6 strategies to teach you how to grasp the cottage market

Originalartikel von CryptoAmsterdam

Originalübersetzung: TechFlow

1. When does the copycat season come?

I think the copycat season will come soon, here are some key analysis points:

1.1 The cycle is divided into two stages

-

Phase 1: Bitcoin price rises, altcoin prices fall (Bitcoin market share increases).

-

Phase 2: Bitcoin breaks through its historical high, and altcoins begin to enter a rapid rise phase.

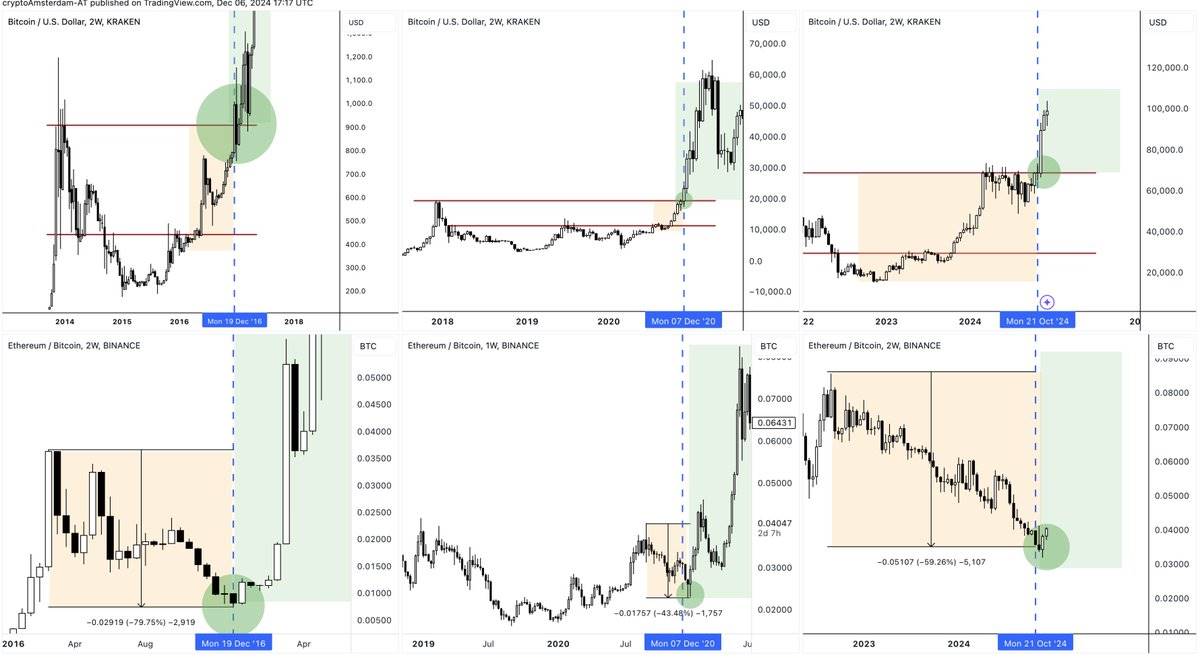

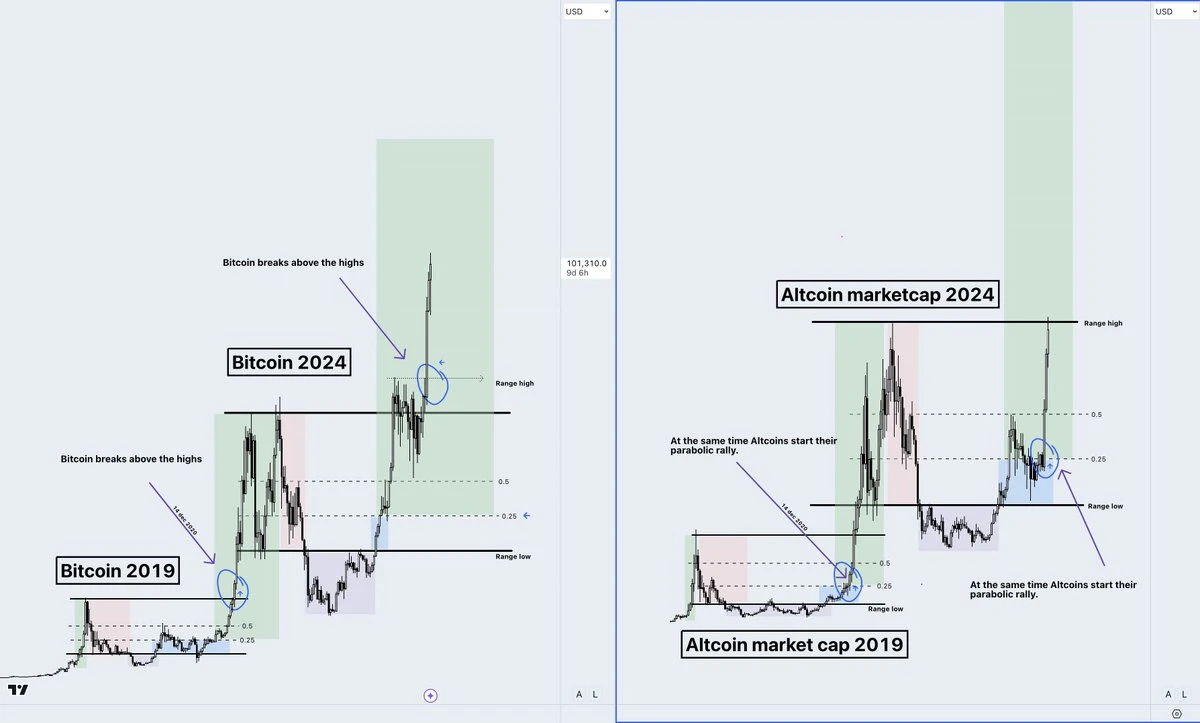

This pattern can be seen more clearly in the following figure:

At this stage, we started accumulating altcoins when the total market value of altcoins was at the low point of the range. I believe that the price of altcoins will break new highs like Bitcoin.

Currently, Phase 2 has started!

For more details, please see: Link .

1.2 Capital Flow Pattern

The starting point of the bull market can be traced back to the end of 2023, when Bitcoin bottomed out, returned to the range and rose to the previous high, while altcoins depreciated against Bitcoin and Bitcoins market share increased.

When Bitcoin breaks through its all-time high (which is the current stage), funds begin to flow into large-cap altcoins. From the Total 3 (total market value of the top 100 altcoins minus BTC and ETH) chart, although it is currently mainly driven by large-cap coins (such as XRP), the performance of small and medium-cap coins is also catching up.

Eventually, funds from Bitcoin and large-cap currencies will gradually flow into small and medium-cap altcoins.

As market sentiment rises, investors will become more greedy and start chasing small and medium-cap altcoins. I expect other mid-cap altcoins to reach new highs. The real alt season is still ahead.

1.3 Bitcoin Dominance

Each cycle has a similar pattern: when the price of Bitcoin breaks through the previous high and rises for the first time, its market share will begin to decline.

Currently, Bitcoin’s market share has broken an upward trend that lasted for more than 800 days.

1.4 ETHBTC trend analysis

In each cycle, Ethereum will show weakness in the early stages (Bitcoin rises but remains below its previous high), and then begin to rebound when Bitcoin stabilizes above its previous high.

The current cycle is no exception. More funds are expected to flow into Ethereum ecosystem tokens, on-chain utility tokens, and high-risk tokens. Once ETHBTC truly enters an upward trend, the performance of these tokens will be even more impressive.

ETHBTC Chart Analysis

Currently, ETHBTC has retreated and re-established itself at the low point of the range.

The resistance level of Phase 4 failed to be broken in 2021. In this cycle, can we usher in the super rise of Phase 5?

A breakout above the current downtrend line would end a 1,100-day-long bear trend.

In addition, 2024 is also an important year for the launch of the Ethereum ETF (exchange-traded fund), and I believe that the market still underestimates the potential of Ethereum.

2. Have you missed your chance?

As mentioned before, the Amsterdam team has accumulated altcoins during the past 5-6 months at Total 3 market cap lows.

At the low point of the range, it is recommended to:

-

Buy at key support levels;

-

Gradually build positions in a slowly fluctuating market, rather than chasing rising prices;

-

Set a clear stop loss point (such as below the range);

-

The market is less volatile and easier to hold.

But if you choose to buy after the price rises vertically:

-

You may not have a clear stop loss point. For short-term traders, this may not matter much, but for long-term investors, not having a stop loss point increases risk.

-

The profit opportunities from the low to the high of the range have disappeared, and the bet now becomes can the market value of altcoins break out to new highs.

-

By buying during a phase of rapid price increases, you will be exposed to higher market volatility, with 20-30% pullbacks not uncommon.

So, I think its not too late for you, because:

So, I think its not too late for you, because:

-

Bitcoin still has room to rise.

-

The rotation of funds has not yet fully reached the stage of small and medium-cap altcoins (the Others chart shows that new highs may be set), so the most profitable stage has not yet arrived.

-

Bitcoin dominance is likely to decline further, while the ETHBTC ratio will move higher.

But please note the following:

-

Understand where in the current market cycle we are.

-

Be clear whether you are entering a currency for short-term trading or long-term investment.

-

Develop a clear profit plan.

-

Understand that this is a period of high volatility and rapid declines of 10%-30% are possible.

-

Accept that these rapid declines are difficult to predict, and by trying to game these pullbacks you could derail your longer-term investing plans.

A “risk” analysis of entering the market at this stage (rather than entering the market in the past 3-6 months):

Please refer to this .

3. Suggestions on how to enter:

If you missed the accumulation period in the past 6 months, you first need to think about why you missed it.

Its probably because you are influenced by your emotions:

-

In a bull market, prices usually rise very quickly with few noticeable and sustainable pullbacks.

-

Many people miss the opportunity to rise, and when they chase highs due to fear of missing out, the market often enters a stage of volatility or rapid decline.

-

Amid the volatility, they became pessimistic again and ultimately missed the opportunity for a rapid rise again.

The correct strategy is to build positions in batches during the shock or pullback phase, remain patient, and focus on the market structure in a longer time frame.

More information can be found Hier .

Next up are specific suggestions!

Tip 1: Stick to spot trading and avoid leverage

Spot trading is preferred.

Many people are used to using leverage, but this is actually a trap. Every market fluctuation feels like an opportunity, but in fact most of the time it is not. You dont need to rush into it. Leveraged trading will eventually make most people lose money or even go to zero – dont let it ruin your bull market gains.

Stick to spot trading so that you don’t get locked out of your position due to excessive leverage, or even worse, get forced to close your position and miss out on market opportunities.

Trust me, stay away from leveraged trading.

Tip 2: Don’t chase the rise, focus on the pullback

Most people trade based on emotion and only buy when the price is rising (green candles) because it makes them feel “safe”.

But markets don’t go up in a straight line, and even in a bull market there will be pullbacks:

-

Daily volatility: small pullbacks of a few percentage points.

-

Every few weeks: 10%-30% panic drop.

If you buy when prices are rising, you are likely to sell out of panic when they pull back.

-

Feel comfortable buying the upside.

-

There is a sense of relief when you sell the dip.

But the correct strategy is:

-

It might be scary to buy, but it’s the right time.

-

You may feel sad when you sell, but it is a rational choice.

If you can go against the trend, build positions during pullbacks, and buy boldly during panic sell-offs, you will have an advantage over most people.

Suggestion 3: Build positions in batches and be patient

so far:

-

Select spot trading only.

-

Dont chase the rise, but build a position during the pullback.

Additionally, you don’t need to invest all your money at once.

You can choose to build your position gradually. If the price drops by 5%, and you put all your money into altcoins at once, you might sell out of panic if the market sees a bigger correction (like a drop of 10%, 20%, or even 30%).

The correct strategy is: when the price drops by 5%, invest 10% of your funds first. In this way, when there is a larger pullback (such as 10%, 20% or 30%), you can continue to gradually increase your position instead of being thrown out by market fluctuations.

What if the pullback doesn’t go any deeper? That’s OK. Don’t invest all your money at once because you’re afraid of missing out, which could force you out in a deeper pullback.

There will be more pullbacks and opportunities to build positions in the future.

In a highly volatile market, you can’t perfectly time every move. You don’t need to buy at the bottom or sell at the top, just focus on long-term gains.

Tip 4: Control risks and avoid excessive risk taking

You may have heard of those legendary stories of people who made millions by going all-in, but excessive risk-taking will greatly test your psychological endurance. If your position is too heavy, you may be forced to sell out of panic when the market pulls back, and ultimately miss out on bigger opportunities.

Tip 5: Create a plan that works for you

Dont just copy someone elses plan. Instead, create a clear investment plan based on your own goals and risk tolerance. This plan should include risk management and multiple response plans in case the market does not go as expected.

A good plan can keep you calm during market fluctuations, avoid making wrong decisions due to panic or excitement, and help you gradually achieve profitable exits.

Here are some points to make sure of in your plan:

-

Keep it simple: Don’t overcomplicate your plan.

-

Focus on long time frames (HTF): focus on big trends rather than short-term fluctuations.

-

Clear goals:

-

What market signals would I like to see?

-

Which tokens do I want to invest in? Why do I choose them?

-

How much money do I plan to invest?

-

In which price ranges do I build positions in batches?

-

When do I quit?

For more information on how to develop a cyclical profit plan, please refer to this tweet .

Tip 6: Focus on the long term and keep your strategy simple

-

Focus only on long term frame (HTF) charts and avoid being distracted by short term fluctuations.

-

You only need to focus on the key price ranges and market structure, and ignore too much market noise.

-

Keep your strategy simple and straightforward.

Even simple strategies can give you an edge in the market:

-

Most people trade with leverage, but you don’t.

-

Most people chase the price higher when it is rising (green candle), but you don’t chase the price higher.

-

Most people don’t have a clear plan for profit, but you have yours.

-

Most people buy or sell all at once, but you choose to build and exit positions gradually.

Before I share my altcoin watchlist, let me make an important point:

Viewpoint:

In the current market, altcoins (“Others” market cap) are expected to hit new highs and attract capital inflows from Bitcoin and mainstream currencies.

Currently, the market value of “Others” is slightly above the mid-line of the range and is gradually approaching the high of the range.

It is important to note that the range high is often a strong resistance area and there may be multiple tests and pullbacks before a breakout. This is often overlooked when the market is strong (such as todays green).

Recall Bitcoin’s performance before breaking out of the range high: it went through multiple pullbacks and shocks before successfully breaking out.

Even looking back at the last bull cycle, at the beginning of the alt season, the “Others” market cap chart saw a sharp 30% correction before breaking through the range high.

So keep the following in mind:

-

The market could experience a larger correction, perhaps even weeks of decline, before a full-blown alt season arrives.

-

But instead of trying to predict these pullbacks and wait for them, adopt the following strategy:

-

Build your position slowly and in batches: Increase your position gradually, and dont invest all your funds at once.

-

Avoid using leverage: Leveraged trading is extremely risky and may result in forced liquidation.

-

Buy on pullbacks: Focus on entering positions when the market is falling (red candles) rather than chasing prices when they are rising (green candles).

By being patient and following a long-term strategy, you will be more likely to profit from market fluctuations.

1. $SOL

SOL is a currently strong performing large-cap coin, showing clear advantages in this market cycle – it is a choice worthy of attention.

From a market cycle perspective, I expect SOL to break out above its current range high and have clear upside potential as the price enters the discovery phase (i.e., after the price reaches a new all-time high, the market explores its true value).

At present, you can consider building positions in batches, but you need to pay attention that the current price is in the high resistance area of the range. If you buy all positions at once, you may not be able to withstand the 10%-30% price correction that may occur in the future. Therefore, it is recommended to strictly follow the plan of building positions in batches.

In addition, it is recommended to use spot trading and avoid leverage operations. The following is my operation idea:

-

Wait for the price to break through the high of the range before building a small position.

-

If the price continues to rise and stabilizes at a high level, you can continue to add positions in batches.

-

If the price falls back below the range and then breaks out again, this is another opportunity to add to your position.

-

If the price pulls back to the previous range of fluctuations, it can also be used as an opportunity to build positions in batches.

-

You can also consider adding to your position when the price rises again after a pullback and breaks the short-term downtrend line.

In short, it is necessary to formulate clear response plans for various possible market trends and gradually build positions through spot trading.

2. $BLUR

BLUR is a unique coin. Earlier this year, it failed to hold the low of the range in Phase 4 (i.e., the price failed to support in the low area), which may be due to the overall sluggish NFT market at that time.

Today, the NFT market is recovering. Opensea may launch its own token, and Magic Eden’s token will also be launched next week.

Driven by these positive events, combined with the current market and chart performance, BLUR may regain market attention.

My main observation point is whether there will be an opportunity to enter a position when the price re-reaches the low point of the range (marked by the arrow on the chart).

If the market falls again, you can also try to enter a position at the low point of the Phase 3 range.

However, for me, this coin is more suitable for short-term trading rather than long-term holding.

3. $MEME

Even the average investor has heard of the meme-themed investment cycle. It’s hard for me to imagine that a token called “MEME” would not attract widespread attention after it was listed on all the top exchanges.

The price structure of this coin is very perfect and it is currently in stage 3. I will wait for the price to clearly break out and reclaim the key position before entering the market.

In addition, the token is also associated with a large NFT series. With the recovery of the NFT market, the implementation of the $ME incentive plan, and the potential launch of the Opensea token, it may bring further upward momentum.

4. $ORAI

$ORAI is a veteran AI token. Last week, it successfully reclaimed Phase 4 (orange area) in the short-term market structure, so I bought some positions again.

If the price pulls back to this range again, I will continue to increase my position.

Additionally, I have set a price alert that will serve as a new entry signal when it breaks out above the macro range low.

5. $TIA

I have held TIA since it recovered and retested its range low.

Currently, it is trying to break out of the current price structure. I believe that if the price forms a clear breakout above the gray area, the subsequent pullback will be a good opportunity to add to your position.

This article is sourced from the internet: 6 strategies to teach you how to grasp the cottage market

Related: If you miss the first bite of the crab, these AI Agents coins are still exploding

In the past two days, MEME has not seen any new token narrative. It is still centered around the existing AI Agent and meme models, with more details superimposed and gameplay mixed. In the AI Agent track, we can also find that the recent BASE chain has diverted some traffic from the Solana chain, so this time we will also discuss some of the latest AI Agents hot coins on the BASE chain. $UBC In just two days since its launch, $UBC has performed well on the decentralized trading platform Pump.fun, with a current market value of $66 M, becoming one of the most discussed AI tokens in recent times. As a project that combines innovative ideas and practical applications, $UBC continues to gain popularity. $UBC, the full name of…