Neue Überlegungen zur Bewertung öffentlicher Ketten: L1-Prämie steht in Frage, ETHs Souveränität wird in Frage gestellt

Originalautor: taetaehoho

Originalübersetzung: TechFlow

L1 premium, moneyness, xREV/TEV… Do these concepts really exist?

Special thanks to @smyyguy Und @purplepil l3 m for reviewing and providing feedback on this post.

If you are not familiar with REV, you can read this article von @jon_charb .

The following multiples are based on valuation data as of 12:00 noon (ET) on October 30, 2024.

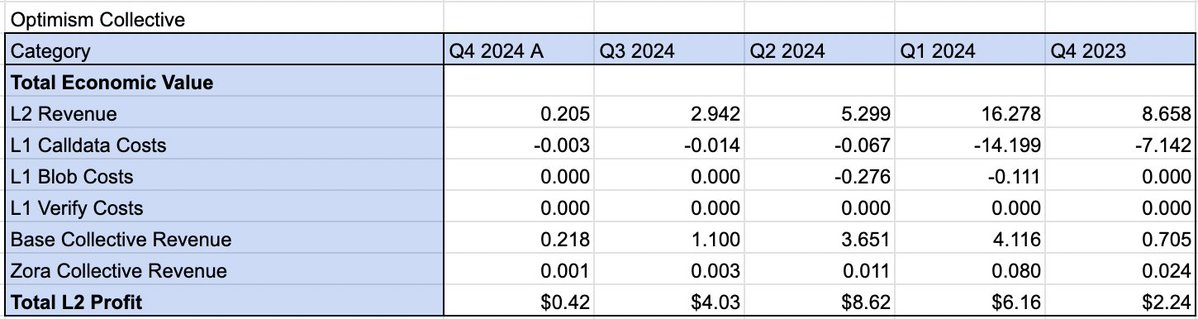

L2’s profit is its revenue (including base fees and priority fees) minus on-chain operating costs (such as L1 data calls, blobs, and verification costs). Arbitrum, Optimism, Zksync, and Scroll have data for the past twelve months, while Blast only has three quarters of data (which makes its multiples inflated compared to other projects). ETH and Solana also have data for the past twelve months.

A few notes:

-

REV and L2 revenue are comparable metrics. L2 revenue is revenue before operator costs (sequencer costs), similar to REV.

-

L2’s DAO distributed a large number of tokens in the Zeichen Generation Event (TGE). A portion of L2’s fully diluted valuation (FDV) can be attributed to governance value that is not present in L1 tokens. Therefore, we mentally adjust L2’s multiple upwards but do not make this adjustment when discussing our observations.

A few direct observations:

-

In terms of fully diluted valuation (FDV), there is no obvious L1 premium, but most L2s are not yet fully circulated. However, in market capitalization comparisons, there is indeed an L1 premium. (Arbitrum and OP have FDV/L2 revenue of about 100-250, while Ethereum and Solana have FDV/REV of about 118-140).

-

Optimism trades at significantly higher multiples than other comparable projects. Investors appear optimistic about its collective expansion.

-

Through collective profit sharing (i.e. 15% of sorter revenue and 2% of profits), the DAO has netted more than the OP’s L2 revenue so far in Q4. The collective strategy is successful in terms of total value accumulated to the treasury. Considering that Base alone has contributed ~$9 million to the collective treasury, large-scale revenue sharing grants in the future are a good bet.

-

Limiting blockspace has nothing to do with increasing revenue. Arbitrum has a median fee of ~$10 at peak liquidation time, yet its L2 profit is lower than Base.

-

Token buyers are not pricing in Scroll’s growth (market cap is 3x L2’s revenue).

-

The L1 verification costs of ZKPs have temporarily reduced the profitability of Zk rollups. Currently, we have not seen the cost savings of state divergence passed on to users.

Please see the spreadsheet for details.

This brings me to a few questions:

-

Does the monetary premium really exist? Or, will L2s have the same valuation when on-chain activity is the same?

-

Does ETH really have a sovereign premium (SOV) compared to Solana? (Ethereum’s REV is mostly concentrated in Q1 and Q2 of 2024, is this premium noticeable if only comparing the most recent quarters?)

This article is sourced from the internet: New thinking on public chain valuation: L1 premium is in doubt, ETHs sovereignty is questioned

Shuffle.com , the fastest growing crypto and sports lottery platform, recently announced a new feature powered by its native token SHFL – SHFL Lottery . The SHFL Lottery feature provides a new way for token holders to participate in the platform and provide a chance to win a lottery every week. How does the SHFL draw feature work? The SHFL Sweepstakes program allows SHFL holders to stake their tokens on Shuffle.com to participate in its sweepstakes. How to participate: Staking SHFL tokens: Users can get one prize ticket for every 50 SHFL tokens staked; Select or automatically generate numbers: The lottery numbers can be randomly generated or selected by the user, and the corresponding SHFL tokens will be deducted from the users balance after confirmation; Cancel the draw: Before each…

Stop it