Autores originales: Matthew Sigel, Patrick Bush, Denis Zinoviev, VanEck

Traducción original: 1912212.eth, Noticias de previsión

Esperamos que los ETF spot de ETH pronto sean aprobados para su negociación en las bolsas de los EE. UU. El avance hacia este hito permitirá a los asesores financieros y a los inversores institucionales mantener este activo bajo la garantía de un custodio calificado y beneficiarse de las ventajas de precios y liquidez exclusivas de los ETF. En respuesta, actualizamos nuestro modelo financiero y reevaluamos el caso de inversión fundamental para ETH. También realizamos una serie de análisis cuantitativos sobre cómo interactúa ETH con BTC en una cartera tradicional 60/40, centrándonos en las compensaciones entre riesgo y rentabilidad.

El contenido principal de este artículo:

-

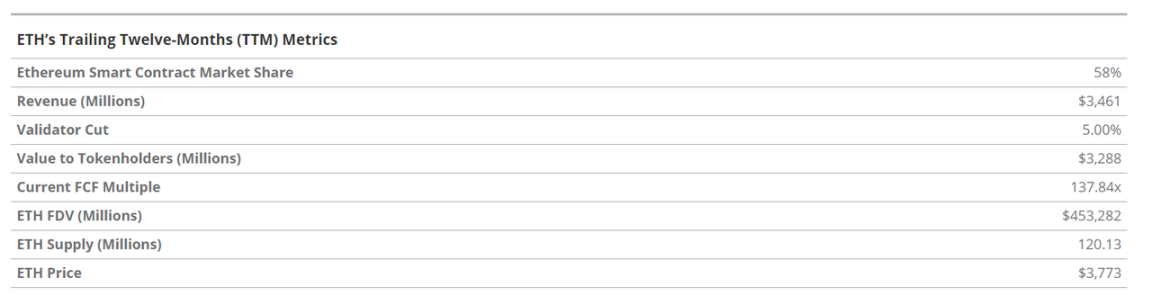

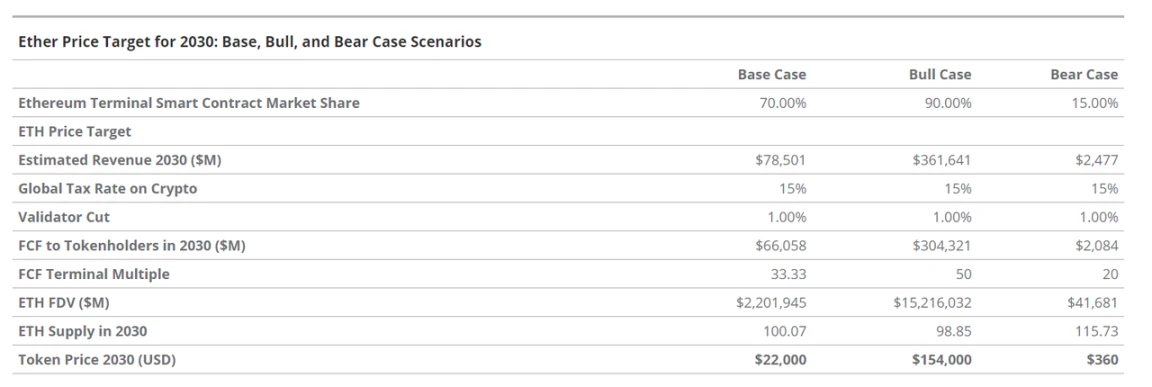

Es probable que la red Ethereum siga aumentando rápidamente su cuota de mercado gracias a los participantes del mercado financiero tradicional y a un número cada vez mayor de grandes empresas tecnológicas. Si Ethereum puede mantener su dominio entre las plataformas de contratos inteligentes y alcanzar las expectativas de crecimiento anteriores, tenemos motivos para creer que para 2030 su flujo de caja libre (CFC, la cantidad neta de ETH disponible para las operaciones de la red después de considerar todos los costos de la red, como las tarifas de gas para transacciones y contratos inteligentes) alcanzará los $66 mil millones, el valor de mercado alcanzará los $2,2 billones y el precio por ETH alcanzará los $22.000.

-

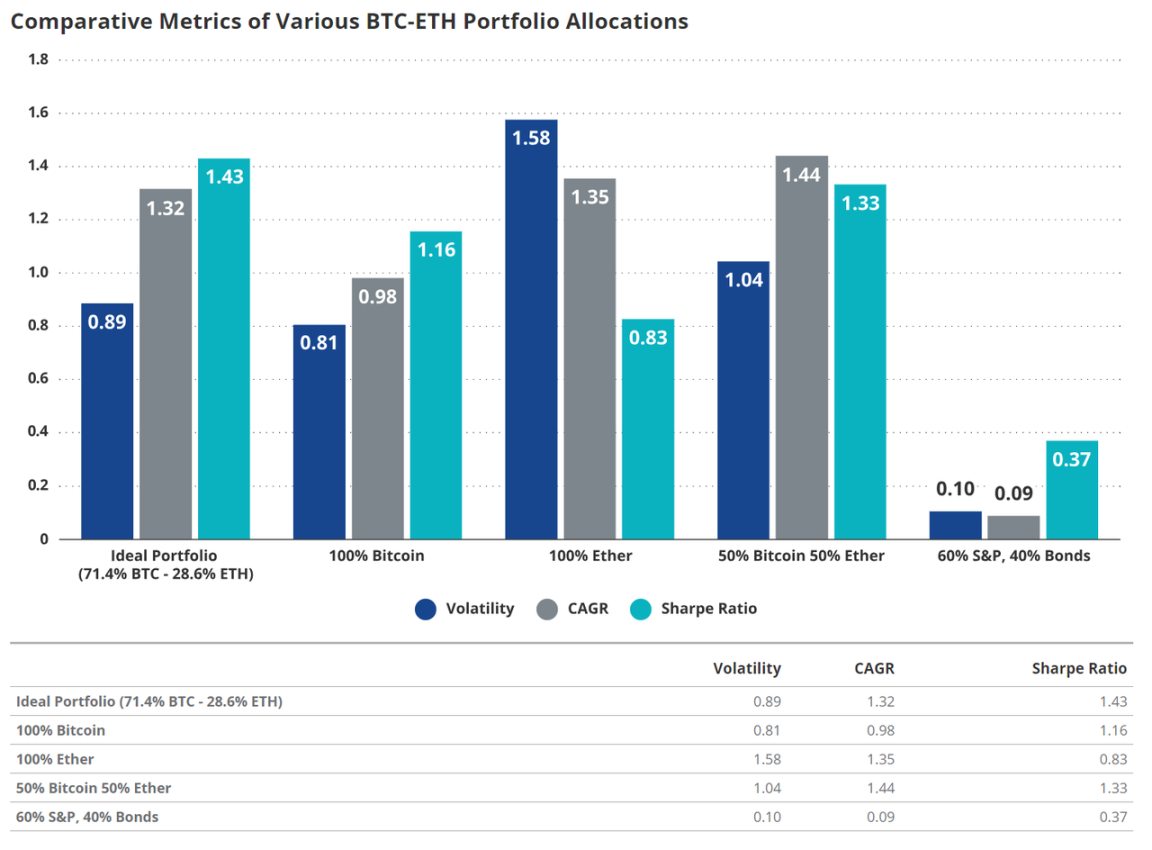

Añadir una asignación modesta de criptomonedas (hasta 6%) a una cartera tradicional 60/40 puede mejorar significativamente el ratio de Sharpe de la cartera con un impacto relativamente pequeño en las pérdidas. Una asignación de una cartera pura de criptomonedas cercana a 70/30 entre Bitcoin y Ethereum ofrece los mejores rendimientos ajustados al riesgo.

Evaluación de inversiones en Ethereum

ETH es el token nativo de Ethereum, un nuevo tipo de activo que ofrece a los inversores exposición a un sistema empresarial nativo de Internet de alto crecimiento que tiene el potencial de alterar los negocios financieros existentes y las grandes plataformas tecnológicas como Google y Apple. Ethereum ha atraído a unos 20 millones de usuarios activos mensuales en los últimos 12 meses, al tiempo que liquidó $4 billones en valor y facilitó $5,5 billones en transferencias de monedas estables. Hay más de $91,2 mil millones en monedas estables, $6,7 mil millones en activos tokenizados fuera de la cadena y $308 mil millones en activos digitales en Ethereum. El activo principal de este sistema financiero es el token ETH y, en nuestros fundamentos actualizados, creemos que ETH alcanzará $22,000 para 2030, un rendimiento total de 487% sobre el precio actual de ETH y una tasa de crecimiento anual compuesta (CAGR) de 37,8%.

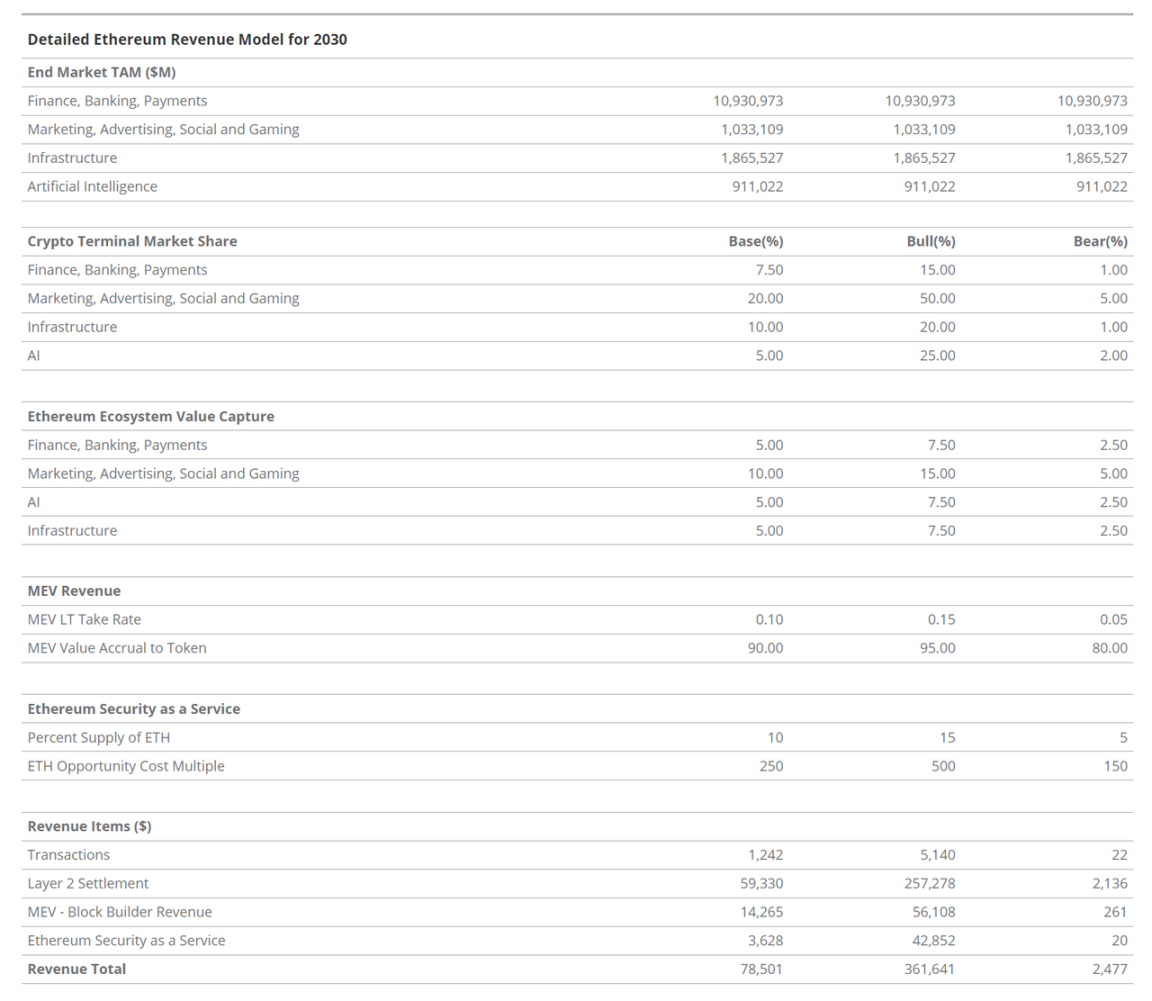

Proyectamos la valoración de ETH en 2030 en función de los 10 billones de TBP en flujo de efectivo libre que se espera que Ethereum genere y atribuya al token ETH. Estimamos que estos flujos de efectivo se comercializarán a un múltiplo P/E de 33x. Dado que Ethereum es una plataforma de aplicaciones, comenzamos nuestra valoración estimando el tamaño del mercado de los sectores comerciales que las aplicaciones blockchain revolucionarán. Estimamos que el tamaño total del mercado (TAM) de los ingresos anuales para estos sectores industriales verticales será de 10 billones de TBP.

-

Finanzas, banca y pagos (FBP) – $10,9 billones

-

Marketing, publicidad, redes sociales y juegos (MASG): $1,1 billones

-

Infraestructura (I) – $1,8 billones

-

Inteligencia artificial (IA) – $1,4 billones

Utilizamos cadenas de bloques como Ethereum para realizar estimaciones de captura de mercado para estos ingresos en función de los datos de TAM. Las tasas de penetración de FBP, MASG, I y AI son 7,5%, 20%, 10% y 5%, respectivamente. Pronosticamos la proporción de aplicaciones criptográficas creadas en Ethereum en lugar de otras cadenas de bloques, y nuestro caso base es 70%. Estimamos las tarifas que Ethereum cobrará a los usuarios de las aplicaciones, que es efectivamente una "tasa de toma" sobre los ingresos de estas aplicaciones, y resulta ser 5-10%. Recientemente actualizamos nuestro modelo ETH para la primavera de 2023, agregando el mercado final de AI para reflejar el enorme potencial de Ethereum en esta área. Otros ajustes influyentes al modelo anterior son un mayor consumo de la oferta de ETH, una mayor captura del mercado final y una mayor aceptación de las actividades económicas subyacentes. Creemos que estos cambios están justificados por las últimas innovaciones que hacen que Ethereum sea más accesible a los fundamentos y la política cambiante en los Estados Unidos.

Creemos que ETH es un activo revolucionario que no tiene comparación en el mundo financiero no criptográfico. Se puede pensar en ETH como un “petróleo digital” porque se consume al participar en actividades en Ethereum. También se puede pensar en ETH como un “dinero programable” porque la financiarización de ETH y otros activos de Ethereum puede ocurrir automáticamente en Ethereum sin intermediarios ni censura. Además, creemos que ETH es un “producto de rendimiento” porque se puede apostar de manera no custodial a validadores que administran la red Ethereum para obtener rendimiento en ETH. Finalmente, creemos que ETH también se puede pensar como una “moneda de reserva de Internet” porque es el activo subyacente para fijar el precio de todas las actividades y la mayoría de los activos digitales, que involucran el ecosistema Ethereum de más de 1 TP10T1 billón y sus más de 50 cadenas de bloques conectadas.

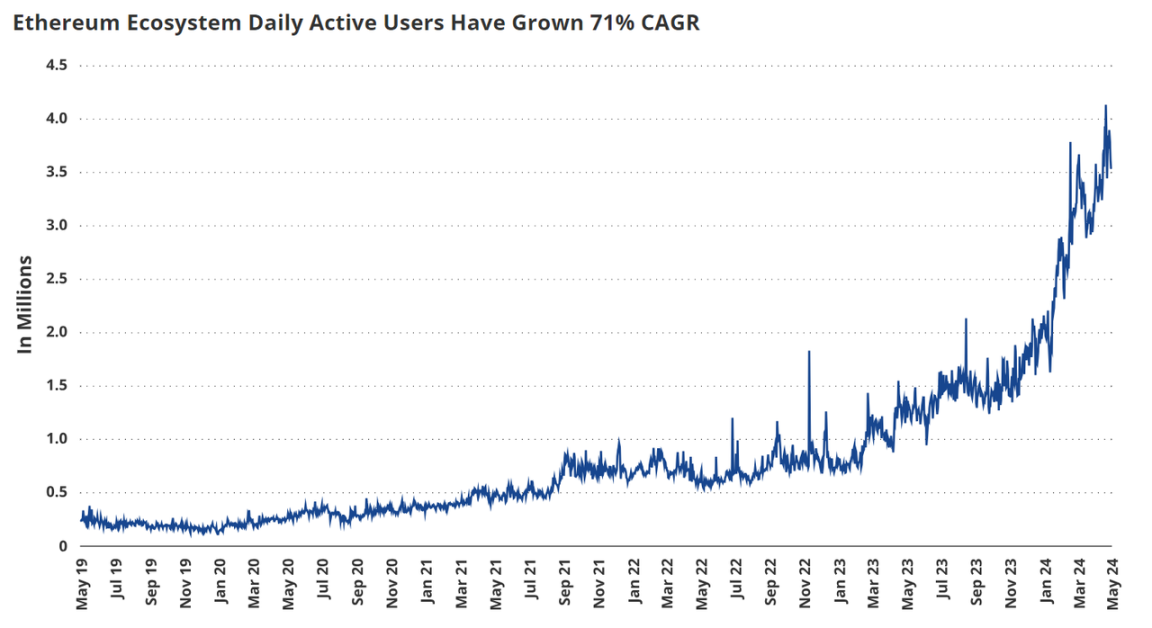

Independientemente de su clasificación, ETH se ha beneficiado del creciente uso de Ethereum. Ethereum, una plataforma económica vibrante que puede considerarse como un centro comercial digital, ha experimentado un aumento de 1500% en usuarios y los ingresos se han disparado a una tasa de crecimiento anual compuesta de 161% desde 2019. Durante el año pasado, Ethereum generó $3.4 mil millones en ingresos. Dado que ETH debe comprarse para poder usar Ethereum, todos los poseedores de ETH se benefician de las entradas de la moneda impulsadas por la demanda. Además, 80% de estos ingresos de ETH se utilizan para recomprar y destruir ETH circulante para eliminarlo permanentemente de la circulación. Esto es similar a una recompra irreversible de acciones.

En los últimos seis meses, se destruyeron 541.000 ETH (0,41 TP9T del suministro total) por un valor de 1 TP10T1.580 millones. Por lo tanto, los poseedores de ETH se benefician doblemente de la actividad de Ethereum, tanto de las compras de ETH impulsadas por los usuarios como de la destrucción del suministro. Los usuarios de ETH también pueden obtener un rendimiento anual de aproximadamente 3,51 TP9T haciendo staking de ETH. Esto se hace haciendo staking de ETH a entidades de la red Ethereum llamadas validadores, proporcionándoles la garantía necesaria para ejecutar la red Ethereum.

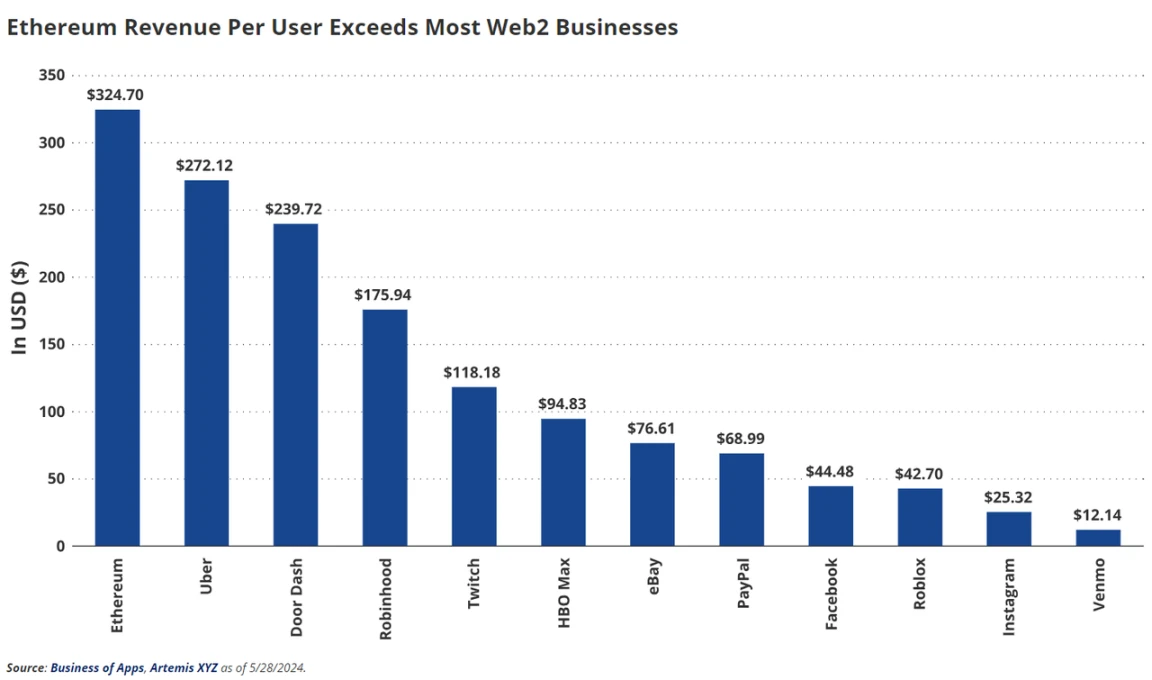

En comparación con las aplicaciones Web2, Ethereum ($3.4 mil millones) genera más ingresos que Etsy ($2.7 mil millones), Twitch ($2.6 mil millones) y Roblox ($2.7 mil millones). Ethereum (20 millones) tiene más usuarios activos mensuales que Instacart (14 millones), Robinhood (10.6 millones) y Vrbo (17.5 millones). Además, el ingreso anual promedio por usuario activo mensual de Ethereum es de $172, que es comparable a los $100 de Apple Music. Netflix es de $142 e Instagram es de $25. Clasificamos a Ethereum como un negocio de plataforma similar a la App Store de Apple o Google Play. Sin embargo, Ethereum tiene una gran ventaja sobre las plataformas Web2 porque ofrece a los usuarios y propietarios de negocios de aplicaciones una propuesta de valor única que no está disponible fuera de las criptomonedas.

El aspecto más atractivo de usar Ethereum es el potencial ahorro de costos que ofrece a las empresas y usuarios. Apple y Google se llevan alrededor de 30% de los ingresos por aplicaciones alojadas, mientras que Ethereum actualmente se lleva alrededor de 24% (14% para aplicaciones que no son DeFi). Además, creemos que la tasa de aceptación de Ethereum caerá a 5-10% en los próximos 18 meses a medida que la actividad se traslade a Ethereum L2 más barata (las tasas de adquisición actuales son de 0,25%-3%). Desde una perspectiva de pago, los procesadores de tarjetas de crédito y otras aplicaciones de pago como PayPal cobran 1,94% en todos los pagos (2,9% para transacciones comerciales), mientras que Visa cobra 1,79-2,43% o más.

En comparación con las plataformas de redes sociales centradas en datos como Facebook, creemos que Ethereum tiene el potencial de ofrecer a los emprendedores aplicaciones más potentes y rentables. Ethereum permite que las aplicaciones se conecten e innoven libremente en un entorno de implementación sin permisos y con datos de código abierto. Como resultado, cualquiera puede crear aplicaciones y aprovechar datos importantes, incluidos los datos sobre toda la actividad del usuario en la cadena, al igual que Visa proporciona datos de pago de los clientes de forma gratuita. Por ejemplo, la aplicación de redes sociales Farcaster genera actualmente $75.5 en ingresos por usuario activo mensual, mientras que Facebook genera aproximadamente $44. Aún más atractivo, la estructura de incentivos de código abierto ha dado lugar a una aplicación más atractiva, con usuarios de Farcaster con un promedio de 350 minutos de uso diario en comparación con los 31 minutos de Facebook.

Como resultado de las propiedades de Ethereum, algunas de las ganancias obtenidas por las grandes finanzas, las grandes tecnologías y los grandes datos pueden transferirse a los usuarios en forma de beneficios para el consumidor. A medida que se generen más datos en público y más comercio se aleje de las vías financieras costosas y cerradas, las ventajas comerciales se erosionarán. El resultado será un negocio potencial formado en torno a la economía de bajo margen del código abierto. Los consumidores y los desarrolladores de aplicaciones migrarán a Ethereum. Creemos que en los próximos 5 a 10 años, entre 7% y 20% de los ingresos comerciales de Web2/Big Finance, o billones de dólares, podrían exprimirse de sistemas como Ethereum y retroalimentarse principalmente a los usuarios y desarrolladores de aplicaciones. Además, las propiedades de propiedad únicas de Ethereum permiten una presencia digital sin censura en las redes sociales y las aplicaciones de juegos. Estas características serán cada vez más valiosas si la censura gubernamental de la información continúa intensificándose.

También hay buenas razones para creer que las cadenas públicas como Ethereum se convertirán en una importante infraestructura de backend para las aplicaciones de IA. La proliferación de agentes de IA y sus economías requerirá una transferencia de valor sin restricciones, una prueba explícita de humanidad y una procedencia de datos/modelo bien definida. Estas propiedades únicas están disponibles en las cadenas de bloques, pero eluden la infraestructura técnica existente. Calculamos que el TAM global para las ganancias de productividad de la IA podría llegar a $8,5 billones para 2030. Con base en los supuestos de adopción empresarial de 66%, captura de valor de software de IA de 25% y captura de valor no hardware de 72%, creemos que el TAM potencial de ingresos para las criptomonedas y la IA es de $911 mil millones para 2030, incluidos $45,5 mil millones en ingresos de aplicaciones e infraestructura de IA de código abierto, de los cuales $12 mil millones en ingresos podrían fluir directamente de regreso a los poseedores de ETH.

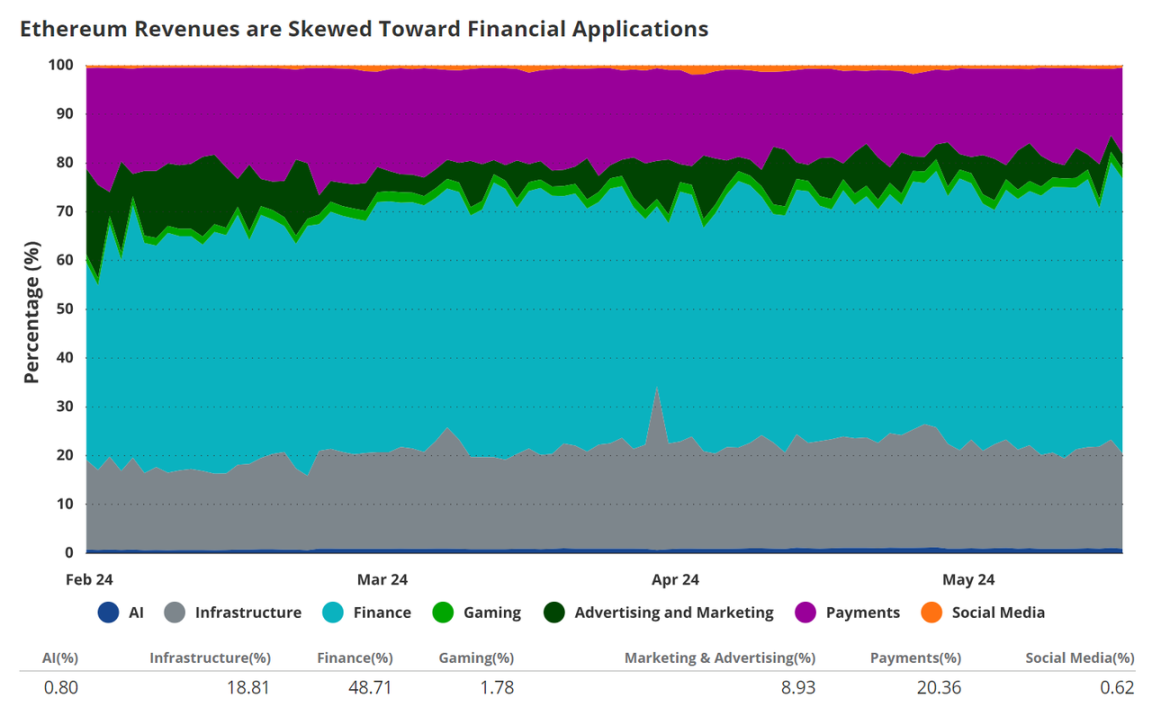

Actualmente, la mayor parte de la actividad en Ethereum es financiera. Los intercambios descentralizados y los protocolos bancarios representan 49% de los ingresos de Ethereum, mientras que 20% se distribuyen mediante transferencias de valor simples. Estos ingresos se clasifican en Finanzas, Banca y Pagos (FGP). Mientras tanto, Infraestructura (I) representa la segunda parte más grande, alrededor de 19%, que está relacionada con negocios descentralizados y la creación de software para servir a aplicaciones descentralizadas. Finalmente, clasificamos las actividades relacionadas con las redes sociales y los NFT en la categoría Marketing, Publicidad, Redes Sociales y Juegos (MASG). MASG contribuye con 11% de estos ingresos. Actualmente, la IA juega un papel muy pequeño en la generación de ingresos para Ethereum.

Los ingresos de Ethereum provienen de los mercados finales mencionados anteriormente, y estas actividades constituyen los elementos de ingresos de Ethereum, incluidas las tarifas de transacción, la liquidación de segunda capa, la clasificación del espacio de bloques (MEV) y la seguridad como servicio. Las tarifas de transacción son tarifas que pagan los usuarios (y futuros agentes automatizados) por usar aplicaciones o transferir valor en Ethereum. La liquidación de segunda capa se refiere a los ingresos que Ethereum L2 paga a Ethereum por liquidar transacciones. MEV es el ingreso generado por las tarifas que pagan los usuarios por el derecho a clasificar un conjunto de transacciones. La seguridad como servicio se refiere al uso de ETH como garantía para respaldar aplicaciones sin permiso que necesitan este valor para realizar sus funciones comerciales. El año pasado, alrededor de 72% de los ingresos de Ethereum provinieron de tarifas de transacción, MEV representó alrededor de 19%, la liquidación de segunda capa representó alrededor de 9% y la seguridad como servicio aún no se ha lanzado oficialmente.

Creemos que la propuesta de valor más sólida de Ethereum se encuentra en el sector financiero, por lo que esperamos que 71% de los ingresos de Ethereum provengan de servicios financieros (FGP) para 2030. Debido a las ventajas de la experimentación y los sistemas financieros y de datos de código abierto de Ethereum, esperamos que MASG crezca a 17%, lo que reemplazará ligeramente la infraestructura para proporcionar 8% de ingresos. En general, la IA representará 2% de los ingresos de Ethereum. Sin embargo, si el software de IA descentralizado demuestra su enorme potencial, la contribución de los ingresos de la IA puede aumentar exponencialmente o más.

Desde la perspectiva de la partida de ingresos, estimamos que una sola transacción de la red principal representará solo 1,51 TP9T de ingresos. La liquidación de capa 2, que agrupa los paquetes de datos de transacciones en la red principal, aumentará significativamente hasta aproximadamente 761 TP9T de ingresos. Esto se debe a que esperamos que la mayor parte de la actividad se produzca en la cadena de bloques de capa 2 de Ethereum, pero la mayor parte del valor de estas transacciones se atribuirá a Ethereum. Al mismo tiempo, MEV mantendrá su importancia y representará 181 TP9T de ingresos, mientras que la seguridad como servicio se convertirá en 4,51 TP9T de los ingresos de Ethereum.

Bitcoin y Ethereum: las mejores asignaciones de cartera

Descripción general del análisis

Realizamos un estudio para evaluar el impacto de incluir BTC y ETH en una cartera tradicional 60/40, que abarca el período del 1 de septiembre de 2015 al 30 de abril de 2024. El análisis se realizó en cinco secciones principales:

-

Asignación restringida óptima en una cartera tradicional 60/40: evaluamos las ponderaciones ideales de BTC y ETH en una cartera de acciones 60% y de bonos 40%, restringiendo la asignación combinada máxima a 6%. Completamos y agregamos exposición a criptomonedas utilizando 169 carteras de muestra.

-

Análisis de las caídas y los ratios de Sharpe: examinamos las caídas y los ratios de Sharpe de un subconjunto de 16 carteras representativas para comprender las compensaciones riesgo-rendimiento. Añadir una asignación de criptomonedas modesta (hasta 6%) a una cartera tradicional 60/40 puede mejorar significativamente el ratio de Sharpe de la cartera con un impacto relativamente pequeño en las caídas. Para los inversores con una alta tolerancia al riesgo (hasta ~20% de volatilidad anualizada), las asignaciones de hasta 20% pueden seguir mejorando el riesgo/rendimiento de toda la cartera. Entre BTC y ETH, creemos que una ponderación de aproximadamente 70/30 proporciona los mejores rendimientos ajustados al riesgo.

-

Asignación óptima de BTC y ETH en una cartera compuesta únicamente por estas dos criptomonedas: analizamos cada permutación de ponderaciones de BTC y ETH en una cartera compuesta únicamente por estas dos criptomonedas, con el objetivo de maximizar el índice de Sharpe y derivar la ponderación ideal de BTC/ETH.

-

Cálculo de la frontera eficiente utilizando carteras de criptomonedas óptimas: estudiamos los pesos óptimos de una cartera ideal de BTC/ETH para maximizar los retornos dados diferentes niveles de volatilidad para ilustrar una parte de la frontera eficiente al agregar criptomonedas a 60/40 (con niveles de volatilidad razonables).

-

Dependencia temporal de los resultados de la frontera eficiente: consideramos el impacto de diferentes puntos de partida en nuestros resultados, mostrando que una mayor asignación de criptomonedas ayuda a lograr el rendimiento ajustado al riesgo de la cartera en cada período de tiempo disponible.

1. Asignación optimizada en la cartera tradicional 60/40

El objetivo principal de esta sección es determinar la asignación óptima de BTC y ETH en una cartera tradicional 60/40 con un peso total de hasta 6% en criptomonedas. El análisis implica la creación de 169 carteras modelo con exposición incremental a criptomonedas (hasta 3% en BTC y ETH).

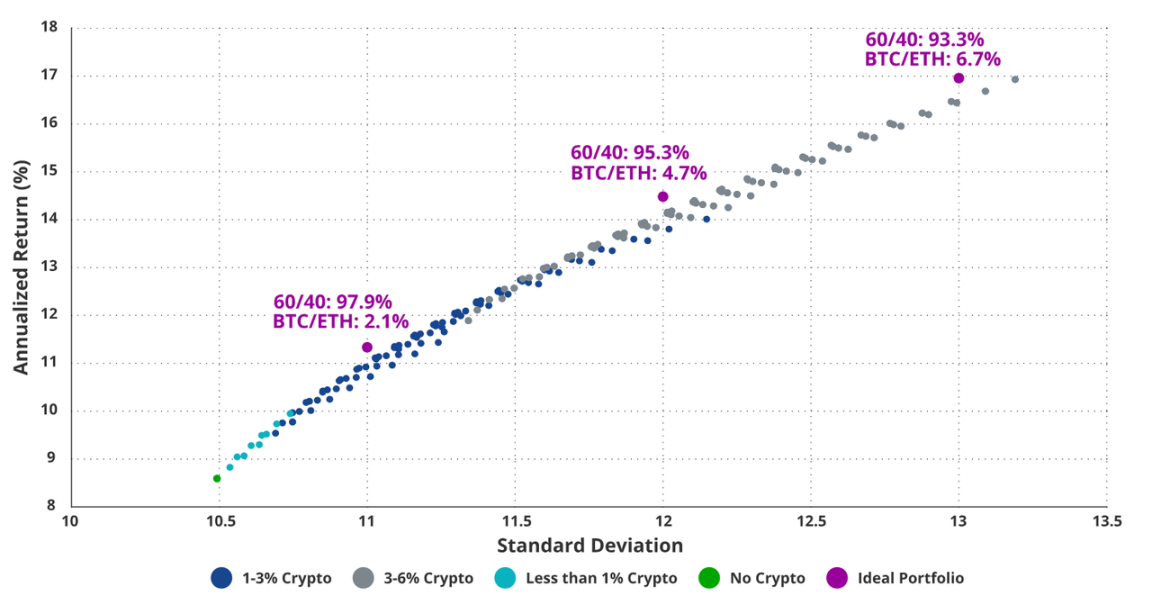

Los resultados muestran que una cartera con 3% de Bitcoin y 3% de Ethereum (junto con 57% de SP 500 y 37% de bonos estadounidenses) ofrece el mayor rendimiento por unidad de riesgo (desviación estándar). En otras palabras, permitir una asignación máxima a criptomonedas mientras se mantiene una asignación general conservadora de 6% logra los mayores rendimientos ajustados al riesgo.

Optimización de la asignación de BTC/ETH en una cartera tradicional 60/40 para obtener retornos ajustados al riesgo (1 de septiembre de 2015 – 30 de abril de 2024)

2. Análisis de la reducción y del ratio de Sharpe

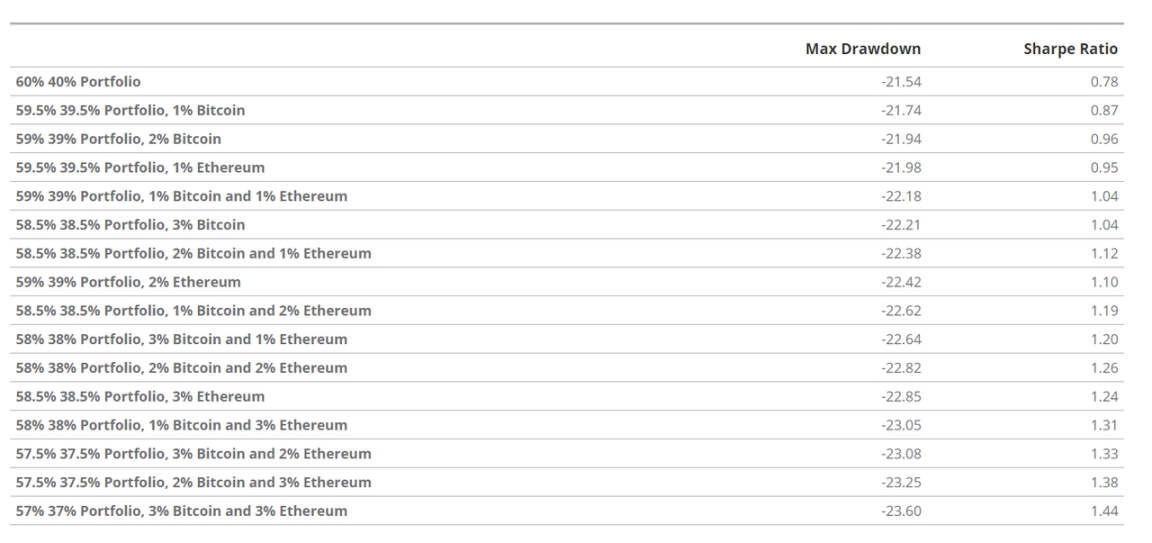

Para evaluar la relación riesgo-rendimiento, analizamos 16 carteras representativas 60/40 con asignaciones de criptomonedas que aumentaron gradualmente hasta 6%. Los principales hallazgos son:

Mejora del ratio de Sharpe: el ratio de Sharpe de la cartera mejora significativamente con el aumento de la asignación de criptomonedas.

Impacto mínimo en las reducciones: las reducciones máximas solo aumentan levemente, lo que hace que una mayor asignación de criptomonedas sea una compensación atractiva para muchos inversores.

Los datos sobre la reducción máxima y el ratio de Sharpe muestran que una asignación de criptomonedas de 6% da como resultado un ratio de Sharpe que es casi el doble que el de una cartera 60/40, con solo un ligero aumento en la reducción. Esto pone de relieve una relación riesgo-recompensa muy favorable al añadir BTC y ETH a una cartera tradicional.

3. Asignación óptima de BTC y ETH en una cartera de criptomonedas

Centrándonos únicamente en las carteras de BTC y ETH, probamos todas las combinaciones de ponderaciones posibles para determinar la mejor combinación que maximice el índice de Sharpe. El análisis muestra que la asignación ideal es 71,4% de Bitcoin y 28,6% de Ethereum. Esta configuración produce el índice de Sharpe más alto, lo que indica el mejor rendimiento ajustado al riesgo para una cartera pura de criptomonedas. Los hallazgos destacan que los inversores deben mantener ambas criptomonedas para maximizar sus beneficios. Una configuración simple de 50% de BTC y 50% de ETH también muestra un gran potencial alcista, lo que refuerza el valor de la diversificación dentro de la clase de activos criptográficos.

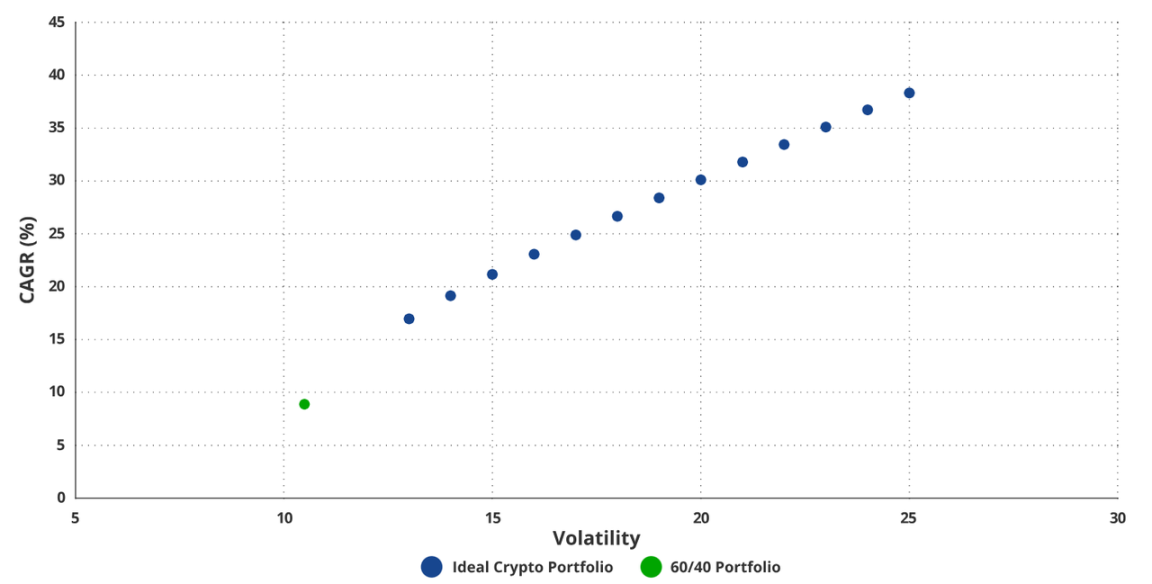

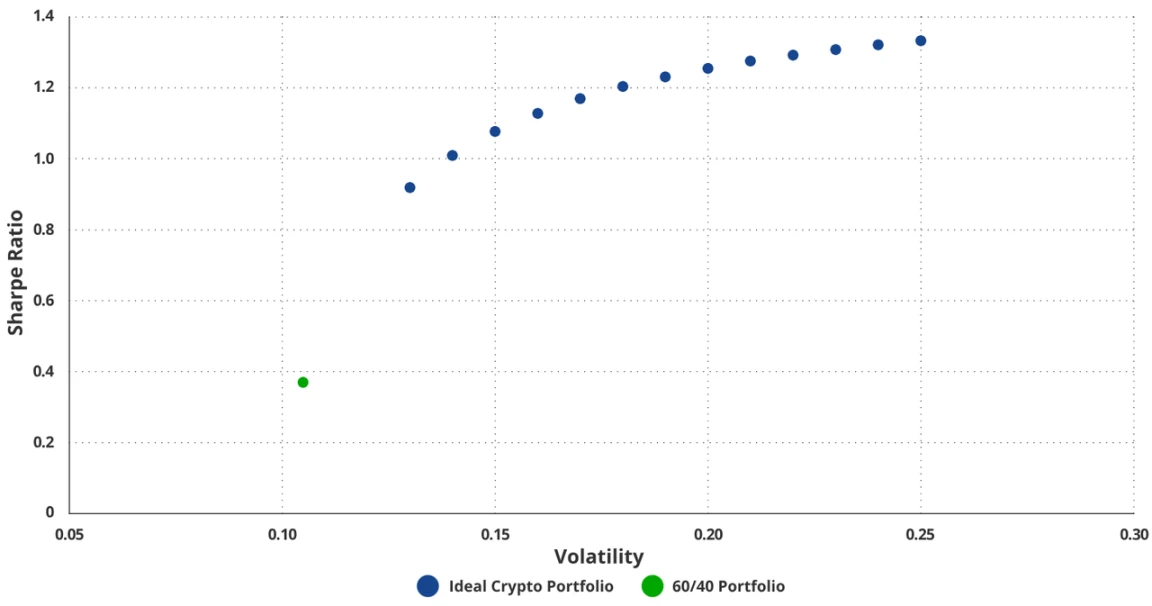

4. La frontera eficiente al incluir criptomonedas

Para lograr una asignación óptima a criptomonedas sin restricciones y manteniendo una volatilidad razonable, examinamos los pesos óptimos de una cartera de criptomonedas ideal (28,61 TP9T ETH y 71,41 TP9T BTC) para agregar a una cartera tradicional 60/40. El objetivo es maximizar los retornos mientras se mantiene un nivel de volatilidad dado (131 TP9T-251 TP9T), generando así una cartera de frontera eficiente utilizando estos activos, con niveles de volatilidad típicamente asociados con una amplia gama de carteras de inversores. El diagrama de dispersión resultante muestra que incorporar la cartera de criptomonedas óptima a una cartera tradicional 60/40 puede mejorar significativamente los retornos con distintos grados de riesgo.

La volatilidad adicional en los activos digitales ayuda a los rendimientos generales

El ratio de Sharpe de la cartera mixta se mantuvo estable en 22% Volatilidad

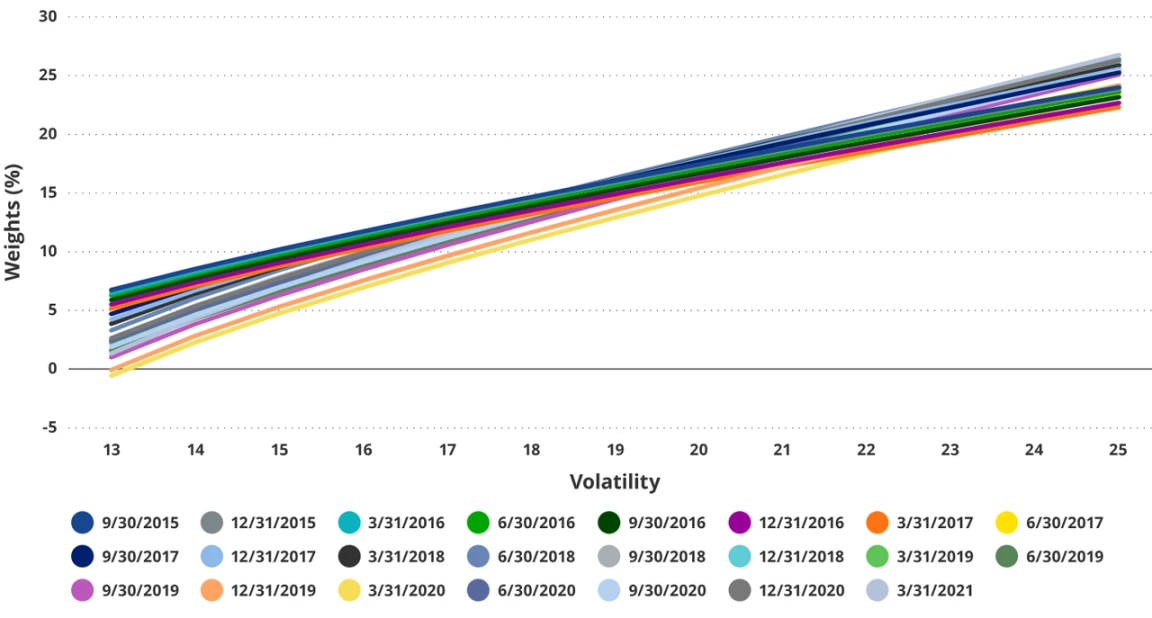

5. Dependencia temporal de los resultados de la frontera eficiente

Para determinar si los distintos puntos de partida tienen un impacto en el perfil de riesgo/rendimiento de la combinación de criptomonedas ideales y la cartera 60/40, repetimos el análisis de la Parte 4, pero desplazando repetidamente el punto de partida hacia adelante en un trimestre. Nuestra única restricción fue incluir al menos 3 años de rendimientos. De este modo, pudimos generar 23 conjuntos de resultados y eliminar la dependencia del tiempo como variable del análisis.

Nuestros hallazgos son:

-

La ponderación óptima de una cartera de criptomonedas ideal aumenta a medida que aumenta el riesgo en todos los períodos de tiempo.

Ponderaciones de volatilidad para carteras con intervalos de tiempo separados

-

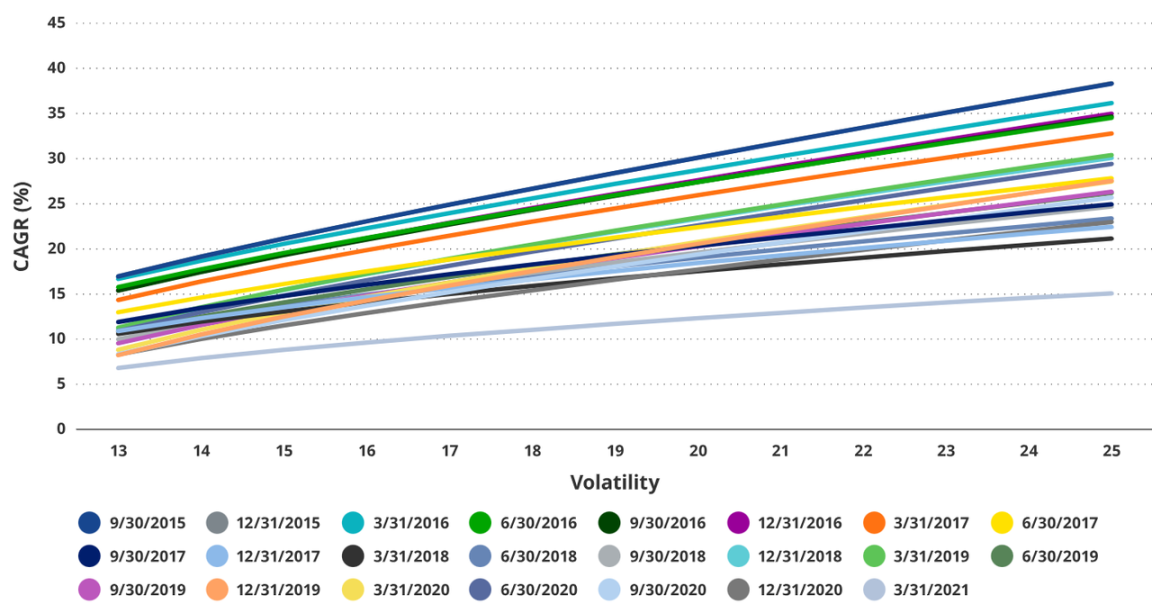

Las mayores asignaciones de criptomonedas permiten tasas de crecimiento anual compuesta (CAGR) más altas en todos los períodos de tiempo.

Tasa de crecimiento anual compuesta de la cartera independiente del tiempo en volatilidad

-

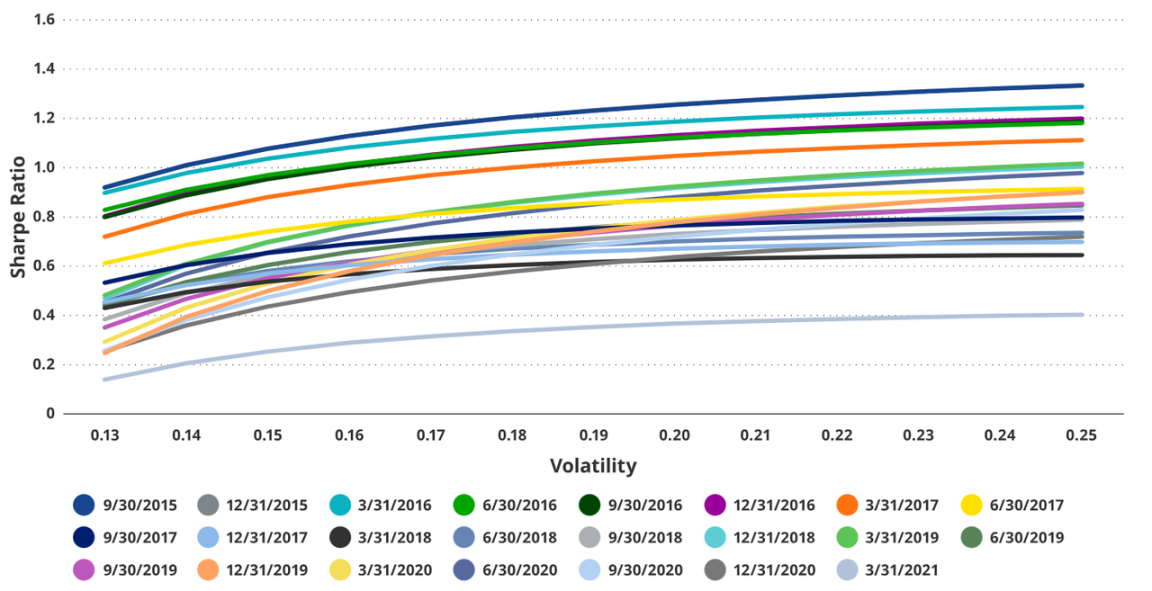

El índice de Sharpe generalmente aumenta con la volatilidad y la asignación de criptomonedas.

Índice de Sharpe para la volatilidad de carteras con intervalos de tiempo separados

En otras palabras, los resultados del Estudio 4 son independientes del punto de partida, lo que apoya la inclusión de una mezcla equilibrada de Ethereum (ETH) y Bitcoin (BTC) en la cartera, hasta un peso de 6% en nuestro estudio.

Riesgos de la inversión en Ethereum

Si bien ETH tiene una capitalización de mercado de más de $400 mil millones y se considera una plataforma de contratos inteligentes madura, es importante tener en cuenta que invertir en ETH conlleva riesgos significativos.

1. Confianza en la especulación

En esta etapa, el ecosistema Ethereum depende en gran medida de la especulación para generar ingresos. Si el apetito por el riesgo general disminuye, ETH podría exhibir un coeficiente beta a la baja significativo con respecto al SP 500 o al Nasdaq Composite.

2. Riesgos regulatorios

Dependiendo de las regulaciones, ETH o muchos activos en su ecosistema pueden clasificarse como valores. Esto puede resultar en que muchos Ethereum tengan que registrarse en la SEC o enfrentar graves consecuencias legales.

Las empresas financieras más grandes tienen grandes lobbystas en gobiernos de todo el mundo y muchos ex empleados designados para puestos importantes que podrían crear barreras regulatorias que perjudiquen a disruptores como Ethereum.

3. Riesgo de tipo de interés

Como activo de alto riesgo, los aumentos de las tasas de interés u otra liquidez global restrictiva podrían tener un gran impacto en la valoración de ETH en comparación con otras clases de activos.

4. Competencia

La competencia en el espacio emergente de las plataformas de contratos inteligentes es feroz. Aunque Ethereum tiene una gran ventaja, las cadenas de bloques de alto rendimiento como Solana y Sui tienen ventajas técnicas y se centran en el desarrollo empresarial y la experiencia del usuario. A largo plazo, esto puede permitirles desafiar el dominio de Ethereum.

5. Las empresas financieras siguen creciendo

Una de las mayores ventajas de Ethereum es que abarata el sistema financiero porque elimina muchos de los aspectos de alto costo del sistema financiero actual. Si las empresas financieras deciden implementar medidas de ahorro de costos, pueden conservar su base de usuarios.

Las empresas financieras existentes también podrían crear plataformas de contratos inteligentes blockchain rivales, socavando el potencial a largo plazo de Ethereum.

6. Geopolítica

El control del dinero es el ámbito más importante del poder gubernamental. Los acontecimientos geopolíticos, como una gran guerra regional o incluso el aumento de las tensiones geopolíticas, podrían impulsar a los gobiernos de todo el mundo a tomar medidas drásticas contra los sistemas financieros no soberanos y las formas de moneda.

en conclusión

En resumen, añadir una pequeña cantidad de criptomonedas (hasta 6%) a una cartera tradicional 60/40 puede mejorar significativamente el ratio de Sharpe de la cartera con un impacto relativamente pequeño en la reducción máxima. En una cartera compuesta únicamente por criptomonedas, Bitcoin y Ethereum tienen un ratio de asignación cercano a 70/30, lo que proporciona los mejores rendimientos ajustados al riesgo.

Los inversores deben tener en cuenta su tolerancia al riesgo individual, pero los datos sugieren que añadir BTC y ETH de forma equilibrada puede proporcionar una mejora significativa de la rentabilidad en relación con el riesgo incremental introducido. Estos hallazgos ponen de relieve el potencial de las criptomonedas para mejorar el rendimiento de la cartera de forma controlada y mensurable.

Este artículo proviene de Internet: Informe de VanEck: ETH alcanzará $22,000 en 2030

Relacionado: Reinicio de las ICO: Lanzamiento de tokens distribuidos (DTL)

Autor original: Anagrama Traducción original: Los capitalistas de riesgo unicornio nunca innovaron en estructuras de financiación, simplemente encontraron una forma de invertir en empresas antes que nunca. No hay duda de que el dinero de capital de riesgo que se infunde en las empresas tecnológicas en sus primeras etapas ha acelerado la innovación, pero también ha significado minimizar las comunidades a las que estos productos fueron diseñados para servir. La criptomoneda en sí misma es una tecnología novedosa con propiedades novedosas (sin permisos, componible, descentralizada) que aportan nuevas capacidades a la tecnología autosuficiente. Con la llegada de nuevas tecnologías y nuevos requisitos, la gente está empezando a pensar de forma creativa sobre la formación de capital por primera vez desde la IPO. En 2017, las ICO recibieron mucha atención y rápidamente atrajeron a inversores de todo el sector. Sin embargo, en 2018, llegó el mercado bajista y muchos proyectos y sus acompañantes…