Originalautor: BitMEX

Schnelle Fakten

-

Merry Christmas to everyone! The market remained sideways this week with moderate trading volumes. New tokens and DeFi sectors continued to perform strongly, while Bitcoin remained below the $100,000 mark.

-

In this trading analysis column, we will take a deep dive into the development of the Bitcoin ecosystem in 2024 and why it has failed to meet market expectations despite many positive factors.

Datenübersicht

Best performers of the week

-

$PENGU (+29.9%): Continues to hit new all-time highs after massive airdrop, strong buying pressure

-

$MOVE (+ 21.4%): Continuing the strong performance of last week, the upward momentum continues

-

$HYPE (+18.3%): Rumors of a North Korean hacker attack caused wild price swings

Worst performer of the week

-

$APT (-22.0%) : a sharp drop in price

-

$ONDO (-12.2%) : Price drops due to insider selling

-

$FTM (-11.2%): Price falls despite upcoming Sonic upgrade

This weeks news

Macro dynamics

-

ETH ETF weekly inflows: +$302 million ( Quelle )

-

BTC ETF weekly outflows: -$89 million ( Quelle )

-

France steps up crackdown on Kryptocurrency fraud ( Quelle )

-

Do Kwons extradition appeal rejected by Montenegrin court ( Quelle )

-

Thailand actively promotes Bitcoin adoption, while Japan is cautious ( Quelle )

-

The proportion of profitable Bitcoin addresses has dropped to 88% ( Quelle )

-

Top 10 NFT Series Surpass Zeichen Markt Gains This Week ( Quelle )

-

SpaceX uses stablecoins to hedge foreign exchange risk ( Quelle )

Projektneuigkeiten

-

Animoca Brands founder Run Run Shaw X鈥檚 account was used by hackers to promote fake tokens ( Quelle )

-

Sonic Labs launches FTM to S token swap feature ( Quelle )

-

Aave and Lido net deposits exceed $70 billion ( Quelle )

-

Rumors of North Korean hacking caused HYPE token price to fluctuate significantly ( Quelle )

-

Floki DAO proposes to provide early liquidity for European ETPs ( Quelle )

Trading ideas

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news and it is recommended that you do your own research before making any transactions. We are not responsible for any transaction results and do not guarantee returns.

2024 Bitcoin Ecosystem Year-End Review: A Good Start, a Late End

2024 is coming to an end, and the crypto market has experienced a year of ups and downs. Although the price of Bitcoin has risen by more than 130% this year, the development of the Bitcoin ecosystem (including infrastructure, Layer-1 token protocol, L2 expansion plan and staking projects) has failed to meet market expectations at the beginning of the year.

A good start

-

Ordinals and Layer-1 assets: From late 2023 to early 2024, the popularity of Ordinals and BRC-20 tokens pushed the Bitcoin ecosystem into the spotlight. Mainstream exchanges have listed these new tokens, and the craze has quickly spread to other asset issuance protocols (such as ARC-20, SRC-20, PIPE), triggering waves of new project issuance and airdrops.

-

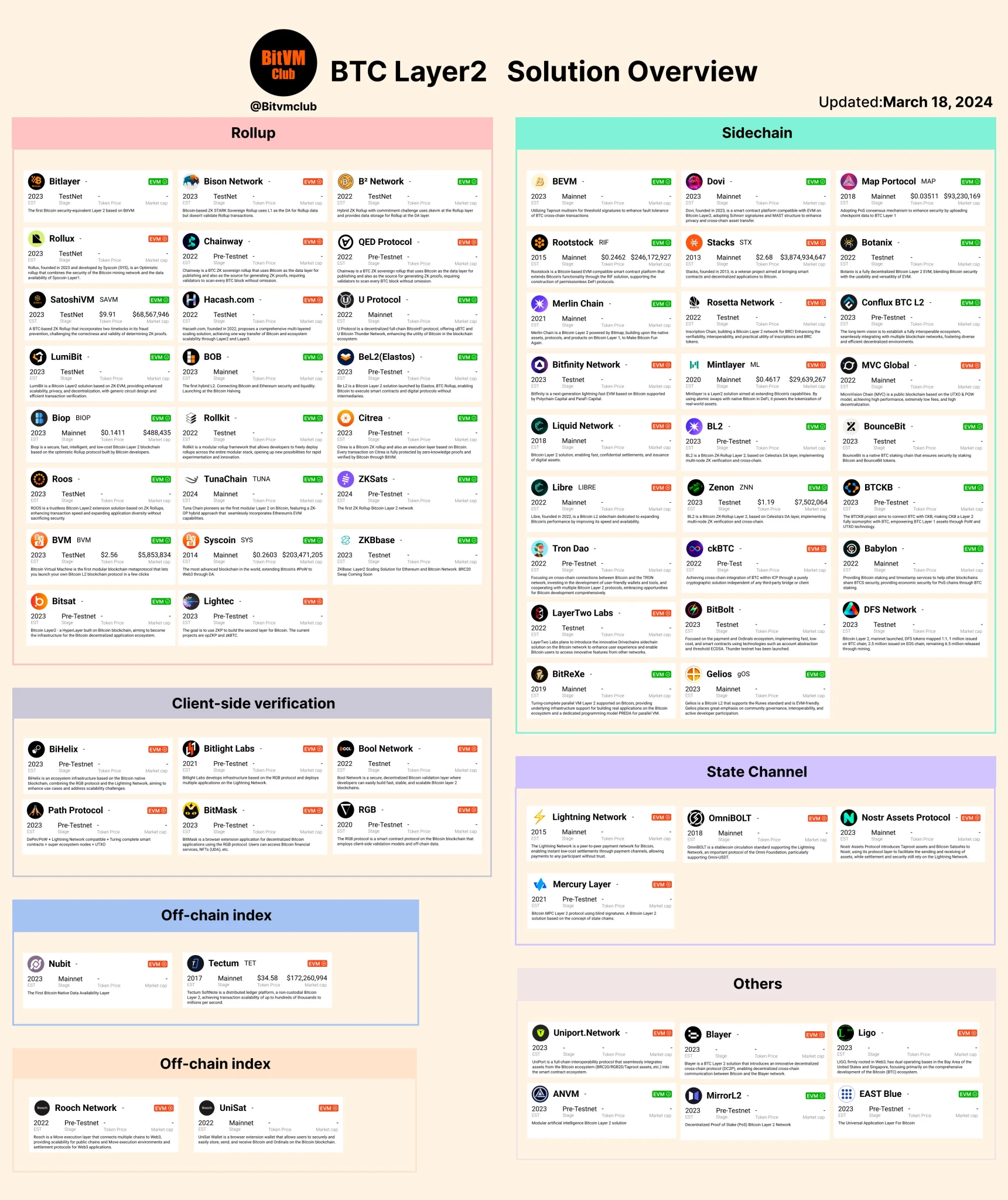

Layer-2 wave: To deal with network congestion and expand Bitcoins functionality, developers have launched numerous Layer-2 solutions. More than 100 projects have emerged, and many investors hope to replicate the success of Ethereum L2 in the Bitcoin ecosystem.

-

Staking and re-staking: Babylons launch in late 2023 has sparked a heated discussion about Bitcoin staking and re-staking, a concept derived from Ethereums EigenLayer model. Given Bitcoins strong base layer consensus, the market generally expects large players to actively participate in staking activities, which is expected to give birth to a vibrant new market.

Many challenges

-

Token issuance cools: Despite some spikes in early 2024 (especially Runes Protocol), prices and market activity for newly issued tokens continue to decline. Well-known tokens have suffered significant losses, with only occasional rebounds. Market saturation, a fragmented community, and limited capital inflows are the main reasons for this decline.

-

L2 project elimination: Most early Bitcoin ecosystem L2 projects simply transplanted the EVM design and relied on short-term TVL incentives. Although some projects briefly reached a high TVL, the popularity quickly faded, and only a few projects survived on DeFiLlama. Currently, the total L2 locked volume of the entire ecosystem even lags behind that of a single Ethereum L2.

-

Re-staking doubts: Although Babylon has demonstrated impressive TVL and deposit volume, its re-staking model faces increasing doubts. Critics point to the lack of a strong penalty mechanism (which is crucial in systems such as EigenLayer), arguing that these products are more like pseudo-staking than true trustless solutions. Major Bitcoin holders remain cautious about using digital gold in exchange for uncertain returns.

Outlook for 2025

Looking ahead, builders and investors see several catalysts that could boost the Bitcoin ecosystem:

1. Community projects continue to grow: Communities such as ORDI, DOG, and PUPS remain under active development, laying the foundation for potential growth through 2025.

2. Infrastructure and L2 innovation: Wallet teams (such as OKX Wallet, Unisat) and persistent L2 pioneers continue to work on solving scalability and user experience issues. The upcoming OP_CAT and related projects are expected to bring more robust designs.

3. Babylon token issuance and subsequent development: Babylon plans to conduct a token generation event (TGE) in early 2025. Whether it can implement advanced staking mechanisms (including real penalty mechanisms or new security guarantees) will be key. If successful, it may attract more Bitcoin holders to participate in on-chain activities.

4. Technical breakthroughs: Observers emphasize that effective re-staking and advanced L2 frameworks require fundamental innovations to fully exploit Bitcoin鈥檚 core security model. Without these breakthroughs, the protocol may struggle to gain widespread adoption.

abschließend

Despite the ups and downs of the Bitcoin ecosystem from early excitement to project elimination, it has maintained a group of dedicated builders and an active community. As 2025 approaches, key developments including OP_CAT, Babylon token issuance, and infrastructure improvements may unlock the networks greater potential. The success or failure of these new generation protocols will determine the direction of the ecosystem in the coming year.

Referenz:

-

@web3_Golem

-

@Bitvm_club

This article is sourced from the internet: BitMEX Alpha: Trader Weekly Report (12.21-12.27)

Must watch next week December 9 Coinbase and OKX will open Movement (MOVE) trading ; December 10 Microsoft will vote on whether to invest in Bitcoin at its shareholder meeting on December 10 ; ME Foundation: TGE will be held on December 10 at 10 pm Beijing time ; KIP Protocol announced TGE on December 10th ; December 11 South Koreas opposition party will bring up the impeachment case against Yoon Seok-yeol again next Wednesday ; The US will release November CPI data on December 11 ; December 12 Suilend鈥檚 native token SEND is scheduled to be launched on December 12 ; From December 9 to December 15, more noteworthy events in the industry are previewed below. December 9 Coinbase: Trading launch of Movement (MOVE) postponed to December 9 Odaily…