Análisis macro de SignalPlus (20240606): las entradas de ETF de BTC superaron los 10T1.2 mil millones en dos días

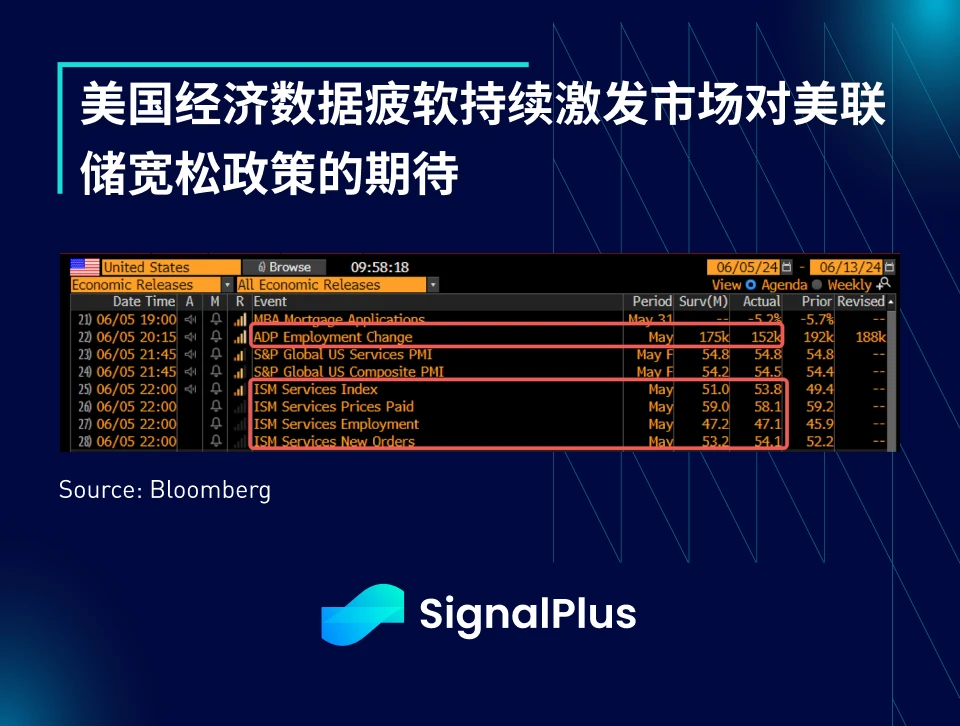

Risk appetite continued on the back of weak ADP employment data (152K vs 175K) and the employment component of the US Services PMI. Survey respondents cited “adjusting our hiring and capital investment strategies and managing borrowing”, “feeling the slowdown”, “hiring is slowing and prices are rising slightly”, and “high interest rates are reducing capital investment and slowing major facility upgrades”, leading the market to ignore the strongest overall performance of the non-manufacturing ISM index in 9 months (53.8 vs 51).

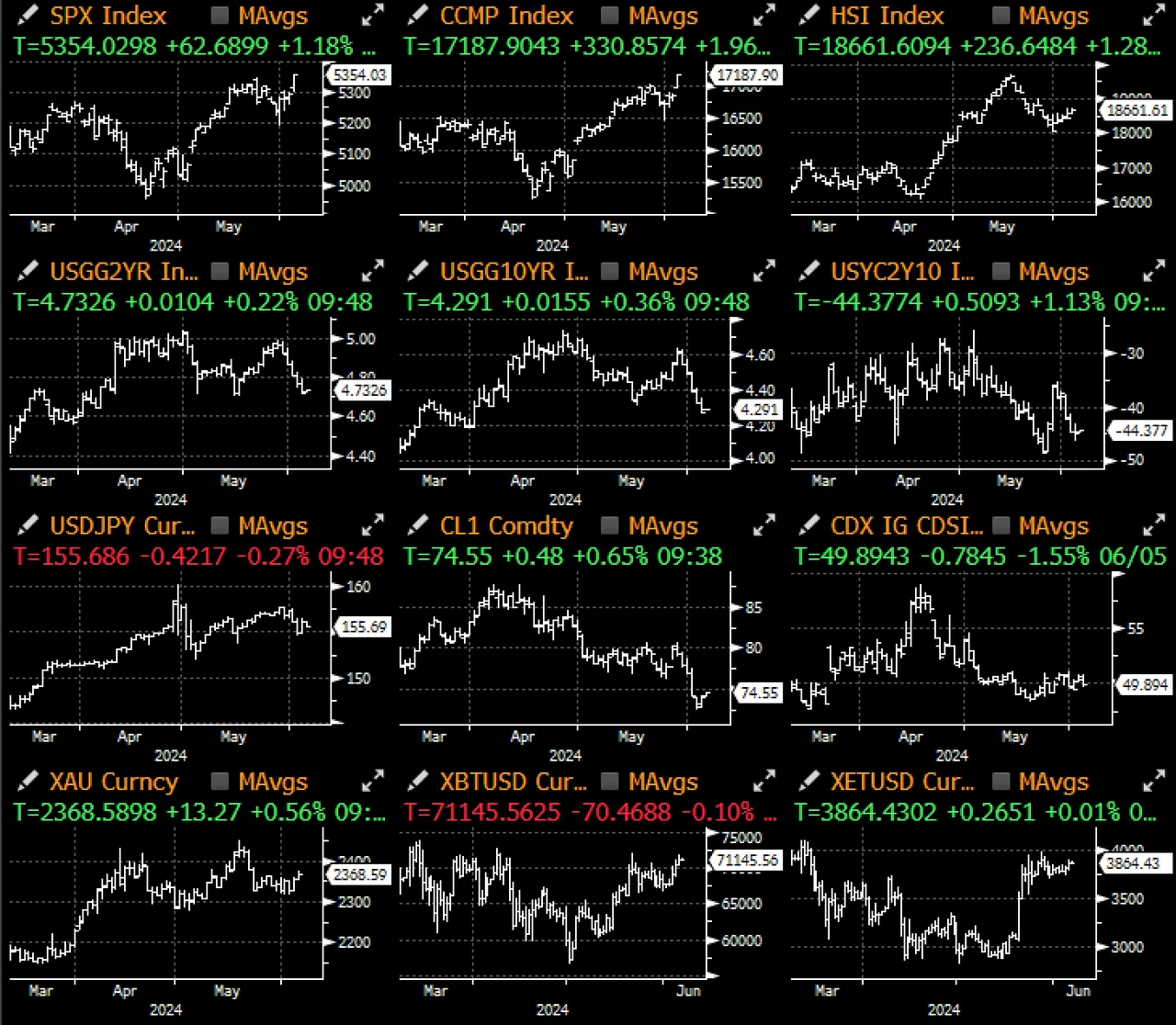

The Bank of Canadas 25 basis point rate cut is seen as the start of the upcoming easing cycle, and federal funds futures pricing shows that there will be two full rate cuts before the end of the year, and the probability of a rate cut in September has also risen to more than 60%. With the full return of the Feds rate cut expectations, the 10-year US Treasury yield is currently below 4.30%, the 2/10 s curve has re-inverted, and the spread has returned to the recent low of -45 basis points.

As yields fell, the Nasdaq rose another 2% yesterday and the SPX rose 1.1%, approaching all-time highs again. With a series of weak employment indicators in the past two weeks, and the market expecting weak non-farm payrolls on Friday, ETF investors have poured $58 billion into the US stock market this month, with inflows up to $315 billion so far this year, the traditional stock market adage Sell in May And Go Away has completely failed to come true.

Incredibly, Nvidias dominance of the market continues to expand, with its daily trading volume almost equal to the next nine stocks combined.

Finally, stocks are also poised to enter a friendly first half of July, the most seasonally positive two-week period for stocks, with data going back to 1928. The crypto space is no slouch either, with ETF inflows continuing to accelerate, with another $333 million yesterday following Tuesdays $886 million inflows. Will prices see more all-time highs? Are there any bears left? Enjoy it while you still can, folks!

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240606): BTC ETF inflows exceeded $1.2 billion in two days

Related: Dogwifhat (WIF) Price Prediction: Will It Reach $5?

In Brief WIF price is moving in a symmetrical triangle, and a breakout will send it rallying by 44%. The Chaikin Oscillator is well above 0, suggesting that buying pressure has been increasing since April began. MACD is also close to noting a bullish crossover, which would substantiate the potential for a rise. The meme coin mania propelled dogwifhat (WIF) price to hit new highs throughout March, and it seems like this might happen again. As the buying pressure increases, the Solana meme token might jump, too, as long as it can breach this resistance. Why Dogwifhat is Gaining Momentum Among Investors WIF price will likely note a surge in the coming days owing to the increase in bullishness from investors. This is visible on the Chaikin indicator, which is…