Risk markets have been stagnant over the past week as the US election entered its final stages, with both parties ramping up last-minute mainstream media campaigns, including an unprecedented three-hour Trump-Rogan interview that has more than 25 million views on YouTube alone. In addition, perhaps in response to recent US pressure, Israels attack on Iran on Friday night was more restrained than expected, providing an opportunity for Tehran, which has not responded to the attack through official channels, to ease the pressure.

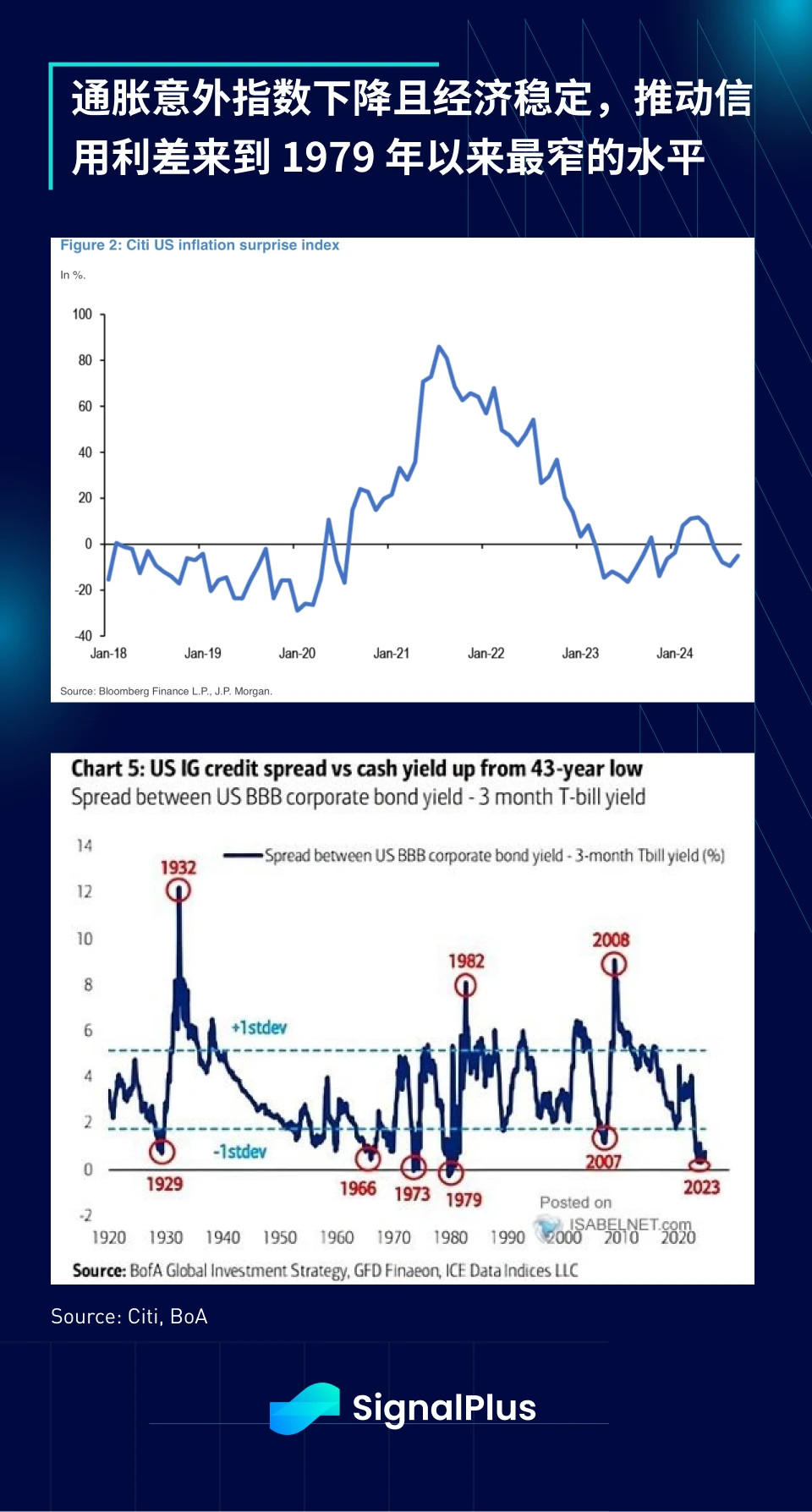

The lack of macro risks and the support of inflation trends have continued to squeeze risk premiums. US investment-grade credit spreads have narrowed to near a 43-year low, and stock pricing also suggests that there is almost no possibility of a recession in the future.

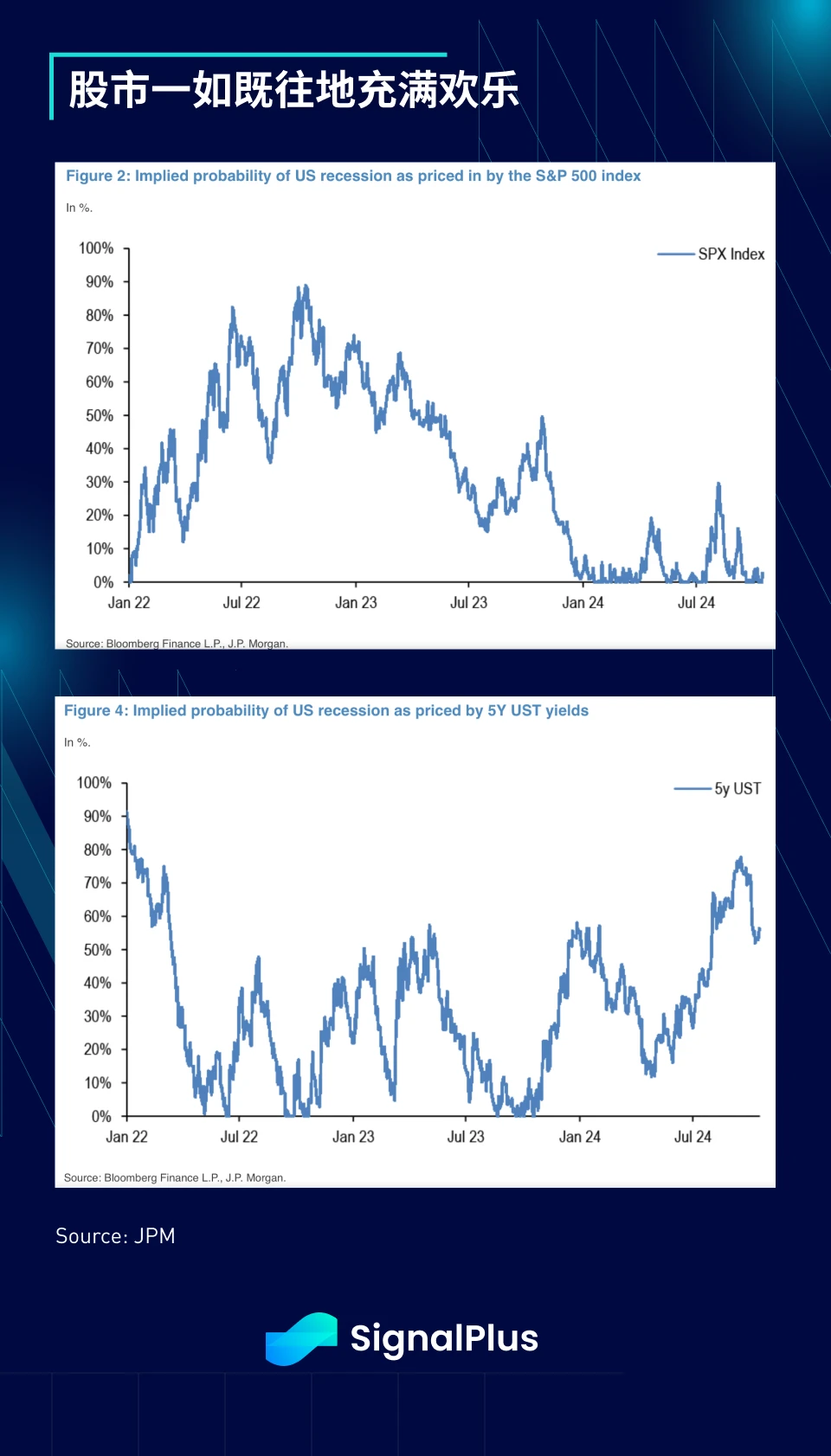

Bond and stock expectations have been diverging on recession expectations, with stocks being more correct so far, causing the 10-year Treasury yield to rise +60 basis points in the past month, with bond managers reporting one of the largest duration reductions in the past 25 years.

Yields have risen in five of the past six weeks, with the 10-year yield hitting its highest level since July, and more than $183 billion of new bond supply is expected in the coming days. With key employment data such as JOLTS and non-farm payrolls due in the coming week, fixed income markets are likely to remain under pressure, while former Fed Governor Kevin Warsh has also joined the fray, criticizing the Feds recent dovish turn and inflation framework.

Speaking of errors in expectations, the recently released University of Michigan Consumer Confidence Report showed that 1-year inflation expectations fell to 2.7%, but the 5-10 year average inflation expectations confusingly rose to a high of 6.6%, the highest level since 1985. The divergence from the median inflation expectation is almost unprecedented. The market seems willing to ignore this difference for now, but if the economy continues to show resilience, inflation concerns may re-emerge in the coming quarters.

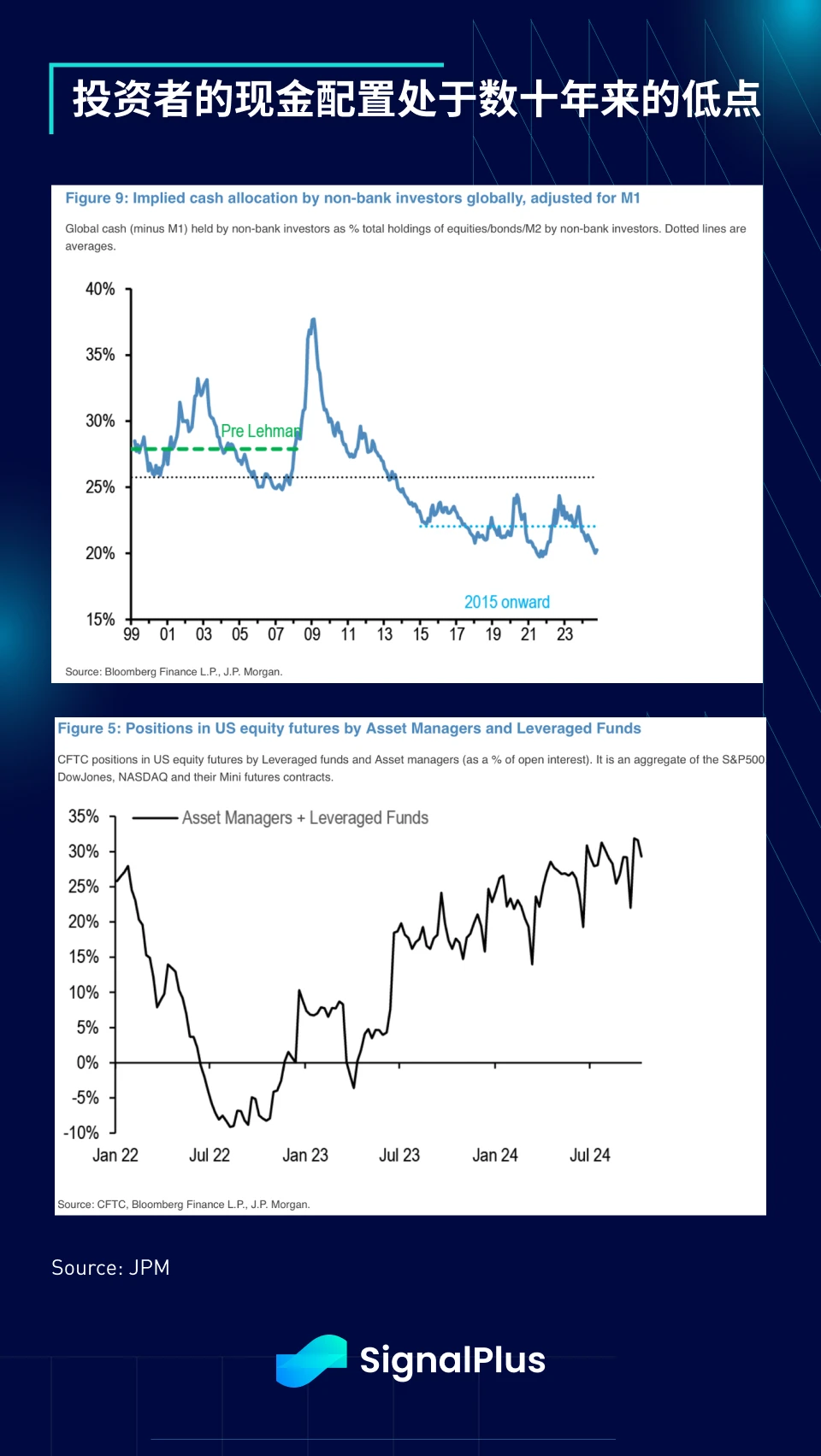

Meanwhile, the SPX hit its 47th all-time high on October 18, with previous records being set in 1995 (+77) and most recently in 2021 (+70). Investors are naturally almost “all-in”, with JPMorgan research showing implied cash allocations near 25-year lows and equity futures positioning at multi-year highs. In the event of a potential Trump victory, will stocks become an “inflation hedge”? This is certainly worth watching…

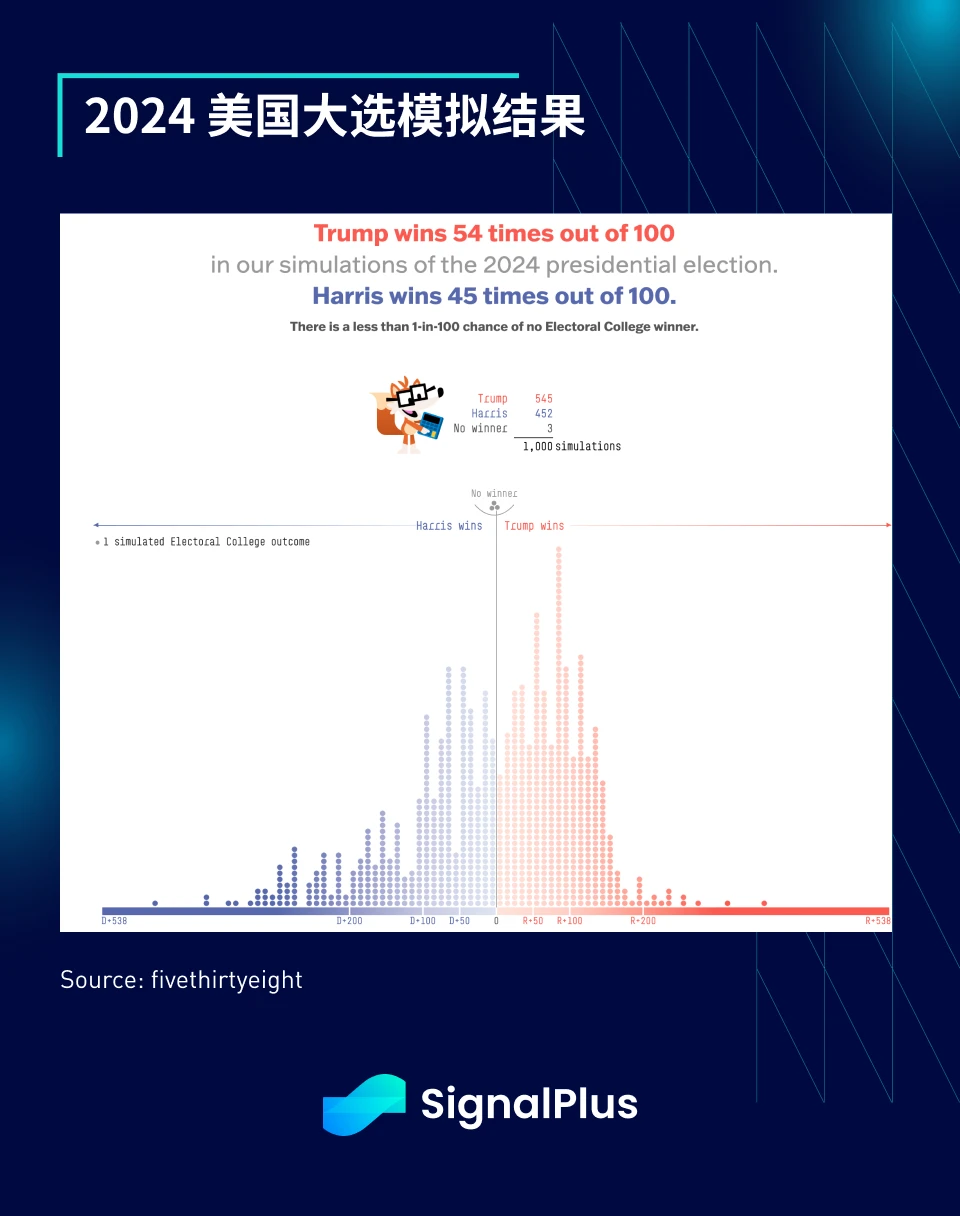

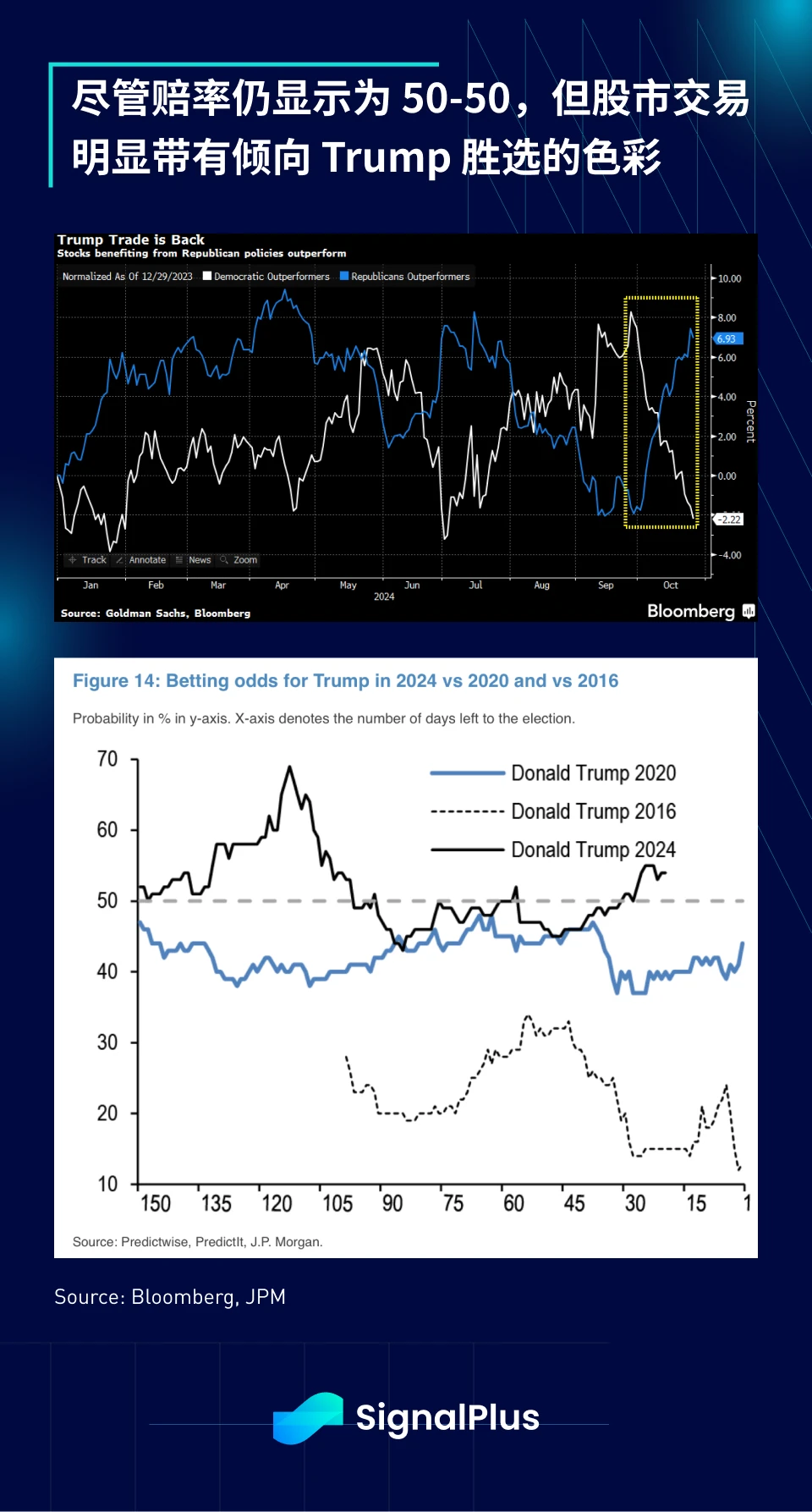

Although official odds still show 50-50, stock market trading is currently clearly leaning towards a Trump victory after a series of successful interview campaigns. Similar tendencies can be observed in gold and Kryptocurrency prices, with the skew of post-election call options being pushed higher as a hedge.

As we head into the final week before the election, the stock market will be busy with corporate earnings releases, including Ford, Alphabet, AMD, McDonalds, Visa, MSFT, Caterpillar, Meta, Coinbase, Starbucks, Amazon, Apple, Intel and Mastercard will all report results this week. In terms of economic data, this week will have JOLTS, ADP, consumer confidence, GDP, Challenger layoffs, core PCE, ISM and non-farm payrolls, etc. Prepare for a lot of macro data in the next few weeks!

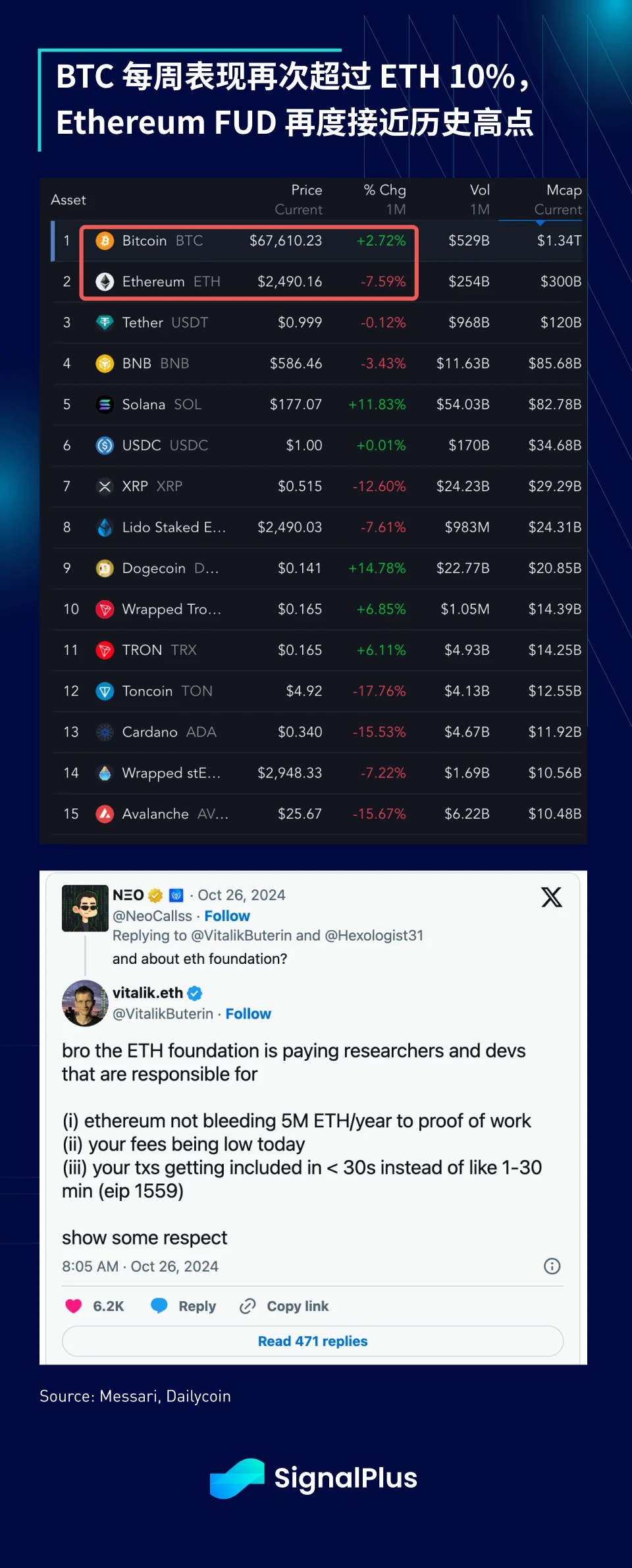

Cryptocurrencies have had a turbulent week, with BTC retesting $69k earlier before retreating to $65k support and remaining in the current consolidation pattern. BTC net inflows reached nearly $1 billion last week, the third consecutive week of inflows, and institutional demand remains strong. In addition, BTC dominance continues to rise (59.8%), while ETH is relatively inferior, with BTC outperforming ETH by 10% per week, while Vitalik is under pressure due to the Ethereum Foundations suspected sale of ETH in the past few months.

Additionally, there were reports that the U.S. government was investigating Tether, causing USDT to fall to 0.9965 before recovering to near its peg level. CEO Paolo Ardoino officially denied these claims, and this time the market reacted more conservatively to these rumors.

In terms of price action, BTC is likely to continue to track SPX fluctuations, with its 3-month correlation with SPX reaching a 1-year high, while its correlation with the USD and inflation is close to zero.

Wishing all readers good trading during this busy week!

Sie können die SignalPlus Trading-Vaver-Funktion nutzen unter t.signalplus.com um mehr Krypto-Informationen in Echtzeit zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie bitte unserem Twitter-Konto @SignalPlusCN oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegrammgruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren.

Offizielle SignalPlus-Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: The Final Stretch

Related: Top 20 Cryptocurrency Predictions for 2025: Will Bitcoin Break $100,000?

Original author: Minty This article was compiled by the Ringing Finger Research Institute team As the cryptocurrency market continues to evolve, we are excited about what the future holds for 2025. Based on a detailed analysis by author @DeFiMinty on Twitter, here are 20 predictions for the cryptocurrency world in 2025: 01 More tokens backed by physical assets will emerge It is expected that more tokens backed by real-world assets (RWA) will be listed, and real-time asset trading on the chain will become an important driving force for mainstream market acceptance. For example, Visa plans to launch Visa Tokenized Asset Platform (VTAP) on the Ethereum network in 2025 to help banks issue tokens backed by fiat currencies, covering RWAs such as commodities and bonds, and achieve near real-time settlement through…