Columna de volatilidad de SignalPlus (16/05/2024): la macroeconomía es positiva, BTC vuelve a 66.000

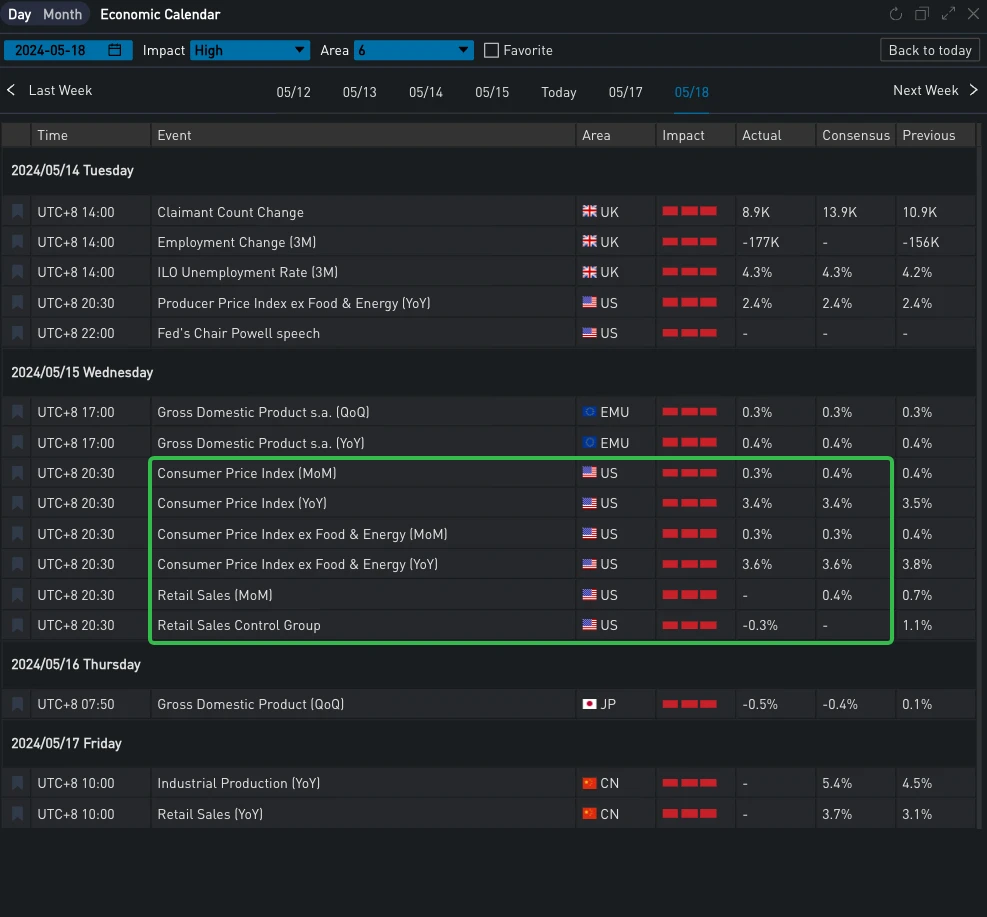

Ayer (15 de mayo de 2024) se publicaron importantes datos económicos. En los últimos días, tres datos consecutivos de inflación superaron las expectativas, mientras que el índice de precios al consumidor de EE. UU. estuvo aproximadamente en línea con las expectativas; los datos minoristas se mantuvieron inesperadamente estables, lo que continúa la reciente debilidad de los datos de consumo. Aunque el nivel actual de inflación y el impulso siguen siendo mucho más altos que el objetivo de la Reserva Federal, estos dos datos han aliviado hasta cierto punto las preocupaciones del mercado sobre la reaceleración de los precios, han restablecido la confianza del mercado en el recorte de tasas de septiembre de la Reserva Federal y los rendimientos de los bonos del Tesoro de EE. UU. cayeron en el corto plazo. Los tres principales índices bursátiles de EE. UU. también cerraron con un alza de alrededor de 1%, estableciendo un máximo histórico.

Fuente: SignalPlus, Calendario Económico

Fuente: Invertir

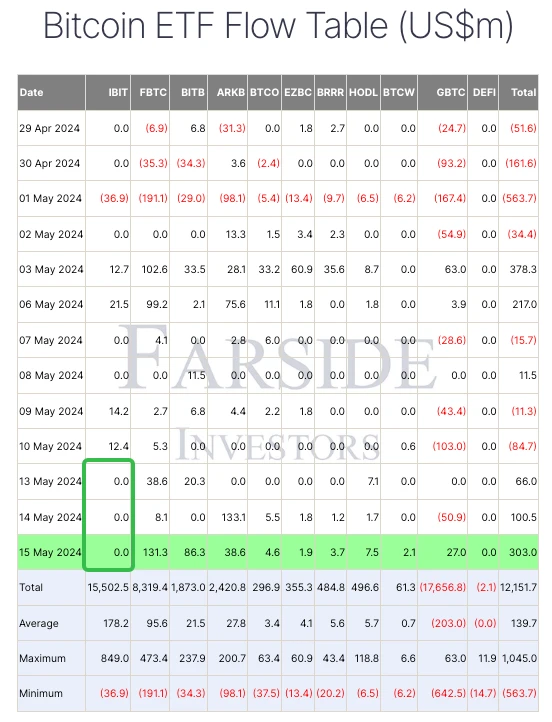

En términos de monedas digitales, impulsado por el debilitamiento de los datos económicos de EE. UU., el precio de BTC ha estado subiendo hasta superar la marca de 66.000, atrayendo el carnaval de la comunidad. La reciente entrada de BTC Spot ETF también es relativamente saludable. Aunque IBIT ya no tiene crecimiento, la entrada total por día ayer alcanzó 303 $m, principalmente aportada por FBTC y BITB. Por otro lado, del cuadro comparativo a continuación, podemos ver que el rendimiento de ETH en esta ronda de mercado es relativamente pobre. En las últimas 24 horas, solo ha ganado la mitad del aumento de BTC y ha regresado a las cercanías de los 3.000 dólares estadounidenses.

Fuente: TradingView

Fuente: Inversores de Farside

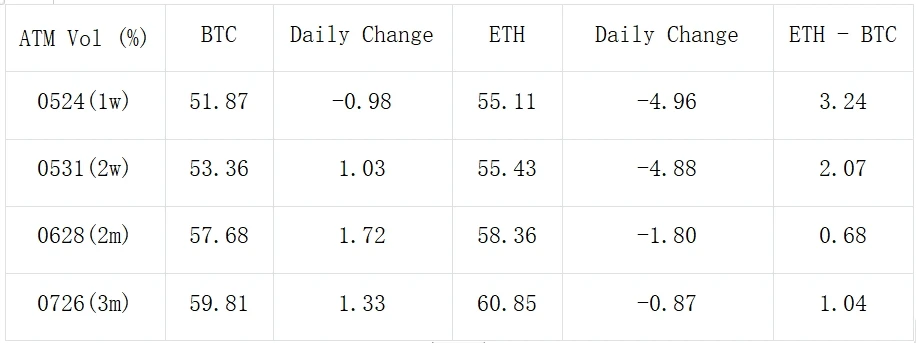

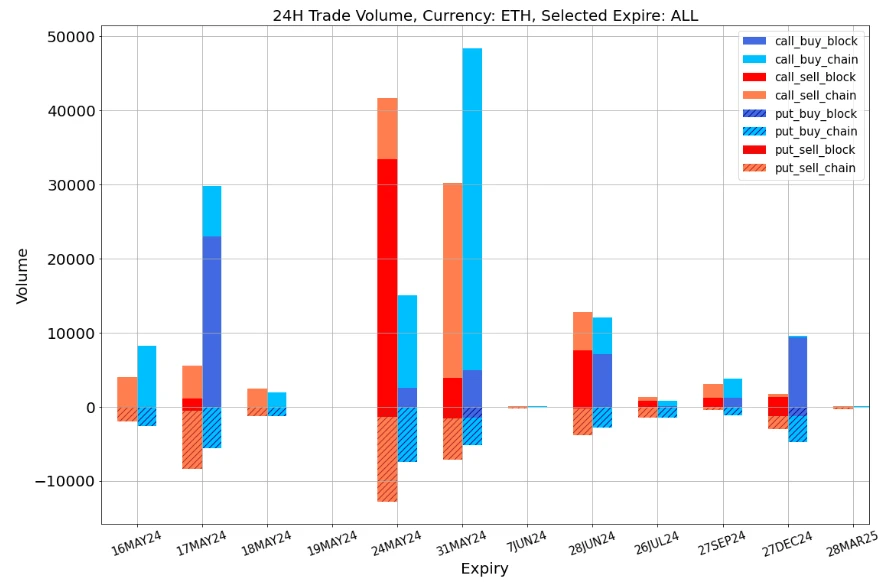

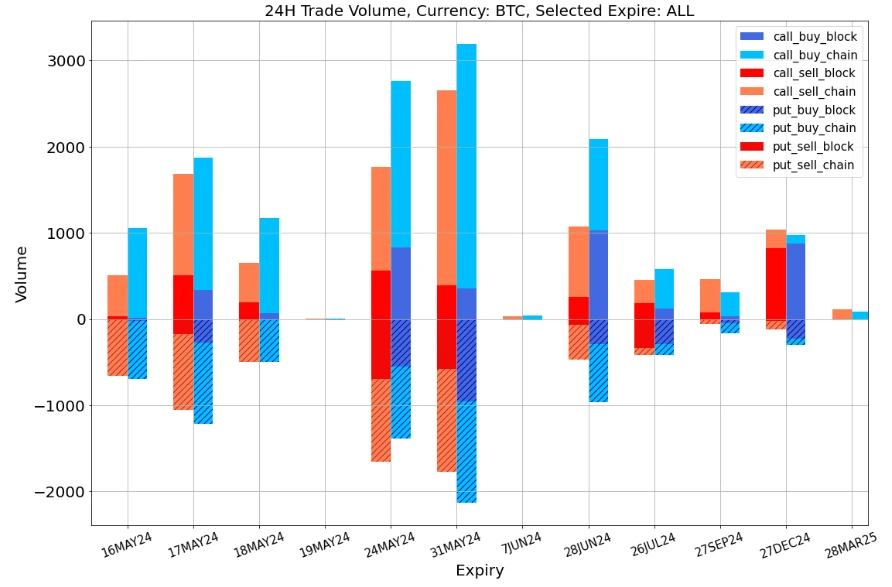

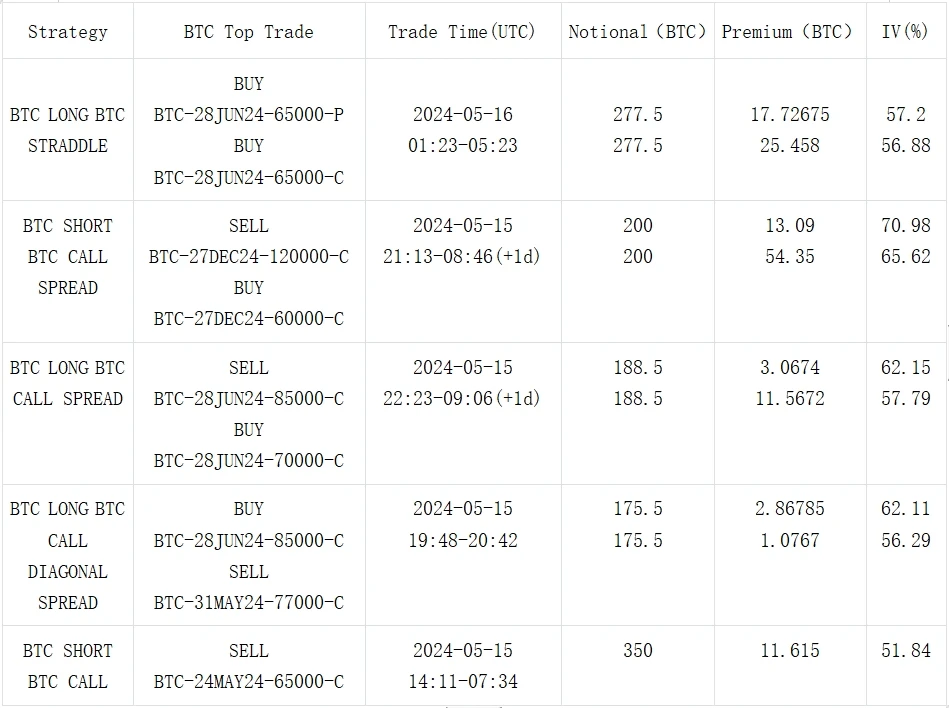

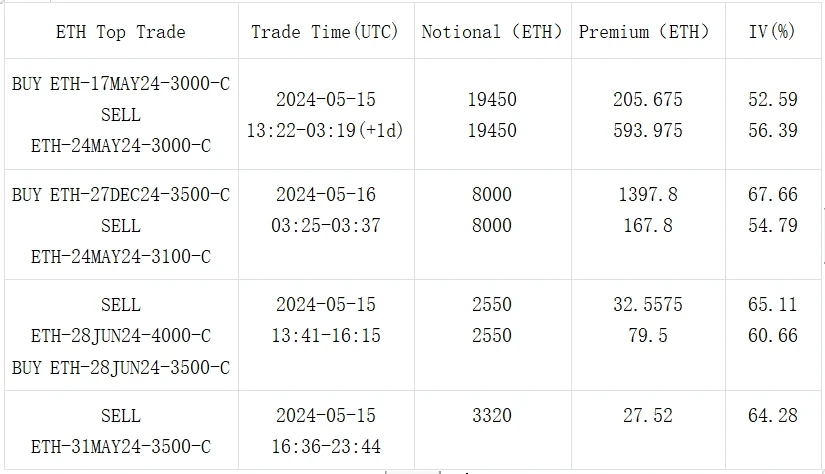

En términos de opciones, los niveles de volatilidad implícita de BTC y ETH también mostraron cambios muy diferentes. El cambio principal de BTC se refleja en el movimiento ascendente del IV de mediano y largo plazo. Las operaciones en bloque en el último día también se distribuyen principalmente en el mediano y largo plazo. El más grande es el Long Straddle de 277,5 BTC por tramo, que es alcista en la volatilidad a fines de junio, y el diferencial diagonal de venta de mayo y compra de call de junio. El IV de front-end de ETH cayó bruscamente, atrayendo un grupo de transacciones de compra 17 MAY vs. venta 24 MAY con un volumen de hasta 19.450 ETH por tramo en el bloque. Al mismo tiempo, también hay muchas posiciones de opciones de compra en la cadena de opciones a fines de mayo. Aunque ETH ha tenido un desempeño relativamente pobre recientemente, todavía hay operadores que están pagando por su próximo espacio alcista.

Fuente: Deribit (al 16 de mayo de 2016:00 UTC+8)

Fuente: SignalPlus

Fuente de datos: Deribit, distribución general de transacciones ETH

Fuente de datos: Deribit, distribución general de transacciones BTC

Fuente: Deribit Block Trade

Fuente: Deribit Block Trade

Puede buscar SignalPlus en la tienda de complementos de ChatGPT 4.0 para obtener información de cifrado en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlus_Web3 o únase a nuestro grupo WeChat (agregue el asistente WeChat: SignalPlus 123), el grupo Telegram y la comunidad Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

Este artículo proviene de Internet: Columna de volatilidad de SignalPlus (20240516): La macroeconomía es positiva, BTC vuelve a 66.000

Relacionado: Predicción del precio de Fantom (FTM): ¿puede alcanzar un nuevo máximo de 2 años?

En resumen La oferta de FTM en manos de los comerciantes ha disminuido significativamente en los últimos días, lo que indica un aumento en los tenedores a mediano y largo plazo. El RSI de 7 días del FTM se encuentra actualmente en 77, frente a 81 la semana pasada, lo que aún indica un estado de sobrecompra. Las líneas de la EMA están pintando un escenario alcista y pronto podríamos ver un máximo de 2 años para el precio de FTM. La disminución de la oferta de FTM entre los comerciantes durante los últimos días indica un cambio notable hacia la acumulación por parte de los tenedores a mediano y largo plazo, lo que sugiere una creencia fortalecida en las perspectivas futuras de FTM. El precio del FTM se ve impulsado por el sentimiento positivo del mercado, y su RSI de 7 días indica un alto interés de los inversores a pesar de estar en la zona de sobrecompra. La tendencia alcista sugerida por las líneas de la Media Móvil Exponencial (EMA) insinúa…