Die Bewerbungsfrist beginnt heute Abend um 20:00 Uhr. Hier ein kurzer Blick auf die Bewertungserwartungen für Kamino (KMNO).

Original | Odaily Planet Daily

Autor | Azuma

At 20:00 Beijing time on April 30, Kamino, the leading DeFi protocol in the Solana ecosystem, will officially open token applications for the governance token KMNO.

Previously on April 5, Kamino added a token creation page to its official website. Users could previously query the specific KMNO token airdrop shares through this page. Tonight鈥檚 open claim means that users will be able to claim the established KMNO shares through this interface and trade them on DEX or some CEX that supports KMNO.

Kamino business model breakdown

Kaminos business model is not complicated, and its basic product is a lending protocol that everyone is familiar with. According to DeFi Llama data, Kamino is currently the third-ranked DeFi protocol and the first-ranked lending protocol in the Solana ecosystem, with a real-time TVL of $1.093 billion.

In addition to basic lending products, Kamino has also built some other derivative services based on its own lending pool and ecological composability, including liquidity management work Kamino Liquidity, leveraged yield optimization service Kamino Multiply, and leveraged trading tools Kamino Long/Short.

KMNO Token Economic Model

KMNO is positioned as the governance token of the Kamino protocol. In addition, Kamino has also mentioned that it will open the staking function of KMNO. Users can speed up the earning of subsequent protocol points (related to airdrops) by staking KMNO.

According to official documents, the total amount of KMNO will be 10 billion, and the estimated initial circulation supply is 1 billion, of which 750 million will be allocated in the Genesis airdrop. In terms of the allocation mechanism, the distribution details of KMNO are as follows:

-

35% (including 7.5% of the Genesis distribution) of KMNO will be used for community development and Grants support;

-

10% of KMNO will be allocated to the treasury to build liquidity during the KMNO token lifecycle;

-

20% of KMNO will be allocated to core contributors. This portion of KMNO will be locked for 12 months and then released linearly within 24 months.

-

35% of KMNO will be allocated to key stakeholders (including investors and teams) and consultants. This portion of KMNO will be locked for 12 months and then released linearly within 24 months.

Eine kurze Analyse der Luftabwurf Mechanismus

Like many current projects, Kamino also uses a points mechanism to measure community contribution. Users can accumulate points by using Kaminos various products, and the amount of points will determine the final airdrop share.

On March 31, Kamino completed a snapshot of the first seasons points activity and calculated the amount of KMNOs Genesis activity based on it. According to Kaminos official documents, the team plans to distribute KMNO in batches through multiple seasons of points activities in the future.

Currently, the second season of Kaminos points activity is in progress. The official document mentioned that this seasons activities are expected to last for about three months after the creation of KMNO, but did not mention the specific total amount of KMNO allocated for this seasons activities.

In addition to obtaining airdrops through points, Kamino also mentioned that 50 million KMNOs will be allocated separately to OG users after the issuance of KMNO to further reward early users.

Valuation expectations

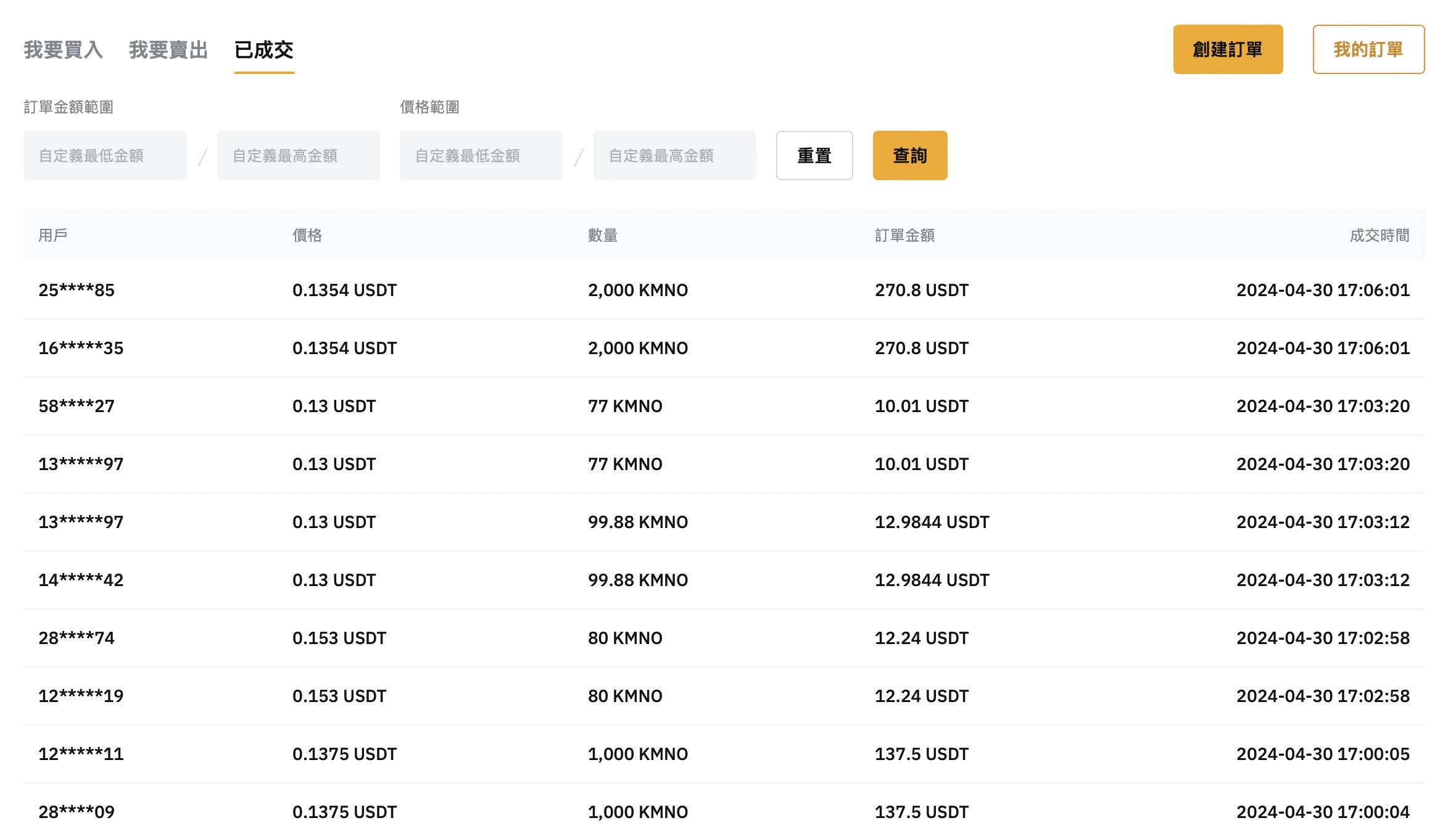

As of the time of writing, several centralized exchanges including Bybit and Kucoin have opened pre-market trading markets for KMNO, which may serve as participation data after KMNO opens for claiming tonight.

Bybit pre-market trading market shows that the latest transaction price of KMNO is about US$0.135, corresponding to an initial circulating market value (MC) of US$135 million and a corresponding full circulation valuation (FDV) of US$1.35 billion.

The Kucoin pre-market trading market showed almost the same data, with the latest transaction price of US$0.133, the corresponding initial market capitalization (MC) of US$133 million, and the corresponding full circulation valuation (FDV) of US$1.33 billion.

Relatively speaking, or due to the recent continuous decline, the markets opening expectations for Kamino seem to be lower than those of previous Solana ecosystem head projects such as Jito and Jupiter. This expectation is not surprising, but all expected data are only for reference. The price performance of KMNO still needs to wait until the opening to have a definite answer.

This article is sourced from the internet: Application will be open at 8:00 tonight, and a quick look at the valuation expectations of Kamino (KMNO)

Verbunden: Avalanche (AVAX)-Analyse: Dieses Todeskreuz könnte die Korrektur verlängern

Kurz gesagt: Der Avalanche-Preis wird möglicherweise den anhaltenden Rückgang fortsetzen, da auf einem 12-Stunden-Chart ein Death Cross stattfindet. Preisindikatoren deuten auch darauf hin, dass bärische Signale an Stärke gewinnen. Auch die Anleger scheinen nicht sehr optimistisch zu sein, da ihre Stimmung überwiegend pessimistisch ist. Der Avalanche-Preis (AVAX) gehört zu den wenigen Altcoins, die Anzeichen eines weiteren Rückgangs im Zuge der Erholung zeigen. Was es für den Altcoin noch schwieriger macht, ist, dass selbst die AVAX-Investoren keine Rallye erwarten. Ist Avalanche zur Korrektur verurteilt? Zum Zeitpunkt des Schreibens wird der Avalanche-Preis nach Korrekturen und einer geringfügigen Erholung in den letzten Tagen unter $40 gehandelt. Während auf dem Markt Hoffnungen auf einen weiteren Preisanstieg aufkommen, ist dies bei AVAX nicht der Fall. Dies liegt daran, dass der…