Bitget Research Institute: GAS en la cadena ETH cae a 2 Gwei, se ha abierto la aplicación de lanzamiento aéreo EIGEN

En las últimas 24 horas, han aparecido en el mercado muchas monedas y temas nuevos y de moda, y es muy probable que sean la próxima oportunidad para ganar dinero.

-

Sectors that need to be focused on in the future: AI sector, TON ecosystem

-

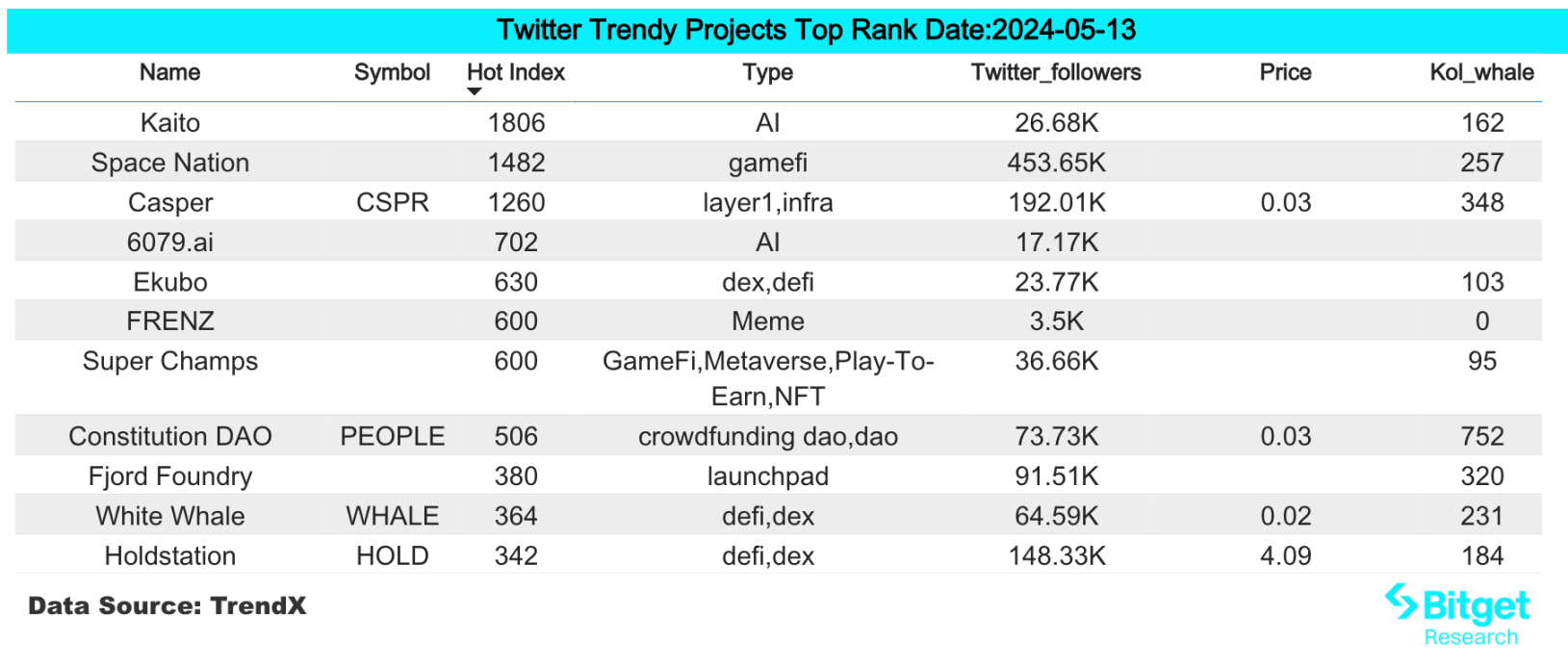

The most popular tokens and topics searched by users are: Kaito, NOT, TON

-

Potential airdrop opportunities include: UXLINK, Li.Finance

Data statistics time: May 13, 2024 4: 00 (UTC + 0)

1. Entorno de mercado

The cryptocurrency market fluctuated over the weekend as the market waited for the US CPI data on May 15. Traders were clearly risk-averse and the market lacked hot spots. ETH/BTC fell to 0.047, and the ETH network gas fee dropped to a freezing point of 2 gwei. In the past two years, the previous three ETH gas bottoms were also the bottoming ranges of the ETH price.

The airdrops and TGEs of well-known projects are still the focus of market attention: since EigenLayer opened the EIGEN token airdrop application, the number of addresses participating in the token application has exceeded 130,000 and is still increasing rapidly. The airdrop announcements of BounceBit, io.net, Notcoin, LayerZero, etc. have attracted market attention.

2. Sector generador de riqueza

1) Sectors that need to be focused on in the future: AI sector

razón principal:

-

The AI sector and the distributed computing sector have a strong consensus in this round of market, with strong gains and a smaller maximum retracement than other sectors, which provides certain support. Today, the AI sector has experienced a certain correction, and you can wait for a good entry opportunity.

-

Market rumors say Apple is close to reaching an agreement with OpenAI to apply ChatGPT to the iPhone. At the same time, Apples Worldwide Developers Conference will begin on June 10, when Apple may announce its plan to upgrade Siri with AI technology.

-

ChatGPT-5 may be officially released as early as June.

Specific project list: TAO, RNDR, AR, ARKM, WLD, FET, AGIX

2) El sector en el que hay que centrarse en el futuro: el ecosistema TON

razón principal:

-

Panteras investment in TON may be at least over US$250 million, which is Panteras largest investment in cryptocurrency in history.

-

Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

-

The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

-

The increase in the issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million within two weeks, making it the eighth blockchain in terms of USDT issuance.

Specific project list: TON, FISH, UP

3. Búsquedas activas de usuarios

1) Aplicaciones populares

Capa propia:

Eigenlayer is an innovative protocol described as recursively composable that enhances blockchain networks by reusing the security of base layers such as Ethereum. This approach enables improved computation and greater scalability by leveraging the established security of the underlying blockchain, ensuring that enhanced functionality does not compromise security, thereby maintaining trust and reliability.

Recently, EigenLayer has opened airdrops. All users on the chain who have participated in re-staking before can receive EIGEN tokens, but EIGEN tokens cannot be transferred at present. Users who currently receive EIGEN tokens can participate in the token staking of AVS services and participate in the project ecosystem development.

2) Gorjeo

Kaito:

Kaito AI aims to build an AI search engine for the crypto industry to bring together fragmented information in the crypto space. Kaito has built one of the most extensive information databases in the crypto space. By combining this database and our in-house AI technology with ChatGPT/GPT-3s advanced language models, Kaito aims to provide a better search experience than existing alternatives on the market.

Kaito AI, an AI-based encryption search engine, announced that it has completed US$5.3 million in financing. This round of financing was led by Dragonfly Capital, with participation from Sequoia China, Jane Street, AlphaLab Capital and others.

Kaito AI is quite agile in capturing hot information in the crypto industry and has recently attracted the attention of the crypto community, which is very helpful for following the dynamics of the crypto community. At the same time, the project has not yet issued coins, so users can actively participate in the interaction.

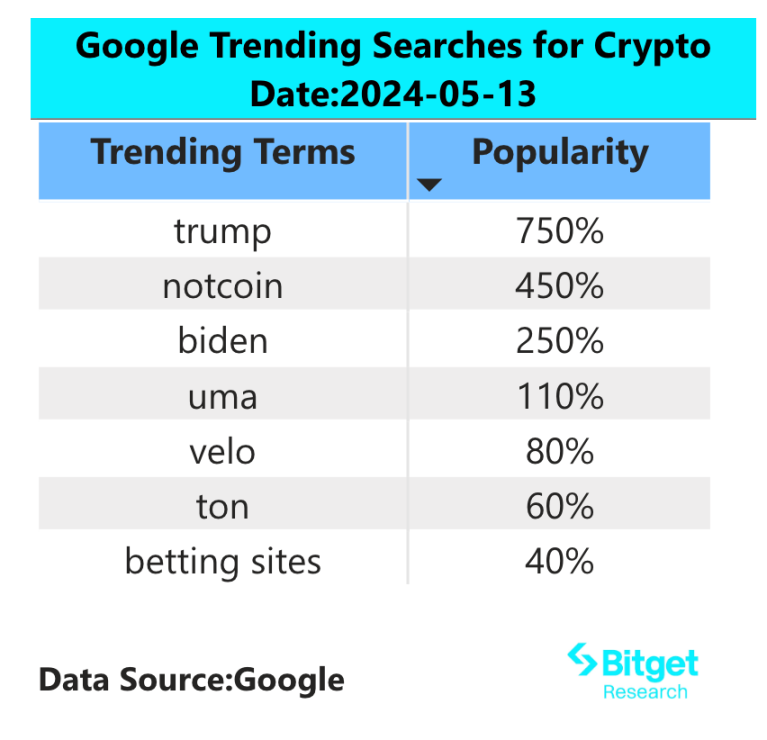

3) Región de búsqueda de Google

Desde una perspectiva global:

Notcoin (NOT): Notcoin es un juego basado en Telegram, donde los usuarios pueden ganar tokens en el juego haciendo clic en imágenes de monedas. Similar al concepto de Tap to Earn. Antes del Notcoin TGE, se utilizaban vales para representar la moneda Notcoin en el juego, que podía canjearse por $NOT después del TGE. El proyecto tiene su propio mercado de operaciones previas a la comercialización: https://getgems.io/notcoin, y los datos muestran que 640.000 usuarios NO poseen tokens previos a la comercialización. Se ha confirmado que figura en Binance Launchpool y OKX.

De las búsquedas más candentes en cada región:

(1) Yesterday鈥檚 hot searches in various regions of Asia were mainly focused on recent hot topics: AI, SocialFi, and MEME

The recent hot AI-related tokens on the chain include: OLAS, FET, etc.; the SocialFi ones that have attracted attention include Farcaster, Degen, Pump.fun, etc.; the MEME ones that have attracted attention include Shiba Inu, Floki, etc.

(2) There are no significant hotspots in Africa, CIS and English-speaking regions

The regional popularity in this region shows a relatively dispersed performance, among which BTC, ETH, and Solana frequently appear on hot searches. Some users will pay attention to narratives on themes such as AI and Meme, and the overall market shows theme differentiation.

4. Potencial Airdrop Oportunidades

ENLACE UX

UXLINK es un sistema social web3 innovador diseñado para su adopción masiva, que permite a los usuarios crear activos sociales y comerciar con criptomonedas. Incluye una serie de Dapps altamente modulares, desde la incorporación hasta la formación de gráficos, herramientas grupales y comercio social, todo perfectamente integrado en Telegram.

UXLINK anunció recientemente una financiación, liderada por SevenX Ventures, Ince Capital y HashKey Capital, con una financiación total de entre 10 y 15 millones de dólares.

Método de participación específico: el proyecto de infraestructura social Web3 UXLINK emite NFT de la serie IN UXLINK WE TRUST como cupones de airdrop. Según la contribución de la comunidad de usuarios, la interacción en cadena y el estado del activo, se divide en cuatro niveles: MOON, TRUST, FRENS y LINK, que corresponden a diferentes derechos e intereses y al número de airdrops de tokens UXLINK.

Li.Finance

Jumper Exchange is a multi-chain liquidity aggregator that supports cross-chain exchange and gas fee exchange functions of most mainstream blockchains, and is technically supported by LI.FI.

Its developer LI.FI completed a $17.5 million Series A financing round, led by CoinFund and Superscrypt.

Specific participation method: Complete multiple cross-chain transactions on Jumper Exchange. The specific transaction amount, number of transactions, active time, etc. can refer to the airdrop standards of other DEXs in the past.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603809478

Descargo de responsabilidad: El mercado es riesgoso, por lo que debe tener cuidado al invertir. Este artículo no constituye asesoramiento de inversión y los usuarios deben considerar si las opiniones, puntos de vista o conclusiones de este artículo son adecuados para sus circunstancias específicas. Invertir en función de esto es bajo su propio riesgo.

This article is sourced from the internet: Bitget Research Institute: GAS on ETH chain drops to 2 Gwei, EIGEN airdrop application has been opened

Autor original: 0x Edwardyw La nueva moneda estable que paga intereses genera rendimiento de tres fuentes diferentes: activos del mundo real, participación de tokens de capa 1 y tasas de financiación de contratos perpetuos. Ethena ofrece el mayor rendimiento pero también la mayor volatilidad, mientras que los protocolos Ondo y Mountain restringen el acceso a los usuarios estadounidenses para reducir el riesgo regulatorio con el fin de distribuir los ingresos por intereses. El modelo Lybras redistribuye los ingresos por apuestas de $ETH a los poseedores de monedas estables y es el modelo más descentralizado, pero enfrenta problemas de incentivos. Según la cantidad de titulares y los escenarios de uso de DeFi, Ethenas USDe y Mountains USDM son líderes en la adopción de monedas estables. Parte I: Diversas fuentes de ingresos A diferencia del último ciclo alcista de las criptomonedas, cuando las monedas estables algorítmicas dependían de subsidios o inflación de tokens nativos para proporcionar rendimientos muy altos pero insostenibles, lo que en última instancia condujo al colapso de los proyectos...