Originalautor: Mensh, ChainCatcher

Ursprünglicher Herausgeber: Nian Qing, ChainCatcher

On November 6, 2024, the most dramatic US election in history came to an end. Trump, known as the Krypto president, was successfully elected, which may mean that crypto has officially entered the White House. At the same time, Bitcoin broke through the $75,000 mark, setting a new record high. The hidden interest groups and beneficiaries behind it will gradually surface.

Crypto lobbying: Real money poured in from congressmen to the president

On May 22, the U.S. House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT21) with a vote of 279 to 136. The bill, led by the Republican Party, aims to amend existing securities and commodity regulatory laws and regulations and establish a regulatory framework for digital assets to promote the development of the encryption industry.

The passage of FIT21 would have been impossible without the massive campaign spending that crypto groups channeled to legislators.

In addition, political action committees influence the election of legislators, which in turn affects the introduction and passage of bills. According to OpenSecret, a political fundraising data tracking platform, political action committees (PACs) that support cryptocurrencies have invested more than $133 million in elections. They have intervened in 51 campaigns, mainly to help candidates who promised not to severely regulate cryptocurrencies. The three main PACs are Fairshake, Protect Progress, and Defend American Jobs.

The rise of super PACs was helped by the 2010 Supreme Court ruling in Citizens United v. FEC, which allowed corporations and unions to make unlimited spending on political campaigns. The subsequent Speechnow v. FEC case further established the legality of super PACs, which can accept and spend unlimited donations as long as they do not coordinate directly with candidates or political parties. This is also why the cryptocurrency industry was able to invest up to $133 million in this election.

For example, Fairshake spent more than $10 million to help California Rep. Katie Porter (D-CA) in her failed Senate run, and more than $2 million to help Democratic Rep. Jamaal Bowman (D-NY) in New York’s 16th District in his re-election bid for the House. Both of Fairshake’s targeted candidates lost in their respective primaries. But the super PAC has directed its energy and money to support candidates across party lines, including 2023 candidates California Rep. Michelle Steel and North Carolina Rep. Don Davis.

In Ohios most expensive election ever, Defend American Jobs spent more than $40 million to support Republican Bernie Moreno in his Ohio Senate race against longtime Democrat Sherrod Brown, a loss that could tip the Senate toward the Republicans.

Reagan McCarthy, a spokesman for Bernie Moreno, once told The Washington Post: Unlike Sherrod Brown, who doesnt know the difference between a blockchain and a chainsaw, Bernie has a deep understanding of this technology, knows how to ensure it grows in the United States, and will work to ensure that the United States leads the world.

Protect Progress has spent more than $10 million supporting the campaign of Rep. Elissa Slotkin (D-Mich.). Slotkin voted for the 21st Century Financial Innovation and Technology Act, a bill that seeks to establish a regulatory framework for digital assets. The super PAC also spent $10 million on Rep. Ruben Gallego (D-Ariz.), who believes that cryptocurrencies are important in driving technological innovation, economic growth, and job creation and that there needs to be an understandable regulatory framework that provides clarity and promotes responsible innovation.

“Whatever happens in this election, this is going to be the most pro-crypto Congress we’ve ever had,” Coinbase’s Brian Armstrong recently told CNBC.

Which crypto institutions are involved in political donations?

Political donation data can provide a glimpse into the financial backers behind the political stage. From the 47 sources of funds for Trumps political action committee, the committee raised a total of $327.47 million in 2024. Among the donors who donated $1 million, Winklevoss Capital Management donated about $2.366 million, making it the second largest donor. The founder of the company is Tyler Winklevoss, the founder of the cryptocurrency exchange Gemini.

Another action committee, Right For America, raised a total of $68.46 million this year, of which A16Z founders Marc Andreessen and Ben Horowitz donated $5 million. Of course, the crypto industry does not only benefit Republicans, and most of the investors in the three crypto-supported super PACs do not have a clear party background. They just want to elect politicians who are friendly to cryptocurrencies.

Institutional donations mostly came from three cryptocurrency trading platforms: Coinbase, Ripple, and Jump Crypto, which contributed $46.5 million, $46.5 million, and $15 million, respectively, for a total of about $108 million. A16Z also contributed $45.2 million.

A recent report from the nonprofit watchdog group Public Citizen found that nearly half of the corporate money flowing into the election came from the cryptocurrency industry.

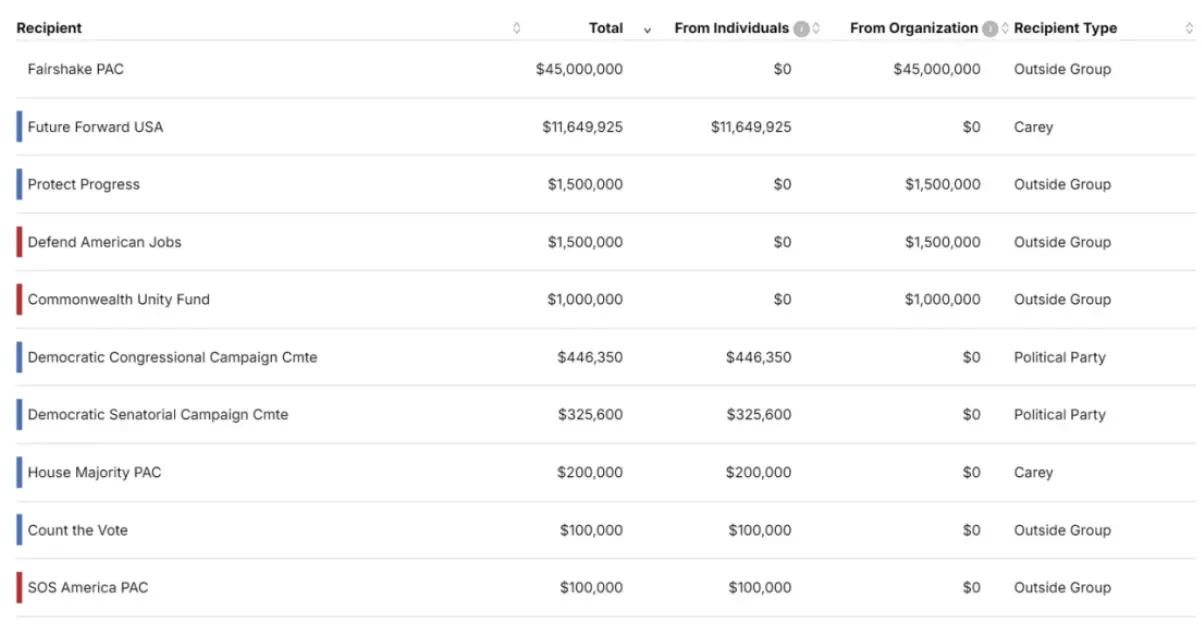

Top 10 recipients of Ripple funding in 2024

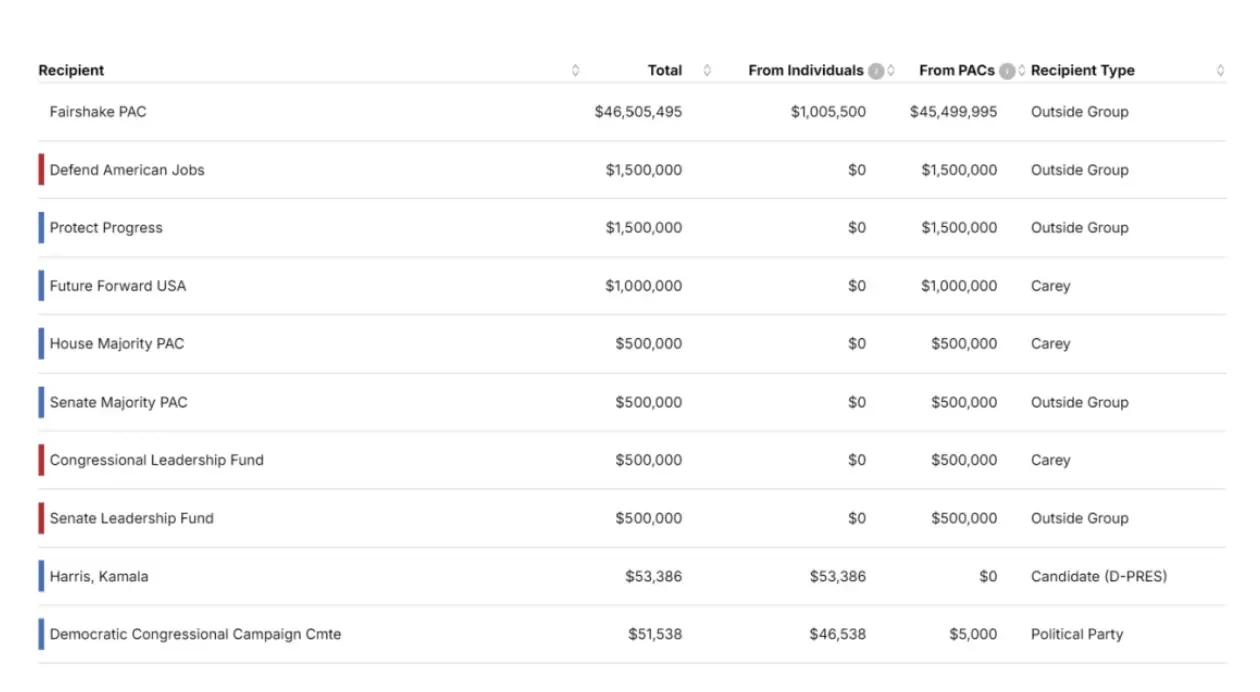

Top 10 recipients of Coinbase funds in 2024

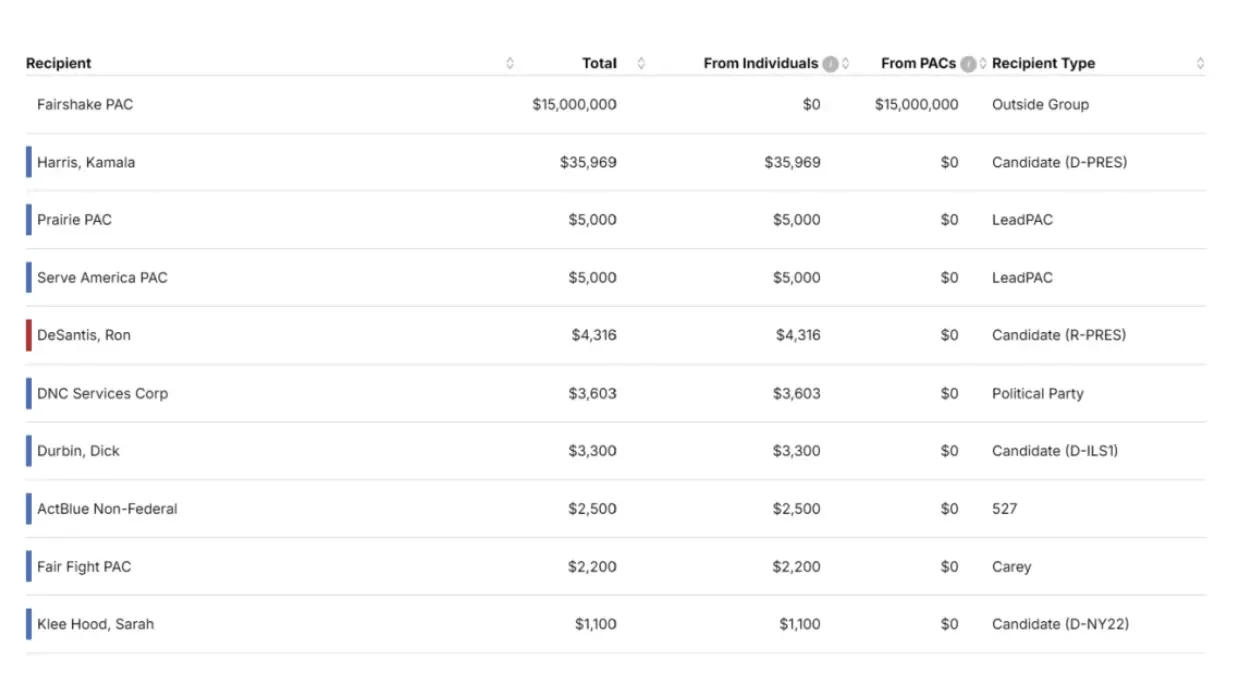

Top 10 recipients of Jump Trading (Jump Crpyto parent company) funding in 2024

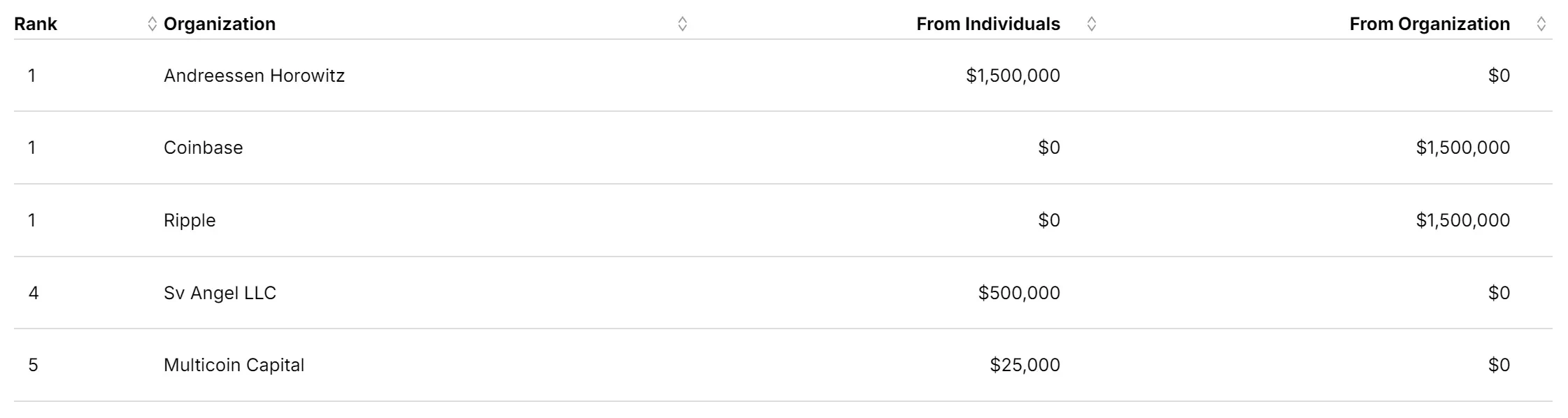

Winklevoss Capital Management Recipients

Subsequent positive news: Who has made a move in the game?

The regulatory framework for cryptocurrencies in the United States will inevitably be gradually improved in the future, and the volume of voices in the ears of politicians will inevitably be transmitted through layers of lobbying groups. The top exchanges, VCs and foundations have already made arrangements. The figure below summarizes the list of donors of three super PACs for investors to pay attention to.

Fairshake PAC Donor List

Defend American Jobs PAC Donor List

Protect Progress PAC Donor List

In addition to A16Z, Coinbase and Ripple, Multicoin also appeared on the list of donors of the PAC with a donation of only $25,000, which is also worth pondering. With the dream of decentralization, the tug-of-war between cryptocurrency and regulation is still a long way to go.

This article is sourced from the internet: The Secretive Crypto Beneficiaries of the US Election

Verbunden mit: Wie könnten Zinssenkungen der Fed die Volatilität von Bitcoin erhöhen?

Die Bitcoin-Märkte bereiten sich auf einen volatilen Monat vor, da die Erwartungen einer bevorstehenden Zinssenkung durch die US-Notenbank große Aufmerksamkeit auf sich ziehen. Nachdem der Bitcoin-Preis von $65.000 Ende August auf rund $59.000 Anfang September stark gefallen ist, erwarten die Märkte weitere Turbulenzen. Das Ergebnis der nächsten Sitzung der US-Notenbank, die voraussichtlich eine Zinssenkung auslösen wird, wird wahrscheinlich die kurzfristige Richtung des Bitcoin-Dollar-Wechselkurses bestimmen, aber was die Märkte nervöser macht, ist das Potenzial für eine tiefere wirtschaftliche Instabilität. Die meisten Marktteilnehmer erwarten eine Zinssenkung um 25 Basispunkte, aber es gibt auch Gerüchte, dass die Fed eine aggressivere Zinssenkung um 50 Basispunkte vornehmen könnte, ein Schritt, der wahrscheinlich eine größere Marktvolatilität auslösen wird. Während die Weltwirtschaft unter…