Encrypted IQ curve: idiots, mediocre people and geniuses, who are the real leeks?

Originalartikel von Andrey Didovskiy

Zusammengestellt von Odaily Planet Daily Golem ( @web3_Golem )

Intelligence is a broad, relative, and highly subjective variable that humans have yet to adequately quantify. Generally speaking, we classify an organism as intelligent if it is “alive” and “autonomous.” This abstract ambiguity is particularly evident in the field of encryption.

From degens writing papers on the potential value of Fartcoin, to governments exploring strategic Bitcoin reserves, to academics developing complex and useless technologies, the Kryptocurrency industry is a huge Pandoras box of paradoxes.

In this crazy world, there are few winners and many losers. The only simple metric that determines the difference between the two is a single, simple measure of intelligence measured by portfolio performance.

If you want to win at the crypto game, you have to be aloof from mediocrity. Either you’re a Sith Lord with an IQ of 200, or you’re an absolute degenerate ape with an IQ of 20. If you’re in between, you’re screwed.

In the crypto world, the greatest insult a person can receive is to be called “average intelligence” (not to mention the emotional and financial pain that comes with it).

What is the Crypto IQ Curve

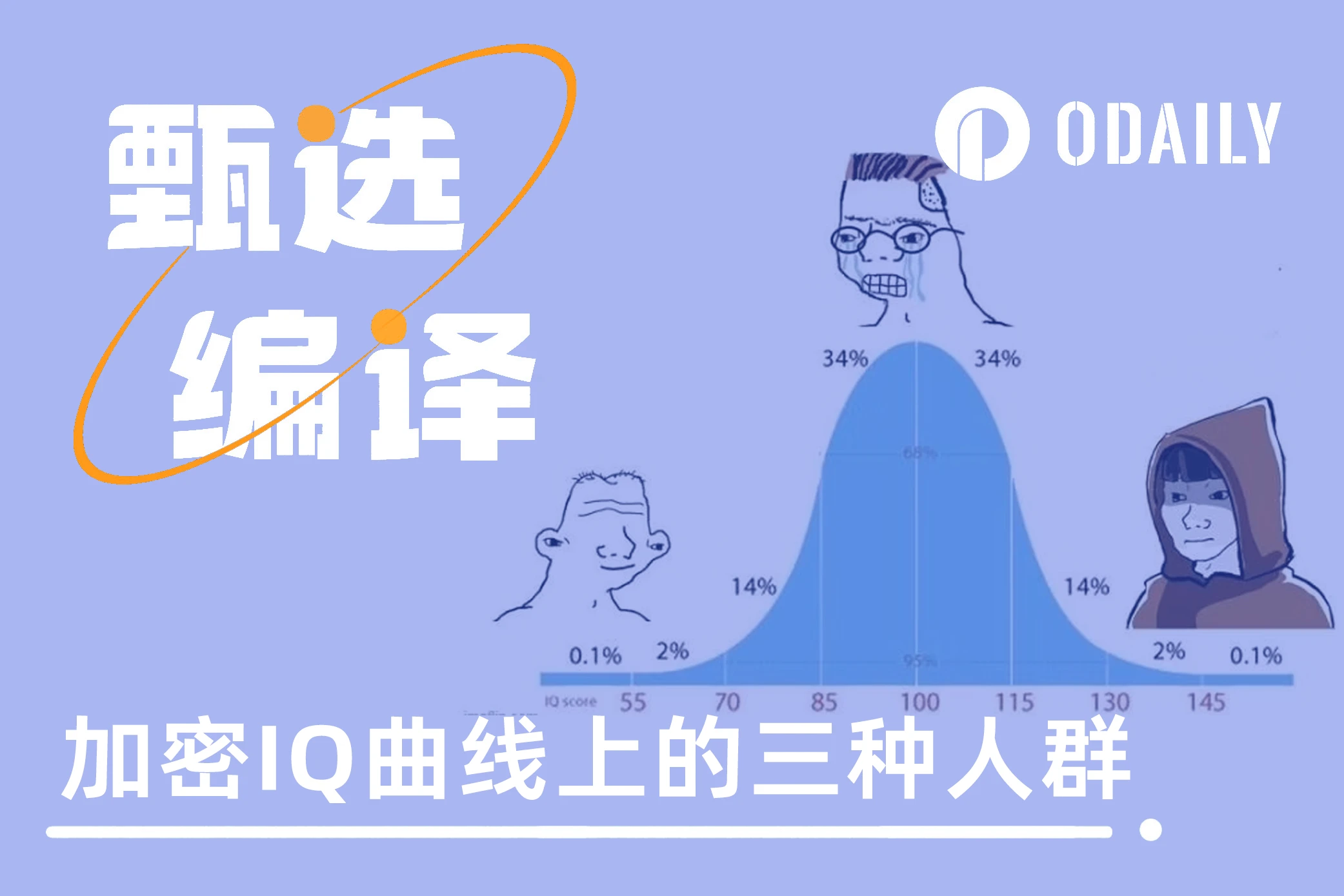

Based on the principle of the bell curve, the crypto IQ curve is a meme used to describe the distribution of intelligence among market participants.

Crypto IQ Curve

-

A very small number of people are at either end of the curve (the winners);

-

Very few people are at either end of the curve (the winners).

This is the essence of vicious competition and zero-sum game in the financial game.

On the left side of the curve are the degenerates (the brainless speculators in the crypto industry) with IQ 20, who have single-cell brains and little self-awareness. On the right side of the curve are the superbrains with IQ 200, who have almost supernatural mathematical and socio-psychological understanding abilities. And in the middle are the hard-working, emotionally dependent ordinary people.

Further analysis of these groups:

Left curve: IQ 20 -70

Thinking like a single-celled organism

This group of bold people are not afraid to take risks; they are at the forefront of crypto, constantly trying, failing, and learning, but always motivated. These creatures are often highly paranoid and sometimes even autistic, but they are good at making memes and CX support each other.

While their fanatical devotion can make it hard to tell the line between degeneracy and gambling, the same energy helps them become diamond hands and an elite group of first adopters of new things. People on the left side of the curve are generally unemotional and have a natural tendency to understand human psychology through intuition.

-

Asset types involved: Mainly Meme coins, but also open to all categories

-

Examples: GOAT, SHIB, SOL, PEPE

-

Investment philosophy: Less is more, Catcoin Gudcoin, HODL, WAGMI (We will succeed)

-

Gain difference: -99% ← → + 10,000% (zero or free)

-

Is it profitable in the end? : Sometimes

Middle curve: IQ 70-120

The group that is considered as liquidity exit

People in the middle curve rely heavily on technical analysis/charting tools. They are meticulous thinkers, but are usually immersed in false narratives and do not take risky experiments. They dare not be the first, but always think they will not be the last. This group of emotional top buyers and bottom sellers has many other names in the crypto market: takers, retail investors, paper hands, basket token holders, etc.

Their presence is vital to the industry – without them, there would be no profits.

-

Types of assets involved: Mostly scams and slow-growing assets

-

Examples: EOS, BTC, HEX

-

Investment philosophy: Buy high, sell low, panic, accuse the market of manipulation

-

Profit difference: -99% ← → + 100% (either zero or small profit)

-

Is it profitable in the end? : Hardly

Right curve: IQ 120 and above

Alpha

These people are cutting-edge thinkers, even narrative creators, who anticipate and control trends.

To join this group, one needs to have expertise in cryptography, economics, finance, sociology, psychology, computer science, statistics, and other knowledge-intensive disciplines. People on the right side of the curve are very aware of their emotional states, very obsessed with human psychology, and very patient. These people will not give in to social pressure, are not afraid of losses or admitting mistakes, and this group of open-minded people are flexible.

-

Asset types involved: Mainly Meme coins, but open to all categories

-

Examples: SOL, GOAT, PEPE, OM

-

Investment philosophy: HODL, BUIDL, DCA, no leverage

-

Gain difference: -99% ← → + 10,000% (zero or free)

-

Is it profitable in the end? : Always

Intelligence levels of people in different countries

The following data can be used to understand the average intelligence level of different countries in the real world:

(Data sets vary depending on their sources, so the data below contains the most consistent/persistent information across multiple sources that search engines can find)

-

The average IQ worldwide is about 94 (range 70-110)

-

The average IQ in the US is about 97 (varies between 95-103 between states)

-

The average IQ in China is about 104 (Hong Kong is 106)

-

Russias average IQ is about 96 (ranked in the top 4 of countries with an annual income of less than $10,000)

-

The average IQ in India is about 77 (probably influenced by culture and large population)

(Take this data with a pinch of salt. To be sure, there is some bias in the census methodology used to collect and aggregate this information. If you are struck by this data, congratulations. You are probably somewhere in the middle of the curve. Don’t be offended, but be aware of it.)

What kind of person do you want to be?

Choose extreme left or extreme right? (Political pun intended), you can choose your preference. However, due to human arrogance, many people will think they are on the far right, and some people will not care about this (investors on the left), but the fact is that most people will end up in the middle.

“He who chases two rabbits may catch neither.” Whichever side you choose, remember that mediocrity is the only wrong answer.

Understand where you really stand?

While asset type alone is a strong indicator, accurately quantifying where a person is on the crypto IQ curve requires a combination of factors, including their emotional and psychological state during the decision-making process, logical reasoning (or lack thereof), ability to handle social feedback, and the end result of the decision. It all comes down to being objective, being honest with yourself, understanding your risk appetite, and taking action.

Step outside your comfort zone, thats where the seeds grow. May peace, love and absolute abundance come to everyone (no matter where you are on the curve currently).

This article is sourced from the internet: Encrypted IQ curve: idiots, mediocre people and geniuses, who are the real leeks?

Related: Brilliant performance after TGE, revealing the explosive growth momentum of deBridge

According to on-chain data, the total settlement volume of the deBridge cross-chain protocol is about 5.9 billion US dollars, with an average daily cross-chain settlement of about 40 million US dollars. In 100 days, 100,000 new users were added, and the protocol revenue was about 15 million US dollars. In the past 30 days, the cross-chain settlement volume exceeded 1 billion US dollars, and the cross-chain fee in the past 30 days exceeded 1 million US dollars. It is currently the cross-chain bridge with the highest fee income. In addition, 90% of the large cross-chain funds on Solana are transferred using deBridge. Data source: https://app.debridge.finance/analytics Consolidation of market leadership Cross-chain fee income ranks first In the past 30 days, deBridges cross-chain fee income exceeded $1 million, which shows that it…