Original|Odaily Planet Daily

Autor: Azuma

In the early morning of May 24th, Beijing time, the U.S. Securities and Exchange Commission (SEC) officially approved the 19 b-4 forms of all eight spot Ethereum ETFs applied for by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Invesco Galaxy and Franklin Templeton, opening the door for ETH to enter the traditional financial market.

It should be noted that although the 19 b-4 forms of the above-mentioned spot Ethereum ETFs have been approved, the ETFs still need their S-1 registration statements to take effect before they can officially start trading. Given that the SEC has just started discussions with issuers on S-1 and it will take time for consultation and revision, it is unclear how long this process will take – Bloomberg ETF analysts speculate that it may still take several weeks.

With the release of the SECs announcement, the bet on whether the spot Ethereum ETF will be approved before May 31 on the well-known prediction market Polymarket also came to an end, and it was confirmed that it would be executed with a result of YES (will be approved) , which means that users who chose YES will take away all the $13.22 million rewards in the bet. Conversely, if you choose NO (will not be approved), all the funds invested will be reduced to zero.

In a supplementary statement on the execution results, Polymarket stated: “According to the documents released today, the SEC has approved eight proposals to allow the listing and trading of Ethereum ETFs, and the documents also mentioned that “this is hereby approved in an accelerated manner”, so the final result of this bet will be YES.

However, this execution has caused great controversy within the Polymarket community .

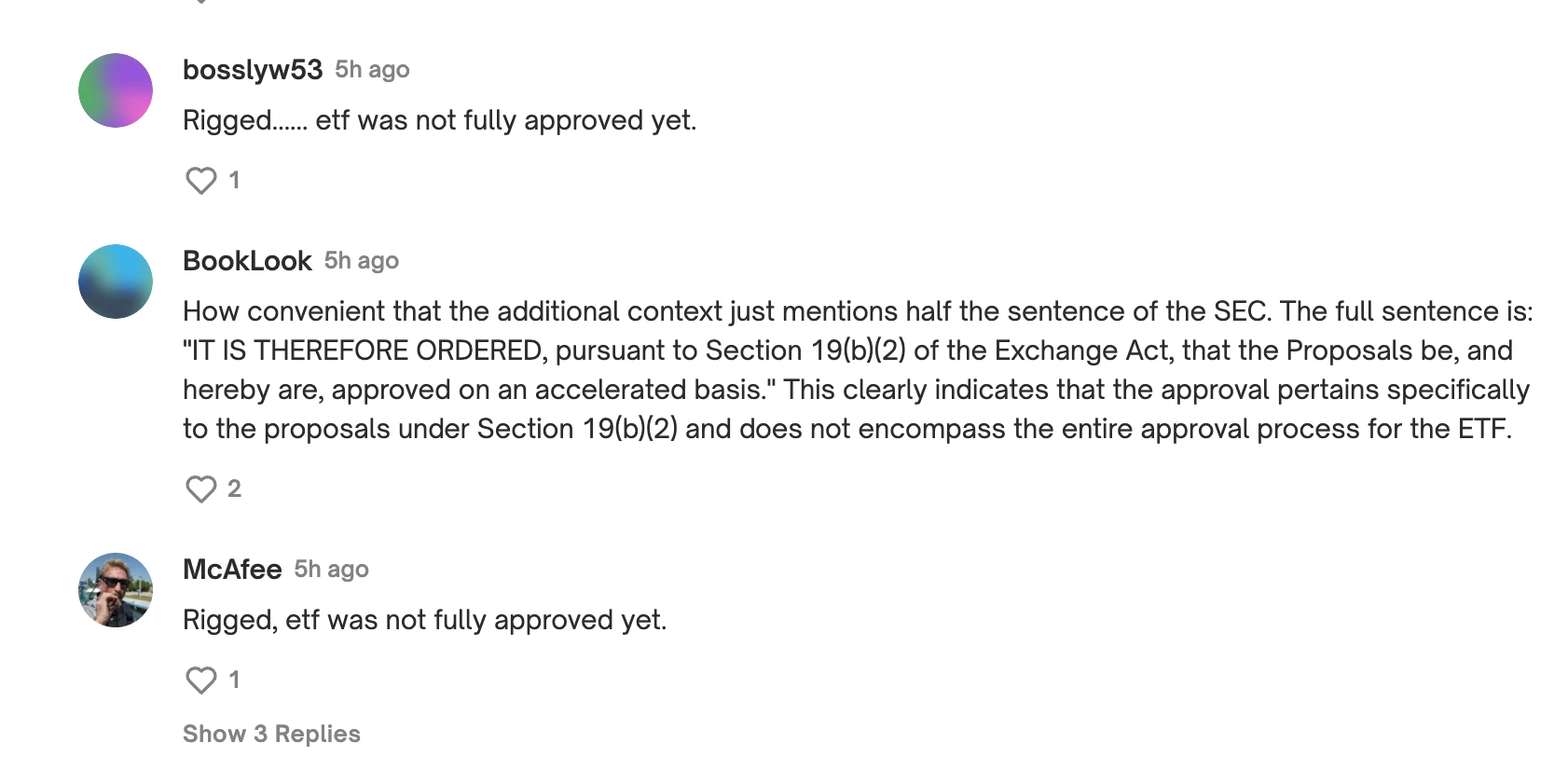

The party raising questions mainly came from users who chose NO. Below the bet, a large number of users are expressing their dissatisfaction with Polymarkets execution result, and even bluntly stated that Polymarket was manipulating the market and they were robbed.

Based on the questions raised by these users, users who chose NO generally believe that Polymarket’s execution result is not rigorous, because the approval of the ETF requires the approval of both 19 b-4 and S-1. The result of S-1 is currently uncertain. The approval of 19 b-4 alone does not mean that the ETF has been fully approved. Therefore, it should not be closed directly with YES.

In response to this, some users called for the market to be restarted and a decision would be made when the betting deadline of May 31st arrived; some users believed that this was due to the laxity of Polymarket rules and therefore a 50/50 refund should be made.

Objectively speaking, judging from this incident, Polymarket clearly had loopholes in its rule design. It failed to provide sufficiently clear criteria for judging the results before the bet was initiated (or during the effective period), and failed to fully explain the specific conditions for approval – that is, whether 19 b-4 and S-1 needed to be approved at the same time.

As for the potential reasons why Polymarket made such a mistake: first, the turning point of this ETF approval was too sudden . Just a week ago, the market generally believed that it would be difficult for the spot Ethereum ETF to be approved at this juncture. Therefore, the SEC had not previously conducted sufficient communication with major applicants and exchanges. However, as the Biden administration suddenly changed its regulatory attitude towards cryptocurrencies due to vote pressure, the SEC had to urgently work overtime, but the time window was too short, so the SEC could only finalize 19 b-4 first, and the approval of S-1 still needed to wait for more time; second, because there is no precedent for a similar approval process in the history of cryptocurrency ETFs , the spot Bitcoin ETF at the beginning of the year approved both 19 b-4 and S-1 documents at the same time, so Polymarket may not have expected that there would be a time difference between the two.

As a result, Polymarket can only choose a result that is relatively more acceptable to the market under the imperfect rules. Combined with the supplementary explanation, Polymarket may have considered that the industry generally believes that the approval of 19 b-4 means that S-1 will only be a matter of time, so it chose YES as the final result.

But on the other hand, users who chose NO would find it difficult to agree with such a vague answer, especially when they lost real money.

As of the time of writing, Polymarket’s official channels have not yet made any further response to this matter. Odaily Planet Daily will continue to pay attention to you and follow the latest developments in a timely manner.

This article is sourced from the internet: A $13 million ETF dispute

Related: This Is How Fetch.ai (FET) Could Enter a 25% Bull Rally

In Brief Fetch.ai’s price is holding above a key support level, from which the altcoin has generally bounced back. The altcoin is noting a buy signal flashing at the moment owing to increased participation and low prices. The Sharpe Ratio for FET is bouncing back from a 6-month low, suggesting the altcoin is undervalued. Following the broader market cues, Fetch.ai’s (FET) price fell below the support of $2, but it is likely on the verge of bouncing back. This is because the altcoin is in an ideal spot for accumulation, indicating potential gains going forward. Fetch.ai Is Undervalued Fetch.ai’s price could observe a recovery, given the altcoin is trading above a key support level. Currently, the altcoin is noting a surge in participation. This is evident in the increase in active addresses in the last 48…