A comprehensive interpretation of the new ace public chain Mantle: from fundamentals to ecosystem

Original author: Klein Labs + Web3 Labs

1. Background of Mantle

1.1 Project Introduction

Überblick

The public chain track has always been the main battlefield of Web3. Since the birth of Ethereum, there have been many challengers. On the basis of Ethereum, the L2 route dispute has been derived, until todays L2 era of contention. We can gradually see that technological innovation and high performance alone are not enough. A public chain is like a digital kingdom. It needs a sufficiently prosperous ecosystem and the consensus of a large number of developers and users to continuously obtain taxes.

Mantle is a dark horse that has emerged in this fiercely competitive race. Since the launch of the mainnet in July 2023, in just over a year, it has become the fourth-ranked L2 in TVL, and has an extremely large treasury support of 2.6 billion US dollars. It has become the top L2 and has the momentum to become a first-tier public chain. So, how did Mantle get to where it is today step by step, and what greater development will it have in the future? We will discuss this in more depth in this article.

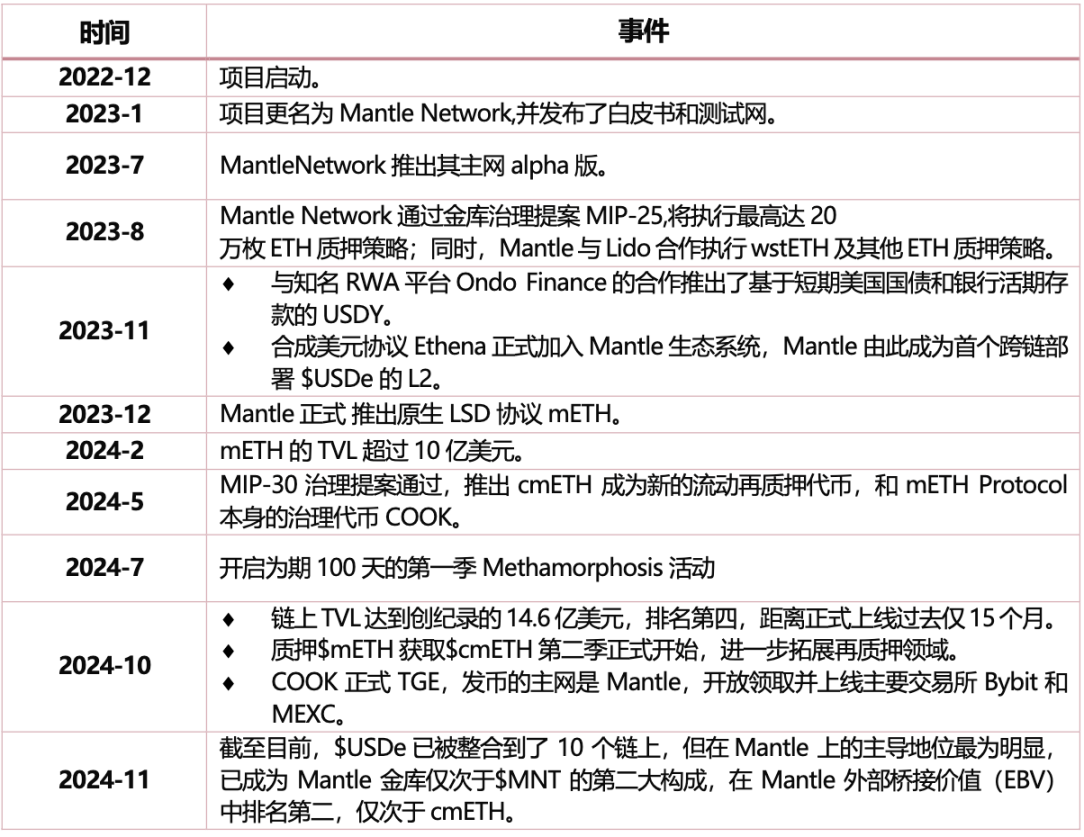

Important development nodes

1.2 Zeichen Wirtschaft

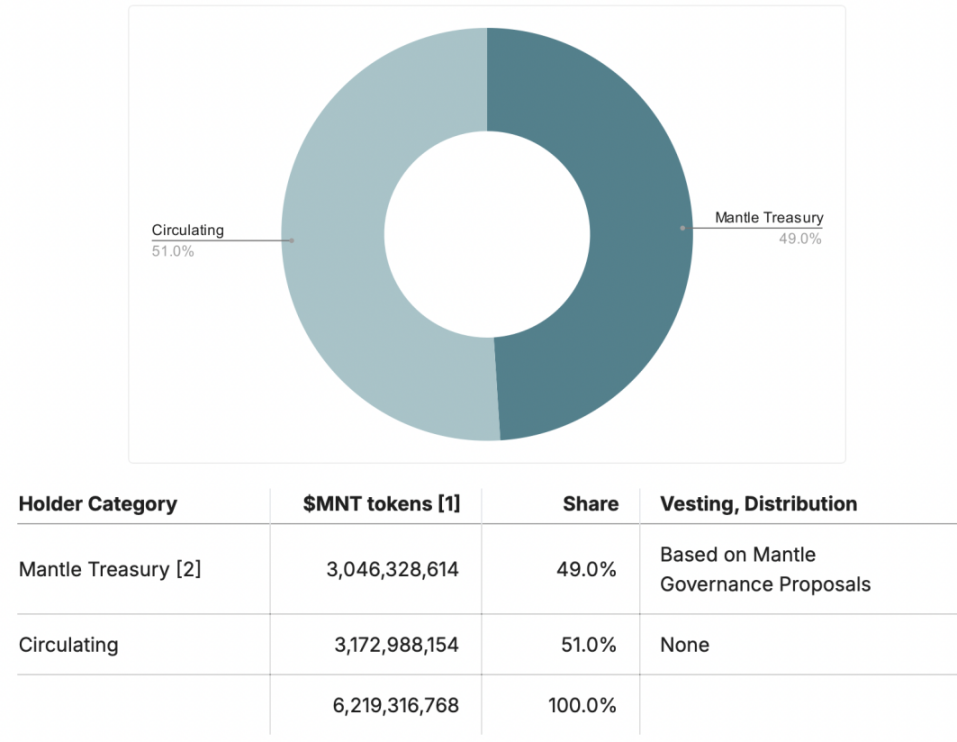

$MNT tokens are governance tokens and utility tokens in the Mantle ecosystem, with a total of 6.219 billion. As a governance token, each $MNT has voting rights in the Mantle governance process. As a utility token, $MNT can be used to pay gas fees for the Mantle network and is also the main asset for Mantle rewards. This is actually a big difference between Mantle and other L2s. It consumes $MNT as gas fees, which is conducive to the increase in the value of $MNT.

According to the official $MNT initial distribution snapshot provided on 2023-07-07, the $MNT distribution is as follows:

Source: Mantle

As can be seen from the distribution chart, Mantle Treasury holds nearly half of the $MNT tokens, which are non-circulating. The distribution of Mantle Treasurys $MNT tokens is subject to the Mantle governance process, and the budget, fund raising and allocation process follow strict procedures. After the initial distribution, the sources of $MNT in Mantle Treasury include: irregular donations from third parties and Mantles mainnet gas fee income.

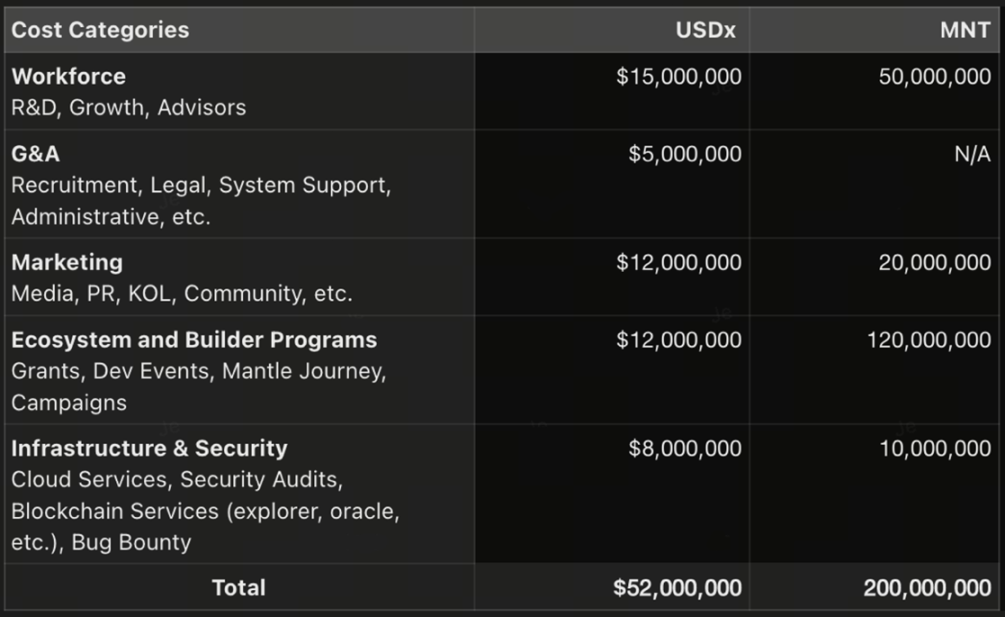

The Mantle Core Budget is the primary expense for $MNT and is used for payments and incentives for: Labor, General and Administrative Expenses, Markting, Ecosystem and Builder Programs, and Infrastructure and Security.

In MIP-31, which was just passed in September 2024, Mantle made new plans for its second budget cycle (the 12-month period from July 2024 to June 2025), with the main expenditures being: RD and growth (15 million $USDx and 20 million $MNT), and marketing (12 million $USDx and 20 million $MNT). In fact, Mantle has already cooperated with various marketing agencies and research entities, including Bankless, Unchained Podcast, Delphi Digital, Messari, and other well-known media and research institutions and influential thought leaders have reported on Mantle.

Mantles budget composition, source: Mantle

1.3 Data Overview

Project related data

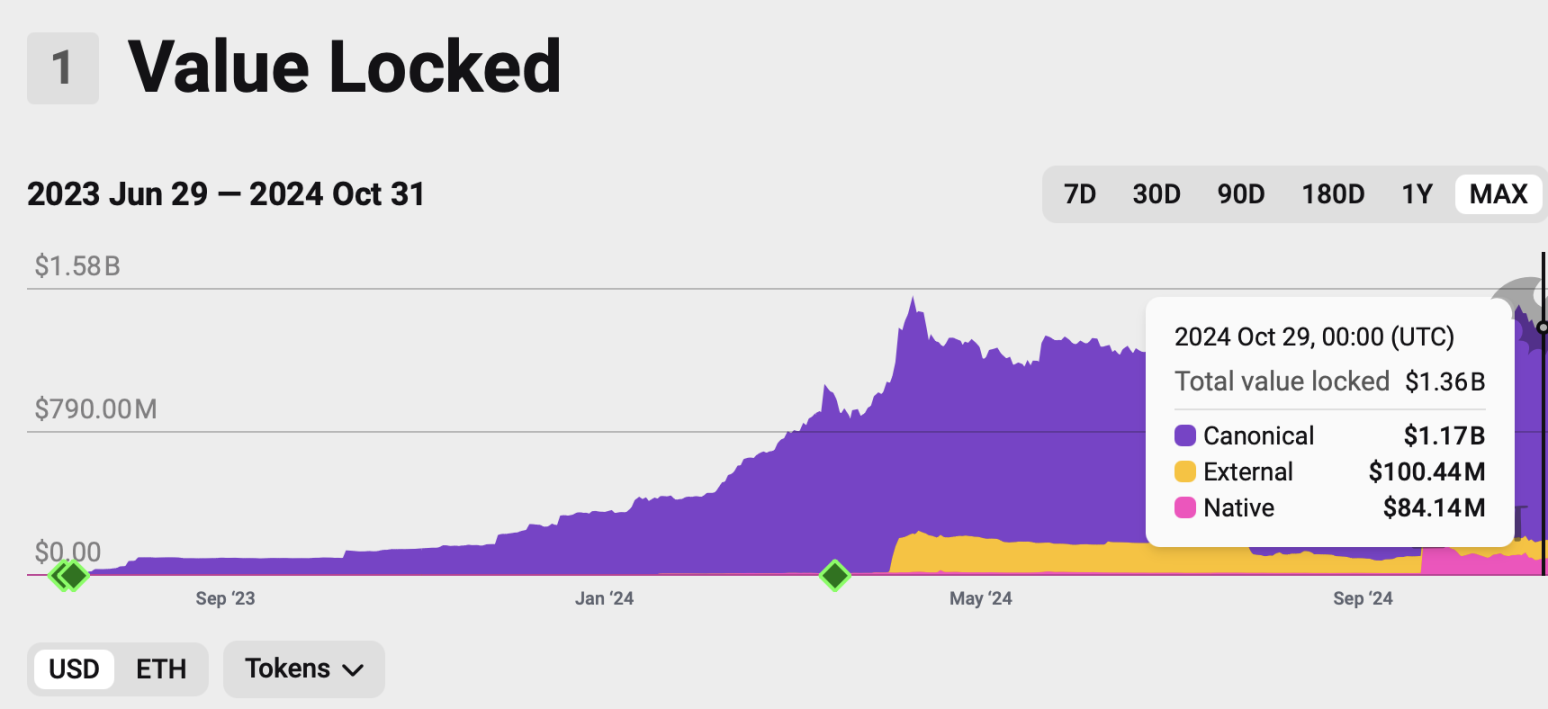

Lets now compare multiple sets of data to gain a concrete understanding of Mantles growth over the past year. We know that Mantles mainnet was launched on July 17, 2023. It can be seen that after a period of stability, it ushered in explosive growth in early 2024.

In terms of TVL, Mantles on-chain TVL just exceeded $400 million in early February this year, and then began to soar all the way, reaching a peak of nearly $1.5 billion in April 2024, an increase of more than 300% in 4 months. As of the time of writing, Mantles latest on-chain TVL data is $1.38 billion, ranking fourth in L2. As a basic indicator for evaluating the development of L2, TVL largely reflects the value information of user participation, market confidence, and the health of the ecosystem. The rapidly growing TVL often represents the trust and acceptance of users, and is also one of the proofs that Mantle can provide stronger liquidity.

Mantle’s TVL, source: l2 beat, 2024/10/31

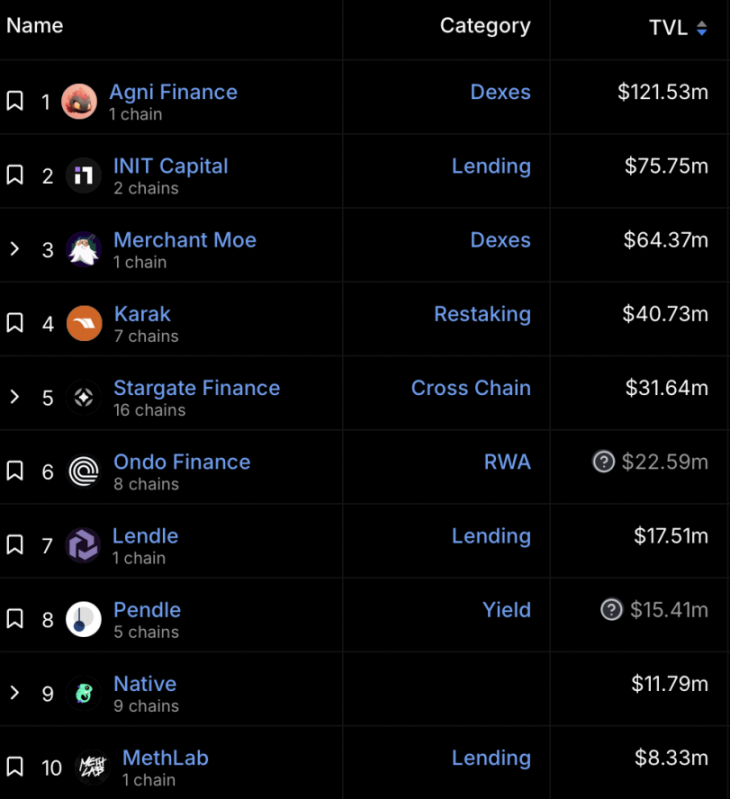

From the perspective of In-dApps TVL, the DeFiLlama data dashboard provides a more intuitive view of its ecological composition. It is not difficult to find that the core sources are Dex, lending, Restaking and other DeFi fields, and the rapid growth of Dex TVL accounts for a relatively high proportion. This also shows that DeFi is the focus of Mantle.

TVL of Mantle ecosystem projects, source: DeFillama, 2024/10/24

After looking at the TVL fundamentals, lets take a look at Mantles on-chain activity. More and more L2s are born, just like spending a lot of time and energy to build highways, but because there is no demand, there are very few cars driving on the highway. This is a common problem faced by most L2s: there are no high-quality applications. Therefore, it is more realistic to measure the prosperity of L2 through data such as user volume and transaction volume, and we have also seen the excellent user activity shown by Mantles growth data.

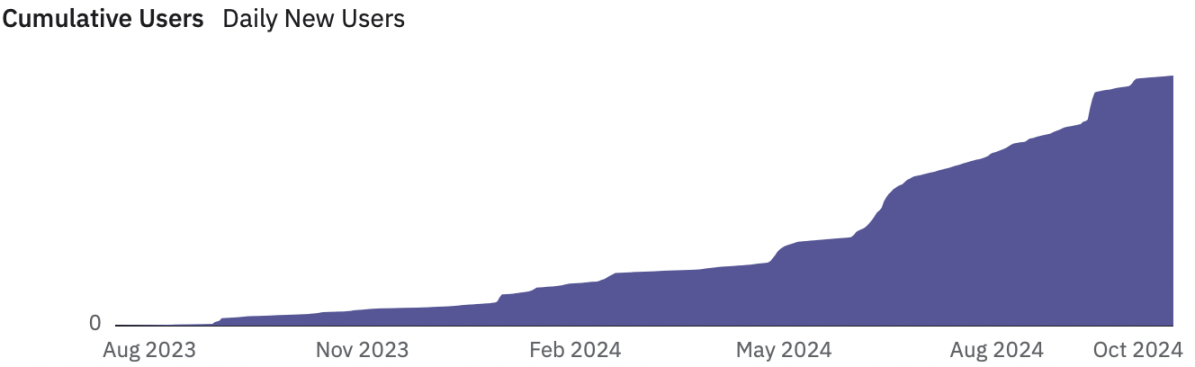

In terms of the total number of users, Mantle had approximately 330,000 users in December 2023, and as of October 15, 2024, the total number of Mantle users has exceeded 4.42 million, a 13-fold increase in less than a year, indicating that more and more users are entering the Mantle ecosystem.

Mantle user data, source: Dune, 2024/10/24

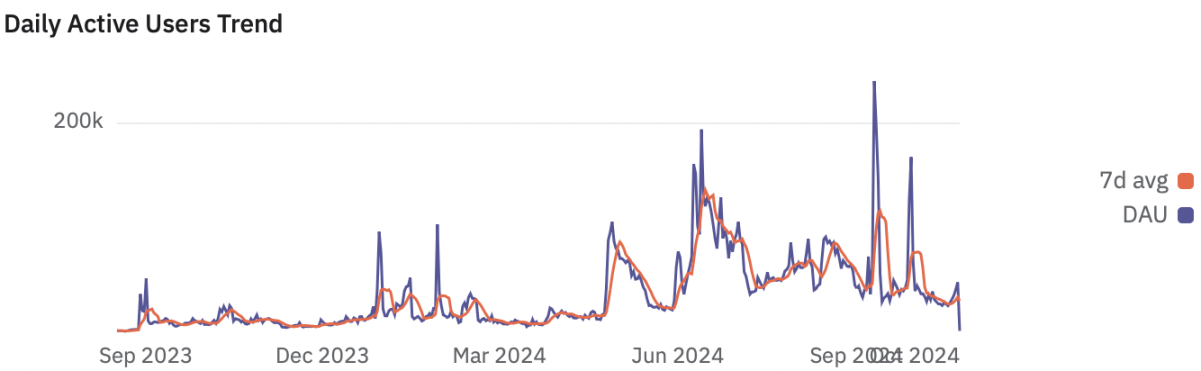

In terms of daily active users, Mantles monthly active users saw a significant increase at the end of April 2024, and have maintained a higher average level since then. The current monthly active users are around 40,000, which is nearly 3 times the level around September 2023 more than a year ago.

Mantle’s daily activity data, source: Dune, 2024/10/24

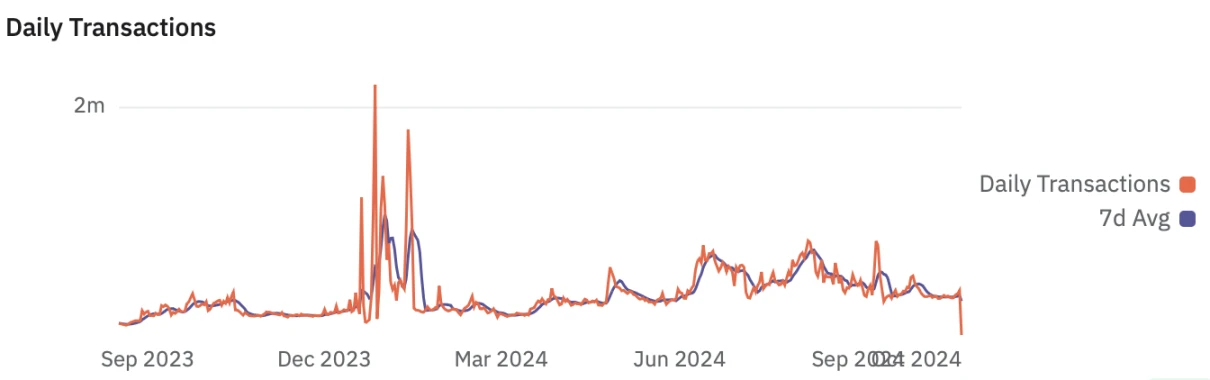

In addition, in terms of transaction volume, as of October 23, 2024, the total transaction volume on the Mantle chain has exceeded 150 million, with a daily transaction peak of more than 2.2 million, showing strong on-chain activity. The more active the on-chain transactions, the higher the network transaction fee income, which to a large extent represents the networks stronger self-sustaining ability.

Mantle transaction data, source: Dune, 2024/10/24

Social media related data

As of October 24, 20234, Mantle has accumulated more than 800,000 followers on X, and the communities on Telegram and Discord are very active, with more than 200,000 members participating in discussions, AMA meetings, and project updates. Currently, Mantles Discord community has attracted nearly 440,000 members, with more than 10,000 people online per day, becoming one of the most popular channels. At the same time, Twitter updates and interactions are frequent.

In addition, Mantle has conducted more than 120 AMAs on official social media channels and ecosystem channels, hosted by KOLs and project team members. These include series of events such as Mantle Ecowaves and Mantle Showcase Radio, which have played an important role in promoting user participation and adoption. In addition, Mantle can also be seen around the world, and has held more than 50 offline events.

1.4 Technical Architecture Principles

L2 Rollup is mainly divided into two types: OP (optimistic Rollup) and ZK (zero-knowledge proof Rollup). Mantle Network implements L2 expansion solutions based on OP Rollup, and also develops its own DA layer of modular components.

Modular design significantly reduces transaction costs

When we discuss modular blockchains, we must first understand the concept of Monolithic Blockchain. Taking Ethereum as an example, a mature monolithic blockchain can generally be roughly divided into four architectures: Execution Layer, Settlement Layer, Data Availability Layer/DA Layer, and Consensus Layer. Each layer has its own unique functions and roles. Simply put, Mantles modular design handles the four key functions of the blockchain at different levels, rather than completing them on a single network layer like most single blockchains. The four functions are:

-

Transaction execution: It is carried out on Mantles EVM-compatible execution settlement layer. Mantles sorter generates blocks on the L2 execution layer and submits the state root data to the main blockchain.

-

Consensus and settlement: Responsible for the Ethereum L1 network.

-

Data availability: An independent data availability layer was developed based on Eigen DA, allowing Mantle to submit only necessary state roots to the Ethereum mainnet for storing callback data that would normally be broadcast to L1.

-

Data acquisition: Other nodes obtain transaction data from Mantle DA through the DTL service and perform verification and confirmation.

In the current blockchain architecture, OP Rollup needs to submit all transaction data to Ethereums data availability layer at a high Calldata fee. As the transaction volume grows, this fee is as high as 80-95% of the total fee, which seriously restricts the cost efficiency of Rollups. Mantle Network has successfully reduced operating costs through its independently developed modular data availability layer. In addition, the modular design makes it easier to access new technologies.

Decentralized sorters eliminate centralization risks

The sorter is the core role in the L2 solution responsible for collecting and sorting transactions, calculating status and generating blocks, and is critical to the security of the network. In traditional Rollup solutions, the sorter is usually a single centralized node, which is vulnerable to failure, manipulation or censorship. Mantle replaces the centralized sorter with a permissionless sorter cluster, bringing the following benefits:

-

It improves the availability of the network, eliminates the risk of single point failure, and ensures the continuous operation of the network.

-

It improves the consensus reliability of the network, prevents manipulation or censorship of the sorter, and ensures the fairness and transparency of transactions.

-

The incentive compatibility of the network is improved, and the compliance behavior of the sorter is driven by the reward mechanism, ensuring the long-term sustainability of the network. In contrast, centralized sorters face the public product dilemma.

1.5 Competition Landscape

The background of Ethereum congestion has created the grandest narrative. In his article “The Three Transitions”, Vitalik Buterin proposed three major technical transitions that Ethereum needs to go through: transition to L2 expansion, where everyone turns to Rollup; transition to wallet security, where everyone uses smart contract wallets; transition to privacy, where privacy-preserving fund transfers are feasible. Vitalik Buterin believes that without the development of L2, Ethereum will fail due to high transaction costs.

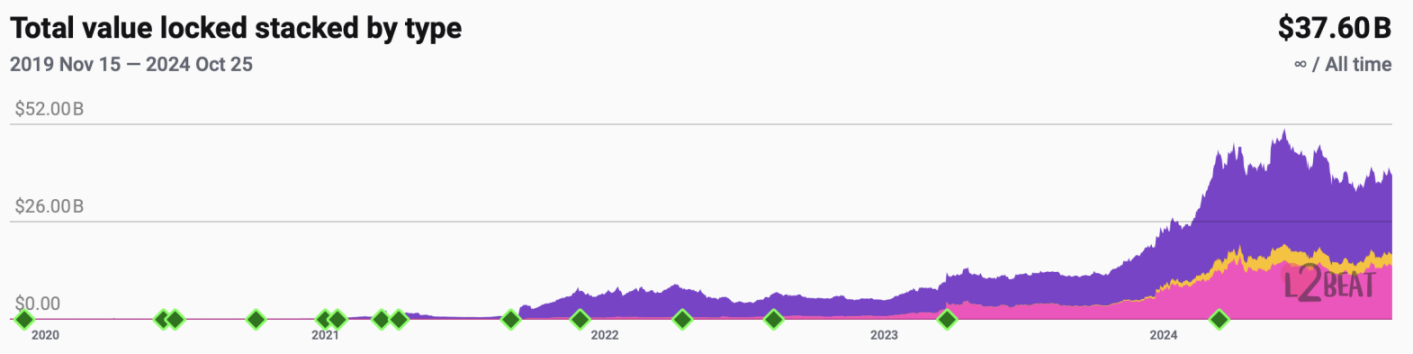

It is in this context that the current L2 track is booming. According to L2 Beat data, there are already 110 L2 or L3 expansion solutions in operation on the market, however, only a few L2s can gain mainstream recognition and generate a large number of TVL and users. As of October 24, 2024, the TVL of L2 expansion solutions has reached US$37.62 billion, a three-fold increase from a year ago, showing strong development momentum and user demand.

Source: l2 beat, 2024/10/25

Comparison between Mantle and mainstream L2

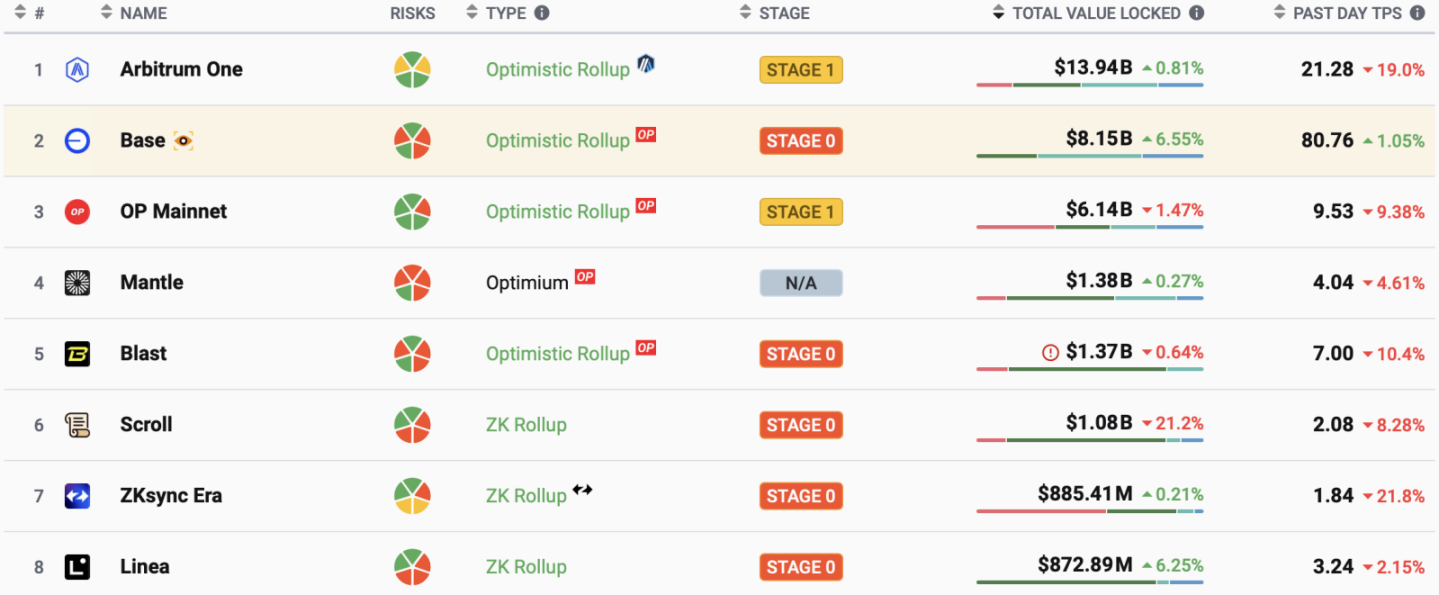

In terms of TVL, the top three are Arbitrum, Base, and Optimism, which have accounted for more than 73% of the market share. Mantle came from behind and became the fourth largest Layer 2 one year after its launch.

L2 TVL ranking, source: L2 beat, 2024/10/31

In terms of FDV, Mantle ranks second only to Optimism and Arbitrum with $3.58 billion. In terms of MC/FDV, Mantle ranks first with 54.1%, which proves that MNT will face less selling pressure in the future.

Source: Coinmarketcap, 2024/10/26, compiled by Klein Labs

In terms of revenue and profit, Base has surpassed Abitrum to become the most profitable L2 since March this year, while Mantle remains in the top five.

Source: Dune, 2024/10/26

Comparison between Mantle and public chains in transaction background

Mantle’s early supporters include the third largest exchange, Bybit, which also brings it unique advantages. In this section, we will also look at some other L2s with exchange backgrounds for comparative analysis.

When it comes to public chains supported by exchanges, we all know that Binance incubated BNB and opBNB chains, Coinbase incubated Base, OKX supported X Layer, etc. And just on October 24, the exchange Kraken also announced plans to launch its L2 network Ink, which is expected to be launched on the mainnet in early 2025.

Before introducing these L2s, let’s take a look at the major exchanges behind them. According to Coinmarketcap’s ranking, Binance, Coinbase and Bybit are the top three Krypto exchanges, and OKX and Kraken are ranked 4th and 6th respectively. This also means that among the top 6 exchanges, 5 have supported at least one public chain. This is also an important strategic choice for exchanges.

The entry of exchanges into the public chain field is not only to expand the service boundaries, but also to explore the transfer from off-chain to on-chain. This trend will Führung a larger number of users and assets to gradually migrate from off-chain centralized exchanges (CEX) to on-chain (decentralized finance, DeFi) platforms, making the trading ecosystem move towards decentralization. Public chains and exchanges have something in common in essence, both of which require new assets to be issued and traded on them to generate income. The rich asset operation experience and high-quality industry resources of exchanges are also one of the competitive advantages of this type of public chain.

1.5.2.1 BNB Chain

BNB Chain (formerly Binance Chain) was created in 2019. At that time, the utility token BNB, which was launched in 2017, was migrated from the Ethereum network to BNB Chain. BNB Chain was renamed from BSC. Although it is L1, we will also briefly introduce it here due to its strong Binance background.

BNB Chains current TVL has reached 4.7 billion US dollars. With the exchange background and financial support of Binance, BNB Chain has successfully built DeFi into a strong field, among which Pankecswap is the most well-known.

Binances financial and technical support are undoubtedly important advantages of BNB Chain, but its close relationship with the exchange has also raised questions about the degree of decentralization. For example, in the 2022 hacker attack, in order to quickly control the situation, Binance requested all validators to suspend transactions on BNB Chain. This centralized operation actually reflects the limited number of verification nodes on the chain at the time, and also means that most nodes are directly or indirectly controlled by Binance.

How to reasonably utilize the resources of the exchange behind it while gradually achieving independent on-chain governance and truly practicing the decentralized Web3 concept is actually a key issue that all public chains incubated by exchanges will face.

In addition, BNB Chain also launched opBNB, an EVM-compatible L2 scalability solution based on OP Stack, in Q2 2023. According to DeFiLlama data, opBNBs current TVL is 21.6M USD and is still in its early stages of development.

1.5.2.2 Base

Base is an Ethereum L2 public chain incubated by Coinbase. Since Coinbase is subject to SEC supervision, it is difficult for Base itself to issue tokens, which means that it lacks a natural token economic incentive advantage compared to other L2s.

Despite this, Base has achieved remarkable success within a year of its launch, with its TVL experiencing two explosive growths in April and September this year, and now exceeding $2.4 billion. We have also seen innovations such as Friendtech on Base.

The top five projects contributing to Bases TVL are all from the DeFi field. It is worth noting that Aerodrome Finance, which ranks first, contributed nearly 54% of Bases TVL with $1.3 billion. Aerodrome was launched on Base on August 28, 2023 and is a DEX based on an automated market maker (AMM).

1.5.2.3 Cronos zkEVM

Cronos is a blockchain launched by the cryptocurrency exchange Crypto.com (ranked 13) in November 2021. It is an Ethereum-compatible L1 network, but its TVL has not been significantly improved since its launch. Subsequently, Cronos development team Cronos Labs and Matter Labs further launched the zk-based L2 network Cronos zkEVM, which was launched on the mainnet in August this year.

Cronos zkEVMs current TVL is stable at around US$17 million, and its current size is relatively small compared to the previous major chains.

1.5.2.4 X Layer

X Layer is a zk rollup-based L2 jointly launched by OKX and Polygon Labs in April this year. X Layer uses OKB as its native token, which can be used as gas fee payment. In subsequent planning, X Layer will continue a series of technical architecture optimization and scalability improvements, such as decentralization of the sorter. X Layers current TVL is $9.3 million.

From the perspective of TVL comparison, Base is relatively leading, Mantle ranks second, and Cronos zkEVM and X Layer are still on a smaller scale.

Source: DeFiLlama, 2024/10/26

1.6 Preliminary Value Assessment

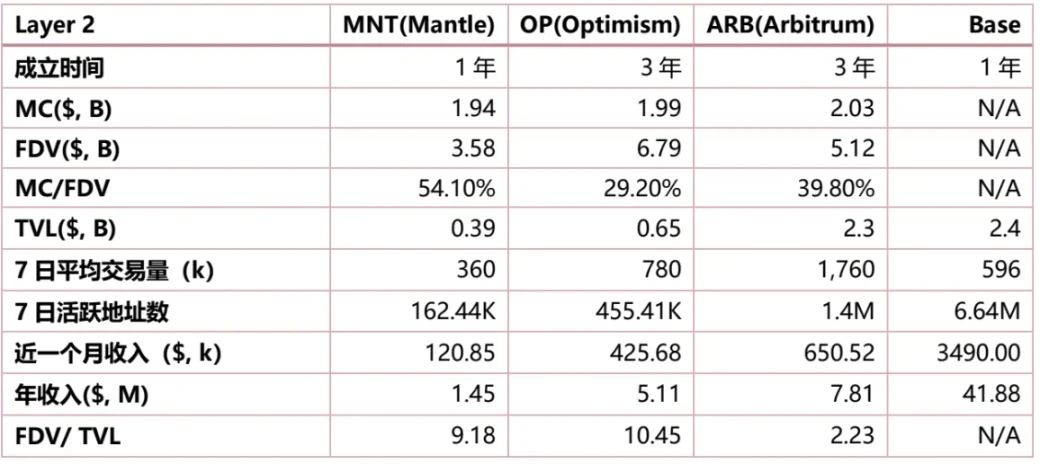

By comparing with different Layer 2 networks horizontally, we can intuitively judge the ecological prosperity and valuation level of the network, so as to better evaluate the development potential of Layer 2.

Before making a comparison, we need to note that unlike other L2 networks that use ETH as a Gas token, the MNT token is used as a Gas token for the Mantle chain. This needs to be taken into account when comparing with other L2 networks. We mainly calculated the following indicators:

Data comparison, source: Dune, DeFiLlama, Klein Labs, 2024/10/26

It can be seen that compared with the Layer 2 networks of other OP Rollup tracks, Mantles ecosystem is still in its early stages. However, more than 50% of Mantles native token MNT is already in circulation, which makes its future selling pressure smaller than other public chains. In addition, Mantle has achieved such a high level of hard-core data indicators such as TVL and on-chain revenue in such a short period of time. We have reason to believe that as the Mantle ecosystem continues to improve and prosper, its competitive position in the L2 track will continue to rise and reach a new height.

2. Mantle’s Ecosystem

As Vitalik said, the ecosystem of the public chain is its killer feature. A rich and diverse ecosystem can not only attract more new users to enter, but also motivate existing users to interact more frequently and diversely in the ecosystem. Thinking about Mantles growth from this perspective, although the rotation of the market cycle has indeed brought it a positive impact, what is more important is the help brought by Mantles constantly enriching ecological landscape.

According to the latest data, there are more than 240 dApps in the Mantle ecosystem, including 89 DeFi, 96 infrastructure, and 20 GameFi. DeFi and infrastructure account for half of the total, which also reflects the prosperity of DeFi on Mantle as the infrastructure of the public chain.

Source: Mantle, 2024/10/24

Below we will also analyze some projects in its ecosystem from these main categories:

2.1 DeFi Track

DeFi is the foundation of a public chain. The perfection of DeFi infrastructure largely affects the potential and upper limit of the development of the entire ecosystem. Among Mantles DeFi projects, 36 are DEXs, and the rest include lending, re-staking, etc. Below we will introduce some of these projects:

2.1.1 Agni Finance

Project Introduction: Agni Finance was founded in 2023. It is Mantles native AMM-based DEX and the number one TVL project on Mantle (US$121 million). Its total trading volume has reached US$3.92 billion. Agni currently provides 6 currencies and 20 trading pairing services, and its most active trading pairing is METH/WETH. According to Coingecko data, Agnis latest 24-hour trading volume is $4.36 M.

After experiencing a doubling explosion in July this year, Agni Finances TVL has remained stable at more than 100 million US dollars, doubling from Q2.

X: @Agnidex

2.1.2 INIT Capital

Project Introduction: Founded in 2023, INIT Capital is a platform for dApp and user interaction, providing both permissionless access to a unified liquidity pool and efficient yield management. As a built DeFi liquidity infrastructure, INIT provides a variety of activities, including lending and yield strategies. Init is now available on Mantle Blast. As of writing, INIT Capital has a market size of $110 million and a total loan amount of over $24 million.

INIT Capital announced at the end of February 2024 that it had completed a $3.1 million seed round of financing, led by Electric Capital and Mirana Ventures.

X: @InitCapital_

2.1.3 Merchant Moe

Project Introduction: Merchant Moe is a DEX founded in 2024. It is a product of Trader Joe and is designed and built to serve the Mantle ecosystem and community. It was launched on the mainnet in January 2024, and the $MOE token was also officially launched. Currently, it provides trading services for 14 currencies and 22 trading pairs, and the most active trading pair is METH/USDT.

Under MIP-28, Merchant Moe will receive liquidity support from Mantle Treasury. In addition, Merchant Moe also received seed investment from Mantle EcoFund.

X: @MerchantMoe_xyz

2.1.4 Ondo Finance

Project Introduction: Ondo Finance is a financial protocol focused on the RWA track. At this stage, its main business is to tokenize high-quality assets such as U.S. Treasury bonds and money market funds within a compliance framework for users to invest and trade on the blockchain. The RWA U.S. Treasury track where Ondo is located has seen a 6-fold increase in TVL in the past year, making it the main driving force of the RWA industry. Ondo Finances TVL has grown rapidly since April and currently ranks third in TVL in the RWA track. It has a certain first-mover advantage and is expected to develop in the future. Ondo Finance currently supports 8 chains, of which the TVL on Mantle ranks third, surpassing Aptos, Arbitrum and Sui.

X: @OndoFinance

2.2 Wrapped assets

To be precise, Wrapped Assets belongs to the category of DeFi, but given Mantle’s remarkable achievements in this field and its recent continued efforts and attention, we will analyze this sector separately.

On October 23, Bybit launched cmETH and planned to launch COOK, the governance token of mETH, which quickly set off the entire network. Before explaining cmETH and COOK in detail, we need to understand what mETH is.

2.2.1 mETH

mETH is a permissionless, non-custodial ETH liquidity staking protocol where users can obtain mETH (1: 1) by staking ETH. Currently, mETH has 15,025 validator nodes and more than 480,000 ETH staked.

As the native LSD protocol launched by Mantle, mETH has achieved rapid growth since its launch on December 4, 2023. In less than a year, its TVL reached US$1.22 billion and it is currently the fourth largest Ethereum LSD product.

Looking back at the background of the birth of mETH, in June 2023, Ethereum has successfully transitioned from PoW to Proof of Stake PoS, and Lido Finance has long been the market leader with a TVL of $13 billion. Following closely behind are Rocket Pool (rETH) and other competing products, which have made the competition in the liquidity staking (LSD) track extremely fierce. For mETH, which has just had its first round of discussions at the Mantle Governance Forum, it is clear that it has not gained a first-mover advantage.

However, after sufficient community governance discussions and technical preparations, the ETH liquidity staking protocol for all users was officially launched on December 8, 2023 (Mantle LSP at the time). With its strong performance, mETH quickly emerged in the fierce LSD track and became a new player at the time.

According to DeFiLlama data, within a week of its launch, the TVL of Mantle LSP exceeded $100 million, and then continued to rise, reaching a peak of nearly $2.2 billion in March this year. Currently, the TVL is stable at more than $1.2 billion, making it the fourth largest LSD product on Ethereum. In addition, official data shows that mETH has more than 8,000 wallet users on Ethereum, and 26,000 wallet users on the Mantle network, and the number of users and activity are also eye-catching.

Source: DeFiLLama, 2024/10/25

mETH holders can access various DeFi platforms for liquidity pools, yield farming, and other financial activities without unstacking ETH. Here are a few examples of dApps available to users:

-

For trading, Bybit offers mETH/USDT and mETH/ETH pairs, while NativeX offers mETH/WETH pairs and other exchange options.

-

On the lending side, INIT Capital allows depositing/borrowing positions using ETH, Timeswap utilizes ETH as collateral, and MYSO Finance offers zero-fee swaps and custom zero-liquidation loans.

-

In terms of liquidity, Merchant Moe offers various liquidity pools, while Butter.xyz allows liquidity to be added to any available token, including ETH and MNT.

This is also the unique advantage of meETH: backed by Mantles rich and mature ecological landscape, meETH is given more liquidity scenarios, bringing richer profit space and stronger demand for meETH. This healthy cycle of benign development model further promotes the continued growth and prosperity of meETH.

2.2.2 cmETH

At the end of May 2024, half a year after the official release of mETH, the MIP-30 governance proposal was passed, and cmETH was launched as a new liquid re-staking token (LRT). Specifically: mETH is used as a liquidity staking token, and users stake ETH to obtain mETH; and cmETH is used as a liquidity re-staking token, and users can stake mETH again and obtain cmETH at a 1:1 ratio.

Like mETH, cmETH will be highly composable in the Mantle ecosystem (including EigenLayer, Symbiotic, Karak, Zircuit, etc.), allowing users to explore more revenue opportunities through L2 and decentralized applications and protocols while maintaining the advantages of mETH. Compared with mETH, the core advantage of cmETH is that in addition to the basic staking income, it also covers more revenue opportunities, including the re-staking points income (airdrop expectations), re-staking AVS income, etc.

In short, cmETH is a higher risk-return option than mETH, and is more suitable for users who want to try to obtain higher returns within a certain risk range. In addition, while the MIP-30 governance proposal launched cmETH, it also announced the issuance of $COOK as the mETH governance token.

Here we mention the grand first season of Methamorphosis held by Mantle from July 2024: In this 100-day event, mETH once again played its ecological advantages and directly announced 23 partners, including EigenLayer, Symbiotic, Karak, Zircuit, Pendle and other well-known projects. Users holding mETH can participate in interactions and complete tasks to get rewards, and Power can be exchanged for COOK tokens in the future.

Source: Mantle

Although the first season has ended, on October 23, mETH announced that the second season of Methamorphosis will be launched soon. There is no doubt that the Mantle ecosystem will usher in another wave of hot growth.

2.2.3 FBTC

Mantles Wrapped Assets are not limited to ETH. In its ecosystem, FBTC, jointly launched with Antalpha and others, represents another important form of liquid assets. Introducing BTC into the Ethereum ecosystem, WBTC was relatively successful before, but it sometimes falls into a crisis of trust. At this time, FBTC will be a better choice.

FBTC is a full-chain Bitcoin asset that is pegged 1:1 to BTC and provides cross-chain bridging and trading capabilities on the Ethereum and Mantle networks, thereby improving the accessibility and practicality of Bitcoin. By introducing FBTC, Mantle not only enriches the types of on-chain liquid assets, but also creates new options for cross-chain transactions for users, optimizing the overall user experience.

Products such as FBTC and mETH together constitute Mantles multi-dimensional layout in the field of liquidity and cross-chain, helping to build its on-chain DeFi income ecosystem. Thanks to the support of the Mantle ecosystem, this multi-chain asset layout will drive it to become a strong competitor in the field of Layer 2 and cross-chain liquidity.

2.3 Game

Grant Zhang is the head of Mantles ecological gaming sector. Zhang has extensive experience in the gaming industry, having led the publishing teams for games such as League of Legends and Game of Thrones. The game projects he has participated in have been downloaded more than 500 million times.

In terms of the layout of the game sector, Mantles strategy is very different from most other ecosystems, and this difference is mainly reflected in Mantles team. In other ecosystems, the development of the game sector is usually led by excellent investors, while Mantles game team is more composed of distribution and operation experts in the game industry. Therefore, Mantle is able to provide more substantial support to its game partners, including tokenization design, economic model, game distribution, financing and user acquisition.

In addition, despite having the largest treasury in the Web3 field, Mantle is still very cautious in choosing the games it supports. Unlike other ecosystems that may try to introduce hundreds of games to the ecosystem by casting a wide net, the Mantle ecosystem actually only selects about 7-8 games to establish in-depth cooperation and provide real support. Because of this, the funding and support that these selected games can receive are much more substantial.

Below we select some core game projects for introduction:

2.2.1 Catizen

Catizen is a cat-themed game mini app built on Telegram. Players can raise cats and get rewards by sliding. According to a tweet posted by Telegram CEO Pavel Durov, as of July 30, 2024, Catizen has more than 26 million players, which is just over 4 months from its launch on March 19, 2024.

Catizen example, source: Catizen

In April 2024, Catizen established a strategic partnership with Mantle. But in fact, Mantles partnership with Catizen and its publisher Pluto Studio can be traced back to August 2023. Whether it is game design, token economics, user acquisition, or even cooperation with TON, Mantle provides full support. The reason why Catizen chose Mantle for cooperation is as mentioned above. Mantles unique team structure can provide professional and practical support for game projects. These supports can strongly promote the success of the project, which is also something that other ecosystems cannot do.

For Mantle, hyper-casual games like Catizen and Tap to Earn are just the beginning. These games are very suitable for attracting users and can bring a large number of Telegram user groups into mini-games. In the future, Mantle plans to develop with the Telegram mini-game ecosystem and continue to release more suitable game products at each stage of evolution.

As of press time, Catizen has over 600,000 users on the Mantle blockchain. CATI tops Mantle’s Natively Minted Value list with $76.63 million.

X: @CatizenAI

2.2.2 MetaCene

MetaCene is a massive multiplayer online role-playing game (MMORPG) with Web3 elements. It combines NFT, blockchain mechanics, and AI technology with classic game mechanics such as PvP battles and land management. MetaCene was founded by Qunzhao (Alan) Tan, an experienced game company developer.

As a large-scale MMORPG game, MetaCene has more complex requirements in terms of cost, rules and economic model design. Mantle has teams such as Game 7, Hyperplay, Yeeha and Community Gaming, which can provide comprehensive support in terms of user acquisition, participation, wallet infrastructure, entry, security, etc., and can provide more practical support for MetaCene.

It is worth mentioning that after the founder of the professional blockchain game guild No. 1 Alliance had an in-depth experience with MetaCene, he said that MetaCenes game depth is well designed and the player composition is international, which also indirectly proves the playability of the game.

As of press time, there are more than 510,000 users on Metacene, and the number of daily active users once exceeded 360,000.

X: @MetaCeneGame

2.2.3 Funton.ai

Funton.ai is a new member of the Mantle ecosystem in October this year. As the leading modular multi-game platform in the TON ecosystem, Funton.ai is committed to building a decentralized GameFi ecosystem that combines artificial intelligence and games, and provides one-click game generation services. As of July this year, its monthly active users have exceeded 350,000. The cooperation with Mantle will help attract hundreds of millions of Telegram users into the Mantle ecosystem. Funton.ai also customized Flappy MNT for Mantle. Connect a wallet containing $MNT to earn $MNT + FUN Points by playing games.

It is worth mentioning that Funton.ai has recently cooperated with multiple organizations such as Gate Austausch and OKX Wallet to carry out airdrop activities for its token $FUN, which further expanded its influence and user base in the market. At the same time, Funton.ai also entered the acceleration camp of Web3 Labs and KuCoin Labs, further gaining recognition from mainstream Web3 institutions.

X: @funton_ai

3.4 Other Ecosystem Related

Mantle has always invested a lot of energy in the development of ecological support and is also a role model for various public chains. The following is some information related to ecological support and activities:

2.4.1 EcoFund

Mantle EcoFund is an ecological fund of up to US$200 million provided by the Mantle Treasury, which aims to promote the adoption of developers and dApps on the Mantle network, give priority to investing in teams building high-quality and innovative projects within the Mantle ecosystem, and increase investment in potential outstanding projects when appropriate.

According to the official website, EcoFund has funded more than 13 projects, among which INIT Capital, Catizen, Merchant Moe and many other projects have grown into the backbone of the Mantle ecosystem.

2.4.2 Mantle Grants

To further promote ecosystem vitality, Mantle has created two incentive programs:

Mantle Scouts Program. Launched in April 2024, it authorizes 16 industry leaders to issue $1 million in MNT tokens to high-quality projects within the ecosystem to support innovative projects. The program provides mentor guidance, network resources, and financial support to accelerate the success of projects in the Mantle ecosystem.

Public Grants. Mantle offers grants (valued at up to $20,000 in MNT) to early-stage projects to foster a vibrant developer community.

2.4.3 Game 7

As Mantle focuses on the development of its ecosystem, Mantle has also launched a game accelerator program in cooperation with Game 7. Based on the Mantle Network infrastructure, Game 7 provides game developers with key tools, such as NFT markets, cross-chain bridges, game DAOs, etc., to provide high-quality user experience and ecological interconnection for the game projects it incubates and invests in. The two will be committed to promoting the development of a permissionless and interoperable game world.

2.4.4 Sozu Haus

In terms of developer activities, Mantle sponsored and hosted 26 hackathons around the world, as well as numerous technical workshops and online AMA sessions. More than 900 hackathon projects were submitted. Mantle also organized six exclusive Sozu Haus events (Mantles mini accelerator and maker home program), while hosting large global crypto events to attract top founders and developers.

2.4.5 Other Ecosystem Partners

In addition to its own huge ecosystem, Mantle is also actively cooperating with other partners in the industry. These partners not only support the expansion of the Mantle ecosystem, but also provide it with technical and liquidity resources in areas such as capital support, user traffic, development resources, market trust and industry endorsement, and developer education.

For example, Mirana Ventures has continued to provide financial and resource support to the Mantle ecosystem. Mirana Ventures has also been shortlisted for the Top 100 investment institutions in 2023 selected by RootDada. Its fund has a management scale of tens of millions of US dollars and has established and incubated multiple projects. Representative investment projects include: TON, Morpho, Zircuit, Story Protocol, etc. In addition, Mantle is also the only technical partner of Eigenlayer.

In terms of developer community, Moledao is also an ecological supporter of Mantle. Moledao is committed to providing resource docking and support for early Web3 projects and developers. Through the Web3 series of public welfare courses, hackathons and other offline activities, Moledao helped Mantle contact and attract many outstanding blockchain projects and developers. As a developer community, Moledao continues to provide Mantle with technical innovation support and talent reserves to help it quickly build and improve the blockchain ecosystem.

2.4.6 Ecosystem Incentives

Mantles huge treasury (nearly 3 billion US dollars, the second largest in the world) is Mantles biggest source of confidence. The PoS interest income of the treasury can be directly fed back to users, for example, the restaking income through EigenLayer can be used as an ecological reward. This reward mechanism has really increased the motivation of users to participate in the ecosystem. Through ecological interaction or staking, users can not only support the development of the ecosystem, but also get a share of the Treasurys income, making the entire ecosystem more dynamic.

3. Summary of highlights

Over the past year or so, Mantle has demonstrated its strong competitiveness in the L2 track through impressive growth data. For current users, with the in-depth integration of the ecosystem and the arrival of cmETH and COOK, Mantle will continue to grow strongly in the future. In the face of this foreseeable growth, we have the following main views:

-

Strong endorsement from Bybit: Based on the close relationship between Mantle and Bybit, excellent projects in the Mantle ecosystem will have the opportunity to be listed on Bybit and be discovered by more investors through Bybits recommendation. For dApps development teams, this is an extremely attractive resource and exposure channel.

-

The worlds largest treasury support: The Mantle Treasury, with nearly $3 billion, is a strong backing for projects built on the Mantle Network and the biggest source of confidence for its ecological development. Mantle is building a more rewarding on-chain application center for finance and consumption. For example, the interest income generated by the treasury can create additional subsidies to be fed back to users.

-

Advantages of technical architecture: Mantles modular design provides significant scalability and cost optimization advantages, and also makes Mantle more flexible and able to innovate openly.

-

The fourth largest Ethereum LSD product: Mantles top four TVL contributions all come from the DeFi field. It is crucial to achieve the ideal liquidity integration of DeFi. The Mantle ecosystem is committed to solving the problem of liquidity fragmentation and placing a heavy bet in the field of liquidity staking. Relying on advanced underlying design and powerful ecological empowerment, mETH has grown into the fourth largest Ethereum LSD product in a short period of time.

-

Booming gaming ecosystem: So far, the gaming sector in the Mantle ecosystem has launched 7 flagship products, among which projects such as Catizen and MetaCene have performed well in their respective segments. Mantle plans to gradually release all gaming products in the next few quarters to promote further growth of the ecosystem.

-

Full support for developers and founders: The Web3 industry needs more innovation and crypto application cases. Mantle has implemented a variety of developer incentive programs, such as the Sozu Haus Hacker Home Program, and the $200 million EcoFund, to actively explore and support top developer talents. For talented, creative and passionate developers, Mantle is an ideal growth platform.

As a Layer 2 project that is both cost-effective and in line with future trends, Mantle has the potential to lead the development of on-chain transactions and applications, and provides an ideal ecological environment for DeFi and decentralized applications. We should not only pay attention to Mantles potential as a Layer 2, but also compare Mantle in the entire public chain track. Its performance, ecology, TVL, etc. have surpassed most Layer 1s. Considering its relatively short growth history, strong financial support from the treasury, and its good performance in doing the right thing, we have every reason to expect Mantle to bring surprises to the web3 world.

Perhaps the next paradigm-level innovation will happen in Mantle?

Quellen:

https://l2 beat.com/scaling/projects/mantle/tvl-breakdown

https://coinness.com/en/news/29331https://www.mantle.xyz/ecofund

https://coinness.com/en/news/20359

https://tokenpost.com/Mantle-Network-Blockchain-for-scaling-Ethereum-11054

https://coinness.com/en/news/25225

This article is sourced from the internet: A comprehensive interpretation of the new ace public chain Mantle: from fundamentals to ecosystem

Related: Bitcoin breaks through $93,000, a quick look at the three catalysts for the bull market

Original author: 1912212.eth, Foresight News Recently, the price of Bitcoin has exceeded $93,000, setting a new record high and is just a stones throw away from $100,000. The Google Trends chart shows that the popularity of Bitcoin has reached its highest point since 2021. In addition, CryptoQuant CEO Ki Young Ju released data saying that Bitcoin retail-level (below US$100,000) trading volume hit a three-year high, which also indicates that retail investors are entering the market. After Bitcoins rise stagnated and began to fluctuate and consolidate, some market funds flowed into meme coins, while some altcoins still performed poorly. In the future, what other catalysts will drive bull market prices upward? MicroStrategy may be included in the SP 500 index The SP 500 Index, also known as the SP 500 Index,…