In-depth analysis of Hyperliquid: potential market opportunities and HYPEs bullish logic

The Bull Case for Hyperliquid

Original author: fmoulin 7, encrypted Kol

Originalübersetzung: zhouzhou, BlockBeats

Editors note: Hyperliquid attracts users through low fees and strong incentives. It is expected that the first-year incentives will be close to $1 billion, and the inflation rate will be 11.65%. After the launch of EVM, it may become an important platform for the new DeFi protocol to drive the growth of HYPE demand. The platform makes profits through transaction fees and token auctions, and the fee distribution is automatically executed to support staking rewards, platform operations and token destruction. Increased capital inflows, especially through Kucoin, will drive HYPE prices if more market funds can be attracted. However, centralization and EVM transition risks may affect user experience, and investors need to be cautious and do research.

Nachfolgend der Originalinhalt (zur leichteren Lesbarkeit und Verständlichkeit wurde der Originalinhalt neu organisiert):

Hyperliquid is a perpetual trading protocol built on its own L1, which aims to replicate the user experience of centralized trading platforms while providing a fully on-chain order book and decentralized trading, supporting spot, derivatives, and pre-launch market transactions.

This article will focus more on Hyperliquid’s market opportunities and the fundamental bullish logic of HYPE.

Currently, HYPEs trading price has exceeded $20, becoming a top 30 asset with a market value of $7.5 billion and a fully diluted valuation (FDV) of more than $20 billion. So, where does Hyperliquids popularity come from? What is the bullish logic?

Next we will explore:

-

Trading platform opportunities

-

EVM Ecosystem Opportunities

-

Income structure, valuation and comparative analysis

-

Risiko

1. Trading platform opportunities

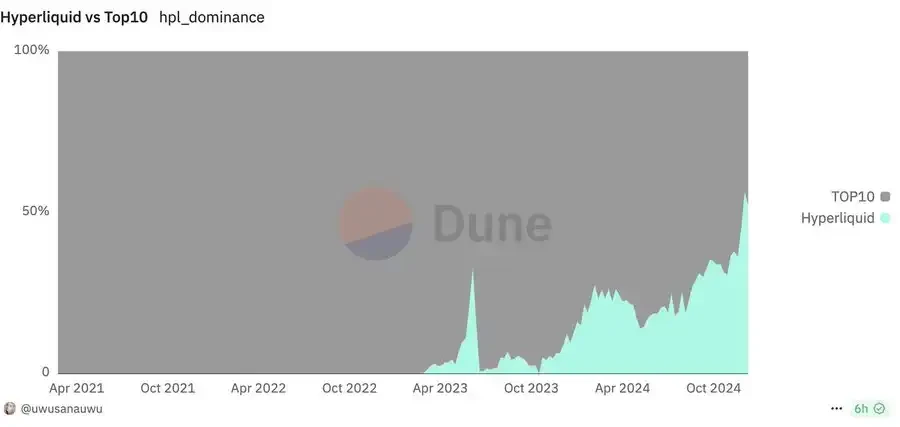

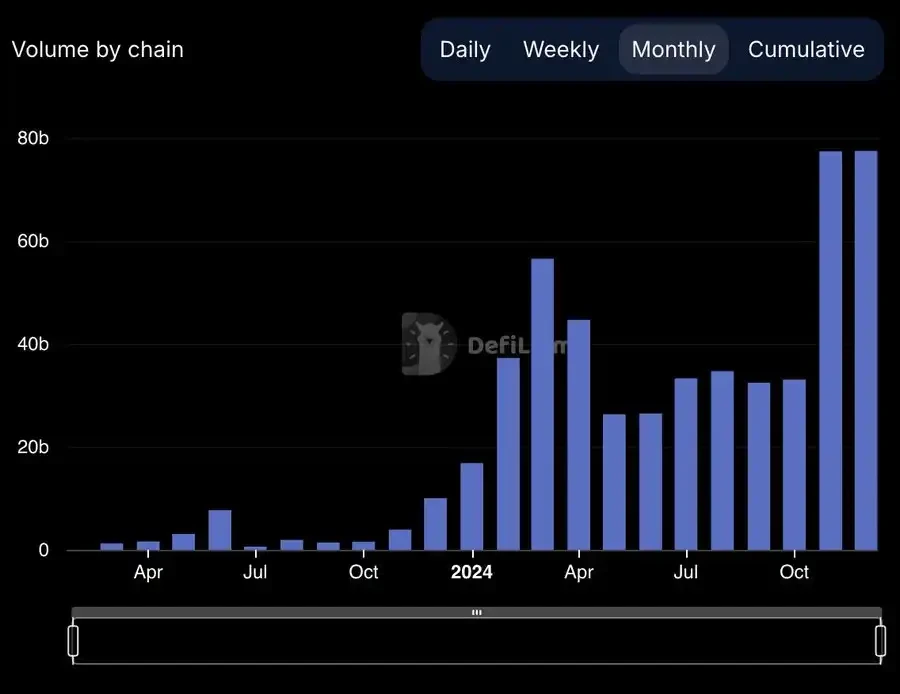

Hyperliquid dominates the perpetual decentralized exchange space, accounting for over 50% of trading volume in the past month.

As of now, Hyperliquid’s open interest (OI) accounts for about 10% of Binance’s.

A few points to note here:

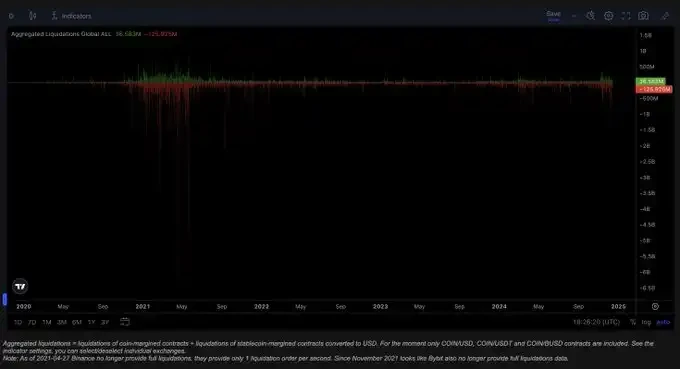

As the bull run deepens and market volatility increases (the Crypto Volatility Index is currently at just 64), open interest (OI), trading volumes, funding rates, and liquidations are expected to continue to grow.

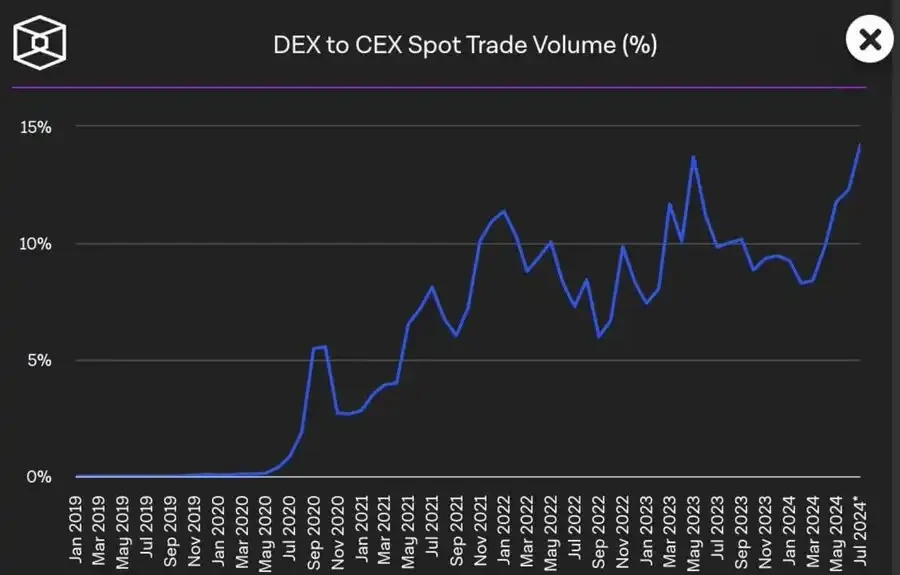

The share of DEXs vs. CEXs for perpetual swaps is likely to increase, just as AMMs and Uniswap have boosted the share of DEXs vs. CEXs for spot trading.

With lower fees and stronger incentives than its CEX competitors, Hyperliquid has a great opportunity to attract more users and capital away from CEXs. The Zeichen Generation Event (TGE) and the rapid rise in HYPE’s price have undoubtedly become the strongest marketing campaign.

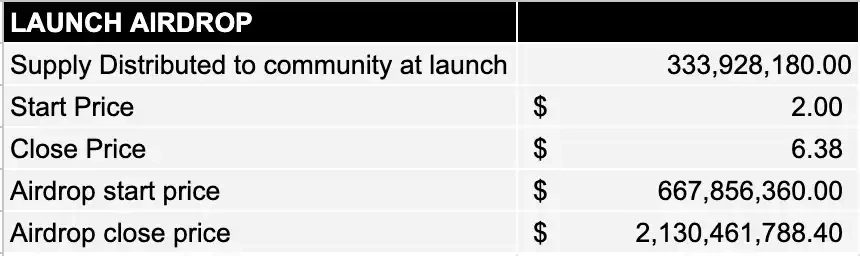

Regarding the incentive mechanism, although the specific structure has not yet been disclosed, it is easy to speculate that perpetual contracts and spot trading volume may be incentivized (or already incentivized), after all, more than 40% of the token supply is reserved for community rewards. Here are the details of the initial airdrop:

Assuming 10% of the reserved supply is used for incentives in the first year, the situation will be as follows:

At the current price, nearly $1 billion in incentives will be distributed in the first year, which is far more than the amount distributed at the $2 opening price during the airdrop. The resulting incentive inflation rate is approximately 11.65% (including staking rewards, which may need to be calculated separately).

More users will lead to more trading volume, revenue, destruction and buybacks, so in this case, the actual dilution cost to token holders caused by incentives will be lower than 11.65%.

The team can also choose a higher inflation rate and incentive level to attract more users. This is exactly the difference in HYPEs fully diluted valuation (FDV) dynamics mentioned by blknoiz 06 .

Brief summary of the perpetual contract sector:

Growing market (cyclical + DEX gradually dominates CEX)

Hyperliquid market share is expected to grow (with incentives)

also:

The spot market is also likely to continue to grow, with Hyperliquid expected to become a top three spot DEX in the short term. Yesterday’s trading volume was around $500 million, enough to make Hyperliquid the fifth-largest spot DEX in the entire chain.

With the addition of the EVM, more interesting assets may enter the spot market for trading, such as new issuance of utility tokens and native assets (such as native USDC and SOL/ETH/BTC spot trading pairs).

More trading tools are being developed based on Hyperliquids open infrastructure and builder code . Currently, teams such as InsilicoTrading, KatoshiAI and pvp dot trade have launched many cool applications. More products will be released in the future to improve user experience and attract more traffic to the trading platform.

The above factors themselves have extremely bullish potential.

Trading platforms and stablecoins are the most profitable and valuable businesses in the Krypto space. Competing directly with mainstream players (Binance, Coinbase, Bybit, OKX) for perpetual contracts and spot trading is bullish in itself.

The most optimistic scenario is:

1. Major trading platforms use Hyperliquid as a decentralized backend;

2. The trading platform hedges by including HYPE in its balance sheet ( refer to ThinkingUSD proposal ).

Although the possibility of achieving these two points in the short term is not clear, who would have thought that Trump would buy $ENA? Everything is possible.

2. EVM Ecosystem Opportunities

What is HyperEVM?

Description from hyperdrivedefi : “The Hyperliquid stack consists of two chains, Hyperliquid L1 and HyperEVM (EVM). The two chains exist as a unified state under the same consensus mechanism, but run in independent execution environments.

L1 is a permissioned chain that runs native components such as perpetual contracts and spot order books, and is designed to meet the high performance requirements required to run these native components. L1 provides API programmability, and operations submitted through the API must be signed just like submitting transactions to the EVM chain.

EVM is a general EVM-compatible chain that supports common Ethereum tools. EVM is permissionless, and anyone can deploy smart contracts, which can also directly access on-chain perpetual contracts and spot liquidity on L1.

HyperEVM is scheduled to be launched in the coming months and many teams are already preparing for it. Why is this bullish?

DeFi’s new home?

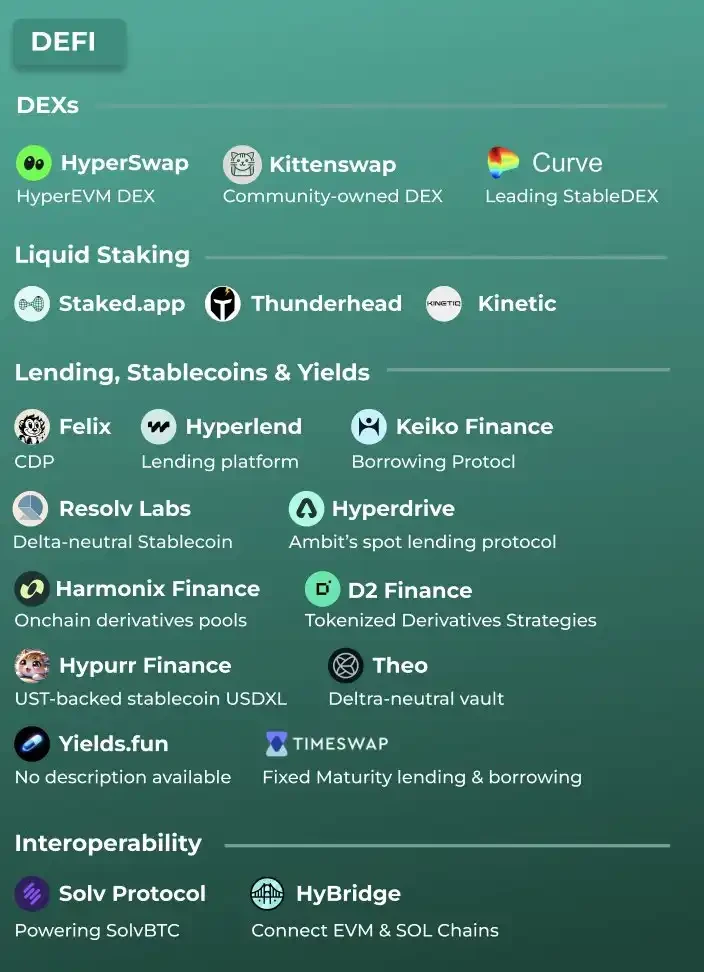

Many DeFi teams are preparing to go live with the EVM. Most of the well-known DeFi protocol types (AMMs, lending, liquidity staking, CDPs) are expected to go live with the launch of the EVM.

These projects will improve overall capital efficiency by allowing HYPE holders to use HYPE as collateral in lending and money market protocols.

It will be interesting to see whether bringing order book liquidity directly on-chain unlocks new DeFi primitives as existing protocols are adopted. I would not be surprised if entirely new DeFi primitives emerge first on Hyperliquid.

For example, ethena labs will reduce its reliance on centralized trading platforms, which will improve its system resilience and potentially diversify and reduce counterparty risk by partially integrating Hyperliquid in its hedging process. [Reference link]

The market needs practical projects

Whether it’s the AI craze on Base and Solana, the performance of Hyena, or the trading volume of $HFUN and $FARM on Hyperliquid, market participants are showing that they are eager to see projects with real value.

With the many DeFi projects coming up, Hyperliquid is likely to become a platform for the rise of utility projects in the near to medium term. At the same time, there is a high probability that the AI infrastructure currently built on Solana by AI16Z, Zerebro, etc. may be extended to Hyperliquid.

Hyperliquid’s unique features

Hyperliquid natively supports the creation of vaults. These strategies running on vaults can take advantage of the same advanced features as DEX, such as efficient liquidation of ultra-leveraged accounts and high-throughput market-making strategies. Anyone can deposit into the vault to receive a share of the profits, including DAOs, protocols, institutions, or individuals. The owner of the vault can receive 10% of the total profits.

This primitive provides an ideal competitive scenario for AI agents to attract capital.

Why is the EVM launch a bullish signal?

The launch of EVM will bring in more fee income that can be used for staking rewards, token burns, etc. Take Base as an example, it has generated $15 million in fees in the past 30 days. I think the activity of HyperEVM may be on par with Base in the next few months.

The EVM also unlocks more use cases for the HYPE token within the ecosystem. HYPE will become a necessary asset to pay for gas fees, and can also be used for lending, staking, locking positions to earn income, etc. This will significantly increase buying demand.

We can refer to the examples of SOL in 2024 (Meme) and ETH in 2020 and 2021 (DeFi and NFT) – on-chain activities directly drive demand for native assets.

Utility projects with higher market capitalization + more native asset bridging options (such as native USDC, spot BTC, SOL, ETH, etc.) will drive up spot trading volume, thereby bringing in more revenue.

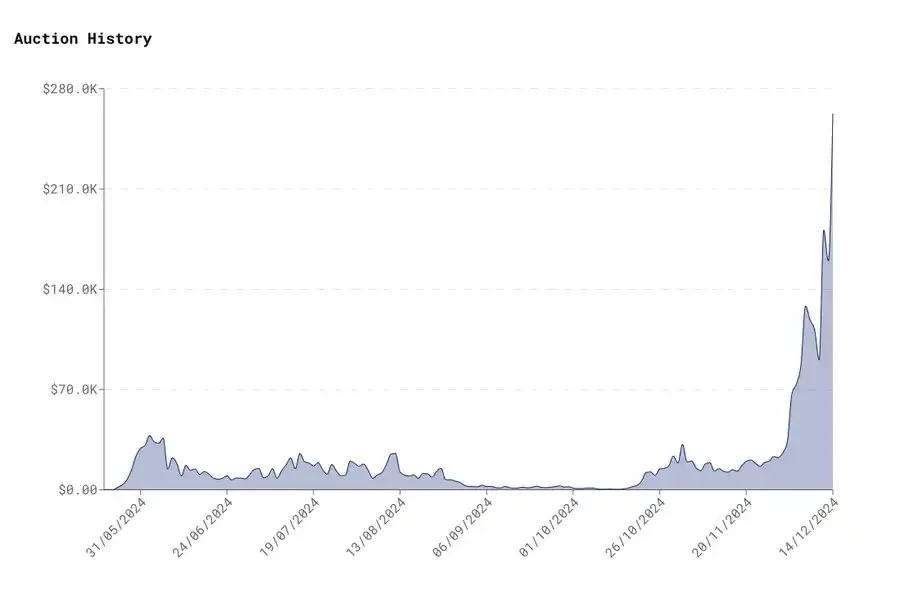

As more teams go online on EVM, the auction price of token codes (tickers) will continue to rise, further increasing revenue.

In addition, EVM will make Hyperliquid an “official” L1 network in the minds of more people and attract more attention to its ecosystem. This may release capital currently on the sidelines to enter the market.

Revenue breakdown, valuation and comparable companies

How does Hyperliquid make money?

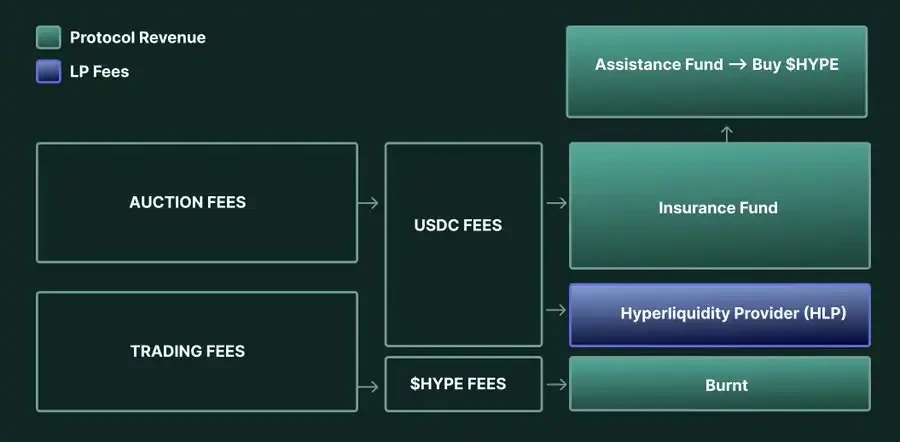

Hyperliquids revenue comes primarily from platform fees and ticker auctions.

Platform Fees:

Ticker Auctions:

Hyperliquid earns revenue through token ticker auctions. In these auctions, projects bid to purchase specific tickers, which are key identifiers for them to display and trade on the platform. As more projects go live on the EVM, token ticker auctions will become more competitive and prices will gradually rise, bringing more revenue to Hyperliquid.

Fees flow on-chain like this:

As of writing, the Assistance Fund holds 10,761,181.28 HYPE (over 3% of circulating supply) and 3,143,786.73 USDC. The Insurance Fund has also accumulated 7,071,990.99 USDC that has not yet been transferred to the Assistance Fund. In total, over $10 million in USDC is currently not on the market to purchase HYPE.

So, how much revenue does Hyperliquid generate? In the past 30 days, Hyperliquid has generated approximately $26.5 million in USDC revenue. Revenue from auction tokens accounted for $2 million of this, and the rest came from platform fees. This revenue was mainly redistributed to the insurance fund.

Additionally, since HYPE went live, approximately 79,600 HYPE tokens have been destroyed by transaction fees, which are denominated in HYPE . At todays prices, this equates to approximately $1.75 million in additional revenue. As a result, Hyperliquids total revenue in the past 30 days is over $28 million, which equates to over $336 million per year.

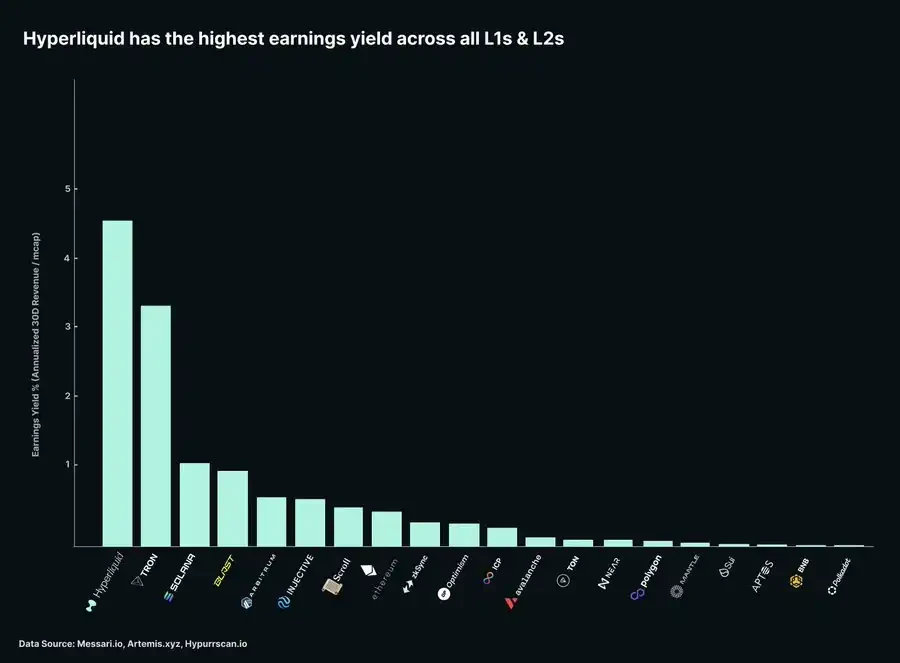

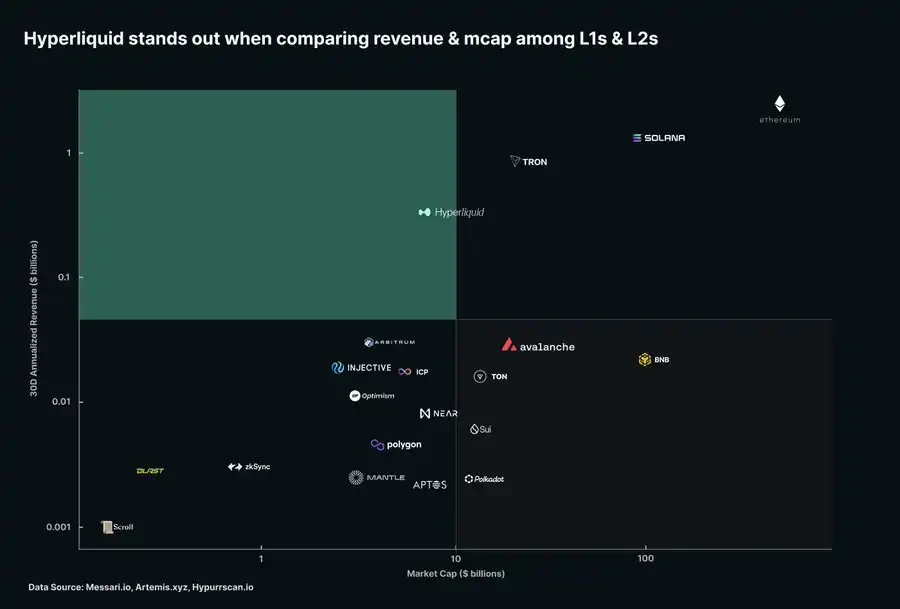

Currently, only 3 first-level blockchains (L1) have more revenue than Hyperliquid: Ethereum, Solana, and Tron, which have much higher market capitalizations. In fact, Hyperliquids yield (annualized revenue/circulating market capitalization) is far ahead and the highest among all L1 and L2 platforms.

Potential income growth

Where can it go next? The main drivers of revenue include:

-

Platform Fees

-

auction

-

Future revenue mechanism (EVM fees?)

Let’s analyze these factors one by one.

Platform Fees

December volumes are already on par with November. If volumes remain at similar levels in the second half of the month, this would represent a 100% month-on-month increase.

auction

Recently, auction prices have soared, showing a sharp upward trend.

auction

The latest round of auctions settled today at nearly $500,000.

Auction prices are likely to continue to rise as more projects look to secure their spot (there are only 282 spots available each year).

EVM Fees

Base has generated approximately $15 million in fees in the past 30 days. According to DeFiLlama, Hyperliquid’s TVL has surpassed Base in the past 24 hours, and given current trends, economic activity on the EVM is likely to be comparable to or even higher than Base when Hyperliquid goes live.

Scenarios and Valuations

Based on the above, we can come up with a base case scenario and a bull case scenario. This post is about the bull case scenario, so there is no bear case scenario, but the risks will be discussed in the last section.

Base case

Trading volume is one third higher than in the past 30 days

Auction prices remain stable

EVM activity is similar to Base

Bull Markt Scenario

Trading volume doubled over the past 30 days

The auction price doubled and then remained stable ($1 million per auction)

EVM activity is twice that of Base

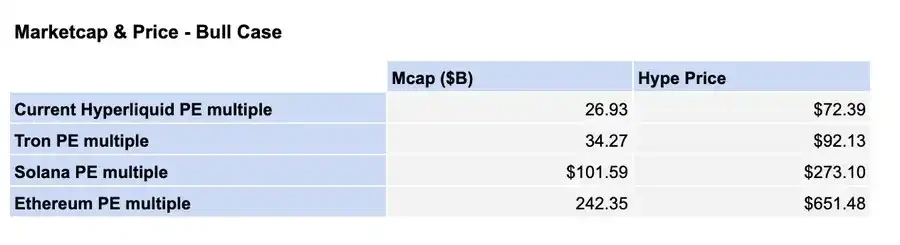

In the base case, 30-day revenue is $59 million, while in the bull case it is $102 million. To arrive at a valuation, we can use different price-to-earnings ratios (PE multiples) that are based on observed data from the main first-tier chains (L1) and combined with annualized revenue.

Next, we calculate the market value for the base and bull scenarios based on revenue and price-to-earnings (PE multiples). To arrive at the price of HYPE, we use the current circulating supply, plus an inflation rate of 11.6% (for incentives and rewards), which was calculated in Part 1.

Under these conditions, we can see HYPEs price range from $41.93 (base case, lowest multiple) to $651.48 (bull case scenario, highest multiple).

Given HYPE’s relative immaturity and higher risk relative to Solana and Ethereum, it is reasonable that HYPE’s P/E ratio should be on the lower end. In addition, HYPE’s revenue mainly comes from decentralized exchanges (DEX), which Solana and Ethereum do not capture. Therefore, it is logical that HYPE’s P/E ratio is closer to DeFi protocols.

That being said, considering the P/E ratios of other L1 and L2 chains, Hyperliquid’s current P/E ratio may be low. A “reasonable” scenario might be:

-

The price-to-earnings ratio is 40 times

-

Between Base and Bull Case: $1 billion in annualized revenue

This would bring the valuation to $40 billion ($100 billion fully diluted) and price HYPE at just over $100.

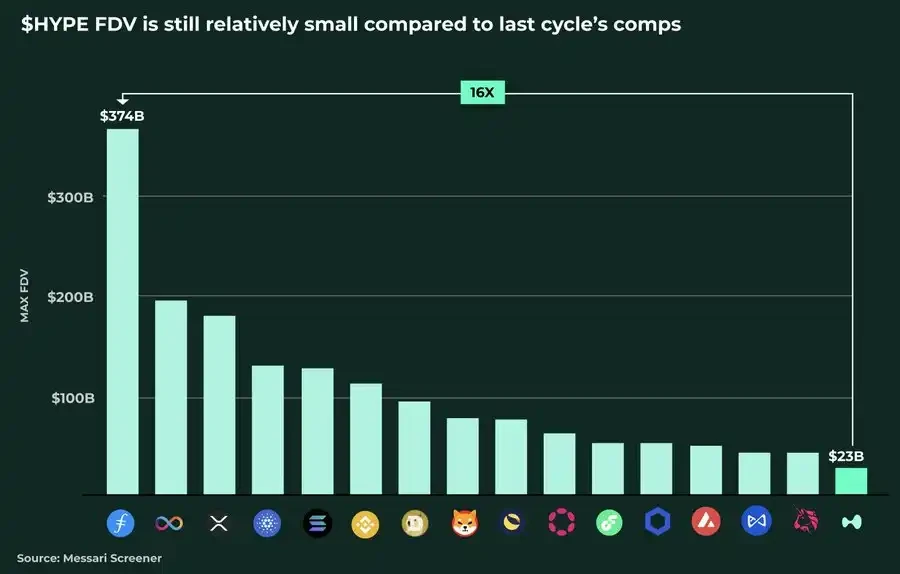

Comparison to the Last Cycle While a $40 billion market cap and a $100 billion fully diluted valuation may seem high, bull markets tend to get even crazier.

In 2021:

-

BNB market cap grew from $5 billion to $100 billion (20x growth)

-

ADA market cap grew from $5 billion to $95 billion (19x growth)

-

SOL market cap grew from $86 million to $77 billion (900x growth)

-

AVAX market cap grew from $282 million to $30 billion (100x growth)

-

MATIC market value grew from $85 million to $20 billion (235 times)

-

FIL’s fully diluted valuation reaches $373 billion, which is 16 times today’s HYPE valuation.

Capital Inflow

We have seen a significant amount of capital flow into Hyperliquid .

Although the number of holders is increasing, the current number of HYPE holders is still relatively small, especially considering that HYPE is currently only listed on Kucoin.

Comparison data:

HYPE: 60,000 holders

KMNO: 55,000 holders

WIF: 211,000 holders

BONK: 861,000 holders

In an old Messari report , robustus calculated that the capital inflow multiple for an asset could be as high as 10x, meaning that $1 billion in net inflows could increase an assets market cap by $10 billion. While its impossible to calculate exactly, this is particularly important given HYPEs potential as the third most active L1. If HYPE could get 5% of Solanas market cap and 1% of Ethereums market cap as inflows, this would represent $10 billion in inflows and have a huge impact on price.

We have partially seen this inflow since the TGE, but as fiskantes said, there is still a lot of funds on the sidelines waiting for the release of HyperEVM and the transition to decentralized validators before they will be allocated to HYPE .

Risiko

While the article paints a fairly optimistic picture for Hyperliquids future, it is not without risks.

One major risk is the validator set, with the current mainnet validators being completely centralized (4 validators operated by a team based in Tokyo). Although the testnet is now live and has a decentralized validator set (over 60 validators), including some experienced validators (such as Chorus One, ValiDAO, B Harvest, Nansen, etc.), the transition is still risky. If performance degrades, user experience and trust will be at risk.

Another risk is the unrealized nature of the EVM ecosystem. High-quality projects need to be launched on the EVM for the ecosystem to thrive. If most of the projects are low-quality or simply copied from other chains, less capital and activity will be attracted. Therefore, attracting high-quality developers rather than speculative developers will be key.

On the EVM side, we may see HYPE become increasingly capital efficient (e.g. liquidity staking, lending, etc.) Depending on what is built and how it interacts with L1, we may see some new risks that are not present in existing DeFi protocols and may pose a threat to HYPE or the entire trading platform.

Regulatory risks remain, but as Fiskantes said (again, quoting), geo-fencing and Trump administration policies can reduce those risks .

Like all assets, and especially as a trading platform, HYPEs performance should be highly correlated with the overall market. The team needs to deliver results before the market reaches weakness.

The crypto market is uncertain and everything could go back to zero. I own HYPE. The above is not financial advice. Investors please do your own research (DYOR).

This article is sourced from the internet: In-depth analysis of Hyperliquid: potential market opportunities and HYPEs bullish logic

Original | Odaily Planet Daily ( @OdailyChina ) Author: Azuma ( @azuma_eth ) On October 29th, local time, Magic Eden will open the airdrop application of testME, the pre-test token of the official governance token ME (the specific time has not been announced), so that the community can familiarize themselves with the application process before the ME airdrop officially arrives. After the testME airdrop, Magic Eden will gradually announce the ME token economics and open the application of the official ME token. Although Magic Eden officials have repeatedly mentioned that testME has no economic value and users are not encouraged to trade it, considering that Jupiter, another major project in the Solana ecosystem, also airdropped the test token WEN before airdropping JUP, the market value of this test token is…