niftytable

In response to this, zkSync officials told PANews that the decline in transaction fees is related to its technological advancement, and zkSyncs transaction costs have been reduced by 10 to 20 times compared to before.

User rights are ignored in the dense rug environment, and the community accuses the official of inaction

The failure to protect user rights and official inaction are causing zkSync to lose community trust.

Although there are many on-chain accidents and Rug incidents in the crypto dark forest, the zkSync ecological project and the official indifference to user rights are becoming one of the important reasons why its market scale is difficult to expand.

For example, the Zksync lending protocol Eralend previously suffered a total loss of approximately $3.4 million due to a flash loan attack. Not only did it fail to recover the stolen funds, it also did not compensate users accordingly. Zksync only issued a risk warning in the Chinese community after the project was sold to a Chinese team. After the zkSync ecological lending platform xBank Finance suffered a loss of $550,000 due to a hacker attack and its liquidity was close to zero, although it stated that it was contacting the attacker to recover user funds through a white hat bounty, it also did not mention the issue of user compensation. The decentralized entertainment platform ZKasino was questioned for soft Rug after forcibly exchanging more than 10,000 ETH user pledge deposits into platform coins. Afterwards, the official did not respond to the private modification of the rules and the whereabouts of the funds, and transferred the funds in batches. At present, the Dutch Fiscal Investigation Bureau has arrested the suspect suspected of the ZKasino fraud case and seized his 11 million euros in assets. However, ZKasino was also anti-counterfeited by Ethereum co-founder Vitalik Buterin, who said that the project did not use any ZK technology and was only hosted on the zkSync platform.

Faced with severe damage to user interests, zkSync officials have never made any effective improvement measures, which also reflects its poor management of the ecosystem. The excessively low cost of doing evil has become one of the important reasons for its chaos.

In this regard, many community members expressed dissatisfaction that the zkSync team did not take on the responsibility of ecological construction, including supporting some high-quality projects, but allowed various rug projects to run rampant. Although the official has repeatedly emphasized the importance of the community, it has turned a blind eye to the evil deeds of the project and the rights of users. Compared with the community, zkSync cares more about gas income.

From this point of view, at a time when L2 is being launched intensively in the market, as the airdrop effect becomes increasingly ineffective, if zkSync does not pay attention to ecosystem construction and user interests, it will face greater challenges.

This article is sourced from the internet: The current status of zkSync: the airdrop effect has failed, profits have shrunk significantly, and the ecological construction is poor

Fuente original: DLNews Compilado por: Odaily Planet Daily Wenser Nota del editor: Recientemente, la tendencia del ETF spot de Ethereum se ha revertido, lo que ha atraído una gran atención del mercado y los reguladores. Con base en el optimismo de la aprobación estadounidense del ETF spot de Ethereum, el precio de Ethereum ha aumentado drásticamente esta semana y el precio actual es de $3,807. Aunque las razones detrás del brusco cambio de dirección aún son controvertidas, los observadores del mercado y los profesionales de criptomonedas de alto nivel generalmente creen que la aprobación de los reguladores tendrá diferentes grados de impacto en Ethereum y otras criptomonedas. Se informa que la empresa de gestión de activos VanEck es la primera firma de corretaje en presentar una solicitud de ETF spot de Ethereum a la Comisión de Bolsa y Valores de EE. UU. (SEC). El resultado de la solicitud del documento 19b-4…