Verkauf von Trump: Die Familie Trump hat zig Millionen Dollar durch Sponsoring und Branding verdient

Originalautor: Grapefruit, ChainCatcher

Ursprünglicher Herausgeber: Nian Qing, ChainCatcher

On November 5th local time, the voting for the 60th U.S. presidential election came to an end. Who between Donald Trump and Kamala Harris will eventually move into the White House is not only the focus of world attention but also a new change in the Krypto world.

Since the beginning of his campaign, Trump has publicly expressed his support for the development of cryptocurrencies many times. If he successfully returns to the White House, the United States strict regulatory policy on the crypto market may usher in a change, injecting new vitality into the development of the industry. At the Bitcoin 2024 Conference, Trump said in his speech: If re-elected, he will ensure that the government retains 100% of the Bitcoin it holds and will list Bitcoin as a strategic reserve asset of the United States.

Trump is not only a supporter of the crypto market, but also a personal participant. During the campaign, he not only received donations from crypto whales and institutions, but also personally involved in multiple crypto projects. The cumulative revenue from NFT and DeFi crypto projects he participated in through OEM has exceeded 10 million US dollars.

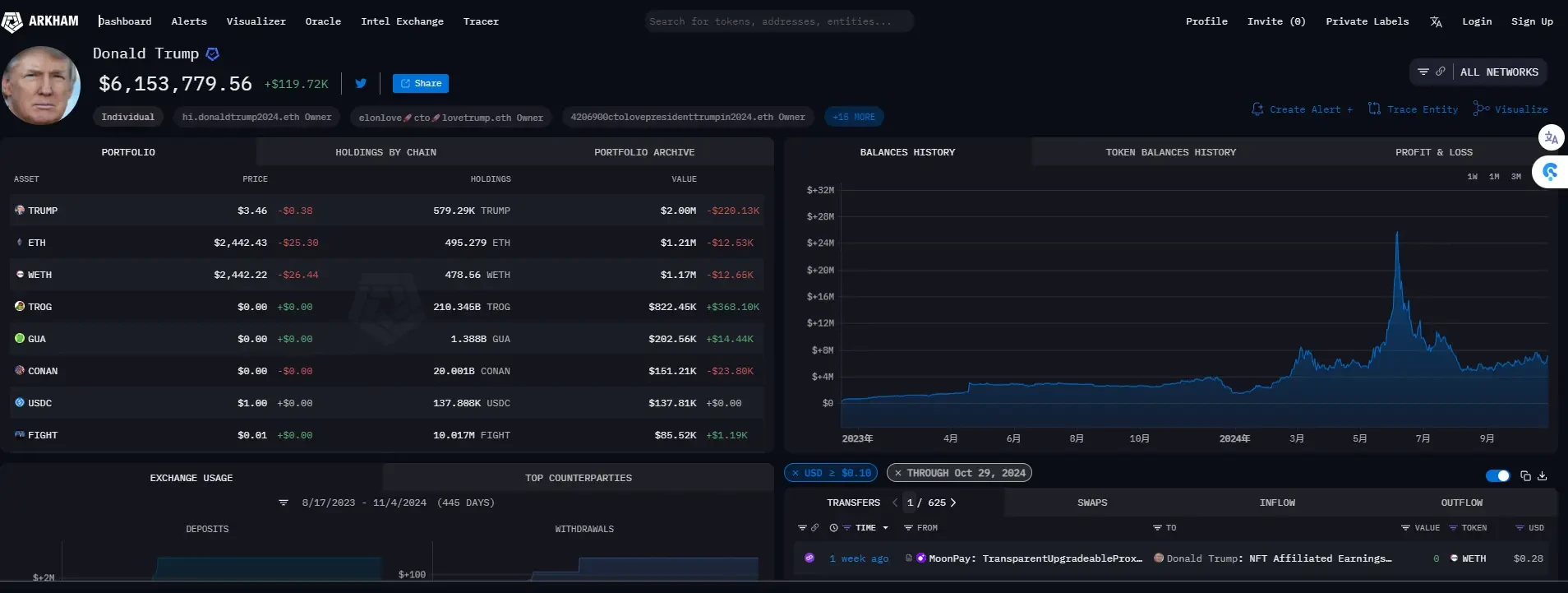

According to data from the Arkham platform, the value of crypto assets held in Trumps wallet address was $6.15 million on November 5. At its peak in June this year, the value was as high as $25 million. The number of Ethereum held was close to 1,000, worth $2.38 million.

Trumps active participation in the crypto market and significant gains have undoubtedly brought new changes and attention to the crypto world. If Trump is elected, the impact on the crypto market will be far-reaching.

Trump NFT series card sales revenue exceeded $22 million, and the naming license fee profit exceeded $8 million

Since 2022, four series of Trump-named NFT digital trading cards have been issued, and the cumulative number of NFTs issued has exceeded 200,000. Each card is priced at US$99, and the revenue from selling NFT cards alone exceeds US$22 million.

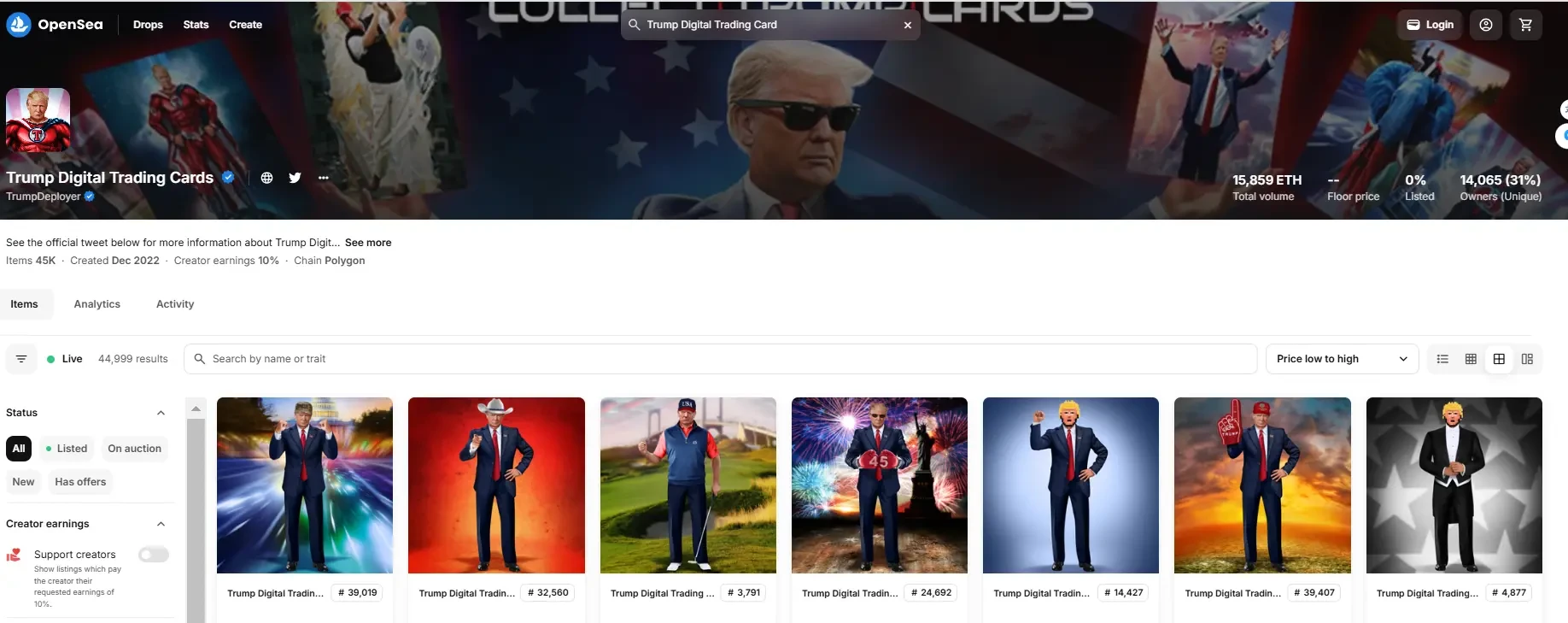

First, in December 2022, Trump released his first series of NFTs, the Trump Digital Trading Card NFT. This series of NFTs was created on Polygon. This series of NFTs is based on Trump鈥檚 cosplay photos, including images of Trump as a superhero, astronaut, racing driver, western sheriff and other cartoon characters.

This is the first series of Trump NFT theme, each priced at $99, with a circulation of 45,000. Buyers can participate in the lottery, meet Trump or play golf, etc. The launch of this series quickly received a warm response from the market, and all were sold out within 18 hours of going online, with sales reaching $4.455 million.

In addition, transactions in this series of NFTs in the secondary market are also quite active. According to the latest data from Opensea, the number of addresses holding this series of NFTs has reached more than 140,000, and the total transaction volume in the secondary market has reached 15,859 ETH, which is approximately US$41.23 million based on the price of US$2,600 per ETH.

This means that Trumps first NFT series has a revenue of $4.45 million from selling cards alone. In addition, the series has a 10% royalty, and the royalty income from the transaction volume of more than $40 million is more than $4 million. The total revenue brought by this series of NFTs exceeds $8.5 million (including revenue from selling cards and royalties).

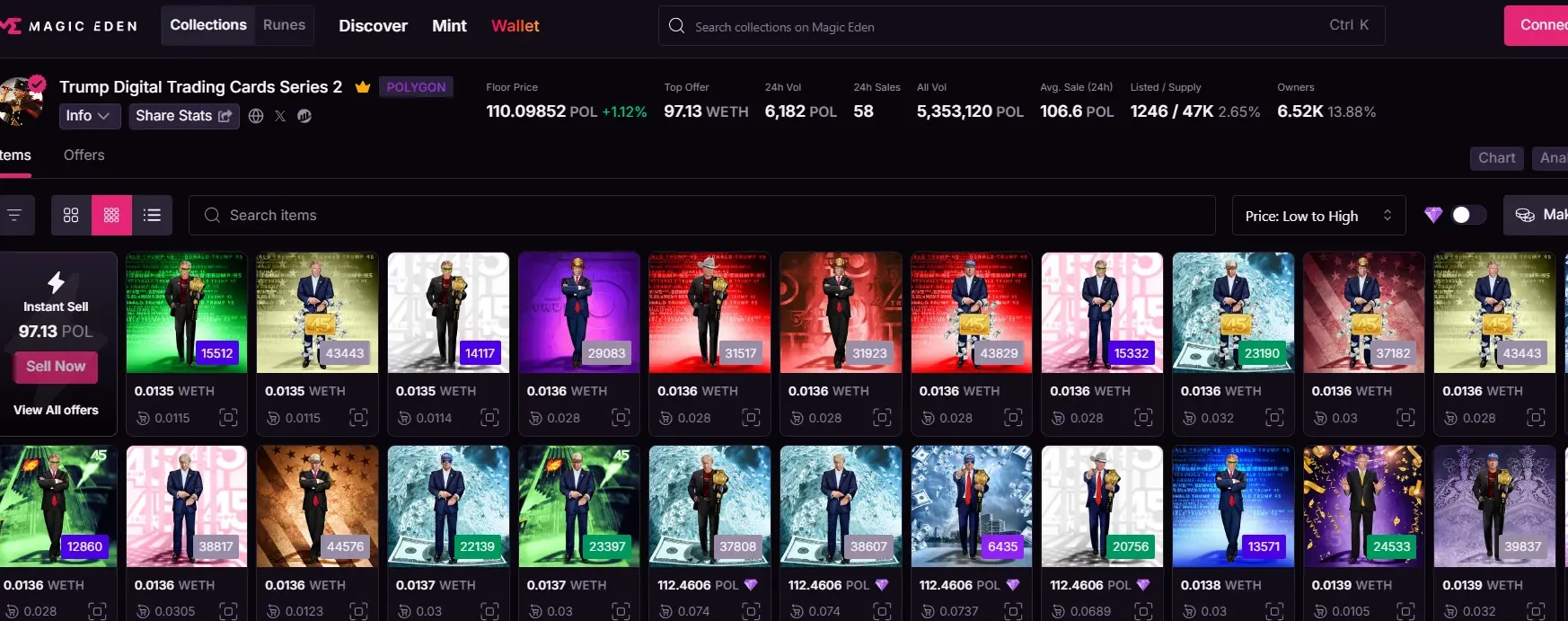

Perhaps seeing the considerable profits brought by NFT, only 4 months after the first NFT (April 2023), the second series of Trump Digital Trading Cards NFT (Trump Digital Trading Cards Series 2) was officially launched. This series of NFTs mainly shows Trumps tough image in a suit. The total number of NFTs issued is 47,000, each priced at US$99. It was sold out in less than 5 hours after it was launched, with sales of US$4.653 million. The current floor price is 110 POL (US$33).

On December 23 of the same year, Trump released the third series of NFTs (Trump Digital Trading Cards MugShot Edition), which was still priced at $99 per piece. Unlike the previous series, this series has a total of 100,000 pieces, mainly showing Trumps image after his arrest. This series of NFTs brought in about $9.9 million in revenue.

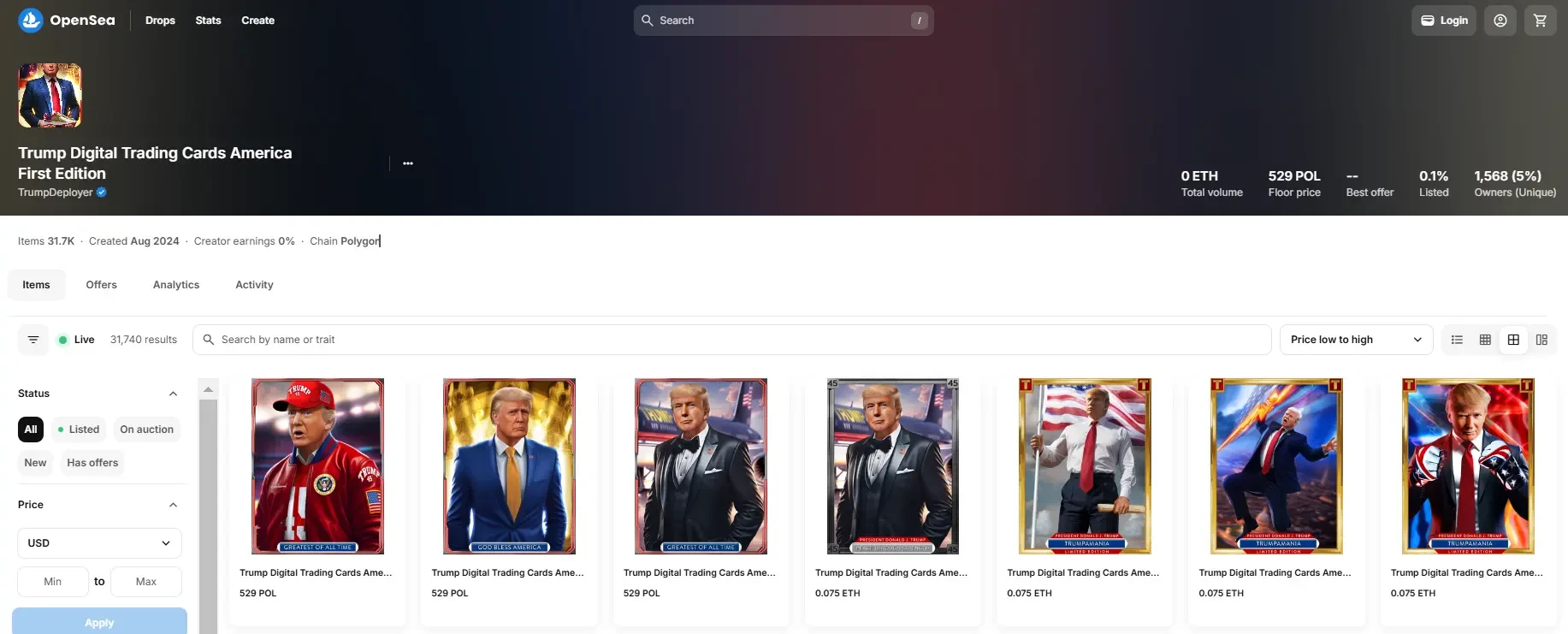

In August of this year, Trumps fourth NFT series (Trump Digital Trading Cards America First Edition America First) went on sale. This series of NFTs is based on the image of Trump in a suit debating with Biden during the US presidential election. It is used to express the political strategy of never surrendering. It also includes scenes such as dancing, holding Bitcoin, and standing next to buffaloes or lions, which makes people more convinced of Trumps support for encryption.

The fourth set of NFT series also costs $99 per card. Holders can get the debate suit part and special benefits, and can also participate in the golf club dinner. The official website shows that it is sold out. However, this series of NFTs cannot be transferred before January 31, 2025. According to the latest data from Opensea, the fourth set of NFT series has a circulation of 31,740, with a total income of approximately $3.14 million from selling cards, 1,568 holding addresses, and a current floor price of 529 POL (approximately $161.7).

To put it simply, the first series of Trump NFTs was issued in December 2022, with a total of 45,000 cards (US$4.45 million in sales revenue); the second series was released in April 2023, with a total of 47,000 cards (US$4.65 million in sales revenue), and series 1 and 2 both had an additional 10% royalty income; the third series MugShot was released in December 2023, with a total of 100,000 cards (US$9.9 million); the fourth NFT series America First was launched in August this year, with a circulation of 31,740 (profit of US$3.14 million).

To date, the revenue earned from Trump鈥檚 NFT digital trading cards has exceeded $22 million.

However, the Trump series of NFTs are not issued directly by him or his company, but are produced and sold by NFT issuing company NFT International LLC (NFT INT LLC). The company is authorized to use Trumps name, portrait and image to produce digital trading cards under a paid license and pay Trump a licensing fee.

According to Trump campaign financial data disclosed earlier this year, NFT INT LLC has earned $19 million by launching three series of Trump digital trading cards, paid Trump $7.15 million in licensing fees, and Trumps wife Melania Trump earned $330,000 from NFT sales.

Then, with the $3.14 million in revenue from the newly launched NFT in August, NFT INT LLC has earned more than $22 million from selling cards through issuing Trump NFTs so far. If the NFT issuing company pays the licensing fee based on the revenue-to-fee ratio, the fee paid to Trump accounts for about 37% of the revenue ($7.15 million/$19 million), and the fourth set of NFTs will need to pay Trump another $1.17 million in licensing fees ($3.14 million * 37%), which means that Trump has made a net profit of more than $8 million ($7.15 million + $1.17 million) just by naming NFTs.

Since Trump participated in the presidential election, the floor prices of the Trump series NFTs have risen sharply. As of November 5, there are 2 NFTs with a floor price above 100 US dollars. The floor price of the first series of digital trading cards is 450 POL dollars (135 US dollars); the floor price of the second series of digital trading cards is 110 POL (33 US dollars); the floor price of the third series MugShot is unknown; the fourth set of NFT series (America Firs) is quoted at 529 POL (about 161.7 US dollars).

Trump family expects to earn $337 million through branded DeFi project World Liberty Financial

If NFT is Trumps first successful attempt in the crypto market, then the DeFi project World Liberty Financial (WLFI) is another masterpiece publicly sponsored by the Trump family.

World Liberty Financial claims to be a project promoted by members of Donald Trumps family (sons Eric Trump and Donald Trump Jr.), and has been supported by Trump himself on his official Twitter account many times. For example, before and after the sale of WLFI tokens, Trumps official X account continuously posted content promoting the sale of its tokens, making World Liberty Financial regarded by the crypto community as a DeFi project that Trump personally supports.

World Liberty Financial is a DeFi protocol where users can borrow and lend cryptocurrencies, create liquidity pools, and trade using stablecoins.

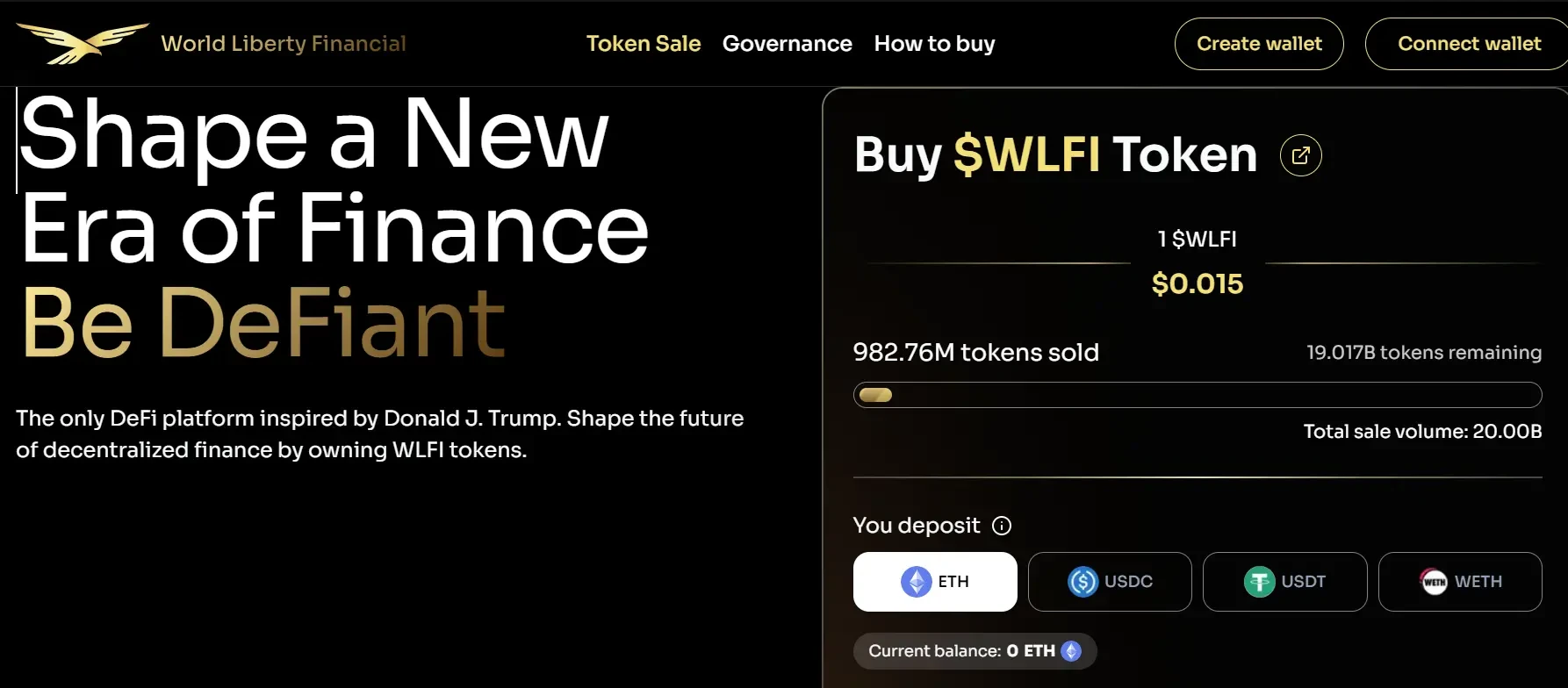

On the evening of October 15, the World Liberty Financial token WLFI officially started its public sale. The total issuance of WLFI tokens is as high as 100 billion, and it is planned to sell 20 billion tokens at a price of US$0.015 (equivalent to US$300 million).

However, the sales results of the WLFI token after it went online were far from expectations, with less than $15 million in participating funds. As of November 5, only 982 million WLFI tokens were sold, raising only $14.73 million.

The main reason for this result is that the white paper released by World Liberty Financial on October 18 showed that the project and the Trump family and Trump only used Trumps image for publicity and promotion through authorized cooperation. Trump himself occasionally had to tweet to promote the WLF and World Liberty Financial agreements. The Trump family did not personally participate in the project, but only appeared in the form of endorsement.

In return for the authorization, the Trump family will receive 22.5 billion WLF tokens, which will be worth $337.5 million based on the issue price of $0.015. In addition, the Trump family is entitled to 75% of the net income of the agreement, but will not be responsible for WLF.

From tweets to Trumps image on the website and white paper, World Liberty Financial seems to be highly tied to the Trump family. However, the truth is that it is an OEM product of Trump and his family. The Trump family only makes profits by renting out the brand, and there are other traders behind the scenes who use the reputation of the Trump family to operate the product. What is more worrying is that the trader behind World Liberty Financial was found to have copied the code directly from Dough Finance, a DeFi product that was hacked this year.

The business model of branding, naming, and platforming is not uncommon in the Trump family. Many Trump hotels or buildings named after Trump around the world are licensed and OEM-ed. Similarly, in the crypto world, Trump issued NFT in the form of OEM and used it again in the crypto DeFi project World Liberty Financial. However, judging from the participation of the crypto community this time, even with Trump naming, users may not buy it.

This article is sourced from the internet: Selling Trump: The Trump family has made tens of millions of dollars by sponsoring and branding

Related: Is the meme hype peaking? Bet on undervalued liquid tokens

Original author: Kyle Original translation: Luffy, Foresight News The liquid token thesis is simple: I believe there is a huge opportunity (alpha) in the liquid token investing space, while the VC token investing space is oversaturated. There are a lot of great businesses being built in the cryptocurrency space, and they all have their own tokens, but they are not priced properly. The main driver of valuations in 2021 is to paint dreams. I believe that valuations after 2024 will come from realizing those dreams. SOL monthly trend Solana is a prime example of this shift, where three years later people realized “maybe it wasn’t all talk.” If you’re a fund manager, here’s your opportunity: Try to figure out who’s building the really cool stuff. You might be thinking “Shouldn’t…