SignalPlus Macro Analysis Special Edition: Too Much of a Good Thing

For the market, good news has once again become bad news.

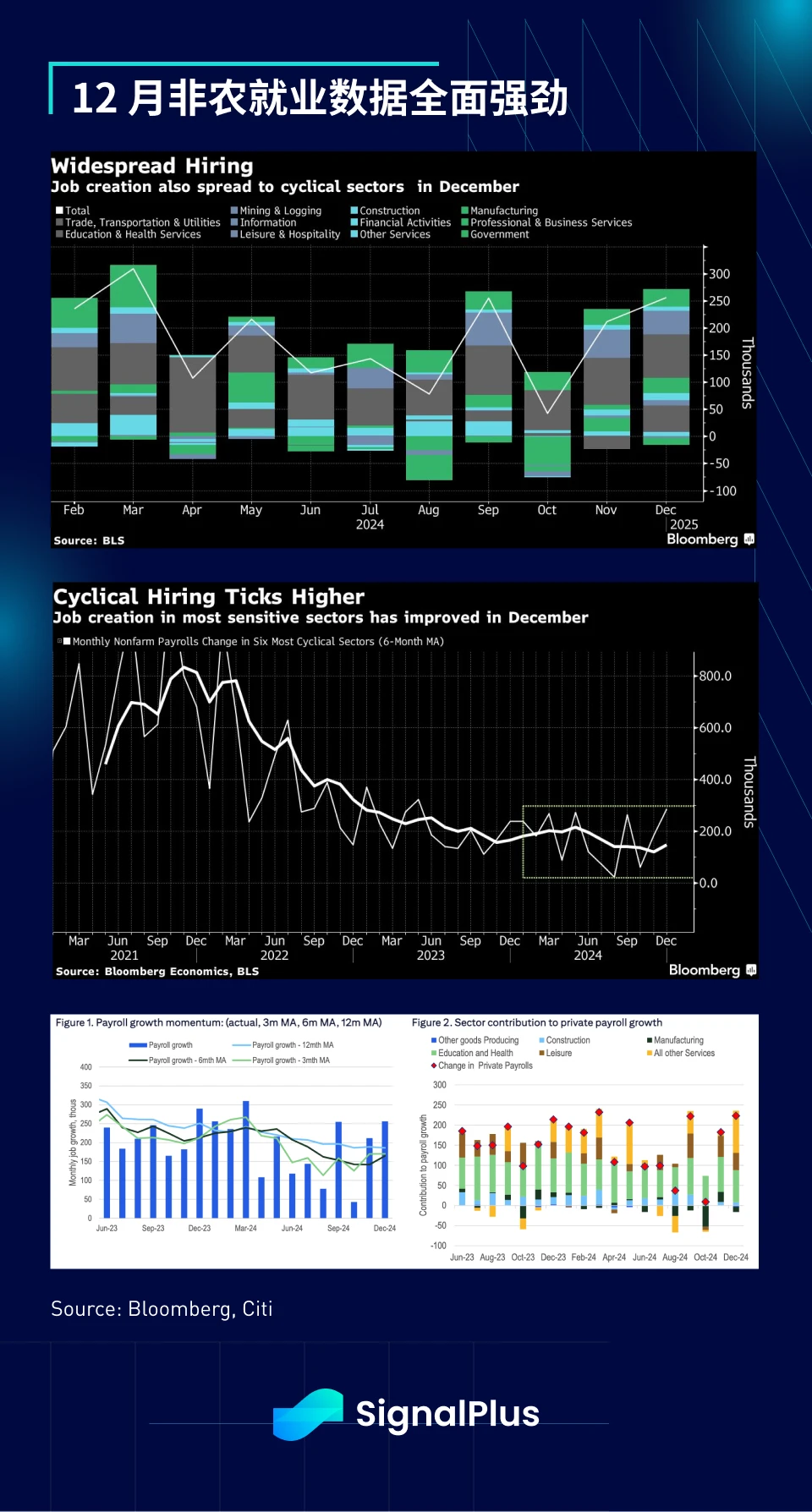

The market had a bad start in the new year due to strong non-farm payrolls data, with employment growth of 256,000 in December (market expectations were +165,000), and the unemployment rate falling to 4.1% (expected to be 4.2%). U.S. Treasury yields rose by about 10 basis points at one point, with long-term yields hitting around 5%, while U.S. stocks fell 1.5%, the dollar strengthened, oil prices rose 3%, and Kryptocurrencies were flat after correcting around 5% in the previous few trading days.

The December employment report exceeded the expectations of all investment banks. The report showed that the number of household surveyed employment increased by 478,000, the number of young employed people working part-time increased sharply, and the average hourly wage increased by 3.9% year-on-year, far higher than the low of 3.6% in July, suggesting that price pressures may make a comeback, which is a major problem that has plagued the Federal Reserve recently.

Bond yields have seen a bearish steepness, with the 10-year yield hitting 4.74% and the 30-year yield approaching 5%, reaching a nearly 12-month high. Moreover, the economy remains strong, and traders have rapidly reduced their expectations for rate cuts from nearly three to just one by 2025, making the Fed鈥檚 dovish turn last September look like a policy mistake.

Stock markets came under pressure as a result, with the U.S., U.K., Japan and China all posting losses, albeit for different reasons. U.S. and U.K. markets were hurt by a rapid rise in bond yields and funding costs, Japan was punished by its central bank for being too slow to raise rates and control inflation, and China faced the opposite problem, with markets disappointed by a slowing deflationary economy and a lack of concrete stimulus measures.

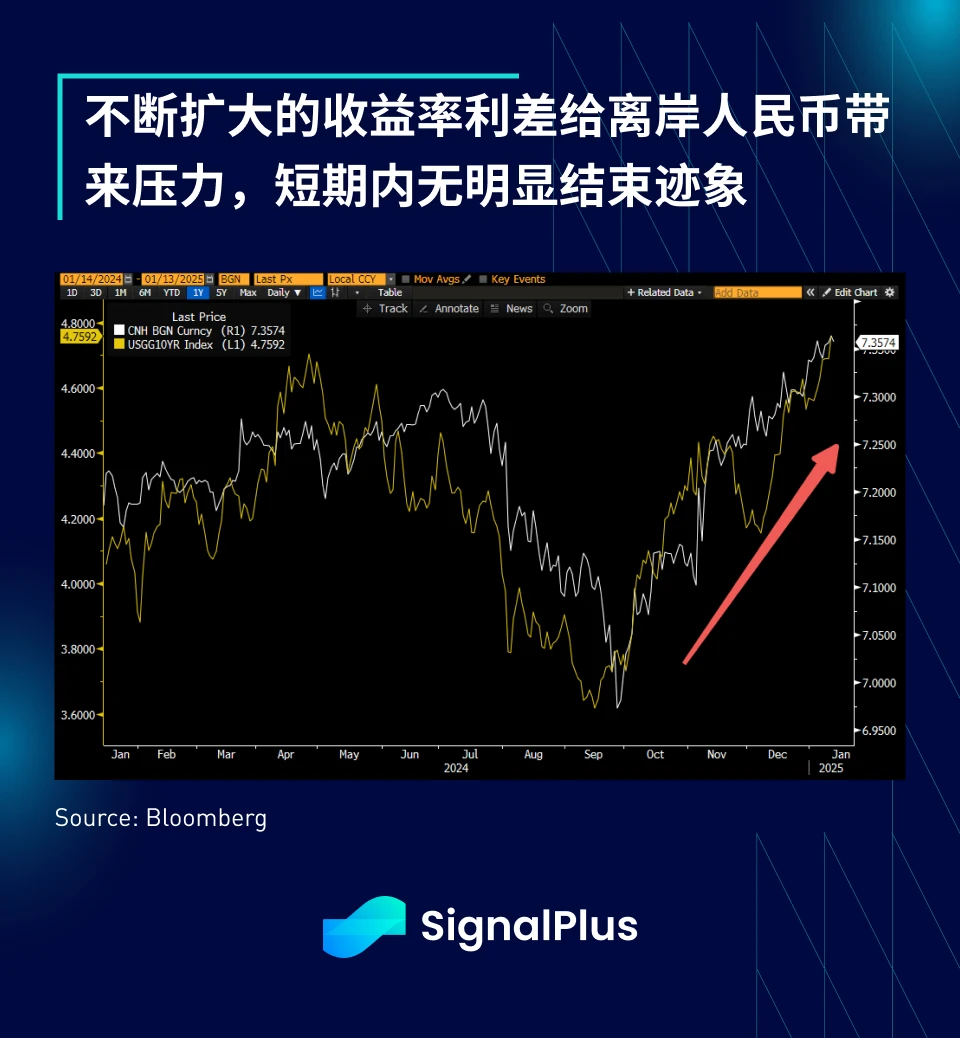

In China, the CSI 300 fell more than 5% in its first week of trading, marking its worst start to a year since 2016. Chinese stocks have fallen 20% from their October highs on growing concerns about tariffs and sanctions risks (Tencent is the latest target) and policy disappointment. In addition, onshore yields have fallen to historic lows, and the RMB exchange rate has weakened, further dampening risk sentiment, with no clear end in sight.

This week the focus will be on CPI and earnings, both of which are currently relatively well-received by the market. The headline CPI is expected to remain below 3%, with breakeven inflation remaining stable. However, the initial rise in inflation expectations at the University of Michigan, coupled with strong wage growth, could tilt the balance of risks upward, which is extremely unfavorable for current market sentiment.

After the CPI is released, the earnings season will officially begin, and financial and large technology stocks may face additional pressure. In terms of policy, there will be press conferences from the Peoples Bank of China and the State Administration of Foreign Austausch, speeches by Federal Reserve officials, and a speech by Bank of Japan Governor Himino, based on which the market will determine the future path of monetary and fiscal policies.

In the cryptocurrency space, prices fell by about 5-10% on a weekly basis, with BTC outperforming the market. Last week, news broke that the U.S. Department of Justice was allowed to liquidate the BTC seized in the Silk Road case (total value of $6.5 billion), which gave the market a reason to sell, but also raised a question: If the government is serious about cryptocurrency, why not just include this BTC in the BTC reserve?

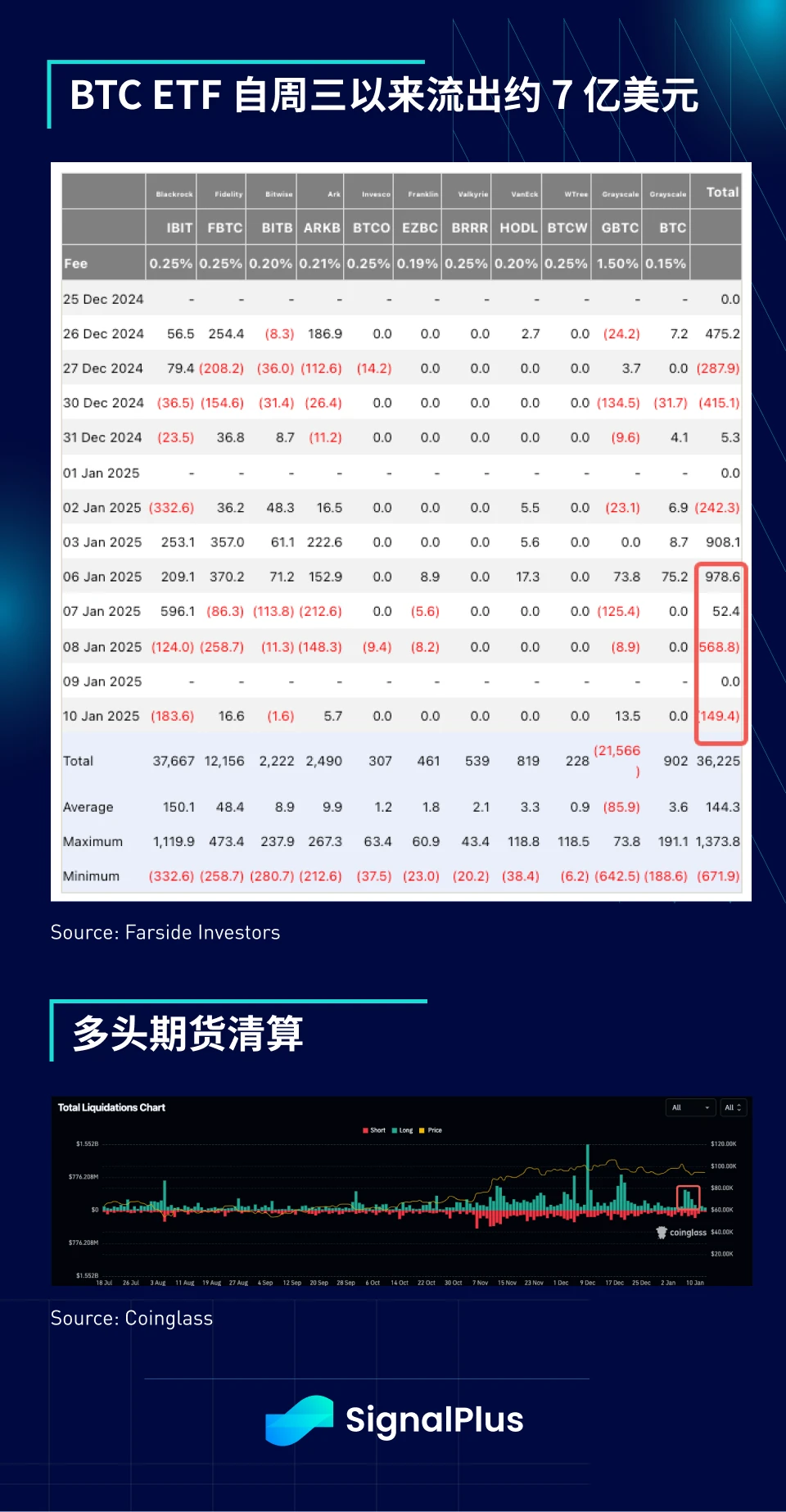

ETFs started last Monday with net inflows, but saw a sharp sell-off in the second half of the week, with outflows of more than $700 million since Wednesday. Futures long liquidations totaled around $1 billion, close to the levels seen during the November-December period.

A recent Citigroup survey (for its TradFi clients) showed that respondents generally expect BTC prices to be higher in 2025, with the majority predicting prices to be in the $100,000-$200,000 range by the end of the year. Does price follow sentiment, or does sentiment follow price? We鈥檒l find out soon!

Sie können die SignalPlus Trading-Vaver-Funktion nutzen unter t.signalplus.com um mehr Krypto-Informationen in Echtzeit zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie bitte unserem Twitter-Konto @SignalPlusCN oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegrammgruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren.

Offizielle SignalPlus-Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Too Much of a Good Thing

1. Popular currencies on CEX CEX top 10 trading volume and 24-hour rise and fall: BTC: -4.69% ETH: -7.60% XRP: -3.58% DOGE: -10.46% BNB: -3.35% SUI: -4.94% ADA: -8.26% PEPE: -9.52% LINK: -9.22% TRX: -5.76% 24H increase list (data source: OKX): SONIC: +4785.45% (yesterdays opening) ICE: +18.45% GALFT: +5.87% G: +0.92% VELO: +0.44% XAUT: +0.22% 2. Top 5 popular memes on the chain (data source: GMGN ): swarms MPLX BUZZ MAX ALCH 3. 24-hour hot search currencies MAX: AI Agent concept token, the market value once exceeded 160 million US dollars, and the current market value is temporarily reported at 125 million US dollars. ALCH: AI Agent concept token. Yesterday, Binance announced that it will launch the U-based ALCH perpetual contract. The current market value is around US$190 million. Headlines…