Análisis macro de SignalPlus (20240517): La prosperidad ideal perfecta regresa

Stock prices once again challenged record highs in the early trading session before retreating, while U.S. Treasuries also experienced a bearish trend, with short-term yields rising slightly due to a sharp increase in import prices (0.7% month-on-month vs. 0.1% expected).

With little important data until next Wednesday, when Nvidias earnings report is released, options imply a +/-8% stock price volatility, slightly lower than its two-year average of +/-8.4% and +10.9% in February. Given the chip giants outsized weighting in the SPX, an 8% implied volatility means an impact of about 0.4% on the SPX, not to mention the spillover effect on sentiment for other related stocks in the index.

In addition to higher-than-expected import prices, an expected rebound in oil prices during the busy summer driving season could keep CPI pressures in place until August, though inflation traders remain confident that CPI will fall back below 2.5% by the end of the year.

Unwavering confidence in inflation and a lack of economic risk have allowed markets to focus purely on interest rate trends, resulting in a perfect negative correlation between U.S. Treasury yields and stock prices since mid-December. In other words, stock and bond prices have risen in tandem in a perfectly ideal boom, (again) ignoring tail risks that could come from a further economic slowdown, stubborn inflation, or a valuation correction.

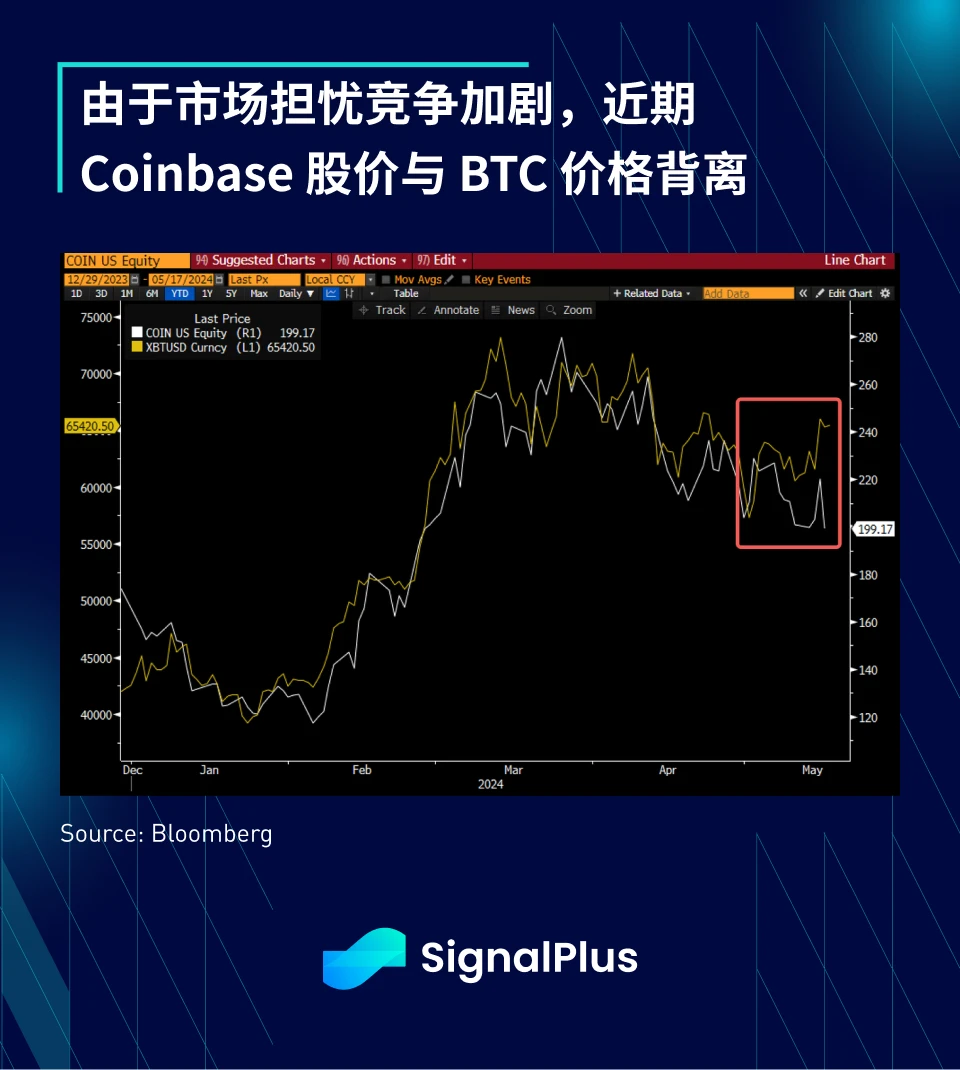

There is not much news worth noting in the cryptocurrency sector, with BTC holding steady at recent highs and trading activity flat. However, Coinbases stock price fell 9% yesterday, a significant divergence from the BTC price, as investors began to worry that the entry of institutions such as CME into the spot trading business will lead to increased competition in the compliance field. The entry of TradFi will undoubtedly bring the inflow of funds needed by the industry, but it will also certainly trigger new competition. What will the cryptocurrency market look like in a year or two? We will wait and see.

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240517): Perfect ideal prosperity returns

En la conferencia BitcoinAsia de mayo, el fundador de Merlin Chain, Jeff, pronunció un discurso titulado From Bitcoin L1 to Merlin Chains Native Innovation, en el que exploró en profundidad cómo la innovación nativa de Merlin Chains puede potenciar el ecosistema de Bitcoin. Revisó la evolución del ecosistema de Bitcoin y exploró en profundidad cómo la innovación nativa de Merlin Chains promoverá el desarrollo del ecosistema de Bitcoin. A continuación, se incluye el texto completo del discurso, compilado en base a la grabación in situ. Antes de 2023, Bitcoin siempre se consideró un oro digital para el almacenamiento de valor y nadie estaba creando nuevos conceptos y aplicaciones en torno a Bitcoin. Pero después de la locura de los Ordinals a mediados de 2023, cada vez más personas comenzaron a crear contenido relacionado con NFT en la red de Bitcoin, emitiendo activos como BRC-20, BRC-420 y ORC-20, y luego Atomicals…