CoinW Research Institute Weekly Report (2024.12.09-2024.12.15)

Die zentralen Thesen

-

The total market value of global Kryptocurrencies is $3.92 trillion, up 2% from $3.84 trillion last week. As of December 16, 2024, the total net inflow of US Bitcoin spot ETFs was about $35.6 billion, and the total net inflow of US Ethereum spot ETFs was about $2.26 billion.

-

The total market value of stablecoins is $208 billion, accounting for 5.3% of the total market value of cryptocurrencies. Among them, the market value of USDT is $140.1 billion, accounting for 67.4% of the total market value of stablecoins; the market value of USDC is $42.1 billion, accounting for 20% of the total market value of stablecoins; the market value of DAI is $5.3 billion, accounting for 2.5% of the total market value of stablecoins. This week, Tether issued an additional 1 billion USDT on the Tron chain and an additional 1 billion USDT on the Äther chain, totaling 2 billion USDT. As of December 16, Tether has minted a total of $5 billion in USDT this month, an increase of 40% this week.

-

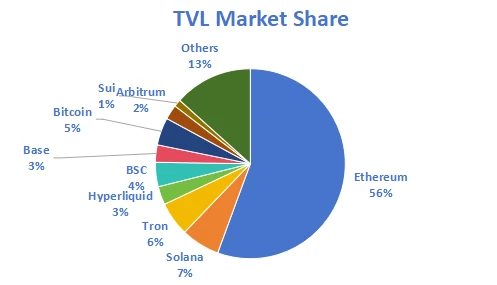

This week, the total TVL of DeFi is 141.3 billion US dollars, an increase of 2.7% from last week. According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%; Solana chain accounting for 7%; Tron chain accounting for 6%. ETH is still the absolute leader in the DeFi field, with its DeFi TVL reaching 78.7 billion US dollars and its circulating market value reaching 482.3 billion US dollars. This week, the TVL of Hyperliquid chain has increased significantly. As of December 16, the TVL of Hyperliquid chain is 2.52 billion US dollars, and the Hyperliquid chain accounts for 3% of the total TVL of DeFi, with a monthly increase of 75%.

-

From the chain data, in terms of daily trading volume, BNB and SUI have seen significant increases this week, with BNB up 52% and SUI up 45% from last week. From the daily active addresses, except for the ETH chain and APT chain, which have seen a decline this week, other chains are on the rise, with the SOL chain seeing a significant increase in active addresses, up 12% from last week.

-

Innovative projects to watch: Kat艒shi : Katoshi is Hyperliquids automatic trading layer, supporting one-click integration with TradingView. Meritt : A social network based on Worldcoin support. One month after the project was released, the number of users has exceeded 30,000 and the number of views has exceeded 6 million. 246 Club: Proposed the concept of integrating the lending market into a unified layer. The official website has not yet been launched.

1. Markt Überblick

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.92 trillion, up 2% from $3.84 trillion last week.

Data source: Cryptorank

As of press time, Bitcoin (BTC) has a market cap of $2.09 trillion, accounting for 53.18% of the total market cap. Meanwhile, stablecoins have a market cap of $208 billion, accounting for 5.3% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index and ETF Inflow and Outflow Data

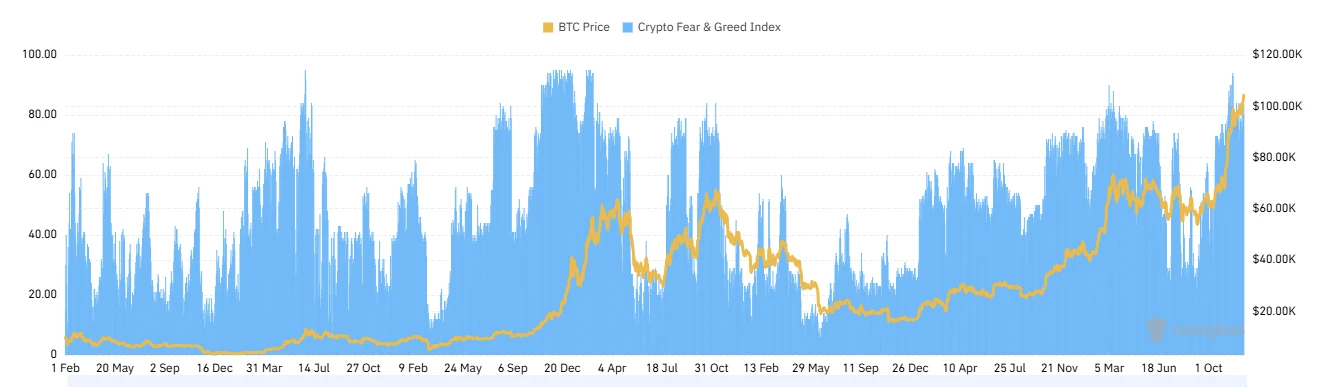

Der Krypto Fear Index is at 83, indicating extreme greed.

Data source: coinglass

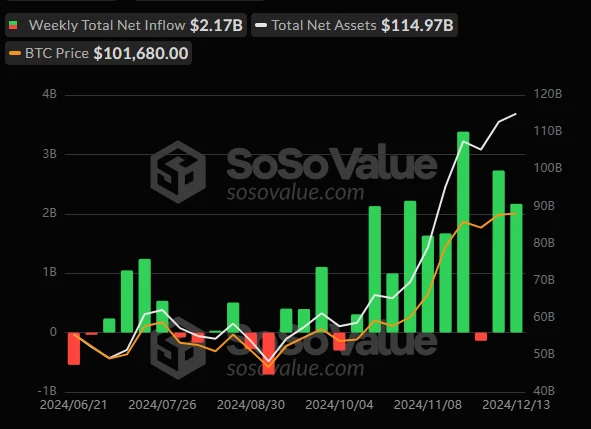

3. ETF inflow and outflow data

As of December 16, 2024, the total net inflow of US Bitcoin spot ETFs was approximately US$35.6 billion, and the total net inflow of US Ethereum spot ETFs was approximately US$2.26 billion, setting a new record. As of December 14, the US spot BTC ETF had a net inflow of US$1.688 billion for four consecutive trading days. The largest inflow during the period was IBIT, with a total of US$1.12 billion, followed by FBTC, with a total of US$423 million.

Data source: sosovalue

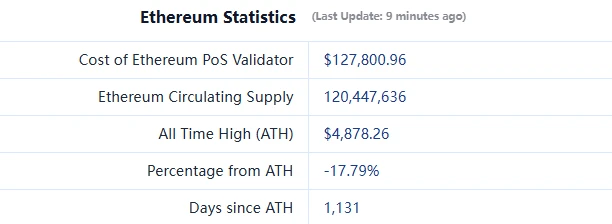

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Currently $3,997, historical high $4,878

ETHBTC: Currently 0.038006, the highest in history is 0.1238, a drop of about 69.3%

Data source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $141.3 billion, up 2.7% from last week.

Datenquelle: defillama

-

According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 57%, Solana chain accounting for 7%, and Tron chain accounting for 6%. This week, the TVL of Hyperliquid chain increased significantly. As of December 16, the TVL of Hyperliquid chain was 2.52 billion US dollars, accounting for 3% of the total TVL of DeFi, and the monthly increase was 75%.

Data source: CoinW Research Institute, defillama

Data as of December 16, 2024

6. On-chain data

Mainly analyzing the relevant data of the current major public chains ETH, SOL, BNB, TON, SUI and APT from the perspective of daily transaction volume, daily active addresses, transaction fees and total locked value (TVL).

Data source: CoinW Research Institute, defillama, Nansen

Data as of December 16, 2024

-

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators to measure the activity of public chains and user experience. In terms of daily trading volume, BNB and SUI have increased significantly this week, with BNB increasing by 52% and SUI increasing by 45% compared to last week. In terms of transaction fees, ETH chain fees have increased significantly, increasing by 28% compared to last week.

-

Daily active addresses: Daily active addresses reflect the ecological participation and user stickiness of the public chain. From the perspective of daily active addresses, SOL still occupies the first place. Except for the ETH chain and APT chain, the data of other chains have declined this week. Among them, the active addresses on the SOL chain have increased significantly, an increase of 12% over last week.

-

Total locked value (TVL) and circulating market value: reflects the maturity of DeFi and the degree of trust users have in the platform. From the perspective of TVL, ETH is still the absolute leader in the DeFi field, with its DeFi TVL reaching US$78.7 billion and circulating market value reaching US$482.3 billion, still the leader of the public chain.

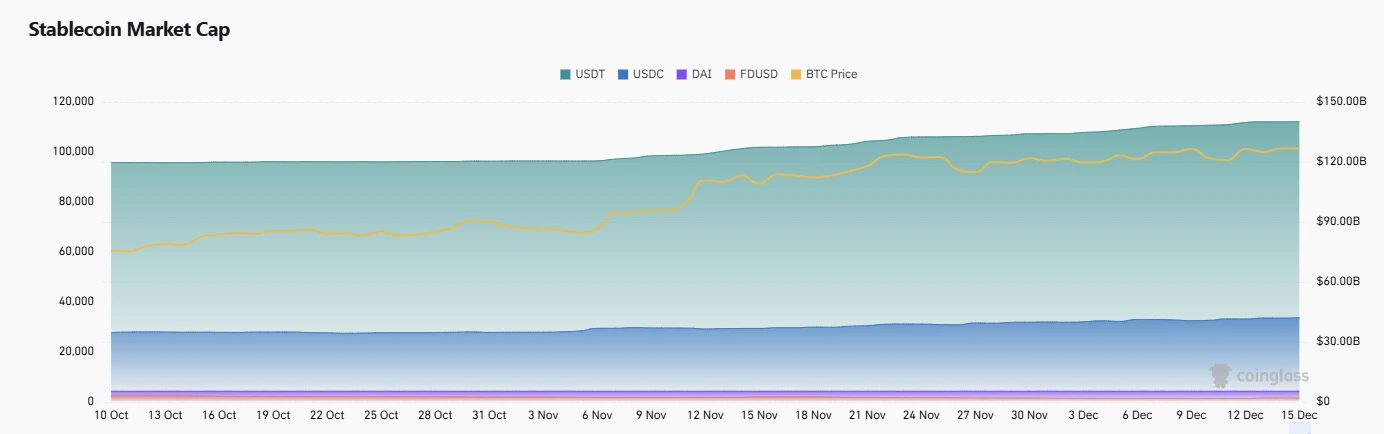

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is now $208 billion, a record high, with an increase of 5.6% in the past week. Among them, the market value of USDT is $140.1 billion, accounting for 67.4% of the total market value of stablecoins; followed by USDC with a market value of $42.1 billion, accounting for 20% of the total market value of stablecoins; and DAI with a market value of $5.3 billion, accounting for 2.5% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of December 16, 2024

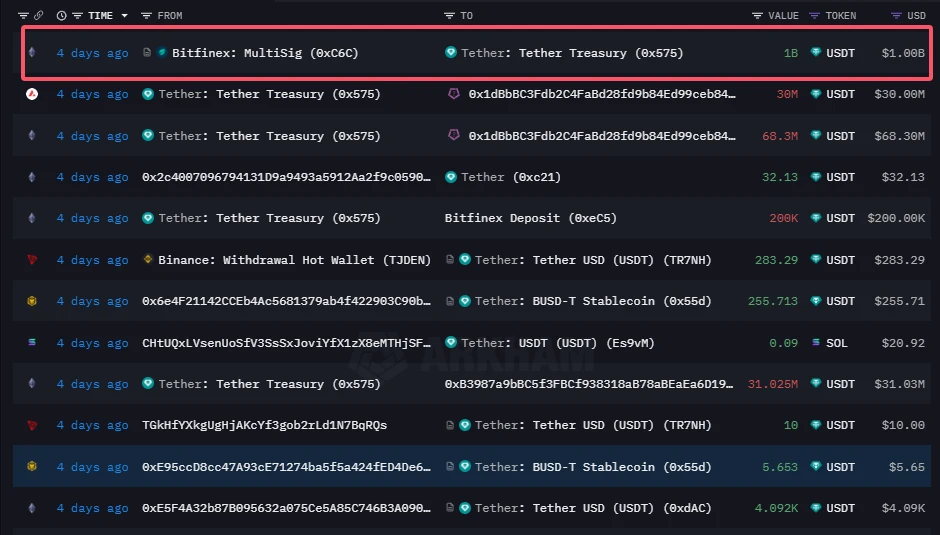

This week, Tether issued 1 billion USDT on the Tron chain and 1 billion USDT on the Äther chain, totaling 2 billion USDT. As of December 16, Tether has minted a total of $5 billion USDT this month, an increase of 40% this week.

Data source: intel.arkm

Data as of December 16, 2024

2. Hot money trends this week

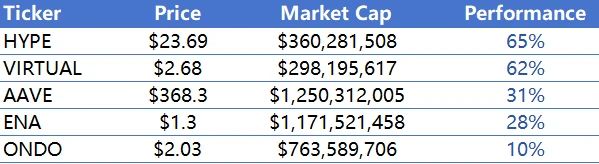

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, Coingeck

Data as of December 16, 2024

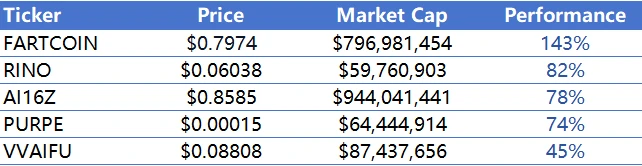

Top 5 Meme-Münzes That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of December 16, 2024

2. New Project Insights

-

Kat艒shi : Katoshi is Hyperliquid鈥檚 automated trading layer that supports one-click integration with TradingView.

-

Meritt : A social network supported by Worldcoin. One month after the project was launched, the number of users has exceeded 30,000 and the number of views has exceeded 6 million.

-

246 Club: Proposes the concept of integrating the lending market into a unified layer. The official website is not yet online.

3. New Industry Trends

1. Major industry events this week

-

Morph releases a three-layer growth strategy: DeFi, application scenarios and payment layout. Cecilia Hsueh, co-founder of the consumer-grade public chain Morph, said that Morph proposed a three-layer growth strategy and is committed to promoting the large-scale application of Web3 in a consumer-friendly way. The first layer: transforming DeFi projects (Morph makes traditional DeFi projects more accessible to ordinary users; the second layer: on-chain application scenarios focus on how to bring everyday users to the chain. For example, the Impackt project, which is in its early stages, helps users exercise through AI physical coaches and earn token rewards as incentives; the third layer: payment solutions, Morph will launch Morph Pay, which supports fiat and crypto payments, simplifies transaction processes, and helps users use blockchain services more easily.

-

The Arweave computing network AO mainnet will be launched on February 8, 2025.

-

French financial group Oddo is developing a euro stablecoin that is expected to be launched next year. Paris-based financial group Oddo BHF SCA is working with crypto technology company Fireblocks to develop a euro-denominated stablecoin, which Oddo expects to launch next year, pending regulatory approval.

-

According to Googles official blog, Google has released a new generation of artificial intelligence model Gemini 2.0. Gemini 2.0 supports multimodal input such as text, images, videos, and audio, and has multimodal output functions such as native image generation and multilingual text-to-speech (TTS). Compared with Gemini 1.5 Pro, the model speed has been doubled, and multimodal reasoning, complex instruction execution, and tool usage capabilities have been optimized, supporting calls to Google search, code execution, and third-party functions. The experimental version Gemini 2.0 Flash is now open to developers. In January 2025, the multimodal function will be fully promoted, and a multimodal real-time API will be launched to provide developers with more application support.

-

Trump was elected as the Person of the Year in 2024 by Time Magazine. According to Time Magazine, US President-elect Donald Trump was named the Person of the Year in 2024 and took the cover photo. This is his first major photography event after winning the election, and it was shot by the famous photographer Platon. Platon has previously photographed many global leaders, including Obama and Putin, and this time he completed the shooting at Trumps private club in Mar-a-Lago.

2. Big events coming up next week

-

Zeichen creation and distribution infrastructure Streamflow launched the STREAM TGE on December 17, 2024.

-

Swan Chain will launch the SWAN token TGE on December 16. The total supply of SWAN tokens is 1 billion, of which 20% of the tokens will be allocated for early users and future community reward airdrops, 20% of the tokens will be allocated to investors, 20% of the tokens will be allocated to the DAO treasury, 25% of the tokens will be allocated to the ecological fund, and 15% of the tokens will be allocated to important developers and team members.

-

Ethereum L2 Taiko Season 2 will last from September 17 to December 16, 2024, and will provide 6 million TAIKO token rewards, of which 5 million are for participants and 1 million are for DApps.

-

Telegram ecosystem application Tomarket announced that the TOMA token will be launched on December 20. Before the token is launched, a round of airdrop activities will be carried out, allocating 30% of the total TOMA tokens to reward users who actively participate in platform activities before the token is launched. The minimum threshold for this airdrop is Silver I level, and all users who reach this level and above can participate. The airdrop amount will be allocated according to the users level, taking into account the participation in blind boxes, sign-in and other activities. The snapshot will be conducted on December 19, 2024.

-

The TON Global Ecosystem Winter Competition Hackers League was held from September 12 to December 20 with a total prize pool of US$2 million, including five tracks: DeFi, Social Networks and Utilities, GameFi Onboarding, and On-chain Data Analysis Interoperability.

3. Important investment and financing last week

-

Klickl Group, Series A, raised $25 million, with investors including Aptos, Web3Port, etc. Klickl is a global virtual asset service provider, providing spot, futures trading, fiat currency OTC, B2B institutional solutions, payment, wallet, custody, wealth management and other services. Klickl has obtained the Financial Services License (FSP) Principle Approval (IPA) from the Abu Dhabi Global Market (ADGM), and can operate as a broker-dealer and provide digital asset custody services. (December 10)

-

Relai, Series A, raised $12 million, with investors including Ego Death Capital, Timechain, Plan B Bitcoin Fund, etc. The Relai platform allows retail investors to buy and sell Bitcoin without additional registration, verification, or deposit restrictions. The platform also supports investors to fully control their funds through non-custodial Bitcoin wallets. (December 10)

-

Exabits, Seed, raised $15 million, with investment institutions such as Hack VC. Exabits is a decentralized infrastructure for artificial intelligence and computing-intensive applications. Exabits enables users to provide distributed GPU services, data storage, or expertise to the AI community without the need for a central agency or intermediary. Participants can use their web3 identities, such as blockchain wallet addresses or decentralized identities (DIDs), to participate in the market and provide services to the AI ecosystem. (December 11)

This article is sourced from the internet: CoinW Research Institute Weekly Report (2024.12.09-2024.12.15)

Related: SignalPlus Macro Analysis Special Edition: Final Stretch

Last week was the Thanksgiving holiday in the United States. The market volume was light and the overall consolidation pattern was maintained. The U.S. stock market is about to make history again. 2024 will be one of the best performing years in history, and the return rate has reached double-digit highs in 5 of the past 6 years. Market breadth remains supportive, the spread between 52-week highs and lows still looks healthy, the uptrend remains intact, the VIX is trending down, while the Treasury market has calmed down after Trump announced Scott Bessent will be Treasury Secretary, with the 10-year yield down nearly 35 basis points from its October high. In addition to his so-called pro-crypto stance, Bessent is also a fiscal hawk and a supporter of an independent Federal…