Ausführliche Enthüllung: Wer hat den Telegram-Minispielen ihre Vitalität genommen?

Einführung

Recently, Telegram robots and Miniapp data have shown a clear downward trend.

Once upon a time, Telegram Miniapp became the focus of the blockchain field thanks to the explosive growth of clicker games.

However, behind the prosperity lies a crisis.

The TON Foundation relied too much on clicker games in its support strategy. Although this brought a surge in users and data in the short term, it also sowed the seeds of ecological imbalance.

When users sense of novelty faded, the problems of homogeneity and lack of depth in clicker games gradually emerged, and the entire ecosystem began to suffer backlash.

Now that the tide has receded, we need to reflect deeply on the strategic mistakes of the TON Foundation and find a new narrative that can lead the next stage of development of the TON ecosystem.

We counted BOT from Telegram Apps Center, TON App, and The Open League (see Appendix)

1. The trend of a sharp decline in MAU is difficult to stop

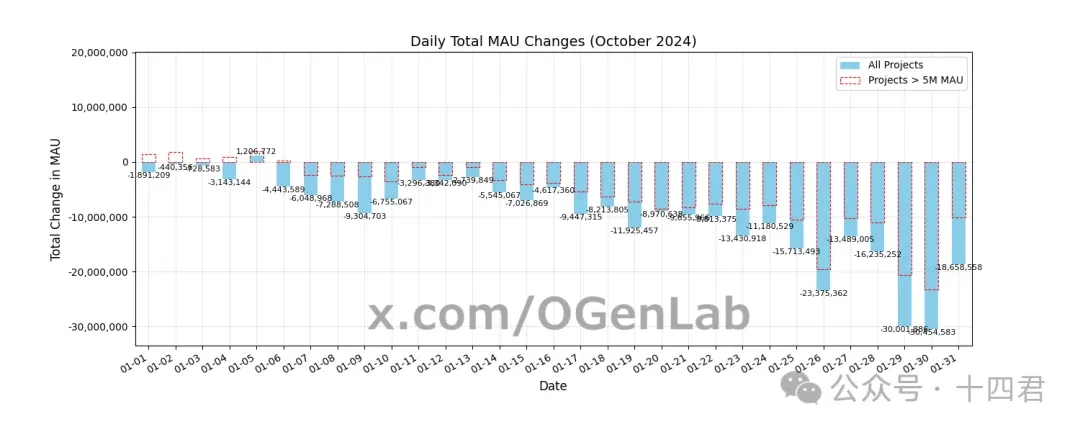

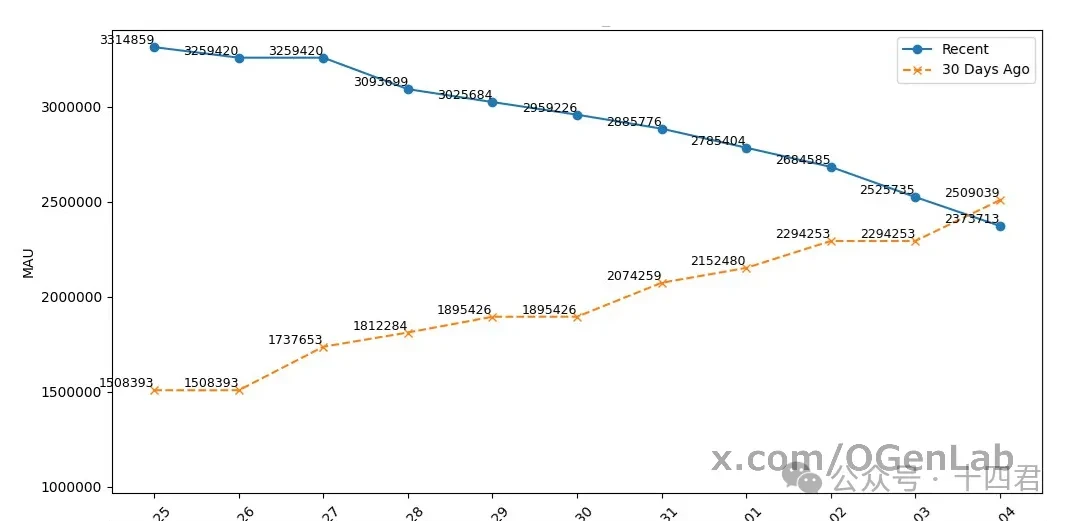

Over the past month, OGenLab has been monitoring 820 Telegram projects.

From October 1 to October 31, although the data cannot be deduplicated, the cumulative monthly active users (MAU) reached 879,922,503.

But behind this huge number lies a worrying sharp decline.

In one month, the total MAU decreased by 295,971,112 (not deduplicated), equivalent to a drop of 33%.

This significant drop reveals a rapid decline in user activity, reflecting that the entire ecosystem is experiencing unprecedented challenges.

[Image source: https://x.com/OGenLab/status/1854060874304221435]

Through the analysis of daily data, OGenLab found that this decline showed an amplifying trend. In particular, for large projects with more than 5 million users, the initial MAU decline was relatively slow and seemed to maintain a certain stability. However, as time went on, the decline of these projects began to accelerate, and even accelerated in the later period, which had a more profound impact on the overall MAU decline. This phenomenon shows that even the top projects with a large user scale can hardly withstand the impact of user loss, showing that the deep-seated problems within the ecosystem need to be solved urgently.

2. Structural changes behind the rise and fall of projects

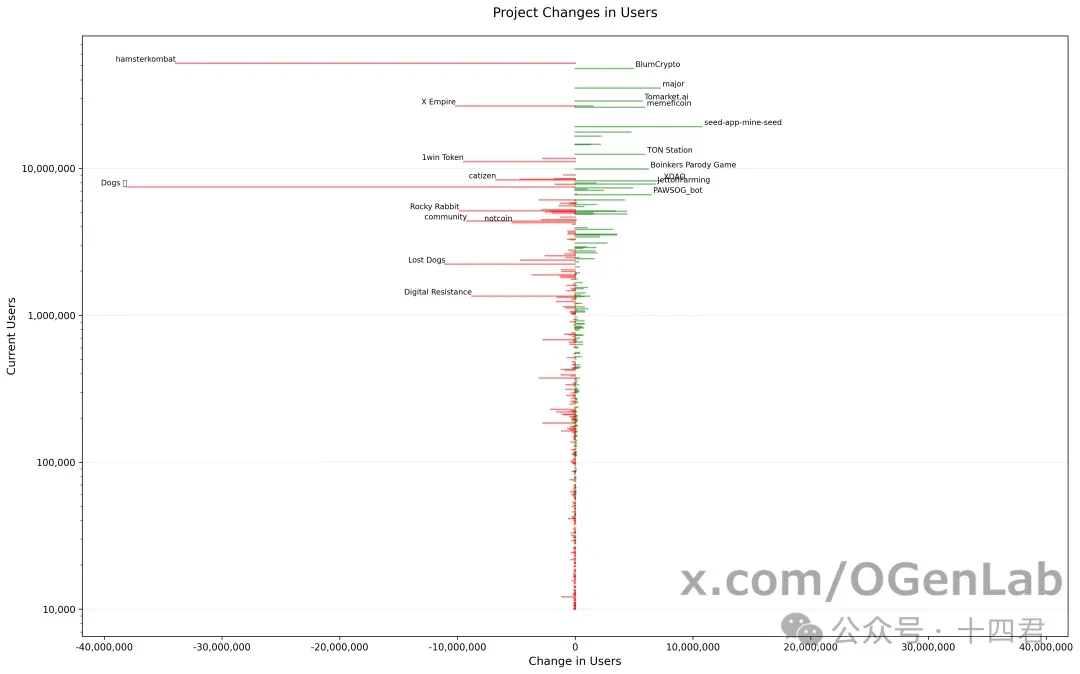

Of the 820 projects monitored by OGenLab, 249 projects saw increases in October and 491 projects saw decreases.

From the analysis of the bar chart, it can be clearly seen that the leading and long-established projects – represented by Hamster, Dogs, Catizen, etc. that have already issued tokens – have fallen most significantly.

These once-popular star projects are now facing a sharp decline in user activity and engagement, reflecting the weakening of their growth momentum and the fading of user novelty.

[Image source: https://x.com/OGenLab/status/1854060874304221435]

At the same time, some emerging projects provided positive growth, injecting new vitality into the market.

However, in terms of quantity and growth rate, the growth of these new projects is far from enough to make up for the decline of old projects. Among the projects with less than 1 million users, the number of declining projects is still greater than the number of rising projects.

This shows that even in the field of small and medium-sized projects, the overall trend is still downward and the market lacks sufficient new forces to reverse this situation.

This phenomenon highlights the structural problems in the TON ecosystem: the attractiveness of old projects is gradually weakening, the growth momentum of new projects is insufficient, and the entire ecosystem is in urgent need of new stimulation and direction.

How to provide more innovative and valuable applications while maintaining user stickiness has become an urgent issue for foundations and developers.

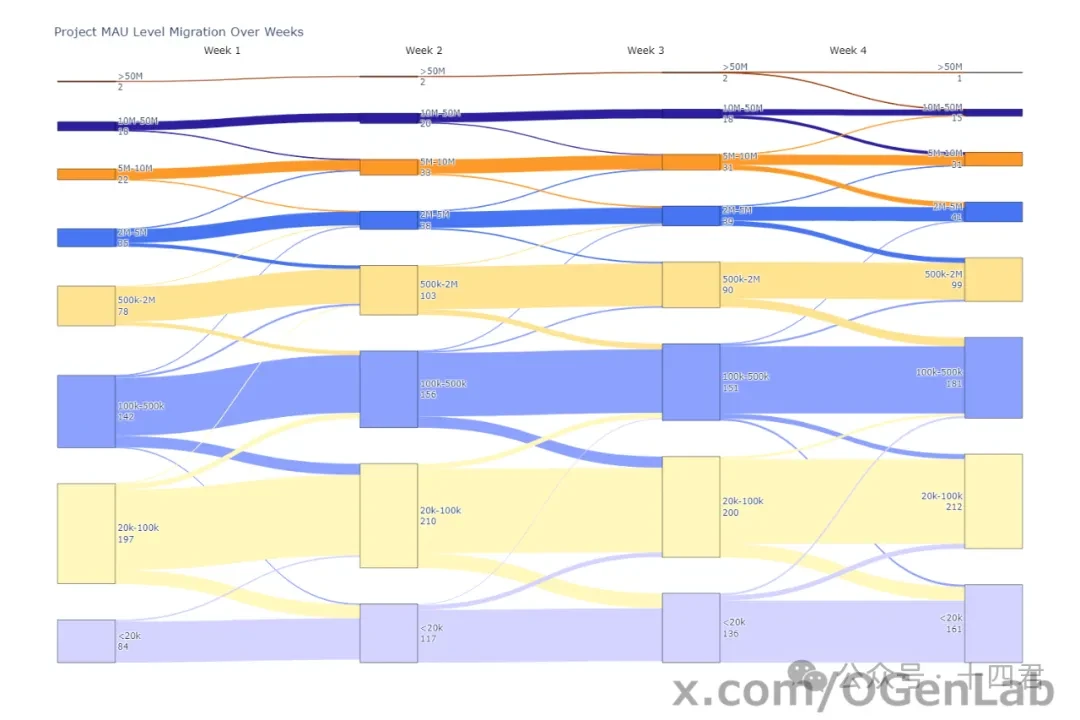

3. Migration of project scale and downgrade of user needs

In order to gain a deeper understanding of the changes in the ecosystem, OGenLab divided the 820 monitored projects into multiple levels according to the number of monthly active users (MAU): more than 50 million , 10 million-50 million, 5 million-10 million, 2 million-5 million, 500,000-2 million, 100,000-500,000, 20,000-100,000, and less than 20,000.

By observing the changes in these projects in October, some interesting trends emerged.

3.1. High-value projects flow to low-end projects

-

>50 million MAU level:

-

10 million-50 million MAU level:

Number of projects: decreased from 18 in week 1 to 15 in week 4.

Flow direction:

-

From week 1 to week 2, one project was downgraded to the 5-10 million range;

-

From the second week to the third week, two projects were downgraded to the 5-10 million range;

-

From the 3rd week to the 4th week, another 6 projects were downgraded to the 5 million to 10 million range.

-

5-10 million MAU level:

Number of projects: Increased from 22 in Week 1 to 31 in Week 4.

Number of projects: Reduced from 2 in Week 1 to 1 in Week 4.

Flow: From the 3rd week to the 4th week, one project with a value of >50 million was downgraded to the value of 10-50 million.

Flow: On the one hand, high-end projects are downgraded and enter;

On the other hand, some of its own projects have been further downgraded to the 2 million to 5 million range.

It is clear that top projects are sliding down the ladder.

The number of projects with more than 50 million users dropped from 2 to 1, showing that user activity in these flagship projects is declining significantly.

This trend has resulted in a decrease in the number of high-end projects and an increase in mid-range projects, reflecting that the ecosystem is undergoing a top-down contraction.

3.2. The quality of medium-value projects has declined significantly

-

2 million-5 million MAU level:

-

500,000-2 million MAU level:

Number of projects: Increased from 35 in week 1 to 41 in week 4, but the growth rate was slow.

Flow direction:

From the 3rd week to the 4th week, 10 projects were downgraded from the 5 million to 10 million range to this range; at the same time, 10 projects were further downgraded from the 2 million to 5 million range to the 500,000 to 2 million range.

Number of projects: Increased from 78 in Week 1 to 99 in Week 4.

Flow: A large number of projects were downgraded from higher-end levels, while some projects themselves were downgraded to lower levels of 100,000-500,000.

Mid-sized projects were not immune to the decline in activity.

The increase in the number of projects is mainly due to the downgrade of high-end projects, rather than their own growth. This shows that the pressure on medium-value projects to maintain their user scale has increased, and user loss is obvious.

3.3. The number of small projects has increased significantly

100,000-500,000 MAU level:

-

Number of projects: increased from 142 in week 1 to 181 in week 4.

-

Flow: Many projects were downgraded from higher-end projects, especially from 500,000-2 million and 2 million-5 million. In addition, some projects were further downgraded to 20,000-100,000 and

20,000-100,000 MAU and

-

Number of projects: The number of projects in these two categories has increased significantly. Among them, the number of projects in the category of

-

Flow: Many projects were downgraded from higher levels, especially from the 100,000-500,000 level. At the same time, the activity of some projects themselves declined, resulting in a surge in the number of projects in the lowest level.

The increase in the number of small projects is not a sign of ecological prosperity, but the result of a decline in overall projects.

Projects of all levels generally face the problem of declining user activity. The influx of new projects is not enough to make up for user loss, and the ecosystem lacks fresh blood.

[Image source: https://x.com/OGenLab/status/1854060874304221435]

The above data clearly reveals the overall downward trend in the scale of TON ecosystem projects.

From top projects to small projects, none can avoid the impact of declining activity.

This trend reflects that the current ecosystem lacks user stickiness and innovation driving force, and urgently needs new strategies and narratives to stimulate growth and regain user trust.

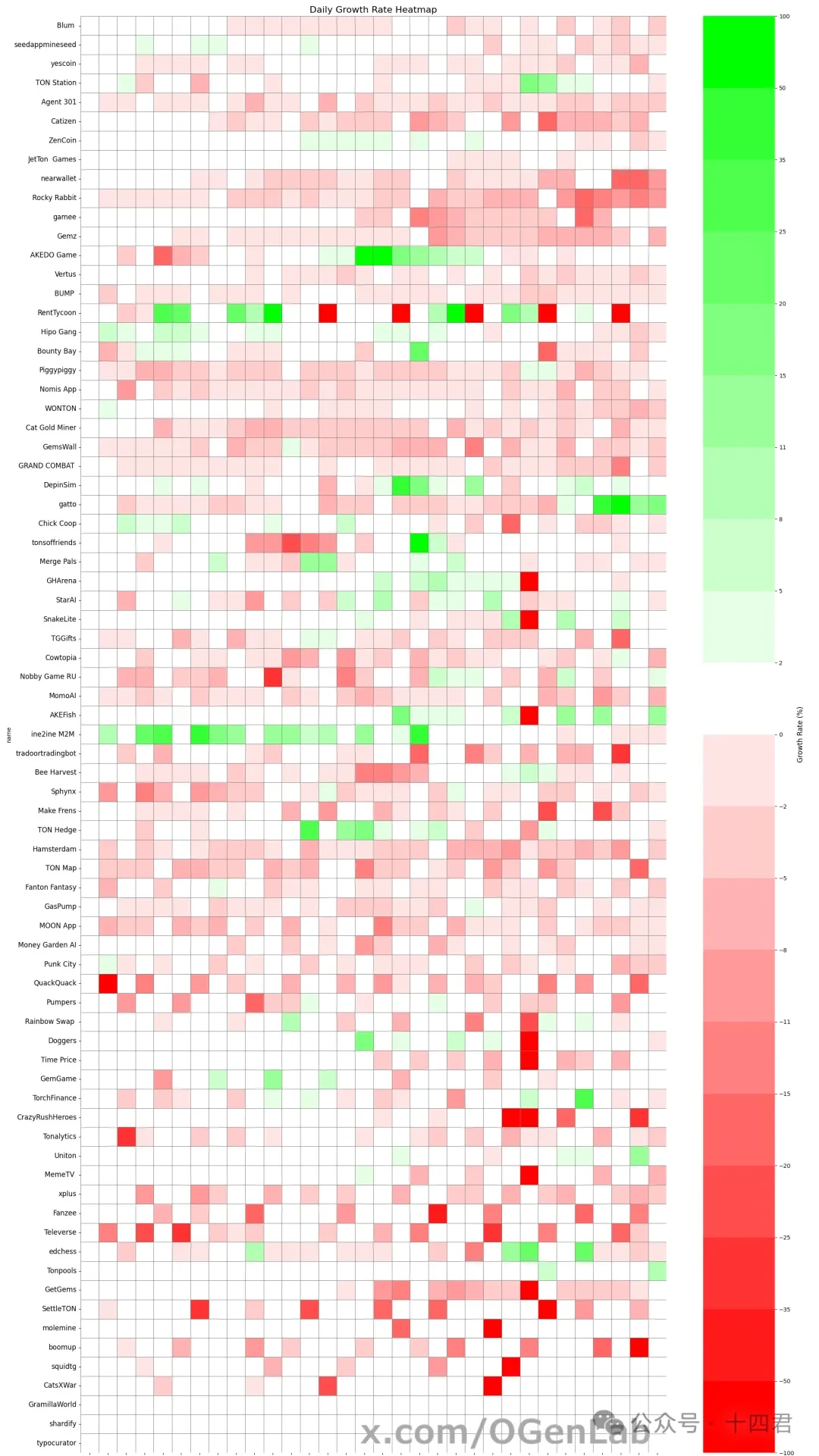

4. Difficulties and highlights of the OpenLeague project

When discussing the development of various projects in the TON ecosystem, we paid attention to the OpenLeague project. Although it has a certain degree of popularity and user base in the market, it still cannot avoid the trend of declining users, and even the decline is more serious in some aspects.

In addition, there is a mixed bag of projects with varying quality.

However, it is worth noting that there are still one or two highlight projects that stand out and bring hope to the entire ecosystem.

[Image source: https://x.com/OGenLab/status/1854060874304221435]

The downward trend of users is more obvious

Through data analysis of the OpenLeague project, we found that

-

Overall user activity has declined: Compared with other projects, OpenLeagues user decline is greater, and the number of active users continues to decrease. This may be related to the projects lack of continuous innovation and user participation mechanism.

-

Increasing competitive pressure: OpenLeague faces more intense competition in similar competitive and gaming projects. The emergence of new projects has diverted users, resulting in a reduction in its market share.

Project quality varies

-

A mixed ecosystem: The quality of sub-projects and activities within OpenLeague varies. Some projects lack clear positioning and high-quality content, making it difficult to attract and retain users.

-

User experience needs to be improved: some projects have deficiencies in design and functionality, resulting in poor user experience during use, which further accelerates user loss.

Highlights worth noting

Despite the challenges, there are some outstanding projects in OpenLeague, such as AKEDO Game and RentTycoon showing darker green on some days and continuing to rise.

5. When a whale falls, everything comes to life, or it all comes to nothing.

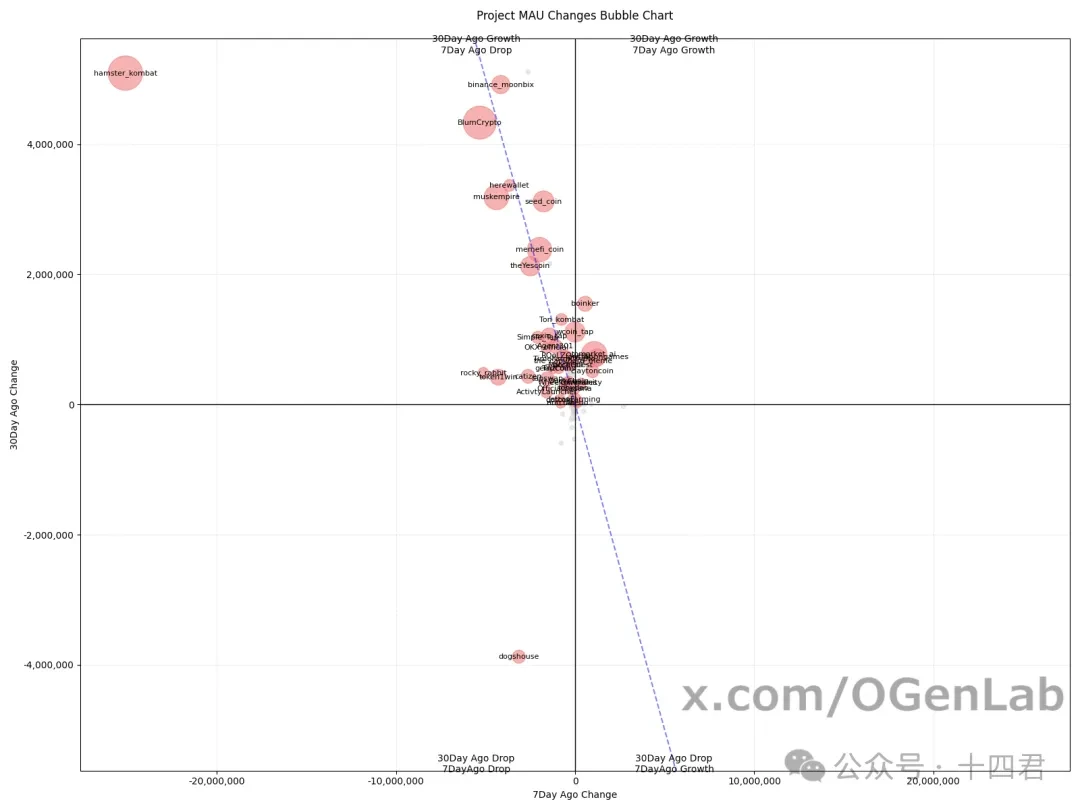

To gain a deeper understanding of the project鈥檚 user dynamics, we studied the project changes in the week 30 days ago (September 24-September 30) and the most recent week (October 25-October 31).

On the one hand, this helps us observe trends throughout the month;

On the other hand, since the official data provided is the number of monthly active users (MAU), the closer the sum of the trend slopes of these two periods is to 0, the higher the suspicion that the project is inflating its volume and lacks new users.

[Image source: https://x.com/OGenLab/status/1854060874304221435]

Analysis Methodology We defined the following metrics for two 7-day periods:

M 1 (user change from September 24 to September 30): During this period, M 1 is equal to the number of valid users on the last day of the period (not empty and greater than 10) minus the number of valid users on the first day of the period (not empty and greater than 10).

M 2 (user change from October 25 to October 31): Similarly, M 2 is equal to the number of valid users on the last day of the period (not empty and greater than 10) minus the number of valid users on the first day of the period (not empty and greater than 10).

In addition, we plotted a two-dimensional coordinate system with M 1 as the horizontal axis and M 2 as the vertical axis, and added an auxiliary line x=-y to assist the analysis.

Coordinate Quadrant Interpretation By plotting the data points of a project in a coordinate system, we can evaluate the user trends of the project based on the quadrant and position it is in.

-

First quadrant (M1>0, M2>0)

Meaning: The project showed user growth in the week 30 days ago and the most recent week. Interpretation: These projects may have sustained growth momentum, with user activity steadily increasing, and are worth paying attention to and following up.

-

Second quadrant (M10)

Meaning: The number of users of the project decreased in the week 30 days ago, but increased in the most recent week. Interpretation: If the data point is on the right side of x=-y, it means that the project has begun to reverse its decline and is expected to become a potential project. If it is on the left side of x=-y, it means that the growth rate is not enough to make up for the previous decline, and the project may still be in an unstable state.

-

The third quadrant (M1

Meaning: The number of users of the project has dropped in both time periods. Interpretation: These projects have a clear downward trend, user activity continues to decrease, and there is a high risk of termination.

-

The fourth quadrant (M1>0, M2

Meaning: The item increased in the week 30 days ago, but decreased in the most recent week.

Interpretation: If the data point is on the left side of x=-y, it means that the decline of the project has exceeded the previous growth, and the user may enter a downward spiral, which requires vigilance.

Suspected fraud projects

For projects whose data points are close to the origin and located near x=-y, the sum of M1 and M2 is close to zero, indicating that the projects user changes lack real growth, there may be brushing behavior, and the actual number of new users is small.

Mögliche Projekte

The projects in the second quadrant and on the right side of x=-y, although they have declined before, have recently seen significant user growth, showing a rebound trend and deserve further attention.

Risky Projects

For projects in the third quadrant, the number of users continues to decline, and their vitality and improvement strategies need to be evaluated.

Projects to watch out for

Projects in the fourth quadrant and on the left side of x=-y have seen a large decline recently and may be in a dilemma of continuous user loss. We can briefly summarize the above content:

-

User growth projects (quadrants 1 and 2) deserve special attention as they demonstrate the potential for continued growth or rebound.

-

Projects with declining users (quadrants 3 and 4) require in-depth analysis of the reasons for the decline and timely adjustment of strategies to regain users.

-

Projects suspected of inflating volumes need to strengthen data monitoring to ensure the authenticity of the data and maintain the healthy development of the ecosystem.

6. Summary

Currently, Telegram mini-program applications are facing unprecedented difficulties, mainly in two aspects: commercialization and content.

Commercialization:

The current commercialization model is mainly about selling volume and listing coins, and the core is traffic monetization.

However, the challenge at this stage is that the sellers and exchanges that list coins have already purchased a wave of traffic, and the new traffic is not attractive enough to them.

At the same time, a large number of tokens were generated in the game, but there was a lack of specific application scenarios and consumption mechanisms. After players obtained the tokens, the only option was to sell them, which led to the rapid decline of the project after the token was listed.

Content:

Currently, most of the top games are based on clickers and a series of fission tasks, and the games themselves lack playability.

Over time, users will form an inherent stereotype about Telegram games, and the players attracted will mostly be the type who want to earn and sell.

To reverse this situation, we need to create truly playable games, rebuild from scratch, and rebuild user trust. The next bright new game star rising in the sky of Telegram will be a truly touching masterpiece. We also sincerely hope to see new content creativity and new commercial models to give these games new vitality and lead users to the real game world.

OGenLab is a passionate game studio that stands on the crest of the emerging track and pursues unlimited possibilities for the future.

This analysis was also first published on Twitter: https://x.com/OGenLab/status/1854060874304221435

OGenLab will continue to pay attention to Telegrams data pulse in the future, and will conduct in-depth analysis of the projects TON chain data in the near future.

We have witnessed the fall of giant projects and the rise of new forces, but this is not enough to light up the whole world. As the saying goes, When you are overwhelmed by mountains and rivers, you may think there is no way out, but when you turn around, you will find another village. We hope to see the prosperity of Telegram applications soon.

Quellen:

1. Telegram Apps Center: https://tapps.center/

2. TON App: https://ton.app/

3. The Open League: https://ton.org/open-league

This article is sourced from the internet: In-depth revelation: Who killed the vitality of Telegram mini-games?