Wenn ein Market Maker Token besitzt, bedeutet das, dass er am Market Making teilnimmt?

Original author: Aunt Ai (X: @ai_ 9684 xtpa )

I saw the news this morning that Wintermute becomes the third largest holder of $GOAT, holding 1% of the total supply of tokens. But just as airdropping tokens to Vitalik Buterin is a publicity stunt, airdropping tokens to market makers is nothing new.

So here comes the question:

– How to determine whether market makers are truly involved?

– Typical examples of market making

– Examples used only as promotional material

1/ Take GOAT as an example

1. Falsification: It is true that 10 million GOAT are held and the contract address is correct; do not underestimate this step, as many issuers promote market makers under the name of the same token.

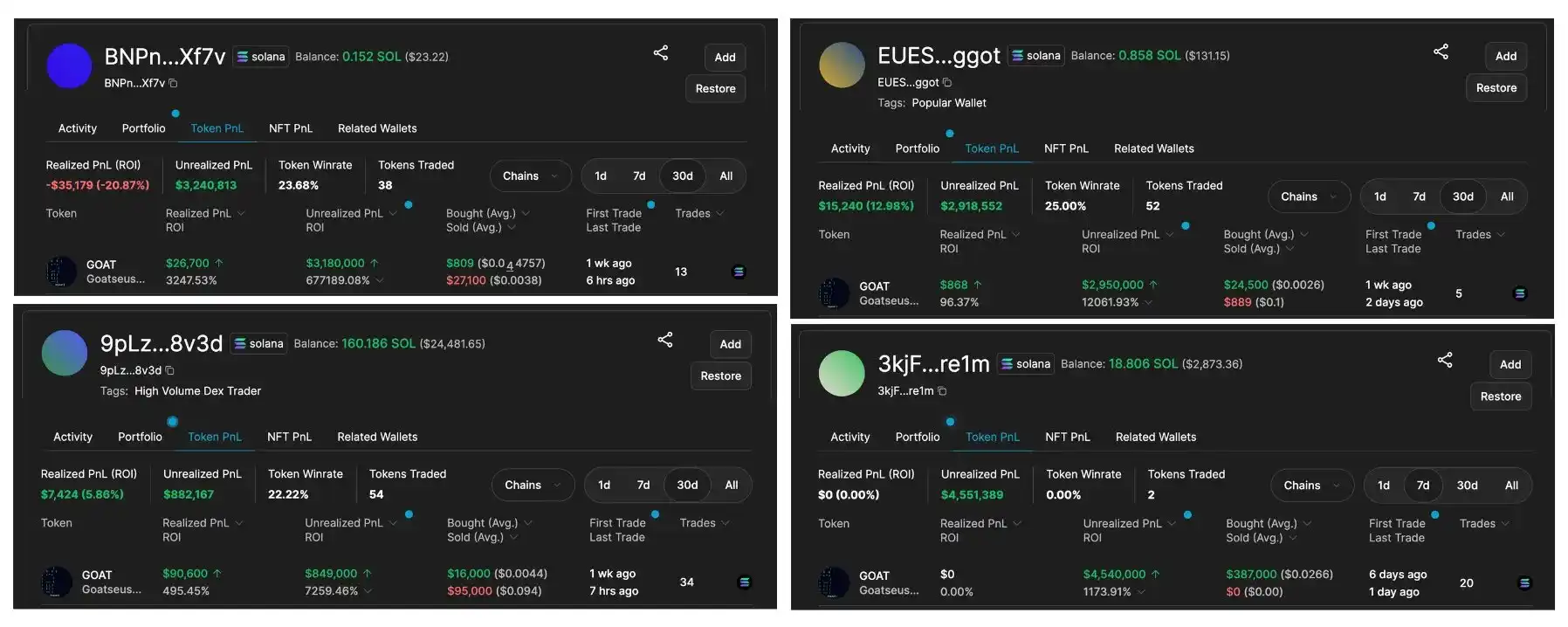

2. Identify the source of funds: Tracing back, it was found that four addresses transferred millions of tokens to 7 GNPT….snUM 1, and all of them were early-stage addresses with extremely high returns, with a cumulative profit of 11.63 million US dollars!

Four early entry addresses for depositing coins to Wintermute:

-

3kjF7ZXfMYo1dqxFNE7WVtQ38zZSciptu1deWYibre1m (the source buying address of CAnS 7…JZT 86)

-

BNPntzDuH7EofLrHGA7gjbeNvJQbEvvrGrCPCTCNXf7v

-

9pLzvD3s5g7nWbMbURPvYQgHp4piosoVLrxiEgr58v3d

-

EUES49UdAkevnREj5YShNXpWjX5DN44uCJQo7yfaggot

3. Check the market makers operation: After receiving the token, it did two things. First, it transferred 1 token to Wintermute 1 and immediately transferred it back. This is an obvious confirmation address action. Second, all tokens were distributed to the Wintermute 3 address after two transfers.

Seeing this, it is basically certain that Wintermute is actively participating in GOAT market making. As for whether it is OTC coin buying/instructed by the project party or a spontaneous behavior, it is unknown.

4. Stay tuned: Ultimately, it depends on whether Wintermute 3 frequently conducts GOAT transactions. If so, it can be confirmed.

2/ Typical examples of market making

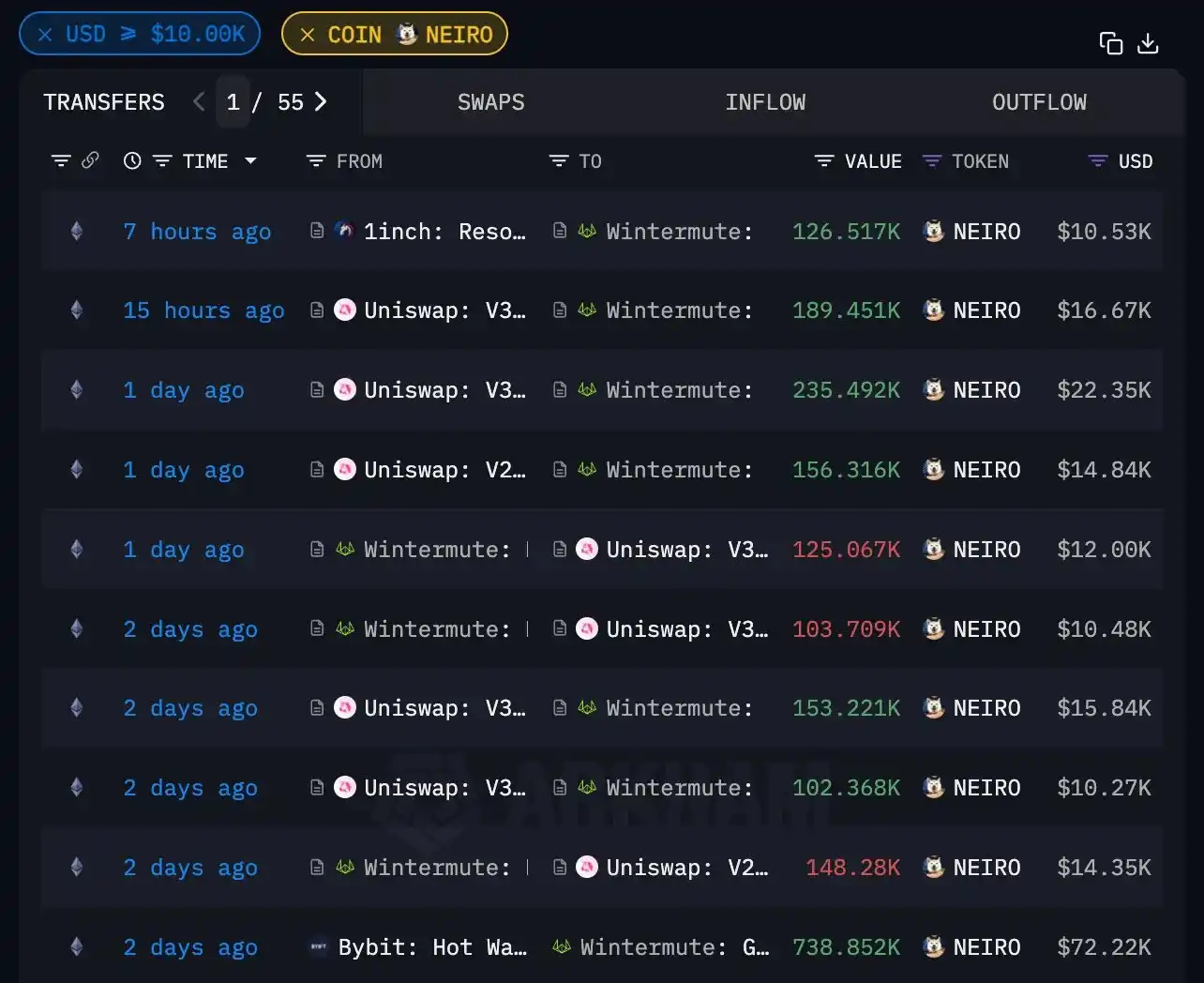

Wintermute participated in market making of capitalized $NEIRO: it once held 4.35% of the total supply of tokens and was once the largest holder. After receiving the tokens, it actively maintained frequent transactions with major exchanges and DEXs.

3/ Typical example of a product that is used only as a promotional tool

This type generally has several characteristics:

-

Direct airdrop by project owner/DEV

-

Usually airdropped to market makers and well-known founders in the Kryptocurrency circle, such as Vitalik Buterin and Sun Ge.

-

The market maker does not take any action after receiving it (V God may sell it directly)

-

The community has made a high-profile announcement that a certain institution has participated in market making

As for pulling down and stepping down, I won’t give actual examples here. You can check these characteristics yourself.

This article is sourced from the internet: If a market maker holds tokens, does that mean he is participating in market making?

Verwandt: Zurück zur Wachstumsorientierung: Wie können VC-Coins dem Narrativ-Dilemma entkommen?

Originalautor: Loki, BeWater Venture Studio TL;DR Das Wesen des Zusammenbruchs der VC-Münzen ist die Überinvestition und irrationale Bewertung auf dem Primärmarkt während dieses Zyklus, die es VCs und Projekten, die eigentlich hätten eliminiert werden sollen, ermöglichte, zu überleben, Mittel zu beschaffen und zu unangemessenen Bewertungen auf dem Sekundärmarkt aufzutauchen. In Ermangelung externer Geldzuflüsse steigt der Grad der Involution auf dem Kryptomarkt auf ein extremes Niveau und hat eine pyramidenartige Klassenstruktur gebildet. Die Gewinne jeder Ebene stammen aus der Ausbeutung der darunter liegenden Ebene und dem Entzug von Liquidität aus dem Markt. Dieser Prozess wird zu zunehmendem Misstrauen auf der nächsten Ebene führen, wodurch die Involution immer schwerwiegender wird. Neben VCs gibt es eine große Anzahl höherer Ebenen…