Diálogo con el cofundador de Magic Eden: Solo se considerará Bitcoin L2 nativo y se deberían implementar incentivos de mercado multicadena

Original title: Zedd: Unpacking the long march of Magic Eden towards the market winner

Original source: Mabel Jiang, HODLong

Original translation: Ladyfinger, Lucy, BlockBeats

This article is compiled from the podcast HODLong, which aims to explore the development of the Web3 community with listeners. The dialogue guests include project operators, investors, other ecosystem participants, etc., with a special focus on the Web3 community in Asia. This episode interviewed Zedd, co-founder of Magic Eden, hosted by Mabel Jiang, the host of HODLong. Mabel Jiang was a partner of Multicoin Capital and is currently the growth officer of STEPN, Gas Hero, FSL Ecosystem and MOOAR.

Before entering the cryptocurrency field, Zedds early career was consulting for corporate clients at Bain Company. Then in 2017, Zedd joined dYdX, which became his starting point for entering the crypto field. It was also during his time at dYdX that Zedd met Mabel Jiang.

Zedd has been working full-time in the cryptocurrency industry since 2017, when the crypto market ecosystem was still small and people were mainly building some DeFi protocols. Zedd then left dYdX and joined Coinbase as a product manager, where he worked for about a year and a half until he founded Magic Eden in September 2021.

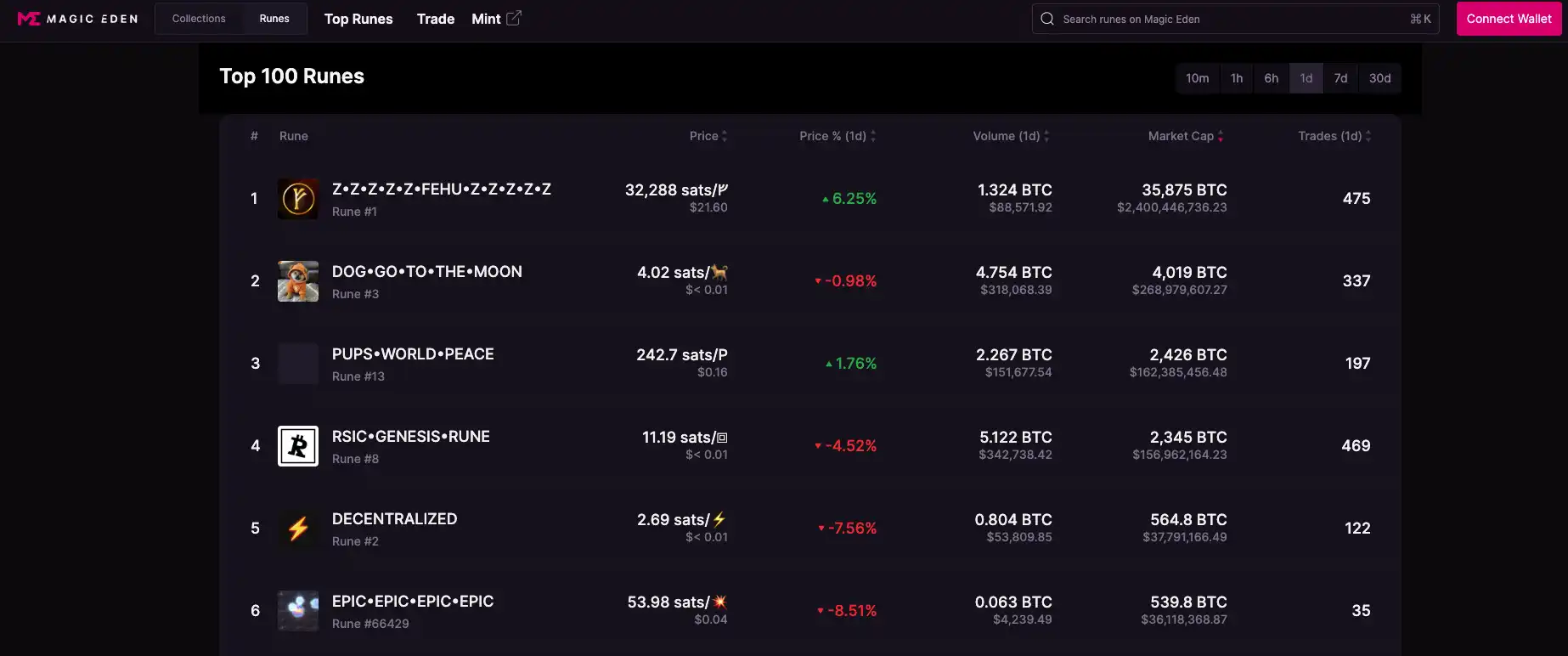

At that time, NFT was very popular on Solana, so Magic Eden initially focused on the Solana market for about a year. At present, Magic Eden has penetrated other chains such as Bitcoin and Polygon, especially its close connection with the Bitcoin ecosystem has almost made it the king. According to DappRadar data, the 24-hour transaction volume of Magic Eden NFT market reached 6.76 million US dollars, only lower than Blurs 24-hour transaction volume of 15.93 million US dollars, becoming the second largest NFT market in terms of transaction volume.

The biggest advantage of Magic Eden is that the transaction cost is extremely low, which provides users and creators with a more economical trading option compared to the traditional NFT market. In addition, the platform does not charge creators for listing NFTs, a policy that further lowers the threshold for artists and creators to enter the market. This podcast discusses the work that Magic Eden has done to explore the multi-chain market. BlockBeats translated the original text as follows:

How does Magic Eden create a multi-chain market?

From Solana to EVM Ecosystem

Mabel Jiang: When you decided to expand into the Polygon market, did you consider other options?

Zedd: Although there werent as many choices as there are now, we did have a few options in front of us at the time. During the evaluation process, we also considered Immutable, which had achieved some success in the gaming field. At the same time, we also considered Polygon and Avalanche (Avax). However, at that time, no platform could show a clear leading advantage that made us feel that we had to choose it, so each choice was accompanied by certain risks and uncertainties.

After careful consideration, the main reason we decided to choose Polygon is because many teams have already started trying new projects there, and Polygon is actively cooperating with many game projects in commercial development. So we think it will be a suitable starting point and help us enter the EVM ecosystem smoothly.

Mabel Jiang: You guys are already influential on Solana, but Ethereum and Polygon are completely new territory for you. How is the experience of building on Polygon and Ethereum? How did you initially enter this ecosystem?

Zedd: I must say that the whole process was indeed very challenging, mainly for several reasons. First, our decision to launch the product at that particular point in time was a very unwise decision. We launched our product on the Polygon platform two months after the FTX incident. We had already started the integration with Polygon before the FTX incident broke out.

However, the Solana ecosystem was also affected by the FTX incident, which led to the outside world mistakenly believing that we had abandoned Solana, but this is absolutely not true. The real challenge for us was that we failed to effectively communicate our vision, plans, and our long-term commitment and loyalty to Solana.

Another challenge we face is to deeply understand and integrate into the community. First, there needs to be more talents within the company who have a deep understanding of EVM and Ethereum. Second, it is more difficult than we thought to establish our influence in this community. Although we have achieved certain success in the Solana community, which gives us confidence, we need to work harder to gain the same recognition in the Ethereum community.

If we were to grade ourselves for our initial work in the Ethereum community, I would say a B, meaning we still have room for improvement. We have not yet achieved widespread success in the Ethereum ecosystem, especially outside of the existing NFT market.

However, as we continued to deepen our work in the EVM field, we began to find opportunities for collaboration. We have established partnerships with senior creators of Ethereum, such as Yuga Labs, Pudgy, and Azuki, helping them deal with royalties and other issues. These collaborations not only help us better integrate into the market, but also gradually make us a true multi-chain market participant. Although the initial challenges were great, we finally made progress in the Ethereum community through unremitting efforts and strategic adjustments.

Mabel Jiang: Can you share some details about your collaboration with Yuga Labs? I understand that you built an NFT mercado for them. Is this similar to a white label solution?

Zedd: We have been in constant communication with the Yuga Labs team over the past six months, and we have a connection because our Chief Gaming Officer has worked with Yuga Labs’ former Chief Gaming Officer, Spencer. Through this relationship, we have gradually gotten to know each other. Yuga has witnessed our efforts in dealing with royalties on the Solana platform.

Yuga reached out to us when the existing Ethereum marketplace decided not to support royalties anymore. We then discussed together whether we could create a platform that would benefit not only Yuga but the entire creator ecosystem, which led to building a marketplace that respected royalties, which we launched about four or five months ago. Basically, this gave us more footholds and breakthroughs in the Ethereum ecosystem, which we lacked before.

Deep into the Bitcoin Ecosystem from Ordinals

Mabel Jiang: How did you decide to build a Bitcoin marketplace?

Zedd: We had an internal hackathon, and ten engineers worked in California for a week, and we launched the market very quickly. The whole process took about three weeks, and we are also developing a multi-chain wallet so that assets can be exchanged on different chains.

Mabel Jiang: What was the process like for you to start building things in the Bitcoin ecosystem?

Zedd: The whole process was really crazy. In 2022, the Ordinals protocol was far from our horizon. However, in early 2023, a member of our team introduced the Ordinals protocol to us, and at first we thought it was just a theoretical concept. But soon, we realized that this technology is feasible and there is a real demand for it. We observed in the Ordinals Discord channel that people had already started trading there, even using spreadsheets to complete over-the-counter trades. This activity convinced us that users were eager to trade this type of asset.

Based on this discovery, we decided to build a marketplace. At the time, we were unsure if we could create a trustless, non-custodial marketplace. At this critical juncture, my co-founder Rex designed an architecture over a weekend and showed us that this idea was feasible.

Mabel Jiang: What company-level adjustments have you made for this?

Zedd: It is indeed a challenge. We basically operate in a business unit model, that is, the market operating on each chain is regarded as an independent business unit. Each unit is equipped with a dedicated product manager, engineering team and business team. This structure ensures that the engineering team and the business team can work closely together to quickly respond to market changes and implement decisions. At the same time, we also need to ensure that the team can collect user feedback in a timely manner and quickly iterate products based on this.

Mabel Jiang:For Solana users, when they switch to Bitcoin, they may need to find a new wallet extension or other way to use it. In this case, will they give priority to using your wallet?

Zedd: Yes, many users will download the Magic Eden wallet, convert some Sol to Bitcoin, and then start using Ordinals. In addition to this, there are some other Bitcoin wallets, such as OKX and Uniswap, which mainly serve Chinese users, and Xverse, which serves both Western and Chinese users. These are the main Bitcoin wallets outside of Magic Eden.

Mabel Jiang: Regarding Bitcoin NFT, what are the characteristics of your target user group?

Zedd: We find that there are many more Asian users using Bitcoin products than Solana. In addition, we also have a lot of users using Solana who are also using our Bitcoin products. There is more crossover across the ecosystem than people think. We have a lot of users who are willing to try new things and have a growth mindset.

Mabel Jiang: What trends do you think these Bitcoin NFTs will have in the future?

Zedd: I think there will be more NFT Ordinals created. These projects are not NFTs with practicality, which I think is actually a good thing. Lets just call it a collectibles market, you dont need to attach any practical functions to them. This is the main difference between NFTs on Bitcoin and the NFTs we see on Solana and Ethereum.

What a lot of people are building right now is tooling around how to mint and burn Ordinals and runes. There are also a lot of people trying to find other ways to simplify these transactions because its obviously more difficult to trade on Bitcoin L1. When you trade Solana meme coins and then go to Ordinals, its like going to a SPA.

Mabel Jiang: Can you quickly explain what Runes and NFTs are and the difference between them?

Zedd: Ordinals can basically be seen as NFTs, which are different from NFTs on ETH and SOL, which actually burn the media or data directly on the chain. BRC 20 and runes are basically different FT standards. There are actually more such as BRC 420 and so on, but the main ones are BRC 20 and runes.

Runes is very new, only about three to four weeks old, while BRC 20 has been around for almost a year. Runes is kind of like a more user-friendly version of BRC 20, without the need for some engraving activity to transfer them. Runes is also developed by the same team that developed the Ordinals protocol. There is a small team working on the core development of Ordinals, which is one of the reasons why Runes has received a lot of attention and hype.

Mabel Jiang: Have you built a DEX?

Zedd: We are actually working with Exodus. Users can convert Sol, ETH, Bitcoin, etc. to USDC through the Magic Eden wallet.

Mabel Jiang: Have you considered building L2 yourself?

Zedd: We don’t really have enough resources to deal with this issue right now. If we have to talk about Bitcoin L2, we will only consider building a native Bitcoin L2, not these so-called L2s now. Because they are obviously not native Bitcoin L2, but just call themselves Bitcoin L2 for narrative, which is actually more like Bitcoin sidechain.

Mabel Jiang: Do you have plans to expand support to other blockchains in the future?

Zedd: We are closely monitoring the market, and although we are not actively developing it, we have noticed that there is not much activity on the EVM chain. At the same time, we are also paying attention to some projects that are building their own chains.

How to deeply understand and integrate into the community?

Targeting Incentives to Buyers

Mabel Jiang: Blur seems to have achieved good results in liquidity incentives. How do you view the competition with them?

Zedd: Since we have not yet entered the Ethereum field, we do not have much perception of the dynamics on the platform. Our core focus is on the actual usage of users, rather than the pure transaction volume, because the transaction volume indicator is easily affected by incentives. We are more focused on analyzing user activity and actual income.

Blur has done a great job in incentivizing liquidity, which we think is a smart strategy. However, we have always believed that the platform we pursue should not rely solely on liquidity incentives. We prefer to focus on user activity and revenue because these metrics are more realistic about the health of the platform. In addition, we also realize that over-reliance on trading volume as a metric can be risky.

Mabel Jiang: How effective is the trading reward gamification strategy you implemented on Magic Eden?

Zedd: We implemented a reward called diamonds and it worked very well. Our original intention was to explore multiple ways to incentivize and reward users, rather than turning it into a pure zero-sum game. Especially in the Bitcoin market, our rewards and incentives are mainly for buyers, and the purpose of doing so is to encourage people to buy NFTs. We dont want all incentives to favor sellers, because doing so may cause the floor price to be adversely affected. Our goal is to create a more robust and healthy market environment.

Mabel Jiang: In the field of games, we noticed that Magic Eden has made a lot of efforts, especially in the past year. How do you evaluate the effectiveness of these efforts? In this process, are there any learnings and inspirations worth sharing?

Zedd: Since the end of 2022, we have formed a game team of about four people, mainly driven by business development. The main task of this team is to work with game projects, assist them in launching NFTs, and provide support in using the market. Looking back on the past 18 months, we found that it has been a very interesting experience. In 2021 and early 2022, the game industry experienced a wave of hype. However, in the past year and a half, many game teams have been focusing on deepening their roots, and there have not been many new activities in the market.

In addition, we also face another challenge, that is, from a product and engineering perspective, the infrastructure required for each game project is very customized, and we have not yet provided deep enough customization support for each game. This means that we still need to make more efforts to understand and meet the unique needs of each game project.

Build a strong native community

Mabel Jiang: What effective measures have you taken to build and cultivate native communities?

Zedd: In order to build a strong native community, we took several key measures. First, we ensured that there were members within the company who could represent and understand the community culture, which was crucial. Second, we paid great attention to communication and social media interaction with the community to keep it active and engaged.

Third, we actively hold offline events. No matter which conference, we will organize related activities to strengthen the connection with community members. Finally, we learn from past mistakes and continue to improve, which has significantly strengthened our relationship with the community. Through these efforts, we are now more closely connected with the community than ever before.

Mabel Jiang: Has your user base changed over the years?

Zedd: Aside from the geographic location, not much has changed. There are many more people on Bitcoin now than there were two years ago.

Mabel Jiang: How big is your team now?

Zedd: About 100 people.

Mabel Jiang: What does it mean to you that your Bitcoin users are from Asia? Do you want to expand your community in Asia?

Zedd: We have a lot of Solana users who are also using our Bitcoin products, which speaks to the crossover nature of our users. We are not building a community specifically in Asia right now, but that is something we would like to achieve.

Mabel Jiang: How do you build a community without native language team members?

Zedd: I admit that it is indeed difficult, and we are not really building a community in Asia at the moment. We need to find the right people and then invest resources to make this happen. If there are people who are passionate about NFTs and our products and are willing to develop a community in Asia, we are happy to talk to them.

This article is sourced from the internet: Dialogue with Magic Eden Co-founder: Only native Bitcoin L2 will be considered, and multi-chain market incentives should be oriented towards buyers

Relacionado: Cardano (ADA) se estabiliza: ¿La compra de ballenas hará subir el precio?

En resumen, las ballenas aprovecharon la última caída para acumular ADA, pero esta acumulación se estabilizó durante la semana pasada. El número de comerciantes a corto plazo que poseen ADA está disminuyendo, lo que podría conducir a una reducción de la volatilidad de los precios. Las líneas de la EMA indican un patrón de consolidación, pero existe la posibilidad de que surja un cruce dorado en breve. Las ballenas aprovecharon la reciente caída para acumular Cardano (ADA), lo que llevó a una notable estabilización en el precio de ADA durante la última semana. Este período de acumulación coincidió con una reducción del número de operadores a corto plazo que poseían ADA, lo que sugiere una posible disminución de la volatilidad de los precios. Al mismo tiempo, las líneas EMA para el precio de ADA demuestran un patrón de consolidación, lo que sugiere un equilibrio del mercado. A pesar de esto, se anticipa una cruz dorada en el futuro cercano, una señal técnica a menudo asociada con alcista...