Odaily interviews THENA CEO: Listing on Binance is just the beginning

Host: @OdailyChina

Guest Speaker: Theseus, CEO Co-founder of THENA

Time: December 3, UTC+ 8 7:00 PM / UTC+ 2 1:00 PM

Topic: Fireside Chat with THENA CEO: Building the DeFi SuperApp for Mass Adoption

With THENA becoming a partner project for the second phase of Binance HODLer airdrops and launching spot and perpetual contracts for $THE, THENA is steadily moving towards its goal of becoming a DeFi super app. Odaily Planet Daily invited and interviewed THENAs CEO Theseus (Adriano) to gain an in-depth understanding of his vision to bridge the gap between DeFi and traditional finance. THENA hopes to make blockchain financial solutions accessible to more people and pave the way for the mass popularization of DeFi. In this interview, we will explore how THENA expands the DeFi ecosystem, addresses key challenges in the industry, and promotes the future development of DeFi.

Odaily Planet Daily: Okay, the first question for the opening session, $THE token performed very well after it was launched on Binance last week. May I ask, are there any changes in the teams daily work? How do you feel now?

Theseus: I am very happy to be able to participate in this interview today. Thank you for the invitation and support from Planet Daily! It feels very exciting to be listed on Binance! After three years of bear market construction, it is not only meaningful but also very satisfying to be able to successfully land on the worlds largest exchange. This is an important milestone for THENA.

Speaking of changes, this is more like a new beginning for us. Since the launch on Binance, THENA has received more and more attention. Now, we have received many cooperation requests, and many protocols hope to cooperate with THENA. At the same time, the platform traffic has increased significantly, prompting us to upgrade the backend infrastructure to ensure scalability and stability.

Despite this, not much has changed in terms of how the team works. We remain focused on optimizing the platform, launching new features, deepening partnerships, and exploring the best strategies to drive ecosystem development. So even though these two weeks have been busier than usual and the traffic has increased a lot, it is still part of our daily work for us.

We are proud of our achievements so far. For some investors and long-term supporters, the listing of $THE on Binance is a long-awaited goal and can even be seen as an ultimate milestone. But for us, it is both a phased achievement and a brand new starting point.

Next, our priority is to maximize the exposure and resources brought by this opportunity to continue to develop THENA and ultimately achieve our goal of making it the most successful decentralized exchange in the DeFi field.

Odaily Planet Daily: Can you tell us more about THENA and your background in the Kryptocurrency field?

Theseus: Of course! First, let me briefly introduce the development history of THENA. I know that many people have only recently become aware of THENA, but in fact, we have been building it for two years. THENA was officially launched in early January 2023. Since then, we have quickly grown into one of the largest DEXs on BNB Chain and began to emerge, and even grew into one of the most influential platforms in the entire cryptocurrency field.

Momentan, THENA is a comprehensive trading platform that combines ease of use and functionality, supporting spot trading and perpetual contract trading, covering more than 250 cryptocurrencies. In addition, THENA also provides liquidity support for protocols that need to expand on-chain liquidity. Currently, THENA has reached cooperation with more than 50 protocols on the BNB chain, and helps these protocols manage liquidity through innovative incentive market mechanisms. I can share more details about this with you later.

From the beginning, THENA has placed great emphasis on user experience. We designed the platform to be simple and intuitive to operate, especially for novice users, so that more people can easily enjoy the convenience and opportunities brought by DeFi.

As for my background, my name is Adriano and I have been working in the cryptocurrency space for almost five years. I first got into crypto during the ICO craze in 2017 as a casual investor. After the first bear market, I started to delve deeper into blockchain technology and started consulting for a few projects in 2020. This experience made me realize that I wanted to create my own product.

Later, I developed a yield optimizer on the Fantom blockchain, which is still running today but is now managed by other teams. Since 2023, I have devoted myself to the construction of THENA. This journey has been full of challenges and achievements, and I believe that THENAs journey has just begun.

Odaily Planet Daily: Can you tell us how THENA was born and how it differs from other DEXs?

Theseus: Of course! As I mentioned before, before creating THENA, I developed a yield optimizer protocol called Liquid Driver. At that time, we worked with DEXs on many blockchains, which gave me a deep understanding of the importance of DEX. In the DeFi ecosystem, exchanges can be said to be the cornerstone of the entire industry. Whether it is DeFi, GameFi or other crypto fields, as long as tokens are involved, on-chain liquidity is crucial. The core mission of DEX is to enable users to easily access and trade these tokens while providing infrastructure support for ecological innovation.

At the time, I was inspired by the famous DeFi builder Andre Cronje, who launched a model called ve(3, 3), which quickly grew to over $1 billion in TVL in a short period of time, but ultimately failed due to flaws in its token economics and front-end design. However, I saw the huge potential of this model to be validated by the market, so I decided to improve it, learn from it, and re-implement it on another chain with our own approach. Thus, THENA was born.

The differences between THENA and other de-DEX are mainly reflected in the following points:

-

Innovative ve(3, 3) model:

THENA is not only a DEX serving liquidity providers and traders, but also a B2B2C platform. THENA works closely with many protocols to help them expand their liquidity strategies through innovative incentive markets and ve(3, 3) models. This model provides efficient liquidity solutions for protocols while bringing more attractive reward mechanisms to users.

-

Advanced AMM Products:

THENA integrates the best and most advanced automated market maker (AMM) models in the industry. THENA provides multiple liquidity models, including centralized liquidity (similar to Uniswap v3), classic AMM (Uniswap v2), and the upcoming weighted pool AMM and Meta stable pool. These AMM models can provide efficient and deep liquidity for various tokens.

-

User-friendly Platform:

From the beginning, THENA has made user experience a core focus. The THENA platform allows both new and experienced users to easily trade and earn returns. Advanced liquidity management tools simplify the process of providing centralized liquidity and lower the entry barrier for new users.

-

In-depth partnership building:

THENA is not just a trading platform, our team also pays great attention to the establishment of practices and partnerships. We have established close relationships with multiple protocols on the BNB Chain to assist them in their development journey. THENA is not only an exchange, but also a business development center on the BNB chain.

It is these characteristics that make THENA stand out from other DEXs, becoming a leader in the DeFi field and an important promoter of BNB Chain ecosystem construction.

Odaily Planet Daily: Can you share how THENA handles income distribution and what is unique about it compared to other DEXs?

Theseus: Of course! Lets start with a quick comparison, which is also one of the most discussed topics in DEX for a long time – how should we distribute DEX revenue. The distribution of DEX revenue involves two main parties: token holders and liquidity providers, the latter of which need to be reasonably compensated for providing liquidity. In terms of token economics, different platforms have different models. For example, Uniswap adopts the model of 0% revenue distribution to token holders, while PancakeSwap adopts a hybrid model, where part of the fee is distributed to liquidity providers and a small part is distributed to token holders.

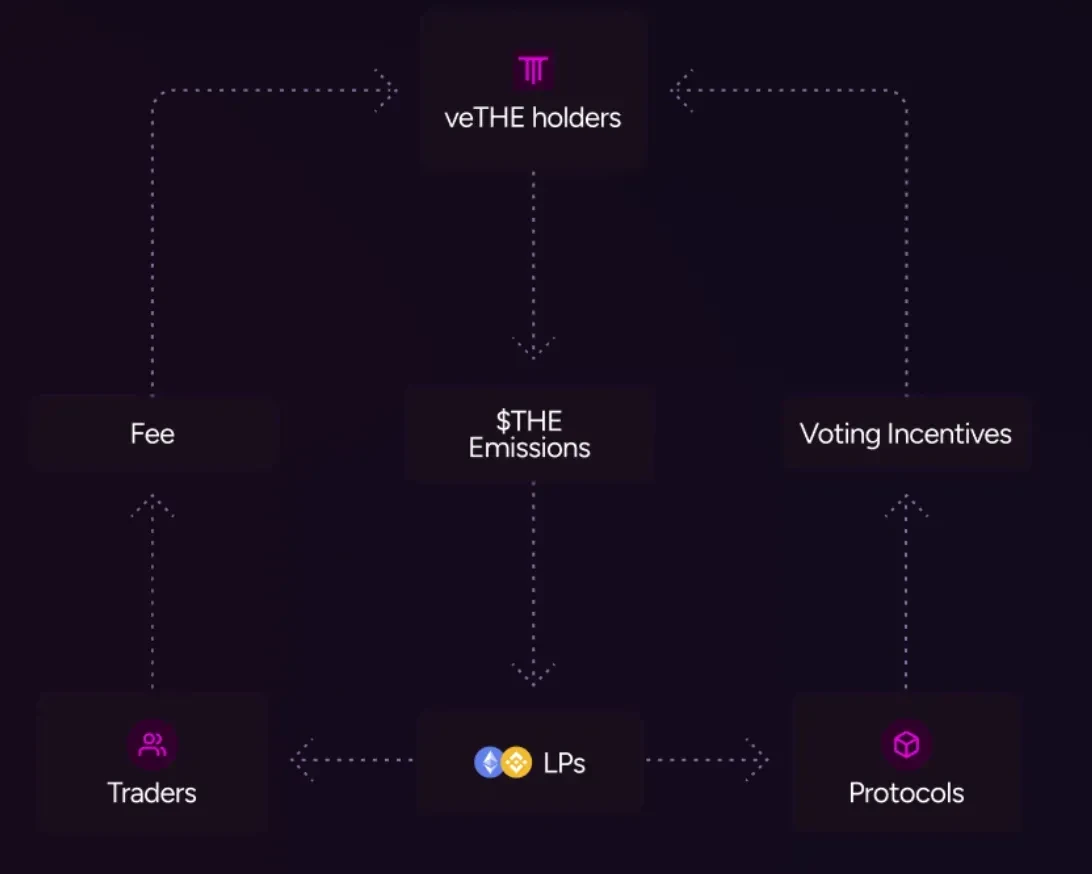

At THENA, we have chosen a unique distribution method – 100% of the profits generated by DEX are distributed to token holders, while liquidity providers receive rewards through the platforms token incentive mechanism.

How does this work? To unlock the full utility of a token, users need to lock it up. The lockup period can range from two weeks to two years. The longer the lockup period, the greater the governance weight that the token holder has. Users who lock up their tokens can vote weekly to decide how the liquidity mining rewards will be distributed. For example, a user might vote 50% for one pool and 50% for another pool. At the end of the week, based on the voting results, the mining rewards for the next week will be distributed to the pools in proportion to the number of votes. Assuming a pool gets 50% of the voting weight, it will receive 50% of the weekly rewards.

Warum ist das wichtig? This model encourages token holders to maximize their returns by voting for pools that generate more fees and rewards. They are able to earn a portion of that pools transaction fees as well as additional voting rewards. This incentive mechanism naturally forces token holder behavior to allocate mining rewards to the most profitable pools, and over time, this dynamic adjustment significantly improves the profitability of the entire DEX.

A win-win ecosystem

This design enables THENA to achieve a win-win situation between token holders and liquidity providers:

-

Zeichen holders: By locking up tokens, they can not only obtain all the benefits of DEX, but also participate in the growth of the platform through governance.

-

Liquiditätsanbieter: Through incentive mechanisms, they still receive sustainable, predictable and competitive returns, which is critical to attracting and retaining liquidity.

This high degree of consistency in the incentive mechanism for stakeholders makes THENA a completely different platform from other DEXs.

THENA has also achieved remarkable results: since its inception, THENA has generated more than $26 million in revenue, which is a very impressive number. Given our recent rapid growth, this number is expected to grow exponentially in the future.

Odaily Planet Daily: THENA has always been a community-driven project. How is this principle reflected? How does THENA reward users? What plans are there to strengthen community participation in the future?

Theseus: THENAs community-oriented principles are deeply rooted in our release strategy and operational philosophy. From the first day of the project, we attach great importance to the power of the community and give back and strengthen this sense of participation in many ways.

1. Community-driven release strategy

It all stems from THENAs launch strategy. As I mentioned before, THENA is a B 2 B 2C platform. At the beginning, THENA introduced 22 protocols and allocated initial locked tokens to them. These protocols can meet their own liquidity needs by guiding emissions. This cooperation not only helps the protocols achieve liquidity goals, but also introduces their users to the THENA ecosystem.

In addition, THENA also conducted a large-scale airdrop through a cooperation agreement during the launch phase, distributing tokens to users who are already active in DeFi, directly aligning the interests of the community with the development of the platform.

2. Innovative NFT strategies

In addition, we launched an innovative fundraising campaign – a series of artistic NFTs. These NFTs are not only beautifully designed, but also allow holders to share a portion of THENAs revenue. The proportion of revenue distribution will gradually decrease over time, but it still becomes an important reward mechanism for early supporters.

It is worth mentioning that THENA launched this NFT series at the peak of the bear market. At that time, the liquidity and demand of the market were very low. However, the value of these NFTs has increased by more than 10 times today and distributed a lot of gains to early investors. These investors are mainly community members, early users of the platform or DAOs.

3. Continuous community interaction and rewards

From the beginning, THENA has been community-centric, and this concept is deeply rooted in the way we operate. For example, THENA will provide beta versions of upcoming features, invite core users to participate in testing and provide feedback to help us improve the product. THENA maintains continuous communication with the community because we firmly believe that this is the best way to iterate the product and provide the best experience for users.

To give back to the community, THENA continues to run various reward programs, such as the biweekly Zealy (formerly Crew 3) event, which gives out more than $6,000 in rewards each time. THENA believes that the community is our strongest ally in marketing. Interestingly, some community members even take the initiative to launch their own events, using their own rewards to attract new users and educate them. This spontaneous participation is very impressive and has begun to show significant results.

This success is inseparable from the joint efforts of THENAs marketing team led by 0x Apollo and the community-oriented approach. Instead of taking the traditional venture capital route and directly inflating the data at the time of release through artificial means, THENA chose to focus on building a long-term and loyal user base. These users not only invest or provide liquidity, they also actively help us improve the product. Understanding user needs has played a vital role in the results we have achieved.

Future plans: To further strengthen community engagement, we will also launch an ambassador program to formalize how we work with some of our most active users. In addition, we will launch more incentive activities in the coming weeks. Please follow us on Twitter and Discord, where we will make all announcements.

Odaily Planet Daily: What are the important milestones for THENA in 2025 and beyond? How will these milestones shape THENAs success?

Theseus: The biggest milestone THENA is about to reach is the migration to V3. The development of this version has been ongoing for six months, and the audit has been completed. We are finalizing the final details and plan to start the migration at the end of this year or early next year. This upgrade will bring significant improvements to THENA and transform us from a DEX to a potential financial super application.

One of the biggest highlights of V3 is the introduction of Hooks . Simply put, Hooks is a smart contract deployed on a specific liquidity pool that allows any logic to be executed when a user interacts with the pool (whether it is trading, adding or withdrawing liquidity). This provides unlimited possibilities for innovation.

For example, Hooks can implement:

-

Advanced order types, such as limit orders.

-

Complex applications, such as building margin trading or leveraged yield farms directly on liquidity pools.

-

Customized requirements, such as requiring specific pools to complete KYC, are critical for introducing real-world assets or securities into on-chain transactions.

These features will open a new door for THENA, allowing us to grow further and begin bringing traditional finance (TradFi) into the world of on-chain transactions.

What I am most excited about is that V3 is more than just the migration itself. Once V3 is online, we expect to attract a large number of developers and builders who will come up with innovations based on the THENA platform that are even beyond our imagination. THENA was designed as a collaborative platform from the beginning. In addition to the core team, there are many external developers who use our technical infrastructure to develop other applications.

In DeFi, network effects are very important. The more you work with others, the more valuable the platform and user base become. By migrating to V3 and enabling Hooks, we are inviting developers to innovate directly on THENAs infrastructure. This will make THENA a one-stop financial platform that provides users with a wide range of functional options.

Our goals remain the same, namely:

-

For traders: Provide the best user experience and the most competitive prices.

-

To partner agreements: providing the best tools to manage liquidity and enable innovation.

DEX is the backbone of DeFi, providing the necessary foundational layer for other applications on the chain. Through the Hooks open platform, THENA is able to iterate and innovate faster than ever before, launching a series of features that provide great value to users and protocols.

I am very excited about the next phase and I am sure it will shape THENA鈥檚 success while driving us to continue growing and redefining the rules in this space.

Odaily Planet Daily: The DeFi market is clearly developing rapidly. What do you think of its current status, and what trends do you think will determine its future?

Theseus: I am more excited about the prospects of DeFi now than ever before. I believe we are on the verge of DeFi Summer 2.0. Those who experienced DeFi Summer 1.0 may remember that it was an exciting period full of innovation and economic experiments. Although many attempts failed, some successful products became flagships of the industry, such as DEXs such as Uniswap, key money markets, and stablecoins, etc. In the first wave, we did find some strong product-market fit points, but the infrastructure was not mature at the time and the entire industry was still in its early stages. However, DeFi is now almost ready to welcome the next billion users. Although there is still some work to be done, significant progress in infrastructure is bridging the critical gap between TradFi and DeFi.

Key trends shaping the future:

-

RWA Asset Tokenization:

A recent trend that has received a lot of attention is the tokenization of real-world assets. At THENA, we have invested a lot of energy in this area. For example, one of THENA鈥檚 key partners, Brickken, is developing solutions to make our DEX more friendly to asset token issuers. This will not only ensure compliance, but also provide strong market making capabilities and trading markets for these assets. This area will accelerate with the migration of THENA V3, which I am very excited about.

-

Combination of AI and DeFi:

Artificial intelligence also has great potential in DeFi. Some liquidity managers are trying to use AI-driven tools to optimize liquidity management. In the future, we are expected to see these innovative applications on the THENA platform.

-

Decentralized Identity and Credit Scoring:

The introduction of a decentralized identity system will be a key development, especially crucial for enabling uncollateralized lending. Currently, most money markets still rely on over-collateralization due to the lack of on-chain identity and credit scoring systems. Solving this problem will enable us to introduce more products like TradFi and accelerate the adoption of DeFi.

-

Improve User Experience (UX):

If DeFi hopes to onboard the next billion users, it must simplify the user experience. Currently, the typical process is too complicated for newcomers, including creating an account on a centralized exchange (CEX), completing KYC, transferring funds, and learning how to use DeFi products.

THENA is working to simplify this process. Through innovations such as account abstraction, gas abstraction, and intent-based systems, we are removing these complexities. For example, THENA allows users to get started directly through our DEX without going through a CEX first. These improvements will make DeFi more friendly and accessible to ordinary users.

By 2025, I expect these innovations to be widely used across protocols, significantly improving UX and infrastructure. DeFi will better align with TradFi, support on-chain trading of RWAs, and provide a richer suite of financial products. This is an exciting time for the entire industry. With THENA focused on leading these innovations, I believe we will play a key role in shaping DeFi Summer 2.0 and its future development.

Odaily Planet Daily: What is the biggest challenge you encountered in the process of building the ecosystem? How did you overcome it?

Theseus: I wouldnt say there is just one specific challenge, but there are several main challenges:

1. Intense market competition

Competition in the DeFi market is extremely fierce. Over the past year, we have seen the rise of a large number of L2 chains and the continued development of many L1 chains, each with its own incentives and branding plans. This environment has led to the hiring behavior of liquidity capital – funds jumping from one chain to another, chasing short-term returns.

Likewise, developers will jump between chains in search of funding and opportunities. In an open source industry, competitors can easily fork a protocol and launch a similar product, making it difficult to maintain a competitive advantage.

As a founder, it is very challenging to acquire a group of loyal users who are willing to use your platform for a long time and not leave for short-term higher returns. The fragmentation of the ecosystem increases the cost of user acquisition and weakens sustainability.

Our solution is community-centric. THENA鈥檚 long-term supporters understand our vision and have witnessed our continued execution over the past two years. They believe THENA can deliver products centered around user experience and value, rather than short-term gains. This approach has helped us build a loyal user base.

2. Team expansion

Building the right team is another major challenge. DeFi requires expertise. For example, in terms of business development, I prefer to hire people with a finance background because we are a DEX. In order to effectively collaborate with other protocols, team members need to be able to communicate in financial terms.

However, the best candidates often have no DeFi experience, which requires a learning process. The marketing department faces a similar problem – it is difficult to find talents who understand our industry and are familiar with related tools.

Additionally, being a distributed team with members from Europe, Asia, and South America presents its own coordination challenges. The journey from hiring individuals to building a cohesive team has not been easy. However, I am proud to say that we have found our rhythm and are ready to scale further.

3. Managing community expectations

As a community-centric protocol, it is crucial to maintain transparent communication, but this also brings corresponding challenges. There is often information asymmetry between the team and the community. When things are going well, everyone is happy. But when things are difficult, the community may criticize some issues that have actually been solved or are being solved internally. This information gap is sometimes frustrating because we cannot share all the details with everyone due to operational or strategic constraints. Balancing short-term goals with long-term strategies while maintaining the trust of the community is a big challenge, especially in difficult times.

How do we overcome these challenges? We address these difficulties by emphasizing consistency, transparency as much as possible, and a long-term vision. We prioritize building strong relationships with the community while continuously improving our products and team collaboration. These efforts help us overcome these challenges and enable THENA to achieve sustainable growth and success.

Odaily Planet Daily: Finally, do you have anything else you want to share with THENA鈥檚 community, investors, and supporters?

Theseus: First of all, we are very grateful for the support. We have spent most of the past two years in a bear market, and it means a lot to THENA to have such an amazing community. Our community has not only shown great support, but has also been proactive in helping by promoting the product, educating new users, and providing feedback. The contributions of the THENA community have been crucial to our growth. Without them, we would not be where we are today.

To all the new users who are joining, we are also very excited to see you join. THENA has an amazing community and a great team of administrators who are always ready to Führung you and answer any questions you may have about the platform.

As I mentioned before, Binance listing is just one milestone for us. Now that we have received more attention and recognition, we will use this opportunity together to build the best decentralized exchange in the BNB chain and the entire ecosystem. Thank you for your unremitting support!

This article is sourced from the internet: Odaily interviews THENA CEO: Listing on Binance is just the beginning

Verwandt: Markt recovery and strategic response: Seizing Bitcoin opportunities and opening positions at a discount | Weekly marke

At 8 pm on October 15, in a live broadcast on the official YouTube channel of Matrixport, Daniel, head of asset management at Matrixport, conducted an in-depth analysis of the market performance of BTC and ETH last week (October 10-October 14), discussed the impact of the global political environment on the crypto market, and the actual operation of the accumulator option tool. Daniel analyzed in detail the reasons for the market recovery, especially the launch of BTC ETF options and the impact of global economic and political events, and provided investors with a variety of strategies to deal with market fluctuations. At the same time, he introduced the accumulator option tool to help investors gradually build positions at a discount during market fluctuations. The live broadcast content is as follows…