Los usuarios activos diarios alcanzan un nuevo récord: ¿se está recuperando con fuerza el sector de los juegos Web3?

Autor original: flowie, ChainCatcher

Traducción original: Marco, ChainCatcher

Los juegos Web3 parecen estar entrando en una fuerte fase de recuperación.

Recientemente, con el lanzamiento del juego social Notcoin (NOT), respaldado por 900 millones de usuarios activos de Telegram, en los intercambios Binance y OKX al mismo tiempo, los juegos Web3 han vuelto a atraer una atención masiva en el mercado de criptomonedas.

Según Jack Booth, director de marketing de la Fundación TON, en comparación con los 2 millones de usuarios activos diarios del rey de los juegos de la Web3 de primera generación, Axie Infinity, en su apogeo, Notcoin alcanzó los 6 millones de usuarios activos diarios durante la etapa de minería. En casi 3 meses, el número de usuarios aumentó a 35 millones.

El 16 de mayo, los datos oficiales de Notcoin mostraron que el valor de mercado de NOT superó los 10.820 millones de dólares solo una hora después de su lanzamiento en varios intercambios.

Además del asombroso crecimiento de Notcoins, según el informe de juegos blockchain de abril publicado por DappRadar y Blockchain Game Alliance, todo el mercado de juegos blockchain tiene una clara tendencia de crecimiento, con un promedio de 2,9 millones de billeteras activas independientes (dUAW) por día en abril, un aumento de 17% desde marzo.

Los datos de Footprint Analytics muestran que el promedio de usuarios activos diarios (billeteras/jugadores) de juegos blockchain superó los 3 millones en abril.

Además, el informe de DappRadar afirmó que la inversión en el sector de juegos blockchain alcanzó los US$$988 millones en abril, un nuevo máximo desde enero de 2021.

Dos importantes firmas de capital de riesgo recaudaron casi 10.900 millones de TFP para ahorrar munición para los juegos de la Web3

La inversión total en juegos Web3 en el primer trimestre de 2024 fue de alrededor de 288 millones, mientras que la inversión total en abril aumentó repentinamente en más de 2 veces, principalmente debido a la finalización de una nueva ronda de recaudación de fondos por parte de dos importantes firmas de capital de riesgo, a16z y Bitkraft Ventures.

El 17 de abril, a16z anunció que había recaudado con éxito un nuevo y enorme fondo de 10.000 millones de dólares, de los cuales 10.000 millones de dólares se asignarían a la industria del juego, incluidas empresas que desarrollan nuevos juegos, plataformas de juego, tecnologías relacionadas con los juegos u otras innovaciones de la industria del juego.

Respecto al uso de los fondos de inversión de la industria de los juegos por valor de $600 millones, Andrew Chen, socio general de a16z y director de a16z Games Fund One, reveló que se utilizarán para crear un segundo fondo de juegos que cubra campos más diversos: desde IA, juegos Web3, VR/AR, herramientas 3D, aplicaciones de juegos hasta estudios, etc.

Anteriormente, Andrew Chen había anunciado que invertiría un total de 130 millones de dólares en varias compañías de juegos, incluidos juegos Web3, a través del programa a16z Speedrun antes del 19 de mayo, y cada startup que se uniera al programa Speedrun recibiría 750.000 dólares.

Los datos de RootData muestran que los juegos Web3 son la segunda área de inversión más grande en las inversiones en criptomonedas de a16zs después de la infraestructura, y ha invertido en al menos 25 juegos Web3.

Desde principios de este año, a16z ha participado en dos inversiones en juegos Web3, una es la financiación Serie A de $13 millones del juego de disparos NFT del fin del mundo MadWorld, y la otra es la financiación de $8 millones de MyPrize, un desarrollador del ecosistema GambleFi.

Además de a16z, otra firma de capital riesgo, Bitkraft Ventures, también anunció el lanzamiento de su tercer fondo de juegos en abril. El fondo ha recaudado 10.275 millones de TPP y se centrará en estudios, tecnologías y plataformas de juegos en las etapas de capital inicial y Serie A.

Bitkraft Ventures también anunció recientemente la introducción de dos nuevos ejecutivos para expandir el mercado asiático de juegos Web3, a saber, Jin Oh, ex presidente de Riot Games y CEO de Garena, y Jonathan Huang, ex vicedirector de Temasek.

Bitkraft Ventures ha estado muy activo en la inversión en juegos Web3. En 2021, Bitkraft Ventures recaudó 10 T75 millones de TP y lanzó su primer fondo de tokens para invertir en juegos blockchain y entretenimiento digital. A fines de marzo de 2023, Bitkraft Ventures recaudó otros 10 T220 millones de TP para su segundo fondo de tokens.

Hasta la fecha, Bitkraft Ventures ha anunciado públicamente cerca de 50 inversiones, la mayoría de las cuales están en el sector de los juegos Web3, con casos representativos como YGG e Immutable.

Desde principios de este año, Bitkraft Ventures ha participado en la inversión de cuatro proyectos de juegos: Metalcore, MadWorld, Avalon y My Pet Hooligan. Entre ellos, MadWorld fue invertido junto con a16z.

Los usuarios activos diarios alcanzan un nuevo récord. ¿Qué juegos de la Web3 lideran el grupo?

En medio de la crisis general en el mercado de criptomonedas, el número de usuarios activos de juegos Web3 está aumentando.

Robin Guo, inversor de juegos de a16z, citó a Footprint Analytics en la plataforma social y exclamó: El MAU (usuarios activos mensuales) de los juegos de Web3 es de 3,3 millones, lo que es mucho más alto que el pico creado anteriormente por Axie. Si no se limpian los datos, estoy seguro de que muchos de ellos son robots, pero el crecimiento reciente liderado por Pixels sigue siendo impresionante. Parece que esto realmente se pasa por alto.

Según un informe de DappRadar, el número de dUAW (billeteras activas únicas diarias) para juegos Web3 alcanzó los 2,9 millones en abril, un récord.

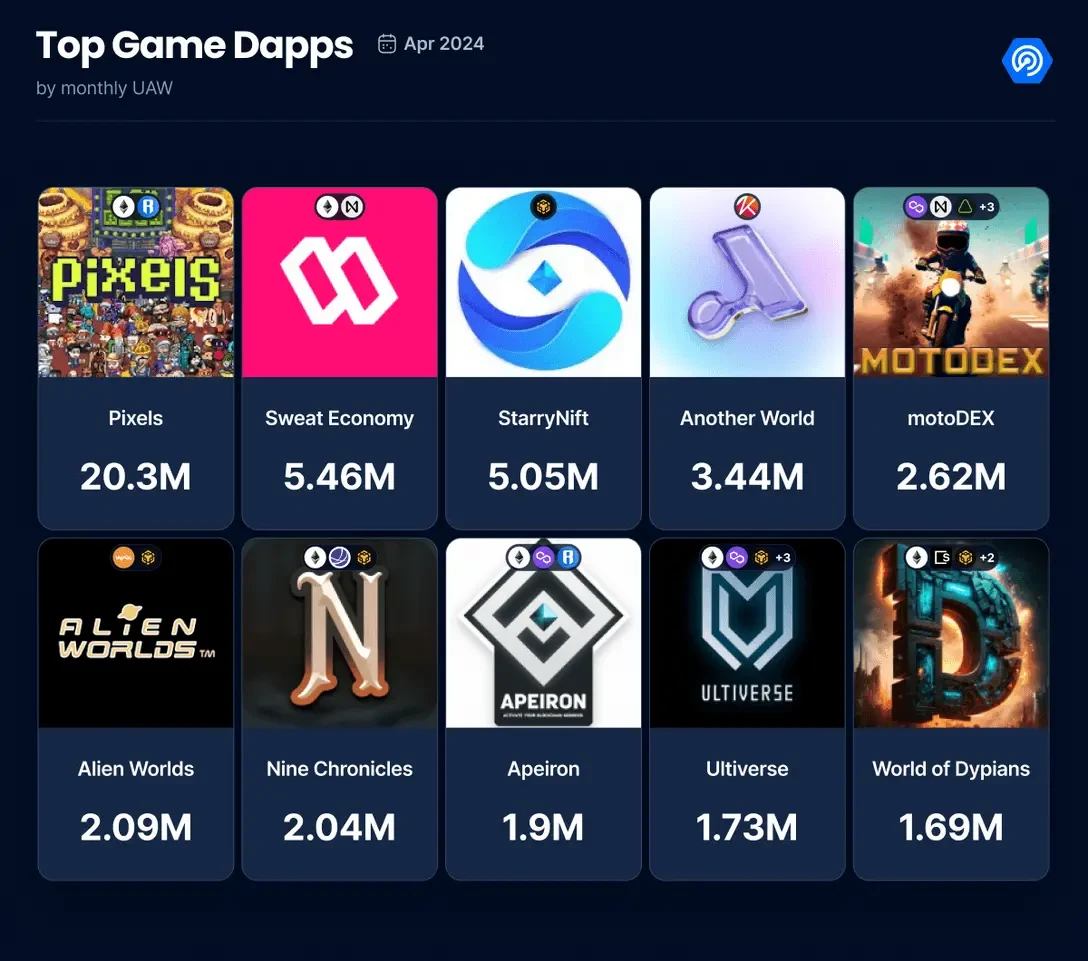

Entre ellas, las diez mejores aplicaciones de juegos Web3 clasificadas por UAW (dirección de billetera única) tienen UAW que supera los 1,5 millones. Pixels todavía ocupa una posición dominante sólida, con UAW que supera los 20 millones, mientras que Sweat Economy y StarryNift le siguen de cerca, con UAW que también supera los 5 millones.

La mayoría de estos 10 juegos se lanzaron alrededor de 2020 y 2021.

Píxeles es un juego de agricultura basado en píxeles lanzado en 2021. Migró de Polygon a la red Ronin a fines del año pasado. Ronin es la cadena de máquinas virtuales Ethereum (EVM) desarrollada por Sky Mavis, el desarrollador de Axie Infinity. El crecimiento de Pixels también convierte a Ronin en la cadena de juegos más activa en la actualidad.

Pixels fue incluido en Binance en febrero de este año y, al 21 de mayo, su capitalización de mercado totalmente diluida era de alrededor de 10 T1.9 mil millones de dólares.

Economía del sudor es un juego de fitness en el que hay que moverse para ganar. Es un juego pequeño modificado a partir de una cadena de aplicaciones de fitness tradicional con 100 millones de usuarios. Sweatcoin está basado en la cadena Near.

StarryNift es una plataforma de metaverso de co-creación mejorada con IA que brinda una experiencia virtual 3D inmersiva para juegos, creación y socialización. El fundador de StarryNift fue socio fundador de Matrix y cofundador de DEx.top. StarryNift ha completado tres rondas de financiación, con inversores que incluyen a OKX Ventures, SIG Asia Ventures, Binance Labs, GBV Capital, BNB Chain Fund, Alameda Research, LD Capital, Coingecko Ventures, etc.

Fundada en 2021, Otro mundo es un proyecto metaverso Web3 coreano construido sobre la cadena Klaytn. Anteriormente conocido como Terra World, acaba de completar la versión beta pública. Según informes públicos, Another World cuenta con el apoyo de Kakao Group y LG Group de Corea del Sur, con una gran comunidad global de usuarios de 200.000 y un potente sistema de tokens blockchain.

Mundos alienígenas es un juego de exploración espacial relativamente antiguo que integra DeFi, NFT y DAO. En 2021, recibió $2 millones en financiación de Animoca Brands, LD Capital y otros. Al 22 de mayo, el valor de mercado totalmente diluido de su token TLM superó los $100 millones.

MotoDex es un juego de carreras de motos creado en la cadena lateral de Ethereum SKALE. Según los datos de DappRadar, su UAW en los últimos 30 días ha superado al de Pixels.

Nueve crónicas es un juego de rol descentralizado de larga trayectoria que ha recibido dos rondas de financiación, en las que han participado Binance Labs y Animoca. Al 22 de mayo, el valor de mercado circulante totalmente diluido del token WNCG de Nine Chronicles era de alrededor de $70 millones.

Apeiron es un juego de duelo de cartas y simulación de dioses. En diciembre del año pasado, Apeiron anunció su migración a la red Ronin. Completó una ronda de financiación inicial de $10 millones liderada por Hashed en 2022. El 28 de febrero, se lanzó la versión beta pública de Apeiron Arena en la tienda de Epic Game, donde los jugadores pueden ganar puntos de airdrop ANIMA descargando y participando en la competencia. Su token APRS se lanzó en Bybit, el intercambio descentralizado Katana de la cadena de bloques Ronin, y al 22 de mayo, el valor de mercado completamente diluido era de $580 millones.

Ultiverio es una plataforma de juegos de inteligencia artificial con una sólida base de inversores detrás de ella. Ha completado tres rondas de financiación, con un total de $1350 millones. Binance Labs participó en dos de las rondas, y IDG Capital, Animoca Brands, DWF Labs y muchas otras instituciones de inversión conocidas también participaron en la inversión. El 3 de mayo, el volumen de negociación de 24 horas del NFT de chips de oro Ultiverse superó los 1100 ETH, ocupando el primer lugar en la lista de transacciones de BLUR.

El mundo de Defish es un mundo de juegos NFT descentralizado que se ejecuta en la cadena BNB, incubado por la plataforma IDO descentralizada Poolz e invertido por Poolz Ventures.

Además de estos 10 juegos Web3 con mayor UAW, también destacan los usuarios activos mensuales del juego de disparos para móviles Matr1x en los últimos 30 días. Matr1x recibió financiación estratégica de Animoca en febrero y en las tres rondas de financiación anteriores participaron instituciones tan conocidas como OKX Ventures, SevenX Ventures, Folius Ventures, ABCDE y Hashkey Capital.

Conclusión

Si bien hay juegos populares como Pixels y Notcoin en este mercado alcista, parece haber cierta brecha en comparación con los juegos fenomenales como Axie y STEPN que lideraron el nuevo paradigma de los juegos Web3 en ese momento.

Después del período P2E, los puntos calientes de inversión de capital de riesgo en juegos Web3 son, en primer lugar, las obras maestras 3A que intentan crear una experiencia de juego Web2, y en segundo lugar, los juegos de cadena completa que se comprometen a poner todo el contenido, como la lógica y los activos del juego, en la cadena.

En la actualidad, los juegos de blockchain 3A también enfrentan dudas sobre si son solo especulación de capital debido al alto costo de producción y al largo período de implementación. Por el contrario, los juegos cortos, rápidos y livianos como Notcoin han atraído mucho tráfico. ¿El próximo juego fenomenal de Web3 nacerá en los juegos sociales?

Este artículo proviene de Internet: Los usuarios activos diarios alcanzan un nuevo récord, ¿se está recuperando con fuerza el sector de los juegos Web3?

Relacionado: 5 altcoins que debes tener en cuenta en mayo

En breve Harmony (ONE) alcanzó recientemente el hito de $1 millón en volumen de transacciones. El creciente interés en la inteligencia artificial probablemente impulsará a Render y NEAR Protocol hacia arriba. Dogwifhat (WIF) ha sorprendido al mercado de las monedas meme con su reciente aumento, colocándola en la lista de vigilancia imprescindible. La dinámica cambiante del mercado de criptomonedas ha abierto Harmony (ONE), Render (RNDR), Near Protocol (NEAR), dogwifhat (WIF) y Stellar Lumens (XLM) a posibles ganancias. BeInCrypto ha analizado la dirección que podrían tomar estas criptomonedas y cómo afectaría a todo el mercado de criptomonedas. Harmony (ONE) alcanza un nuevo hito ONE ha superado con éxito los $1 millón en volumen de transacciones. Esto demuestra que la cadena está notando un aumento en el uso y la demanda, lo que también podría impulsar su acción de precio. Al escribir, la altcoin se puede ver…