Wie sollen die von Scroll abgezogenen Gelder verteilt werden, nachdem der Traum vom Reichtum durch den Airdrop geplatzt ist?

Original | Odaily Planet Daily ( @OdailyChina )

Autor: Azuma ( @azuma_eth )

Scroll officially launched its first season airdrop last week, but the overall revenue situation was quite disappointing. Many users cried out for anti-roll, and some even said that Scroll has ended the wealth-creating effect of airdrops.

The author also roughly calculated the personal yield situation. In total, he had configured about 10,000 US dollars in the form of ETH and USDC on the Scroll network (most of which was in Aave, and a small part was in Pencils Protocol), for about half a year (only the duration of the Session Zero points activity after it was launched in April was calculated, and there was actually interaction in the early stage). The final total airdrop income was slightly less than 500 US dollars (because the amount was small and the collection was late, it was not very good to sell the node). Without taking into account wear and tear, the annualized yield is about 10%, but if the large wear and tear of entering and leaving the network in the early stage is taken into account, the actual yield should be lower, even lower than the general financial management income level on the current chain.

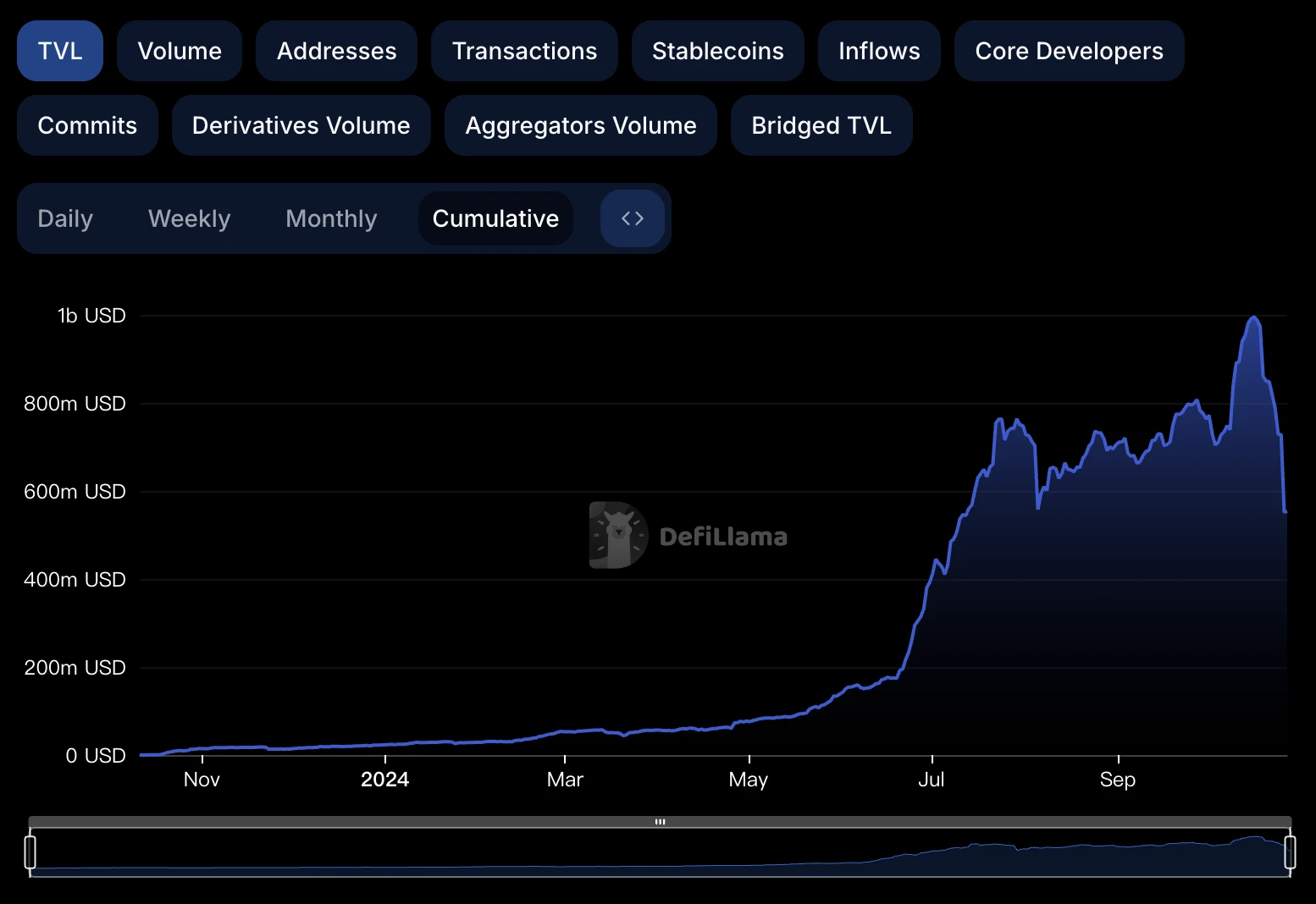

As the dust of the airdrop settles, it is not surprising that a large amount of funds are rapidly flowing out of Scroll. DeFillama data shows that the total locked value (TVL) of Scroll is currently about US$550 million, which has shrunk by 44.6% from the historical peak of US$991 million on October 16 (3 days before the airdrop snapshot), nearly halving.

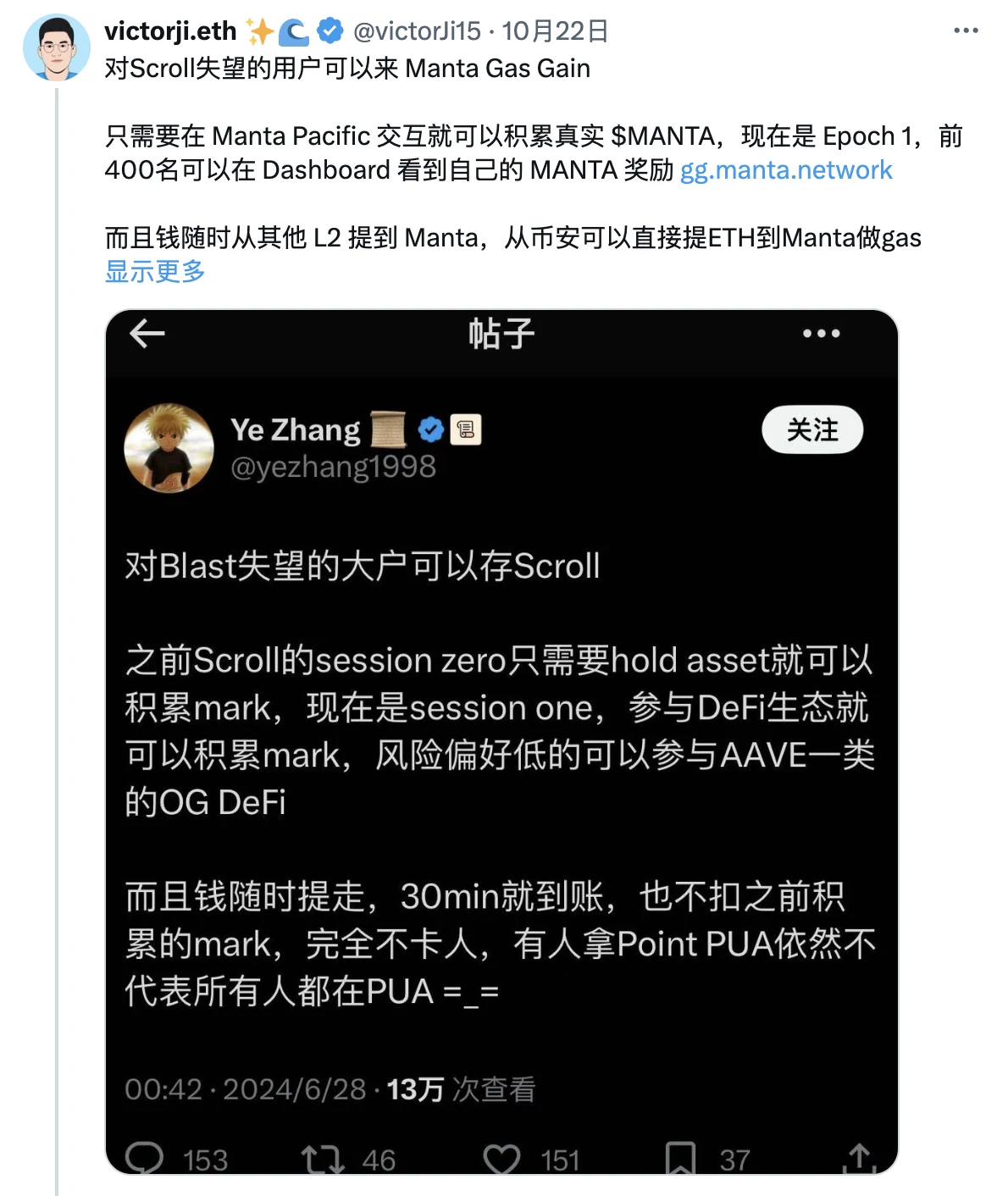

Faced with the outflow of real money, some ecosystems have begun to openly call for the absorption of these liquidity funds. Victor Ji, co-founder of Manta Network, once imitated Scrolls ridicule of Blast and said that users who are disappointed with Scroll can go to the ecosystem to experience Gas Gain activities.

A few days ago, I personally withdrew the funds in Scroll, so I was also faced with the problem of how to allocate these funds again.

In the following, we will sort out the current high-yield financial management opportunities in multiple mainstream ecosystems. The categories will focus on lossless pure interest-bearing income, but will not exclude eating more potential airdrop opportunities. It should be emphasized that for the sake of security and easy management, this article will only involve basic operations within each ecological head protocol, but the security risks on the chain are everywhere, and users still need to be responsible for the security of their own funds, DYOR.

Since most of the funds withdrawn from Scroll are ETH and stablecoins, the following article will only focus on these two assets.

ETH

ETH is currently at the center of controversy, and its weak performance has caused many users to consider whether they should continue holding it. If you do not consider reducing your ETH holdings in the short term, it is still recommended that users use the ETH in their hands flexibly to generate interest and maximize their returns.

Judging from the current application development status of the Ethereum ecosystem, potential profit opportunities with strong water storage capacity still need to focus on the re-staking track. After EigenLayer issues coins, it can focus more on Symbiotic and Karak, which have relatively less competition, especially Symbiotic, which is backed by Lido and Paradigm.

For Symbiotic, you can deposit directly on the protocol, or execute it through liquidity re-pledge (LRT) protocols such as Mellow Finance (ether.fi and Renzo are also supported). The reason is that Symbiotic鈥檚 multiple mainstream LST pools are full, and the LRT protocol can coordinate asset categories on your behalf or wait for the quota to be opened again; secondly, through the LRT protocol, you can earn an extra layer of LRT protocol points at the same time, amplifying the airdrop expectations.

Taking Mellow as an example, after depositing funds into the protocol, if the funds have not yet entered Symbiotic at the bottom layer, you can earn Mellow points 1.5 times faster; if the funds have already entered, you can earn Symbiotic and Mellow points at the same time, as well as basic ETH staking income (about 3%).

Stabile Münzen

Relatively speaking, stablecoins have far more options than ETH. Perhaps because the market is showing signs of warming up, the deposit income and contract funding rates of on-chain lending have increased to a certain extent, which also means that there are good stablecoin interest-earning opportunities in multiple ecosystems at present.

Ethereum-Mainnet

On the Ethereum mainnet, two pools are currently recommended.

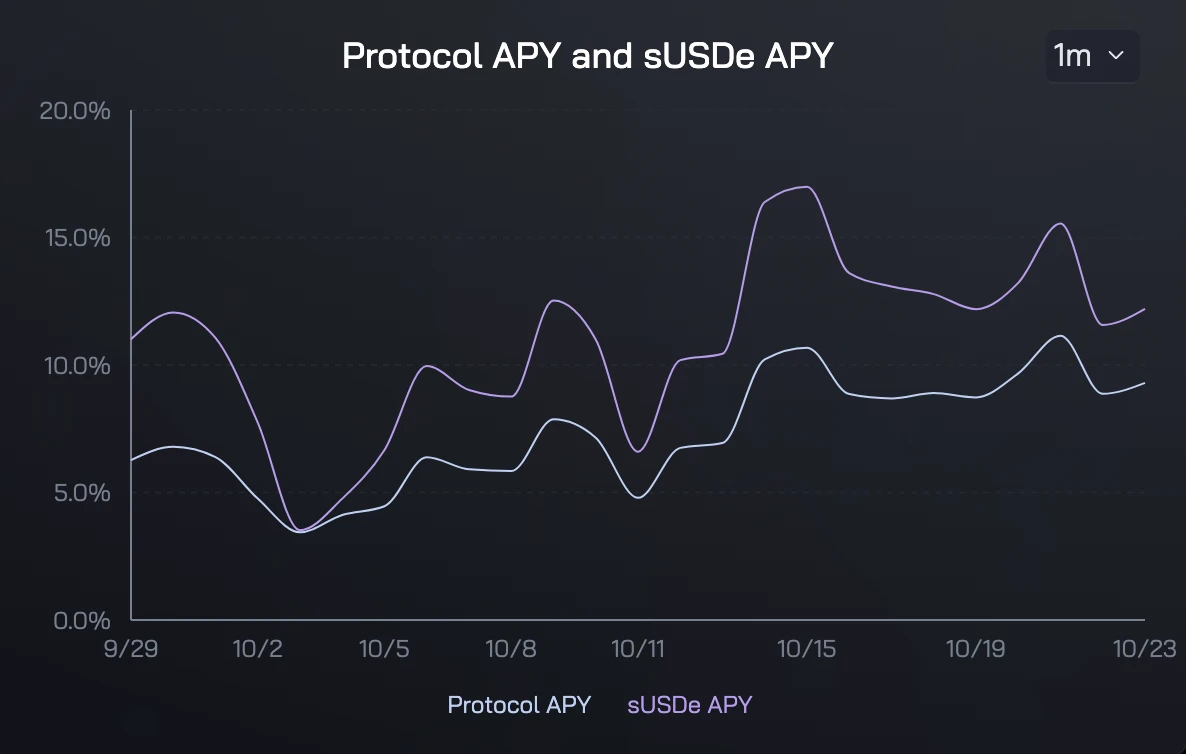

One is Ethenas sUSDe, which is the pledged USDe. With the recovery of the funding rate, the yield of sUSDe itself has rebounded to 13%.

Zusätzlich, static holding of sUSDe can also passively accumulate Ethena points , which are expected to be monetized through Ethenas next round of airdrops; in addition, users can also deposit sUSDe directly into the Symbiotic mentioned above (the quota is full, you need to wait), and obtain Symbiotics point rewards at the same time.

The other is Sky (formerly Maker)s USDS. Users can deposit directly on Spark or Aaves USDS market to obtain a pure stablecoin yield of about 6.5%.

Zusätzlich, Sky founder Rune Christensen has also stated that SKY airdrop incentives will be provided to these two major markets – but there is a variable here. The Sky community is considering changing its name back to Maker. One potential option in the name change direction seems to be to abandon the new SKY token and use MKR as the only protocol governance token again. Users need to continue to pay attention to this progress.

Solana

In the Solana ecosystem, there is a person who likes the fixed investment artifact JLP (essentially an index token of BTC, ETH, SOL, USDT, and USDC, but also has interest-bearing properties). However, considering the recent surge in SOL, it is not recommended to directly use stablecoins to purchase JLP for the time being . Nan Zhi, a PVP expert from Planet Daily, once suggested that JLP could be used to arbitrage relatively high and low positions in SOL. It is recommended to pay attention to our Full Record of Editorial Operations column.

After working hard for a whole year, looking back, it would be better to just lie down and take JLP.

Relatively speaking, it is more recommended that users simply deposit PYUSD in marginfi and Kamino to earn interest. The former currently has a yield of about 7%, and the latter is about 9% . Both protocols can accumulate points income , but marginfi, which has not yet issued a coin, may have a higher expectation than Kamino, which has already airdropped two rounds.

After depositing assets, users who are willing to actively manage the health of their positions can consider lending SOL and then depositing it into popular Solana ecosystem protocols such as Solayer that have not yet issued tokens to earn airdrop income . Although lending SOL requires paying 6% interest, it is enough to be hedged by the SOL staking income (generally around 8%) obtained after the deposit.

Sui

Some time ago, Sui ignited the secondary market, and the financial returns of several major DeFi protocols on its chain are currently relatively objective.

As native USDC officially enters the Sui network, I personally recommend using native USDC to deposit directly on NAVI or Scallop to avoid the protocol risks behind the bridged stablecoin.

Momentan, the native USDC yields on NAVI and Scallop are 7% and 8% respectively . The formers yield structure is stablecoin + NAVI + SUI, while the latter is composed entirely of stablecoins.

Starknet

Although Starknets coin price performance is average, its DeFi Spring is still quite attractive – a rough calculation shows that compared with the Scroll airdrop, the mining income here during the same period is even higher.

Momentan, the two major lending platforms on Starknet, zkLend and Nostra, can provide yields close to 10% for USDC and USDT . The income is mainly composed of STRK, which can be used to pay for the gas of the network (that is, there is no need to configure ETH as gas, which is relatively more convenient).

It is worth mentioning that the price of STRK itself has entered a low volatility state. If you intend to actively manage your LP positions, you can configure the STRK-ETH liquidity pool through EKUBO, with the highest yield rate reaching 70+%.

Other potential revenue opportunities

The above only mentions the interest-bearing strategies of a few relatively mainstream protocols within the ecosystem. The main purpose is to take security into consideration and to facilitate user copying operations.

In fact, there is no shortage of profit space in the current on-chain world. For example, zkSync Era will soon launch an incentive plan for 300 million ZKs, and the total incentive amount is even close to Scrolls airdrop amount. In addition, users can also use Pendles split plan to obtain higher and more stable returns.

But we still want to remind you that security risks on the chain are everywhere, and users are responsible for the security of their own funds, DYOR.

This article is sourced from the internet: After the airdrop dream of making wealth is shattered, how should the funds withdrawn from Scroll be allocated?

Related: Discover the next generation of Ton games from Safepal Ton Fest

introduction Recently, Telegram (TG) and the Ton network have frequently become hot topics. On August 28, due to a surge in $DOGS transactions, the Ton network was congested, causing the garbage collection function to be overloaded and many verification nodes to temporarily lose consensus. In order to restore the normal operation of the network, the verification nodes need to be restarted around 12 noon. So, what applications are there on the Ton network? Who are its users? Let’s explore together. 1. Current status of Ton ecosystem The Ton ecosystem relies on TGs 1 billion users. After half a year of rapid development, the number of active wallets on the Ton chain has reached 14 million, but the penetration rate is only 1.4%. In contrast, WeChat Pays penetration rate in 2023…