Innovation in token issuance: “Let the elephant in the room go out”

Original author: Eric SJ (X: @sjbtc 9 )

“We embrace Bitcoin because it has saved the world economy from inflation, but in Web3, we are practicing what we oppose: inflation in disguise through timed unlocking.”

The theme of this article will horizontally expand on the issues related to token issuance, from the phenomenon of low circulation and high FDV to the improvement of the Launch paradigm of fair launch.

Before that:

I have reviewed the evolution of token distribution methods over the years, from free airdrops to the rise of Tap to Earn. Friends who are interested can jump back and read on .

1. The essential problem of low flow and high FDV

Even though I have published relevant Chinese reports before, looking back now, I have not really explored the essence of the problem. The correct approach should be:

Why is there a gap between market capitalization and FDV? And why are they problematic?

Looking back at the traditional financial market, this seems to be a unique feature of Web3. Although there is a difference between the total share capitalization and the circulating market value in the traditional financial market, it is not very large and this phenomenon is not widespread. However, this phenomenon is common among the VC coins that we are familiar with this year.

(Most initial circulation is controlled within 20%)

Even if new shares are subsequently issued on a security, they are usually done through a capital raising or a stock split, both of which are immediately reflected in the market price.

The fundamental difference between the two markets stems from culture, which is a problem that exists in Bitcoins original design: fixing the supply in advance so that market supply and demand coincide with the issuance curve. If we substitute this phenomenon into the traditional financial market, FDV = all possible future issuances of stocks.

Therefore, in my opinion, whether the FDV indicator has any practical significance or not, so I @sjbtc 9 also only use the circulating market value as the current indicator reference instead of FDV.

However, before the projects official TGE, this indicator is very important for the fundraising stage. How to divide the cake well and raise funds reasonably in the process of distributing interests among all parties is very important for a project. Therefore, back to the first question:

Essentially, the difference between market capitalization and FDV arises from the transition between the primary and secondary markets.

But this is not the culprit criticized by the market. After all, the primary market provides a very high trial and error space for the development of the industry. What really causes problems with this phenomenon is the corresponding problem: time-based unlocking.

The model itself is not the problem, but how to adopt it is. After all, Bitcoin also started with low circulation. However, while most projects imitate Bitcoins limited total supply and low initial circulation, they fail to adopt its core principle: demand-driven issuance rather than on-time issuance.

The relationship between Bitcoin issuance and price is often misunderstood as being purely time-based (thanks to the well-known four-year halving cycle), but in fact it is still driven by demand. Even all mining coins are based on this logic: if upstream miners are ultimately unable to benefit from the market for a long time, then the miners will leave the node group.

This demand-driven issuance and market logic conforms to basic economic principles: only when supply and demand are formed can prices be formed. For an L1 protocol, only when this supply and demand is formed can security be maintained.

In sharp contrast, most Krypto projects (especially venture capital-backed projects) only follow scheduled issuance without the link of market supply and demand, which is the real source of the low circulation, high FDV problem.

In addition, there is a more hidden problem: misalignment of interests.

Most projects have different issuance arrangements for team, venture capital, community, treasury, etc.

Although it seems that certain “disadvantaged groups” (such as the community) are prioritized at the time of issuance, unlocking their tokens first, this leads to conflicts of interest and reflects extremely poor design.

Heres how this situation usually manifests:

(1) Before unlocking, the community/market expects that there will be a token sell-off, so they tend to follow this expectation to avoid further losses. This is also a major starting point for the sell and earn strategy mentioned by the money-making army;

(2) After the unlocking period, the project team artificially raises the token price by creating news and market making to attract retail investors, and then sells the tokens to them;

This misalignment pitted teams and VCs against the community, eroded trust, and caused many VC-backed tokens to underperform post-TGE.

Therefore, demand-driven token issuance becomes a potentially more reliable solution.

2. Demand-driven unlocking

For projects that have a fixed total amount in advance and a low circulation issuance, an economically reasonable solution is to drive issuance based on demand rather than time (this is especially applicable to VC-backed projects with vesting mechanisms)

This will have two market effects:

(1) Supply and demand balance: Zeichens are released only when there is additional demand (e.g., token consumption), thus preventing planned inflation;

(2) Alignment of interests: Unlocking is triggered only when the community/market generates additional demand for tokens (e.g., protocol usage), allowing the team and venture capital firms to stand on the same boat as the community.

However, this also brings new risks: uncertainty about the ownership of the team and venture capitalists. If the community stops participating, demand will fade and no new tokens will be unlocked.

But shouldn’t this risk be borne by the team and VCs? Without it, Web3 will remain a zero-sum game between insiders and the community — or worse, a financial scam.

3. Three models based on demand unlocking

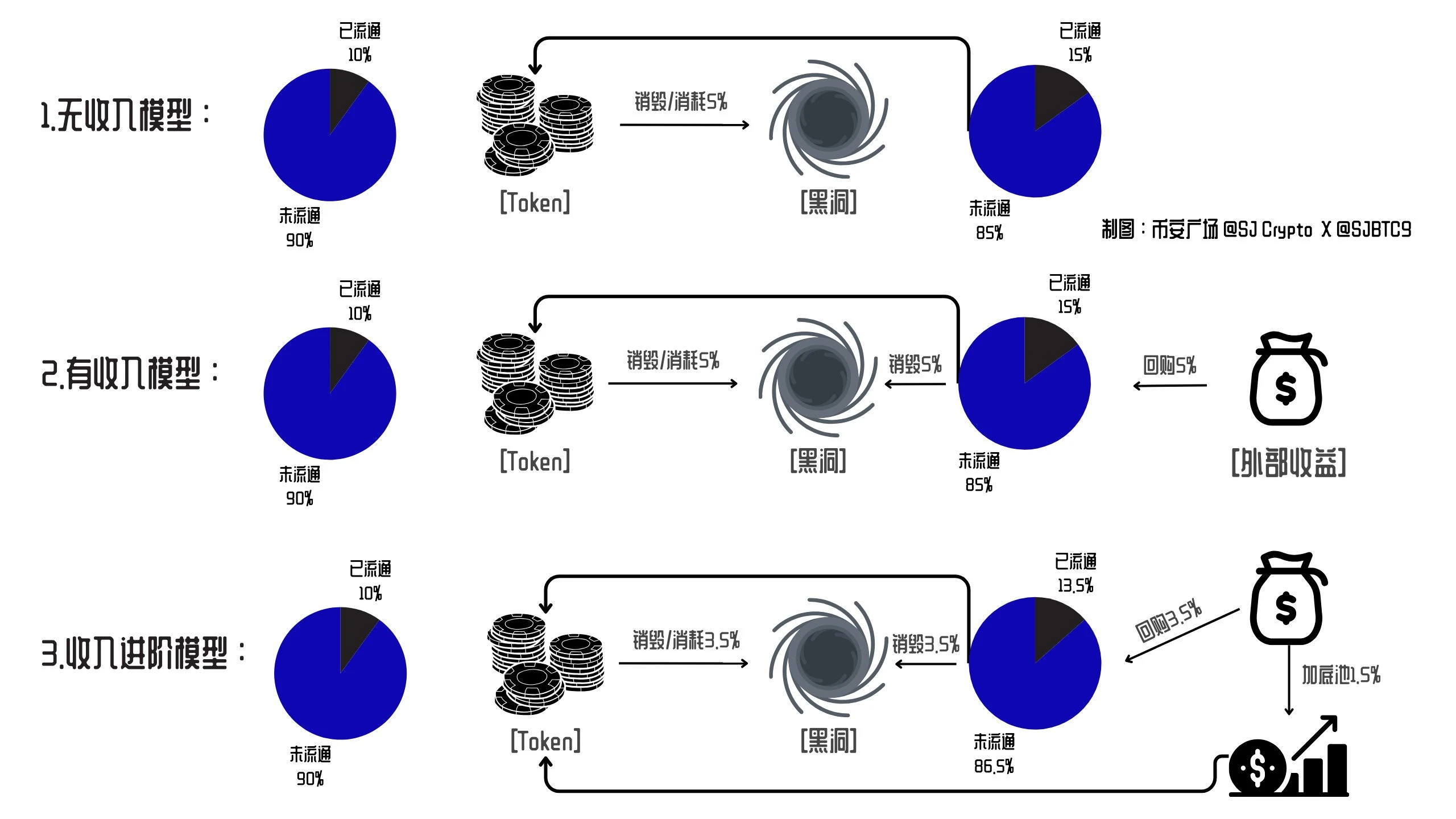

Based on the above phenomena and conclusions, this article provides three token launch methods based on the supply and demand model. The core is to launch the token fairly, but work is done on the revenue model:

– I assumed a common scenario with low initial circulation (10%) and a large amount going to the community

(1) No-income model: If the token has no income model, but each time the tokens in circulation are consumed and destroyed, an equal amount of new tokens will be released (proportionately distributed to the team/venture capital/community/treasury, etc.), so as to keep the circulating supply unchanged until the final release.

This design can be simply summarized as driving the unlocking of new tokens through destruction or consumption. However, this design essentially dilutes the communitys share of the circulating supply with each round of release until the community occupies a larger share than the other parts.

Even so, this version makes more sense than a purely time-based unlock.

(2) Income model: This model requires the project itself to have income other than the currency standard, such as some cross-chain bridges, DEX, Pump and other Defi protocols. This model is based on the no income model and uses the income of the protocol itself to purchase and destroy newly issued shares, thereby ensuring the stability of market circulation.

Under the influence of mutual hedging, the impact on market prices and circulation will be minimized, making the overall pool more stable. In the design of this model, the majority share of the community can be retained to the greatest extent without harming the interests of other parties.

( 3) Plus version with revenue model: This is based on the second version and divides the revenue of the protocol itself into two parts. One part is still used to hedge the impact of unlocking, and the other part is used to inject into the liquidity pool of the token itself.

Ideally, this will allow the basic model design of the token to form a positive flywheel effect until all unlocking is completed, while also ensuring a certain token price stability.

Compared to the previous model, this one requires more precise math: setting the optimal unlocking ratio between destruction and issuance and determining the ideal revenue split – ensuring that a portion of it is used to pay for inflation buybacks, while the rest is effectively injected into the pool.

The core of the above three model designs is actually to tie the unlocking of tokens to the interests of all parties, turning the original misaligned opposition into a demand-driven one.

Currently we can see many projects that incorporate revenue, destruction and buyback into the token economy, but there is no design for high FDV that binds market demand to the unlocking of tokens.

4. Examples based on theory

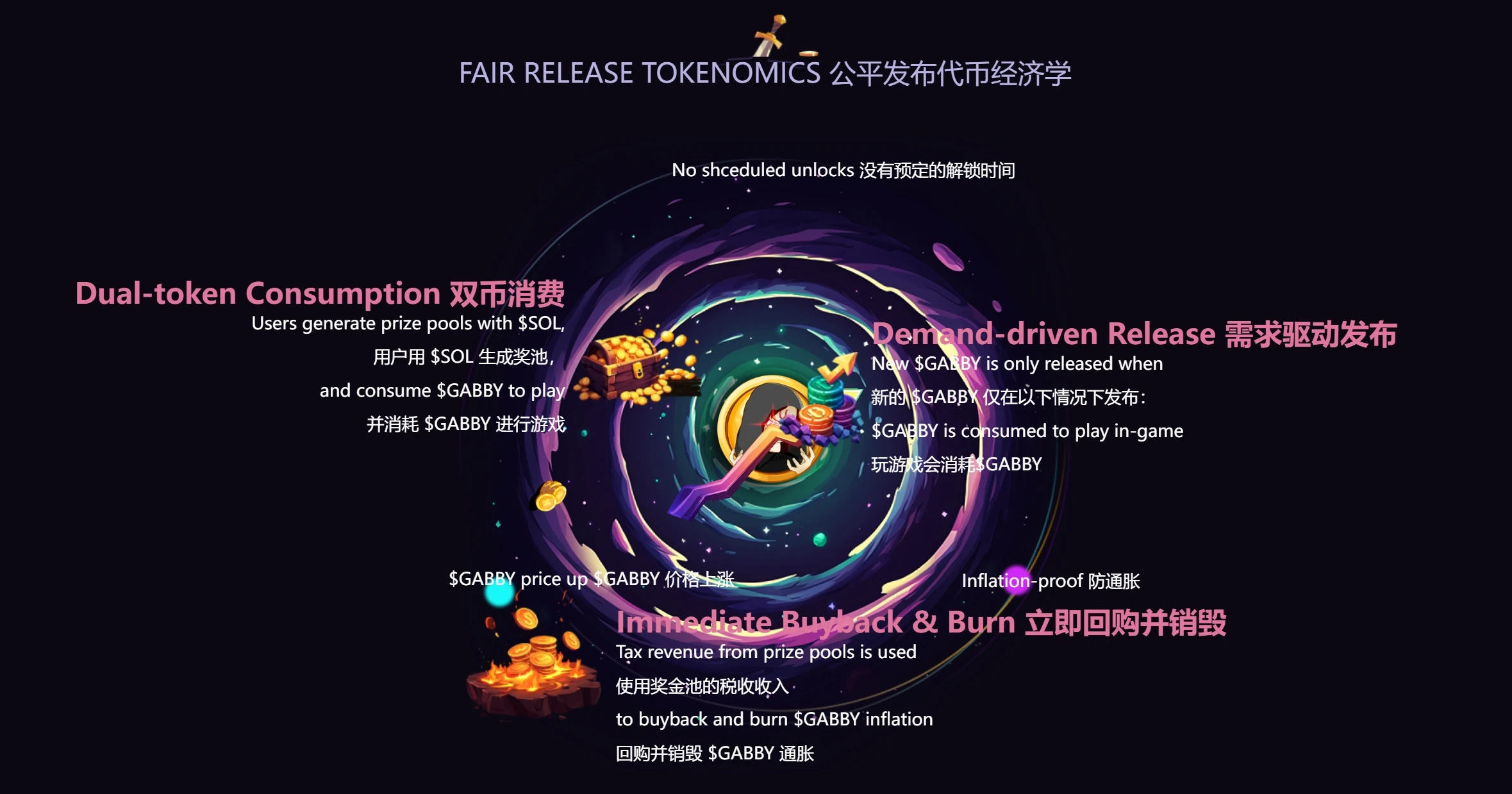

In fact, most of the opinions in this article come from a tweet I posted quoting @gabby_world_ Founder.

I have briefly translated the issues and models mentioned therein and made a lot of modifications, hoping that you can understand the underlying ideas of its economic design and the basis for this design.

And this design has also been applied to the token design of the project itself.

From my perspective, I think unlocking future tokens based on supply and demand is a very bold and difficult attempt, because as a project owner, the first thing to do is to convince his investors to accept this.

I work in VC myself, and to be honest, its hard for us to accept this.

While many blame the crypto market’s poor performance on liquidity shortages, stagnant innovation, or narrative fatigue, few realize that the real problem lies in unfair wealth redistribution, which further exacerbates the divide between institutions and the community and is why the current meme craze continues.

I dont know how the GabbyWorld team coordinated this, but it was not easy to implement it in a post filled with designs that seem ideal to me.

Fair launch of the inscription market. I have said in the past that it is not advisable to rely entirely on community-driven collective efforts, as very high decision-making costs will occur in business expansion.

Gabbys method of using the supply and demand of tokens to drive unlocking is difficult for other projects to replicate. If this can be implemented, it is completely worthy of a separate category in the issuance history category that I put at the beginning.

This article is sourced from the internet: Innovation in token issuance: “Let the elephant in the room go out”

Gastgeber: Fraokh; Tyler; Mando; @FOMOHOUR Gast: Murad Mahmudov Originalübersetzung: zhouzhou, BlockBeats Anmerkung der Redaktion: In diesem Artikel erzählt Murad, wie er in den Kryptowährungsbereich eingestiegen ist und nach und nach seine eigene Meme-Investitionsthese entwickelt hat. Er bespricht, wie man Meme auswählt, warum er denkt, dass Meme, das 2023 auf den Markt kommt, besser sein wird, und wie er seine Anlagestrategie getestet und verifiziert hat. Murad betonte die Verbindung zwischen NFT und Meme und glaubt, dass Meme im Jahr 2025 ein riesiges Wachstumspotenzial haben wird, und vertrat die Ansicht, dass Glaube wichtiger ist als kurzfristiger Handel. TL;DR: Murads Reise in die Kryptowelt: Er kam während seines Studiums in China mit Krypto in Kontakt und glaubte, dass 2025 ein Jahr großer Chancen im Kryptobereich sein würde, insbesondere bei Meme. Meme ist für manche…