How to use GMGN to play with Meme coins (beginners guide)

Originalautor: Biteye-Hauptbeitragender Viee

Ursprünglicher Herausgeber: Biteye-Hauptbeitragender Crush

Recently, the on-chain traffic has exploded, the trading mascot concept coin has skyrocketed by 60,000%, and the DeSci narrative has emerged. Meme coins have become the biggest dark horse in this bull market!

On-chain operations are difficult. In this tutorial, Biteye will teach novices how to use GMGN to play Meme coins!

There will be advanced chapters later, please pay attention.

This article will focus on new IPOs and mainly teach you how to find, analyze and trade newly launched Meme coins.

1. Quick literacy for beginners

1. What is GMGN?

A website that combines Meme coin data dashboard + trading tools.

2. What is on-chain transaction?

Activities and transactions are conducted directly on the blockchain, without relying on centralized exchanges such as Binance and OKX.

3. Which wallet to use?

For installation and usage tutorials of mainstream wallets such as Phantom and OKX, you can search on Youtube and will not go into details here.

4. What is the Zeichen Address (CA)?

You can find this token by pasting a string of letters like GJtJuWD 9 q*****wMBmtY1tpapV1sKfB2zUv9Q4aqpump into the GMGN search box.

As shown in the following figure:

2. Discovery of new projects

1. Pay attention to the smart money

Tracking smart money means tracking the wallet addresses of users who have obtained higher returns on the chain and observing the investment objects they choose. The following three links are lists of smart money on different chains of GMGN, as well as corresponding icon explanations:

ETH chain https://gmgn.ai/discover?chain=eth

Solana Chain https://gmgn.ai/discover/?chain=sol

Blast Chain https://gmgn.ai/discover?chain=blast

After following Smart Money, when there is a new update, a red bubble and sound prompt will be displayed in the Followed in the lower left corner (which can be turned off or on).

After following Smart Money, when there is a new update, a red bubble and sound prompt will be displayed in the Followed in the lower left corner (which can be turned off or on).

GMGN also provides the function of binding Telegram notifications, so that you can receive notifications immediately once the wallet you follow performs any operation.

Click Followed to view the real-time trading dynamics of Smart Money, including buy/sell/add to position/add to position/build position/clear position, etc.

You can also click on any smart money address interface to get more detailed information, including position analysis, profit and loss distribution, trading activities, etc.

Hundreds of Meme coins are launched on the chain every day, and there may be concentrated purchases by smart money. When choosing to follow, it is best to consider your own trading habits and avoid following too many wallets to cause information noise. It is recommended to choose a wallet with a similar style to your own to ensure the efficiency of information flow.

Please note that checking the security of the contract cannot be ignored, because a lot of smart money will buy in without considering the security of the contract.

2. Sweep, push and chain

-

Scan and follow: Follow a large number of Chinese and English KOL accounts related to Meme-Münze on Twitter, and join various discussion groups to get the latest information and developments.

-

Chain sweep: Pay close attention to tokens that enter the external market (large market) from the internal market (small market) and quickly evaluate whether these tokens are worth investing in.

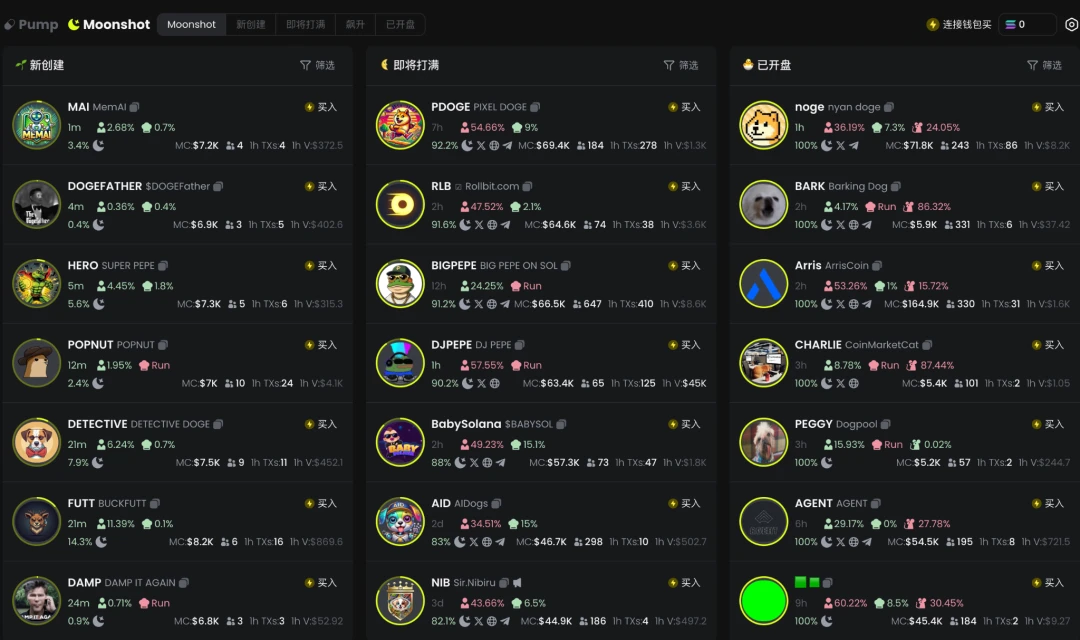

On the GMGN platform, you can view the following three types of tokens:

-

Category 1: Newly created internal tokens (highest risk)

-

Category 2: Internal tokens that are about to be fully allocated

-

Category 3: Tokens that have entered the foreign market (lowest risk)

Explanation of internal/external disk:

When a new project is successfully deployed using the automatic token issuance tool pump.fun, users can use sol to purchase the projects tokens. When its market value reaches $69,000, the projects liquidity will be automatically added from pump.fun to Raydium.

-

Before reaching $69,000, we call it the inner market. At this time, the project is in a very early stage and the risk is extremely high;

-

After reaching $69,000 and successfully adding liquidity to Raydium, we call it an external market. At this point, the project has developed further and the risk has been reduced.

It is recommended to focus on the tokens that have entered the foreign market. Although there are still high risks in the foreign market, compared with the domestic market, the risks have been reduced a lot and are relatively friendly to novices.

Moreover, only a few foreign stocks have market capitalizations of over a million, so there is still a lot of room for profit.

Please note that the entry of tokens into the foreign market does not mean that they will 100% rise. There are also cases where a large number of tokens quickly return to zero after the foreign market opens. Please always be cautious during the investment process!

By patiently monitoring and analyzing the performance of these tokens, judging their potential and investment value, we can eventually make a profit. But how do we analyze this specifically? Let鈥檚 take a look at the following detailed explanation.

Token Analysis

Now that you have learned how to use GMGN to find new coins on the chain, the next step is to analyze and select the ones worth buying from a bunch of Meme coins.

The decision to buy depends on the hot spots, narratives, market value, community and market dynamics. Different types of Meme coins have different strategies:

1. Hotspot

Many of these tokens are small-cap tokens that have quickly become popular due to specific events or trends in a short period of time. They may have a very high increase in the initial stage, with potential space of more than 10 times, from a market value of millions to tens of millions.

However, if the hotspot is not sustainable, the price has no support point, celebrities do not shout orders, it does not reach the level of new narratives, does not form an influential community, and does not experience exciting low-probability events, it is likely to gradually lose liquidity and prices will continue to fall.

Here are a few examples of so-called low-probability events:

-

The founder of $SLERF accidentally burned all the liquidity pool tokens (LP), airdrop reserved tokens, and minted coins, triggering a surge in bullish sentiment on the chain, causing $SLERF to be quickly listed on the exchange.

-

There is also the recent $BITCAT. When the sentiment on the chain was fermenting around the concept of mascot, the official Twitter account of Bitcon suddenly posted a picture of a black cat. Some people thought that this hinted at the Bitcoin mascot. As the consensus continued to spread, the related token $BITCAT quickly pulled up the market. Within 3 hours that night, the price soared from a market value of hundreds of thousands to a market value of 100 million, and maintained at a market value of about 50 million in the second half of the night.

For this type of token, the following suggestions are made:

-

Buy early, the market value of hundreds of thousands is the best. If you enter the market too late, dont wait until the market value exceeds 10 million (tens of millions) before chasing highs, it is easy to get stuck;

-

If you are optimistic about the sustainability of the hotspot, wait for the price to fall back 80% before entering the market, which can reduce the risk.

2. Narrative

Such targets often do not rely on short-term hot spots to rise, but gradually grow from small market capitalization to large market capitalization around a certain narrative or community.

Unlike hot tokens that skyrocket in value instantly, they may go through multiple stages of stable growth, usually with a market value ranging from several million to tens of millions of dollars, and even exceeding 100 million at their highest.

For example, $RIF, with the background of antibiotics used to treat tuberculosis, is currently the leader of DeSci + Meme. The token is pulled up because of the increasing attention on the DeSci (decentralized technology) narrative on the chain. As the first token of Pump science, as the narrative heats up, its buying orders continue to increase, and its position is gradually consolidated as the leader of the track.

For this type of token, my suggestions are as follows:

-

Pay attention to new narratives that are also good narratives, such as DeSci, and choose to build positions in steps at low market capitalizations (hundreds of thousands to small millions);

-

In the medium and long term, pay attention to the social media, community activity and capital inflow of these tokens to judge their sustainability and potential.

4. How to trade

The following figure is an overview of the GMGN trading system:

1. Left column interface

Favorites and holdings list

Quickly understand the price and profit changes of your collection and holding tokens, and sell them quickly at any time when watching the market.

Hot, Pump, Watched List

By checking time, number of transactions, price, and price percentage, you can filter out popular tokens and pump tokens that best suit your trading strategy. The watchlist makes it easy to follow orders and buy at any time while watching the market.

2. Middle main interface

Below the K-line is a large amount of relevant information about the token, including trading activities, traders, holders, blue-chip holders, etc., and is classified by smart money, KOL/VC, whales, new wallets, snipers, large coin holders, developers, followed, and insider trading.

When studying the token, you also need to refer to this information and analyze the whales and smart money holding it. For example:

-

Mark suspected insider trading to determine whether the dealer wants to use small wallets to disperse tokens in an attempt to dump the market and run away.

-

Mark suspected phishing wallets. If the transferred tokens are not purchased, they will be marked.

3. Trading interface on the right

View Metrics

Check the token transaction volume, buy, sell, net buy, liquidity, minting data, blacklist and other indicators. It is also important to check the burning pool ratio and the probability of running away.

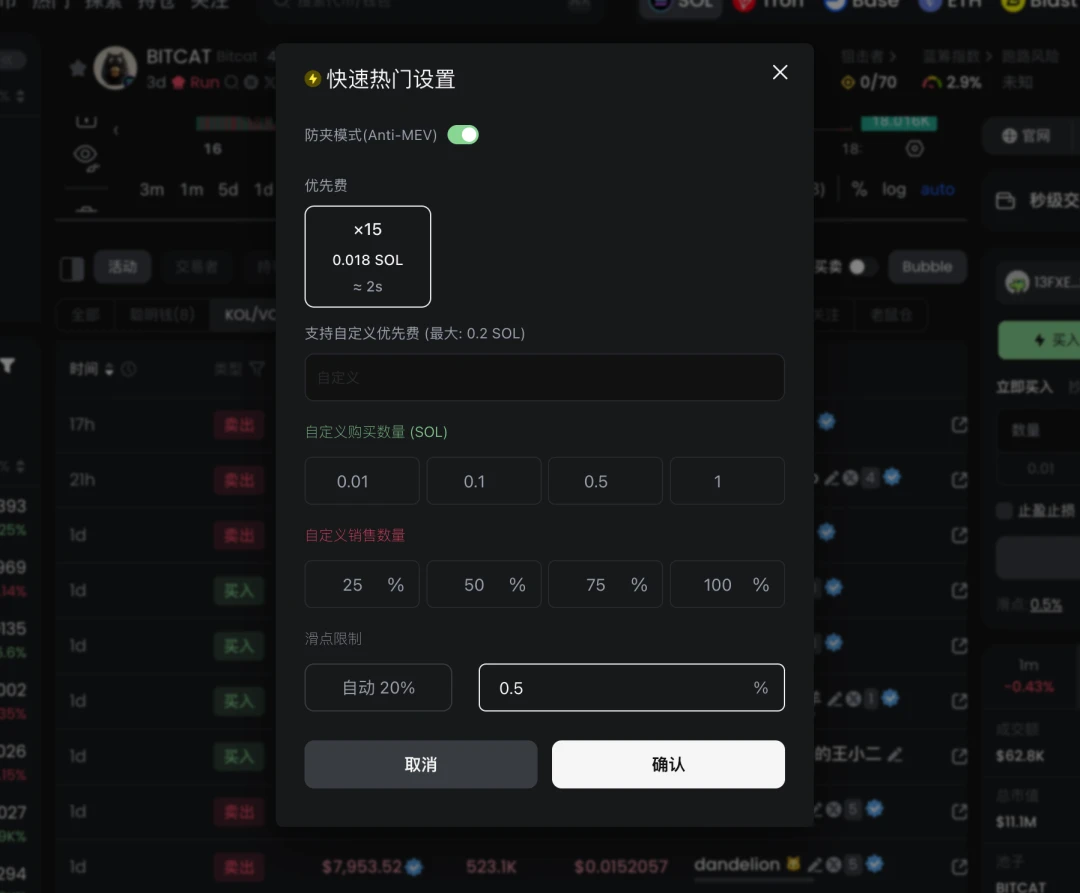

Set the slip point and turn on Anti-MEV mode

Slippage refers to the maximum acceptable deviation in the number of tokens declared for a single transaction. The higher the slippage, the faster the transaction. Most of the time, a slippage of about 0.5% is recommended, and it can be increased to 10% when the market fluctuates violently.

(Note: A MEV sandwich attack is when a MEV robot reads incoming transaction information and preemptively executes orders, thereby pushing up the price of the token when you buy it. Turning on the anti-sandwich mode can effectively prevent sandwich attacks.)

Select amount and buy/sell manually

I will write an advanced article later, discussing operations such as automatic limit buy and automatic pending order buy, so please stay tuned.

V. Risk Warning

Hundreds of Meme coins appear on the chain every day, and most of them will return to zero. The probability of producing a golden dog (market value of tens of millions/over 100 million) is extremely low, not to mention being listed on a large exchange.

In short, the higher the return, the higher the risk, please be responsible for yourself!

This article is sourced from the internet: How to use GMGN to play with Meme coins (beginners Führung)

Originaltitel: Rückblick auf die Seed-Phase 2022 Originalquelle: Lattice Fund Originalübersetzung: TechFlow-Einführung Letztes Jahr haben wir unseren Rückblick auf die Seed-Phase 2021 veröffentlicht, um ein klares Bild der Trends in der Seed-Phase dieses Jahres zu liefern. Wie viele Unternehmen haben ins Mainnet geliefert? Wie viele haben eine Produkt-Markt-Passung gefunden? Wer hat ein Token eingeführt? Mit dem Bericht 2024 richten wir unseren Fokus nun auf 2022, um die Fortschritte und Trends in der Seed-Phase der Kryptowährung besser zu verstehen. Der Bericht analysiert über 1.200 öffentliche Pre-Seed- und Seed-Runden für Kryptowährungen aus dem Jahr 2022 und bietet Einblicke in branchenweite, sektorspezifische und ökosystemweite Trends. Wie bei unseren vorherigen Berichten stellen wir unsere Datenbank als Open Source zur Verfügung, um weitere Untersuchungen und Analysen zu ermöglichen. Wir freuen uns über Ihr Feedback und begrüßen alle Korrekturen; bitte zögern Sie nicht, uns unter hi@lattice.fund zu kontaktieren. Executive…

nb